Copper: Triangle Compression at Resistance – Breakdown Risk Rising?

Zorrays Junaid

PROFESSIONAL TITLE

Market Analyst

EDUCATION & QUALIFICATION

- LLB Law from London South Bank University

- Macroecnomics certification from Oxford University

- CFA Investment Foundations Certicate

EXPERTISE

- Expert in buy-side and sell-side analysis across Equities and Forex markets.

- Experienced portfolio manager of €3 million for diversified asset classes.

- Expert in technical analysis, with a particular emphasis on Elliott Wave Theory.

- Specialised in macroeconomics and fundamental Analysis.

- Extensive experience in market forecasting and market commentary.

- Skilled in strategic portfolio construction and risk management.

SUMMARY

Zorrays has over seven years of combined experience as an analyst and portfolio manager directly controlling up to €3 million. He has worked extensively with proprietary desks and hedge funds in the equities and forex sectors. His expertise encompasses thorough market analysis and effective portfolio management, ensuring robust investment strategies and market performance.

EXPERIENCE

- Served as a Buy Side Equity Research Analyst and Long/Short Market Neutral Portfolio Manager for hedge funds and family offices.

- Functioned as a Sell Side Analyst for research platforms including DailyFX and Elliott Wave Forecast.

- Trained and mentored hundreds of students and professionals in Elliott Wave, portfolio management, and trading strategies, enhancing the capabilities of hedge

- fund managers.

- Held a previous role as a Real Estate Portfolio Manager, managing diverse property investments.

AWARDS AND CERTIFICATES

LLB (Bachelor of Law) from London South Bank University; Macroeconomics certification from Oxford University CFA Investment Foundations Certificate

Zorrays Junaid's posts:

Market Insights

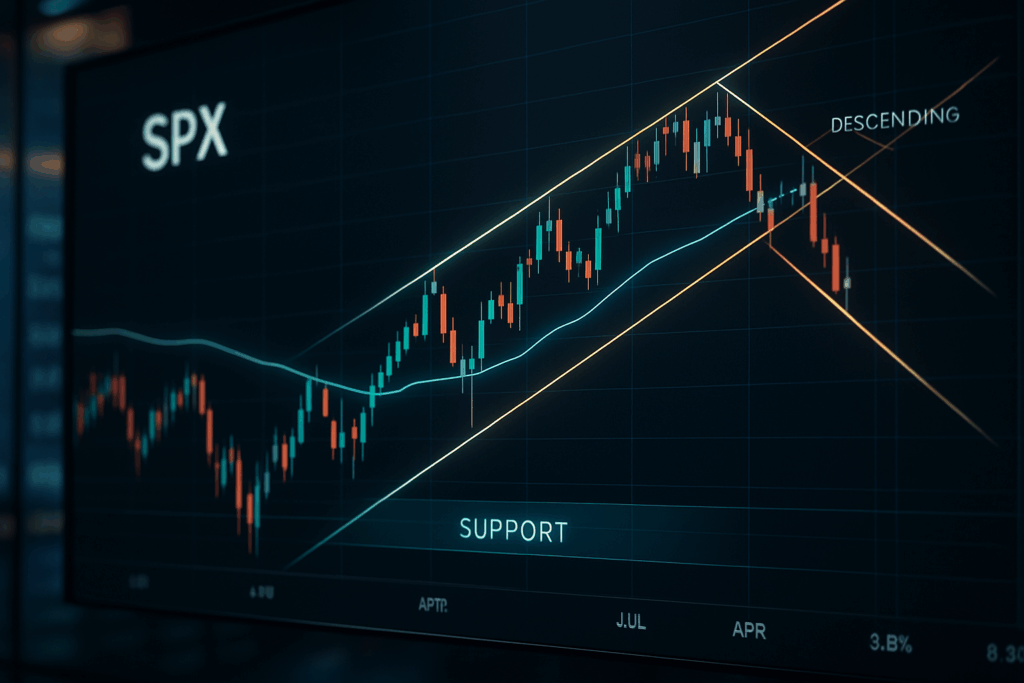

Why SPX Dropped — And Why It Still Looks Like Noise

Dollar Softness, Euro Resilience, and Sterling at a Crossroads

Yields Drifting Higher as Fiscal Risks Re-Emerge

Dollar Rally Looks Fragile Despite Hawkish FOMC Minutes

Sterling Slips as Rising UK Unemployment Keeps March BoE Cut in Play

CPI Cools — But How Many More Impulses Does SPX Have Left? A Tactical Weekly Outlook

Sterling Under Pressure as UK Economy Stumbles into 2026

PY Steadies as Subdued JGBs Open the Door for Yen Recovery

Equal Weight Signals Underlying Strength

BoE and ECB Decisions Shape GBP/USD and EUR/USD Outlooks

AMD Beats on Earnings — But Misses the Market’s AI Imagination

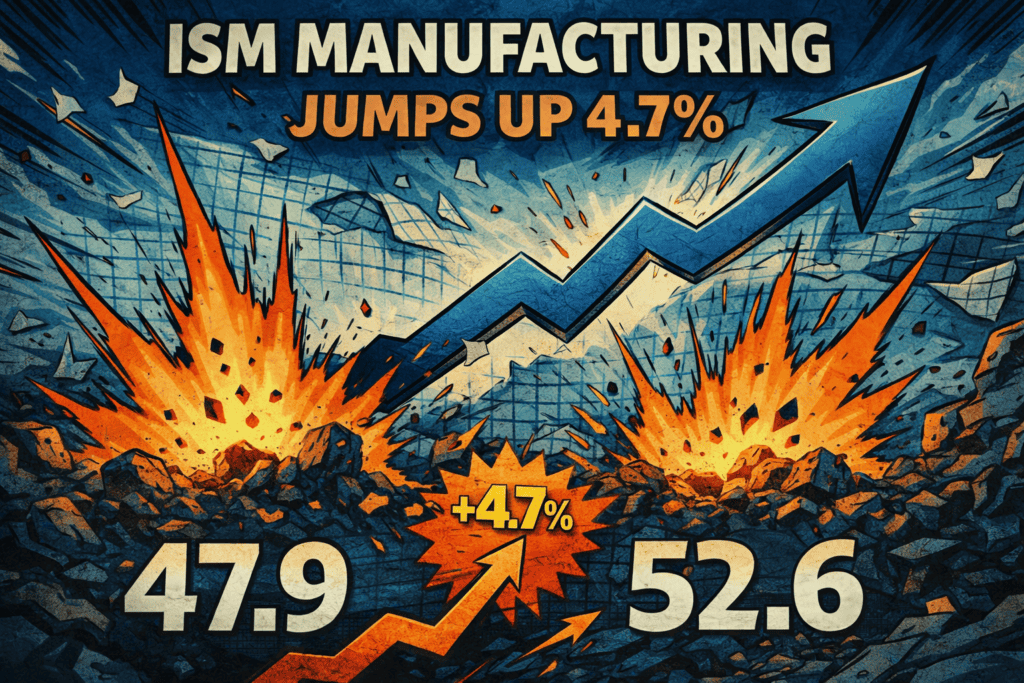

USD & ISM Manufacturing Reaction

Metals Extend Rout, Oil Tests Key Support

From Fed Fears to NFP: A Weekly Gold & Silver Outlook with the Gold–Silver Ratio in Focus

Dollar Slides, AUD Soars, CAD Awaits Guidance — Markets Brace for Central Bank Trio

Gold Breaks $5,000 — Can the Rally Hold?

AI Becomes the New Operating System – and Why the Fed’s Pause Could Define the Next Phase for Markets

Netflix Opens Sharply Lower Despite Strong Earnings

USD/JPY Steady as Japan’s Politics Shake Markets, Risk-Off Tone Prevails

Growth Optimism Meets Fed Patience as SPX Tests Key Resistance

Trump’s Pause on Critical Mineral Tariffs Sparks Silver Pullback, But Fundamentals Stay Firm

US CPI Data Holds Steady at 2.7% — What It Means for the Dollar and Stocks

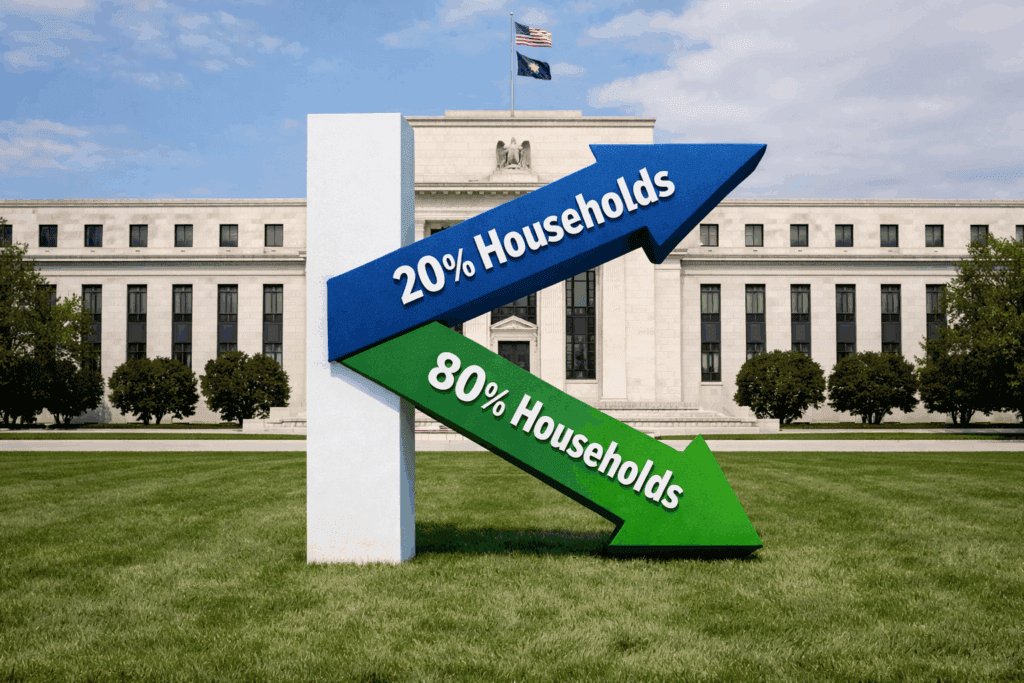

A K-Shaped Economy, Sticky Inflation, and a Bullish EUR/USD Triangle

Disney (DIS) Is Coiling for a Breakout as Catalysts Line Up

US Dollar Recovers as Markets Calm After Venezuela Operation

Powerful Guide to ISM, Building Permits, NFP & Silver Technicals

Gold-to-Silver Ratio: Why It’s Falling — and What Could Come Next

Q1 2026 FX Quarterly Outlook – Majors and Key Crosses

Markets Eye GDP Report as Fed’s Rate Cuts Face Renewed Scrutiny — SPX Holds Steady Within Uptrend Channel

Bank of England’s Cautious Rate Cut Fuels GBP/USD Upside Momentum

USD/CHF Is Falling Hard: A Clear Breakdown of the Fundamental and Technical Bear Case

Week of Central Banks and GBP/USD: Key Decisions and Technical Outlook

A Dovish Cut, a Hawkish Message: How the Fed’s Move Sparked a Nasdaq Repricing

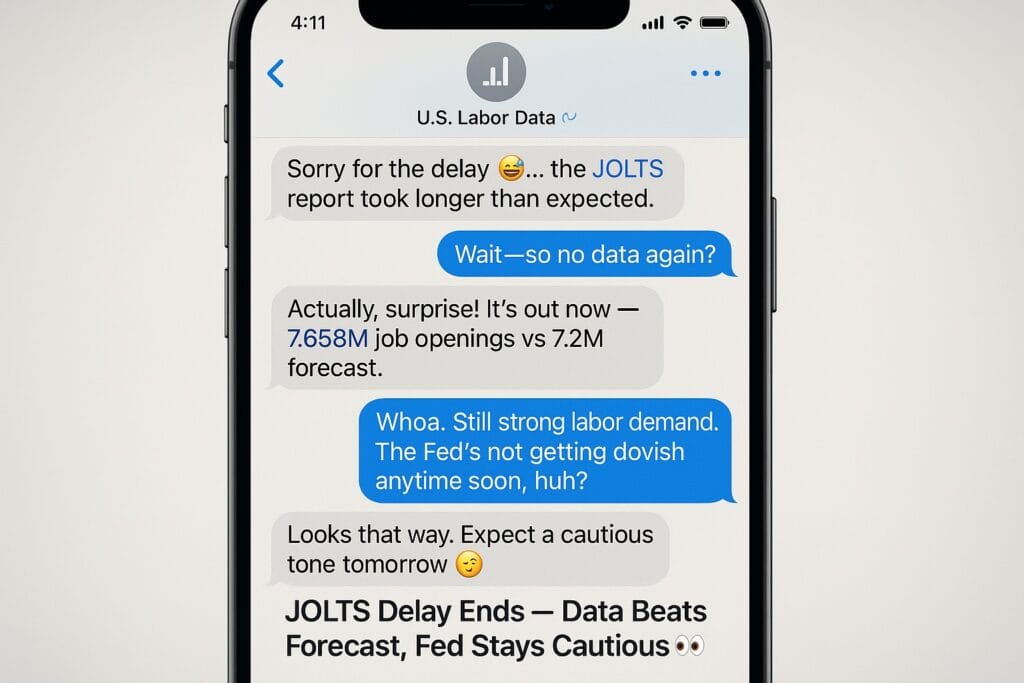

Strong JOLTS Data Keeps Fed Cautious – What It Means for DXY and the U.S. Dollar

Fed Cut Momentum, UK GDP Rebound, and BoC Pause Signal Key Moves Ahead

U.S. Oil (WTI) Breaks Out — Is the Trend Turning?

BTC/USD – Are We Finally Breaking Out of the Downtrend?

Silver’s Shining Moment: A Cup, a Handle, and a Big Week Ahead for Markets

NZDJPY Eyes Breakout as RBNZ Signals End of Cuts

SPX — Bounce and Ready to Climb (Slowly)?

The U.S. Dollar at a Crossroads: Why DXY at 100.000 Marks a Critical Turning Point for Global Markets

NVIDIA: Strong Earnings, But Stock Action Hints at a Short-Term Pullback

Why Bitcoin Is Dropping – And What Must Change Before It Can Recover

SPX Faces a Critical Turning Point as Macro Data Reboots

EUR/USD – Potential Running Triangle Taking Shape

Markets Cheer as US Senate Moves to End Shutdown — AUD/USD Eyes Breakout Amid Risk-On Mood

SPX: Sentiment vs. Reality — Are We Worrying Too Much, or Not Enough?

GBPUSD: BoE Decision Sets the Stage for a December Rate Cut

USD Firms Ahead of ADP, AUD/USD Eyes Key Support Near 0.6420

EUR/USD Outlook: Key Data Ahead as 1.16 Support Snaps — Is 1.14 Next?

Amazon Q3 2025 Earnings Preview: 3 Scenarios That Could Shape AMZN’s Next Big Move

USD/JPY and DXY Face Pressure Ahead of Key Data and BoJ Meeting

The Fed’s October Chill: Is the Dollar Index About to Get Spooked?

WTI Rallies Sharply as Sanctions Bite — $66 Back on the Cards

USD Holds the Line at 1.60 — Key Support or Next Leg Down?

CPI, Fed Cuts & S&P 500 Technical Setup

USD/JPY – Powell’s Subtle Pivot Meets Yen Strength

DXY Eyes 100 as Safe-Haven Demand Returns Amid U.S.–China Tensions

S&P 500 Drops Sharply as 100% China Tariff Shocks Markets – Weekly Outlook Ahead of CPI, NFP & Housing Data

AMD + OpenAI — Big Deal, Bigger Expectations?

SPX Riding High, But Cracks Are Showing

NZD/USD: Bullish Bounce from Channel Support – Eyes on 0.60

USD/JPY: Downside Risks Mount as Shutdown Fears Weigh on Dollar

Q4 2025 Market Outlook: S&P 500 Mildly Bullish, Nasdaq Driven by AI, Dow & FTSE Face Correction Risks

RBA on Hold, Soft ISMs, and a Fragile NFP—What It Means for AUDUSD, DXY, and the S&P 500

USD/CHF Breakout Aligns with SNB Holding Rates at 0.00%

Dollar Softens Despite Hawkish Fed Voices as Powell’s Speech Looms

Fed Speech Outlook: What Powell Means for Markets, SPX Channel Risks, and NVDA’s Breakout Potential

Post-FOMC Update: Fed Cuts 25bps, SPX Tests Upper Channel Resistance

Dollar Index Hits Multi-Month Projection at 97.200, Risks Extend to 96.500

USD/CAD at Risk: Fed, BoC Rate Cuts and Bearish Head-and-Shoulders Signal Market Shift

GBPUSD – Bullish Bias Intact After CPI

USDJPY Tracks Yield Spreads as Fed Cut Bets Weigh on Dollar

Weak Jobs Data Raises Pressure Ahead of Key Inflation Print – SPX Falling Wedge

U.S. Dollar Index: Choppy Data, Sideways Trading, and What’s Next

Reserve Bank of New Zealand: Rate Cut Expected, More Easing to Follow

Shocking Fed Shift? 5 Jackson Hole Questions That Could Move Markets – SPX Outlook Inside

EUR/USD Outlook: Calm Before the Storm or Sustainable Momentum?

DXY Firms Ahead of CPI: Market Braces for a Potentially Hotter Print

RBA Set for August Rate Cut as AUD/USD Eyes Key 0.6380 Support

Gold’s Golden Moment: Why the Bull Trend Might Just Be Warming Up

USD/JPY – Waiting on the 146 Trigger

Economic Slowdown Signs, Sticky Inflation & Major Moves in DXY, SPX & Gold

Meta Q2 2025 Earnings: GenAI Delivers Real ROI, But EU Clouds Loom

Fed Stays Cautious as S&P 500 Tests Key Resistance: Can Bulls Push Higher?

EURUSD & USDCAD Technical Outlook: Potential Reversals and Key Levels

Fed’s Balancing Act in Focus as Inflation Lingers and USDJPY Eyes Key Breakout

USD/JPY Breaks Out – Is a Move to 148 on the Way?

Coca-Cola Q2 2025 Earnings: Margin Beat Overshadows Weak Demand, but Can the $69 Support Hold?

Housing Slump and a Silent Fed – Closer Look At the Euro-Yield

S&P 500 Elliott Wave Update: Flat Correction in ((iv)) Potentially Completed – Wave ((v)) May Be Underway

DXY Breaks Falling Wedge After June CPI Meets Expectations | Bullish Dollar Breakout Explained

Q3 2025 Commodities Outlook: Technical Setups & Macro Signals Across Gold, Silver, Oil, and Copper

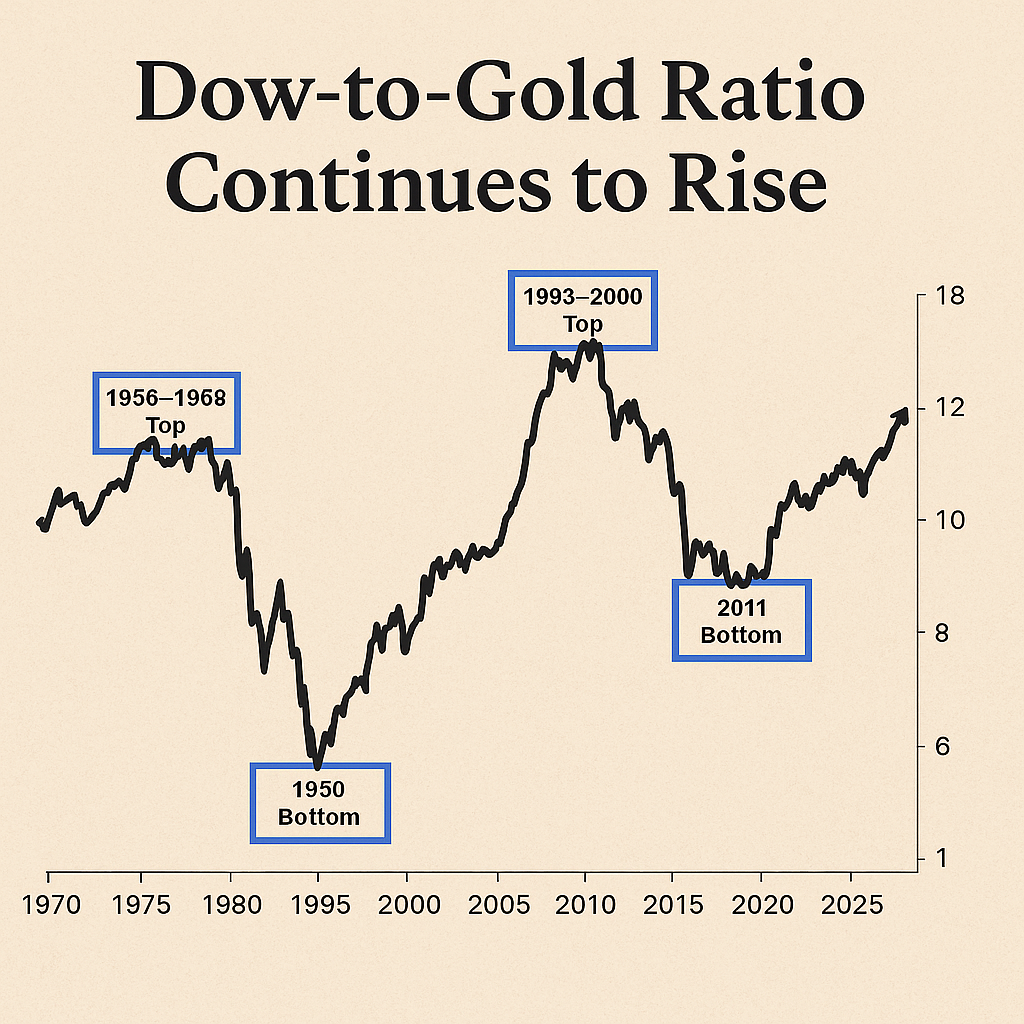

Are Central Banks Overreacting? What the Copper/Gold Ratio Tells Us

EUR/USD – Flag Formation Tightens as Traders Brace for Breakout

AUD/USD, EUR/CHF, DXY: Crosscurrents from RBA Surprise, SNB Dilemma & Tariff Apathy

Are Tariffs Still a Threat to the Global Economy? A Deeper Look into Today’s Trade Landscape

Will the US Jobs Report Tip the Fed’s Hand on Rates? DXY Eyes Key Support as Data Looms

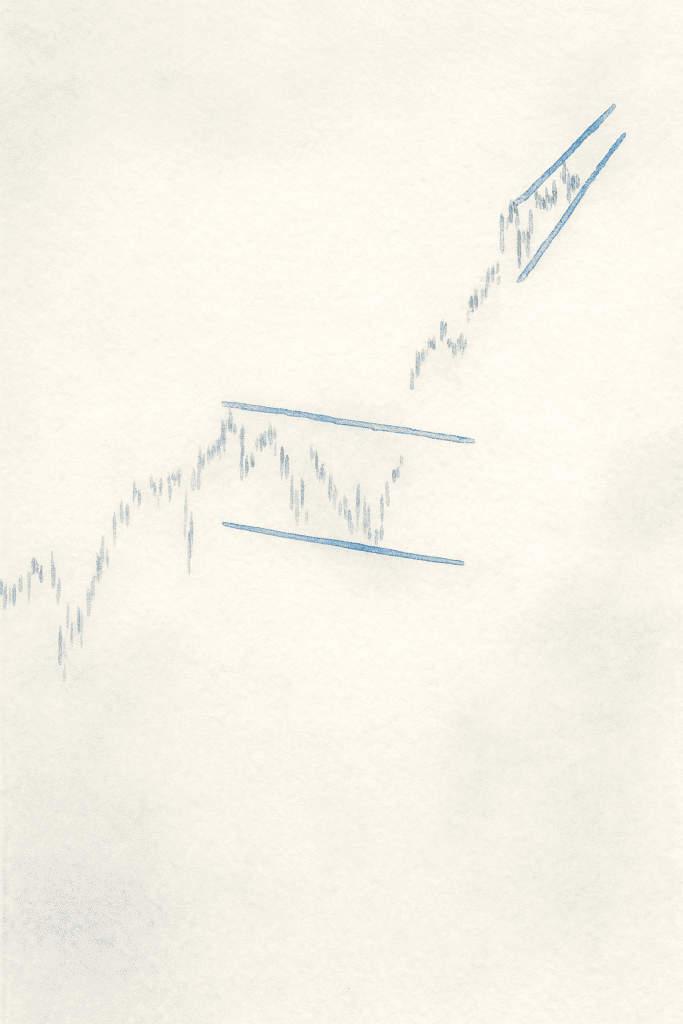

S&P 500: Post-ISM Wedge Compression Could Signal Retest of Prior Highs

U.S. Rate Cuts, Eurozone Inflation, and Crude Oil’s Quiet Comeback

Fed Signals Set the Stage for EUR/USD Upside Potential

Analysing the Impact on US Oil and Key Technical Levels

Powell, PCE, Housing & U.S.-Iran Tensions Stir 20% Correction Risk

Fed & BoE Diverge as GBP/USD Tests Key Support in Rising Channel

BoJ Stays Dovish, USD/JPY Breakout in Play?

Central Banks Eye Rate Cuts as USD/CAD Nears Multi-Year Trendline Breakout

Silver Breaks Out: Confirming the End of Wave 2 and the Start of a Bullish Wave 3 Sequence

Japan’s Resilience Shines Through—Eyes Now on NIKKEI 225 Breakout Potential

SPX at a Crossroads: Weighing Weak Data Against Resilient Markets

EUR/USD: ECB Cut, Euro Rallies – So… Is Wave 4 Really Done?

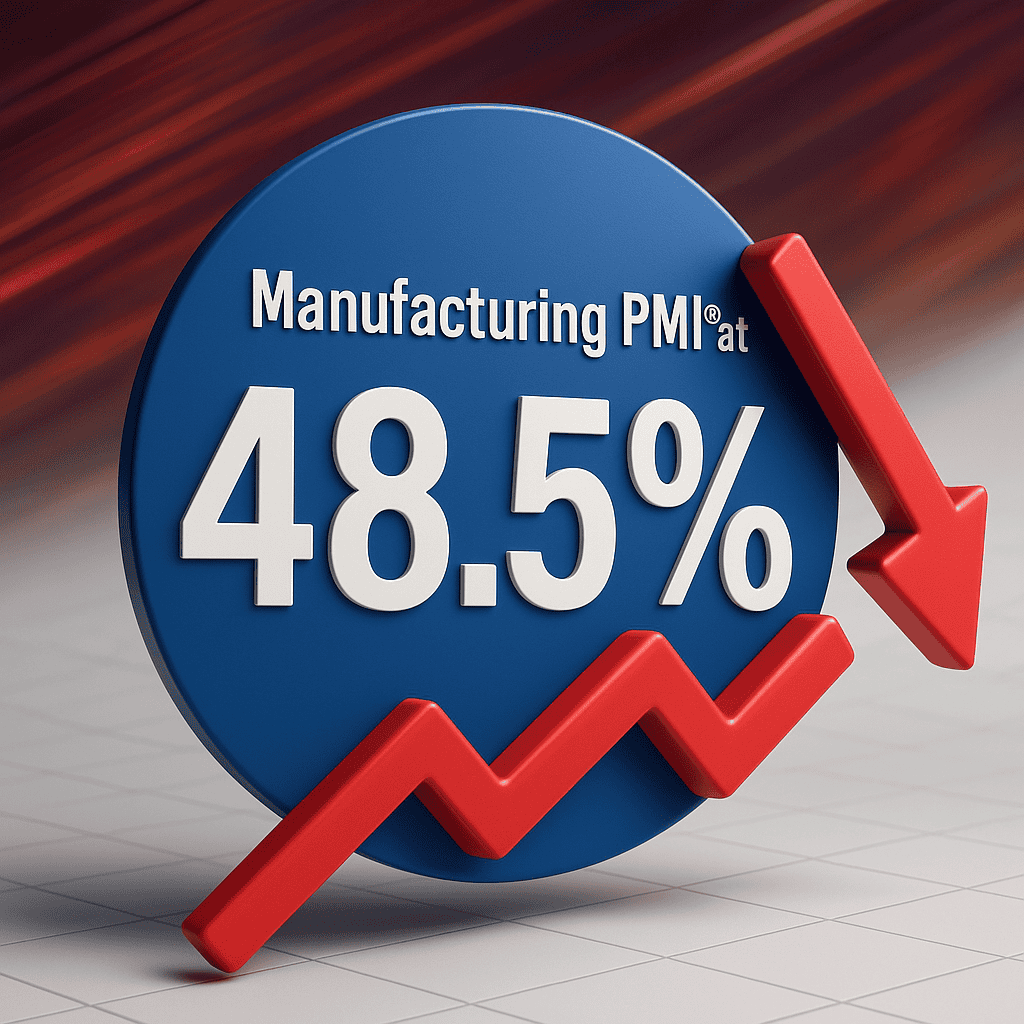

ISM Weakness Deepens: What It Means for SPY and the Market’s Next Move

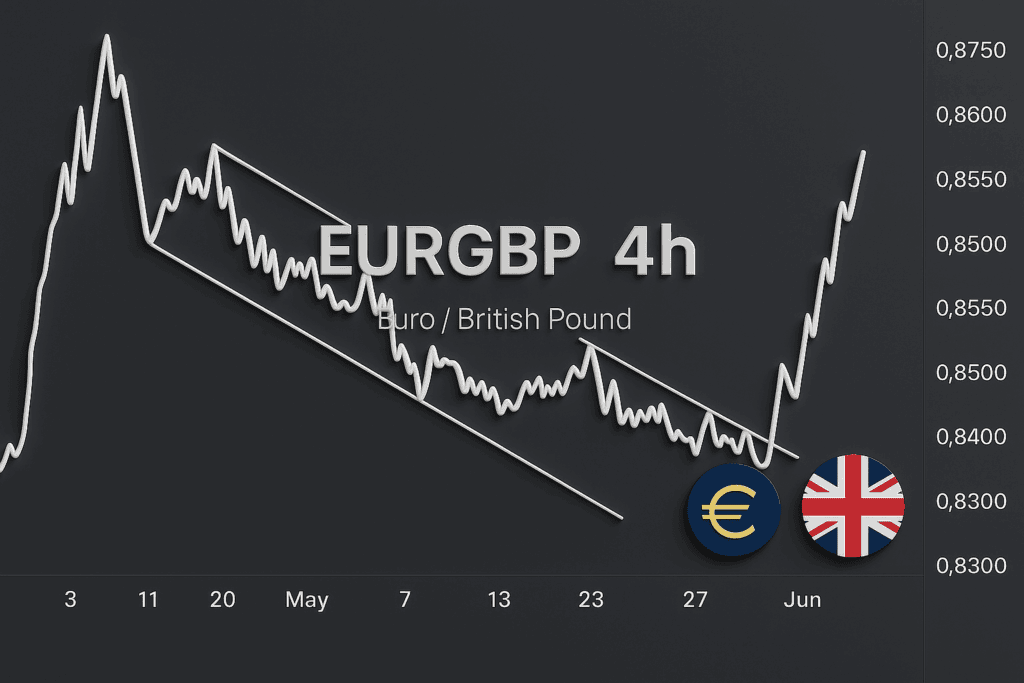

Key US & ECB Decisions, ISM Reports, and EUR/GBP Breakout Watch

U.S. Dollar Index (DXY) Analysis: Rally May Be Short-Lived Amid Legal Setback on Tariffs

NZD/USD Eyes 0.610 as RBNZ Decision Looms – Fundamentals & Technicals Align

Markets on Edge Again: Trump’s Tariff Whiplash Returns to Centre Stage

DXY Crashes Below Key Support – Here’s Why It’s Falling and What’s Next

Has Wave 4 Bottomed in EUR/USD or Is Sideways Grind Still in Play?

US Recession Odds vs Record SPX Rally

Gold (XAU/USD) Bounces from Channel Support: Is a Reversal in Play or Bearish Continuation Ahead?

EUR/USD at Make-or-Break Levels – 38.2% Fib Test and Overvaluation Signals a Key Turning Point

DXY Breakdown Adds Pressure as Markets Brace for US CPI, Retail Sales, and UK Jobs Data

FTSE 100 Outlook: Bullish Momentum Building Toward Wave (iii) – Targeting 9300

SPX Rally Eyes Resistance as Fed & ISM Data Loom, GBP/USD Tests Key Reversal Zone Amid BoE Cut Expectations

SPX Eyes Resistance as ISM Prices Ease

EURUSD Eyes Wave 4 Correction as Markets Brace for US GDP Print

GBP/USD – Major Rejection at Channel High, Bearish Setup Brewing

Next Week’s Crucial Economic Data: Recession Warning Signs to Watch Closely

Gold Drops Nearly 7% Amid U.S.-China Trade Optimism

GBP/USD Trading Outlook: A Pivotal Juncture Amid Shifting UK Inflation Dynamics

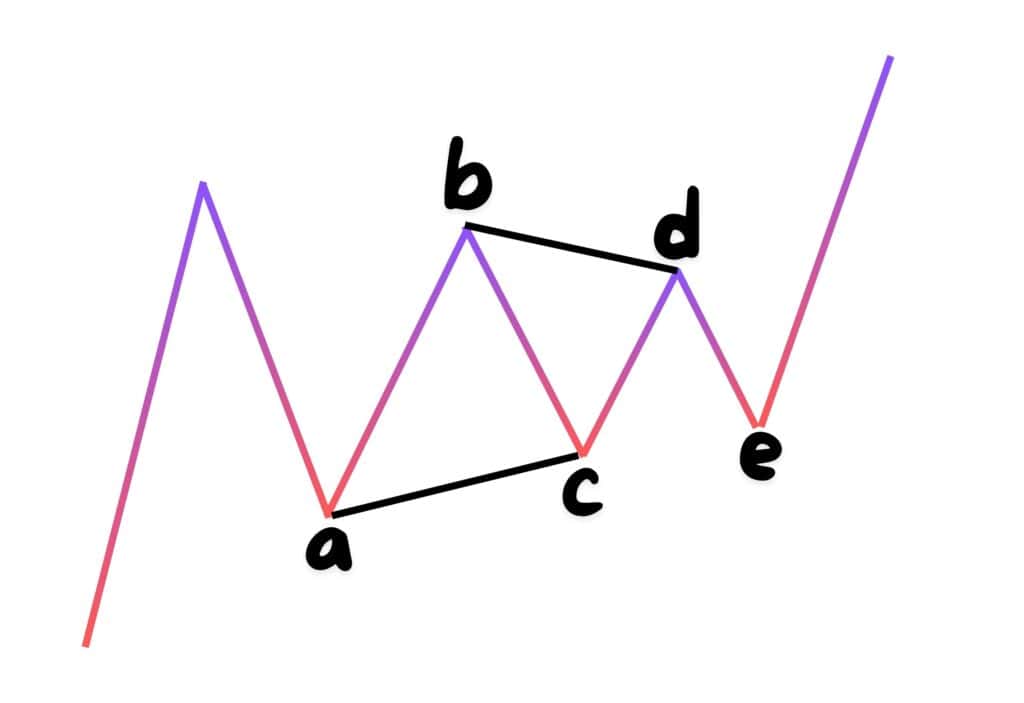

EUR/USD Coils in Wave iv Triangle, Eyes Breakout in Wave v

Tariff Turmoil & Market Mayhem: 7 Wild Days That Left Everything the Same

EUR/GBP Breaks Multi-Year Trendline: Shocking Gilt Sell-Off Signals Sterling Weakness

RBNZ’s Recent Interest Rate Decision and Its Impact on NZD/USD

Navigating Tariffs, Inflation, and Interest Rate Decisions

Shock Tariffs Spark Market Turbulence as Gold Rises, Dollar Sinks, and Stocks Slip

Q2 2025 Equities Market Outlook: Key Levels, Risks, and Opportunities Across Global Indices

ISM Data in Focus as SPX Breaks Down and DXY Weakens Further

FX Market Shrugs Off Auto Tariffs as Dollar Stays Range-Bound

Weak Consumer Confidence Confirms Wave 4 Correction, DXY Eyes 105.000

Post-Fed Market Outlook: Consumer Trends, UK Policy, and SPX Technical Levels

Three Holds and a Cut: Analysing DXY, GBP/USD, USD/JPY, and USD/CHF Post-Central Bank Decisions

US Data Weakens the Dollar as Markets Stay Fragile

Fed Decision, Retail Sales & Housing Market in Focus

USD/JPY Rebounds from Lower Bound of Descending Channel

DXY Approaching Exhaustion, Short-Term Bounce Likely

U.S. CPI Data Next Week and EUR/USD Analysis

US Oil Approaching Critical Support Level

Key Events in the US and Eurozone

BTC/USD Hits Key Support – Is a Major Reversal on the Horizon?

NVIDIA (NVDA) Q4 Earnings Preview: AI Boom Fuels Growth Amid Market Volatility

Will Inflation Cool or Heat Up? Key Economic Data to Watch Next Week

UK Inflation Surges to 3%: Implications for the FTSE 100 and Bank of England Policy

DXY Dollar Index: Bearish Momentum Strengthens as Wave (3) Awaits Breakdown

RBA & RBNZ Rate Cuts Incoming? What It Means for Markets & EUR/USD’s Next Big Move!

Gold (XAU/USD) Breaks Head and Shoulders Pattern

Anticipated U.S. Inflation and U.K. GDP Data

Earnings Recap & Outlook: Alphabet (GOOG), Ford (F), and AMD (AMD) – What’s Next?

U.S. Tariff Surprise Shakes FX Markets, Boosts Dollar

BoE Rate Cut Incoming? Cable and FTSE100

Hawkish Fed Holds Rates Steady, Dollar Index in Wave (2) Correction

SPX and BTC – Markets Take a Dip, But Is It Time to Dive In?

Central Banks Take Center Stage: Rate Cuts and Holds That Could Shape 2025

Tesla (TSLA) Faces Key Hurdles Amid Broader Market Gains: Is Another Decline Ahead?

A Turbulent Start: Donald Trump’s First Day as President and Its Impact on FX Markets

Bank of Japan’s Interest Rate Decision, US Economic Calendar, and CAD/JPY Technical Analysis

S&P 500 Analysis: Elliott Wave Signals and PPI Insights

GBP/USD Outlook: CPI Data and Bearish Momentum Drive Cable into Critical Levels

Nifty’s Roadmap: Targeting 21,000–22,000 as Wave (C) Takes Shape

AUD/JPY Technical Analysis: Expecting a Bearish Wave 3 Move

S&P500: Growing Vulnerability to Correction Amid Wave B Triangle

Energy Market Update: Challenges for Iranian Oil and Rising Gold Demand

ISM Services Data in Focus as Markets Gauge U.S. Economic Momentum

Examining ISM Data and Key Events Ahead

ISM PMI Expected to Hold at 48.3, Dollar Strengthens Amid Economic Uncertainty

AUD/JPY Approaches Bearish Flag Breakout Amid Divergent Central Bank Policies

A Balanced Q1 2025 Equity Market Outlook

S&P 500: A Promising Outlook for 2025 with Strategic Risks and Opportunities

Fed’s Hawkish Shift Sparks USD/JPY Rally Towards 160 – What’s Next?

Bank of England to Hold Rates: Faster Cuts Expected in 2025

Fed’s December Rate Cut: A Slower, Steadier Course Ahead

EURUSD and EURCHF: Global Markets in Focus

RBA Holds Rates Steady at 4.35%, Signals Easing Inflation Pressures

Central Banks Shape Markets Ahead

USD/JPY Slides on BoJ Hawkish Hints; EUR/JPY Signals a Clear Bearish Break

USD/CNH Poised for Breakout: Will resistance Hold or Give Way?

NFP Showdown: Will the Jobs Report Seal the Fed’s Next Move?

Rates, Rallies, and Resolutions in the Last 24 Hours

EUR/JPY in the Spotlight: Is a Slide to 151 on the Cards?

Global Markets on Edge: Key Inflation and GDP Data to Shape the Week Ahead

NVDA: Riding the AI Wave to Unprecedented Highs

EUR/USD: Navigating the Bearish Tide Under ECB Hawks and Rate Differentials

Chips and CPI: Crunching Numbers and NVIDIA’s Next Move

Dollar Bulls Hold Steady on Strong U.S. CPI and Fed Watch

USD/CAD Breaks Out of Ascending Triangle – Eyes on 1.4350 Target

From Trump Bumps to CPI Jumps: Last Week’s Market Moves & What’s on Deck

Trump’s Second Rodeo and What It Means for Markets

AUD/USD Outlook Following RBA Update

Rate Decisions and a High-Stakes Election: Markets Brace for a Pivotal Week

Preview of Apple and Amazon Q3 2024 Earnings

Q3 2024 Earnings Insights for AMD, Alphabet, Microsoft, and Meta

Apple, Google, and Microsoft’s Earnings Reports and BoJ Interest Rate Decision

BoC Rate Cut Anticipation and Earnings Breakdown

Dollar Macro Trends and Today’s Earnings Overview

A Packed Earnings Week and Major Central Bank Decision Looms

Netflix’s Blockbuster Q3 2024: Ready to Stream Higher Pre-Market After Strong Earnings

All Eyes on Tomorrow’s ECB Interest Rate Decision

Dollar and Oil Divergence

ECB Rate Cut Showdown: Inflation Dives, Markets Brace for Impact – GBP/USD Eyes Reversal

Sticky US CPI Keeps the Dollar Firm

RBNZ Rate Cut Showdown

Global Markets on Edge: Middle East Tensions and New Zealand’s Rate Cut Shake Up Outlook

Markets Eye Jobless Claims, ISM Services, and Middle East Tensions

Q4 2024 Equities Outlook: Navigating Volatility, Rate Cuts, and Global Growth Trends

The Hawk and the Dove: Why GBP/JPY is Set for a Bearish Flight

With Inflation Cooling, All Eyes Turn to Jobs

RBA Holds Cash Rate Steady at 4.35% Amid Persistent Inflationary Pressures

Central Banks Playing Limbo – How Low Will They Go?

Fed Cuts Deep, BoE Stays Cool

Fed Rate Cut on the Horizon: Will the S&P 500 Wave 3 Ride Breakout or Bounce?

Bank of England Interest Rate Decision and Market Implications

EUR/USD: ECB Cuts Rates, US Data Stays Steady

Gold’s Bullish Rally: A Strategic Look at its Momentum

Inflation Eases, Rate Cuts Loom, Growth Slows

US Oil – Sell-off Due to Libyan Supply

ISM Manufacturing in Focus

The Rollercoaster of Global Markets – Buckle Up!

NVIDIA’s Growth Story: What’s Next for the AI Giant?

CHF/JPY Poised for a Breakout

Monetary Manoeuvres: What This Week’s Economic Data Could Mean for U.S. and Eurozone Rate Cuts

Shifting Sands: USD Faces Pressure Amid Key Data Releases

Tasman Sea Tussle: AUD/NZD’s Potential to Shine

Central Bank Chess: The Fed’s Next Move and Eurozone’s Economic Jitters

Following the RBNZ’s rate cut, we anticipate no unexpected rise in CPI.

U.S. PPI Data Could Set the Tone for Global Equities Today

RBNZ Holds Steady While Bitcoin Struggles to Find It’s Moon Boots

What’s Next for USD, EUR, and the Fed?

The Dollar and Equities Market Post-Panic

RBA: Will They or Won’t They and SPX in Trouble

NVIDIA’s (NVDA) Bullish Flag

Rate Cuts Showdown: The Fed and BoE Set the Stage

Inflation Trends and Rate Decisions

Key Economic Developments in the U.S. and Canada: Market Implications Unveiled

Revisiting an Old Friend: The Beauty of Elliott Wave Analysis in AUD/USD

Markets Eye BoC Rate Cut

Temporary Dollar Strength and Potential Triangle Formation

Focus on Canadian BoC Interest Rate Decision and US Economic Data

USD/JPY: The Summit Reached, Time for the Descent?

Stable Fed, Slow UK Disinflation Boost GBP/USD

AUD/USD Unfolding Triangle

CPI Frenzy

Soft CPI Data Drives Dollar Lower

AUD/USD: The race to 2%!

USD/CHF: Diverging Monetary Policies and Strategic Trade Opportunities

Inflation and Its Ripple Effects: NZD/USD to U.S. Inflation

NFP Release Today: Anticipation of Decline and S&P 500 Impact

ISM Manufacturing PMI: July 2024 Expectations and Implications for the U.S. Economy and EUR/USD

Tesla’s (TSLA) Inverse Head and Shoulder Pattern

SPX, NQ, DJIA, DAX, FTSE 100: STRONG Q2, CAUTIOUS Q3 AHEAD

Polls, Prices, and PMI

AUD/USD: Australia’s Inflation Surge Sparks Concerns Ahead of RBA Meeting

Analysing U.S’ CB Consumer Confidence and Canadian CPI MoM for USD/CAD

US and UK Economic Indicators to Watch

USD/CHF: Assessing the Impact of the SNB Rate Cut

BoE Holds Interest Rate Steady at 5.25%, Signalling Cautious Optimism

NZDUSD: A Turnaround in GDP Growth

The Inflation Breakthrough: BoE’s Milestone

The Trinity of Central Banks: RBA, BoE, and Fed Steer the Market

Fed’s Rate Call and UK GDP in Focus

Guides

Volume Footprint Chart Complete Guide

Risk Reward Ratio – How Traders Use It

CFDs vs Options: What are the Differences?

CFD vs Stock: What are the Differences

CFD Stocks – Buy, Sell and Trade

CFD vs ETF: What Are The Differences

CFDs Commodities – Buy, Sell and Trade

Wyckoff Distribution Trading Guide

Wyckoff Accumulation Trading Guide

Cryptocurrency CFDs – Buy, Sell & Trade

Dow Theory: Understanding its Key Principles and Strategies

Gold CFDs – Buy, Sell and Trade

Support and Resistance: A Comprehensive Guide

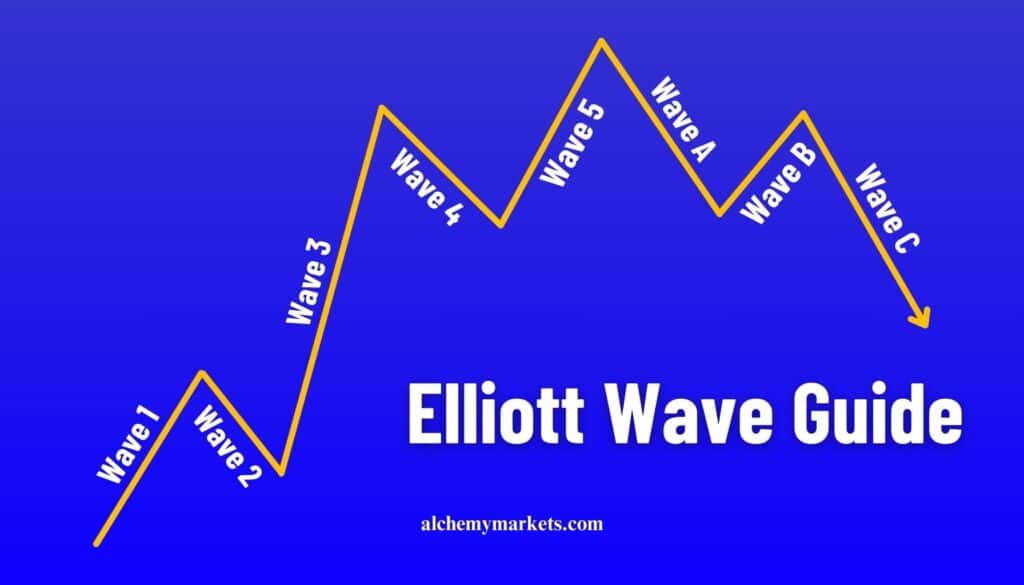

Elliott Wave Theory – How to Use It In Trading

Indicators

20 Support and Resistance Indicators in Trading

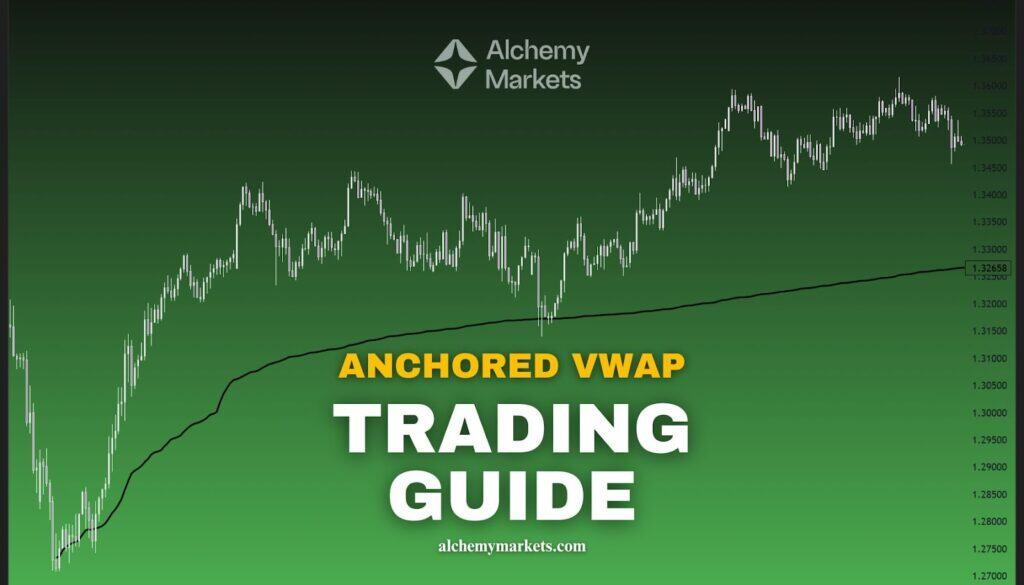

Anchored VWAP Explained

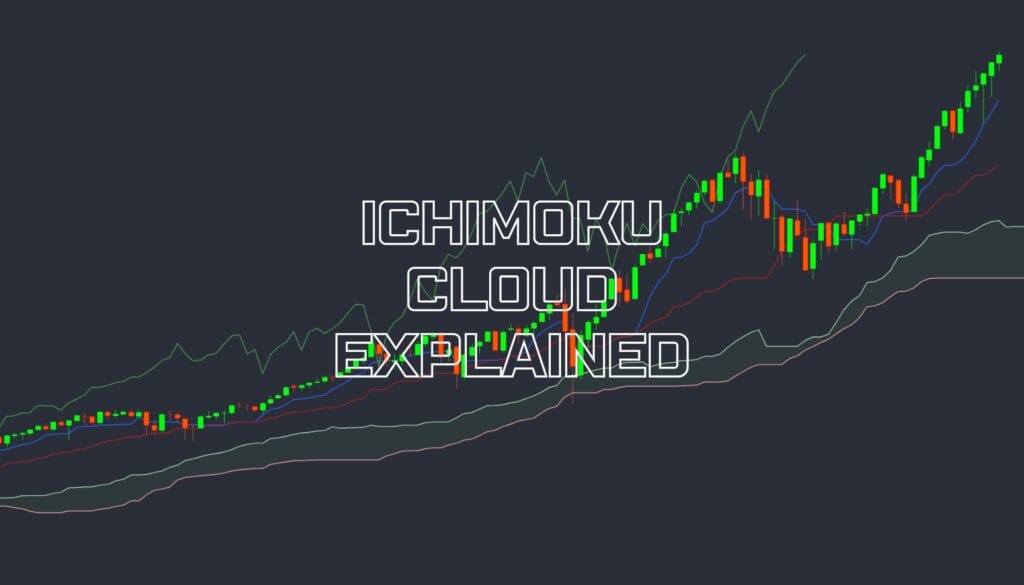

Ichimoku Cloud – How to Trade It

Average Directional Index (ADX)

Stochastic RSI (Stoch RSI)

Fibonacci Retracement – How To Trade It

Fibonacci Extensions Trading Guide

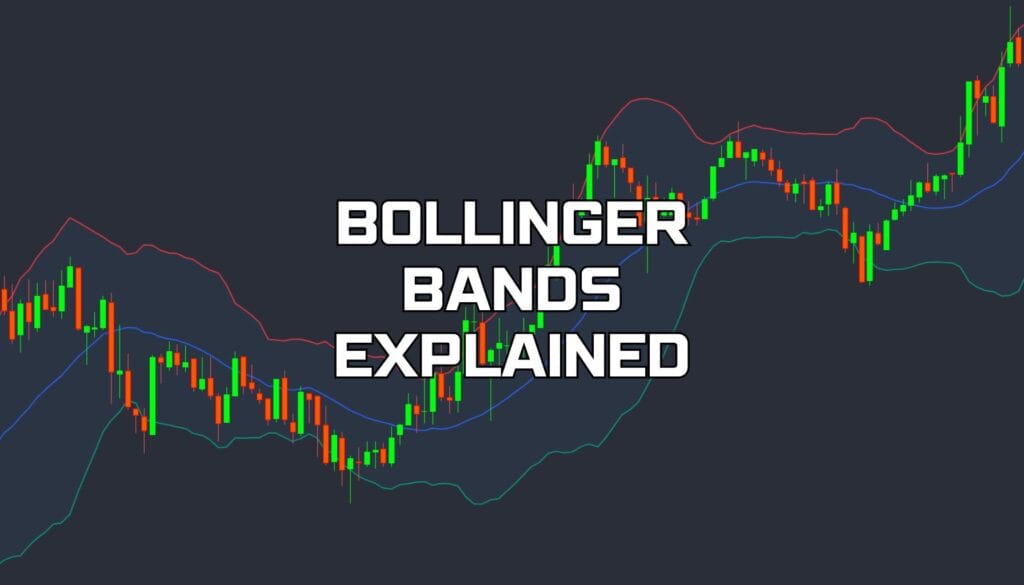

Bollinger Bands® Explained

Trade Strategies

Quasimodo Pattern Ultimate Trading Guide

Triple Bottom Pattern – How to Trade It

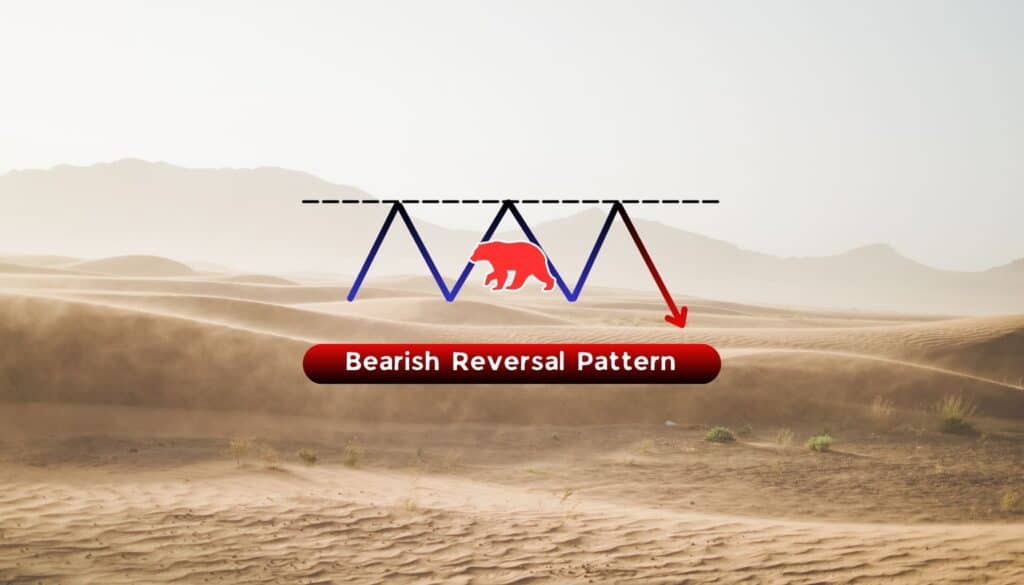

Head and Shoulders Pattern Trading Guide

Descending Triangle Trading Guide

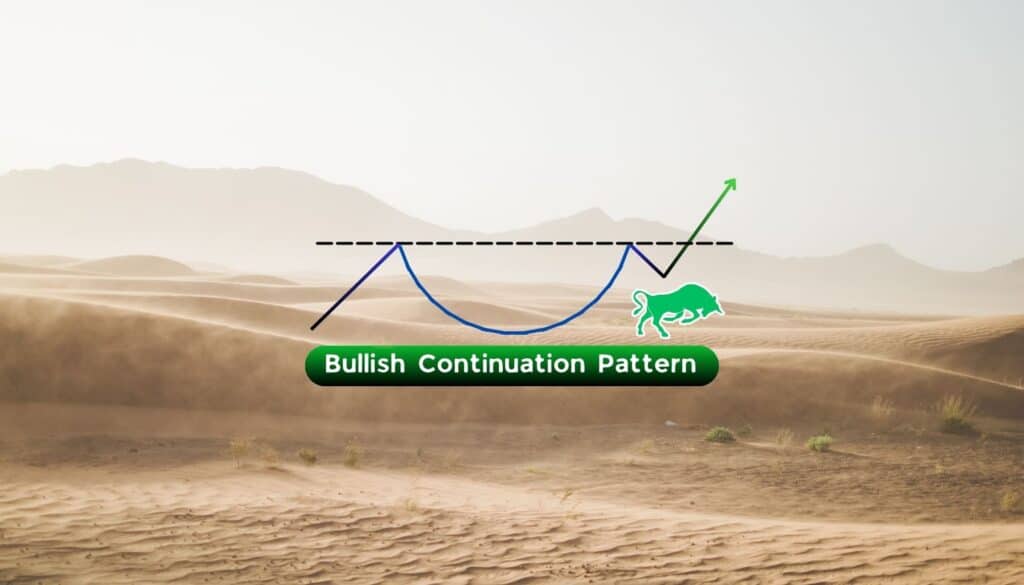

Cup and Handle Pattern Explained With Examples

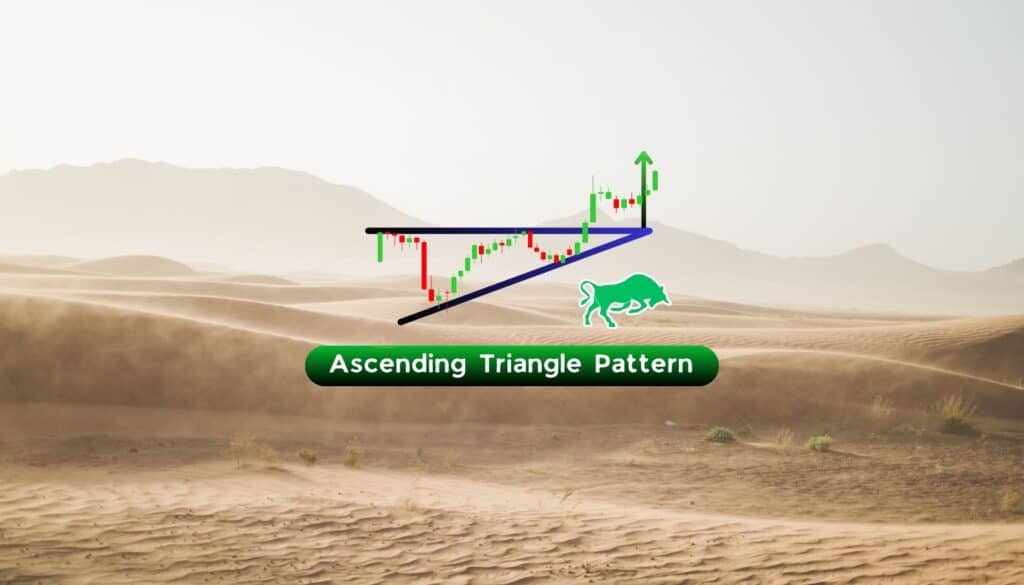

Ascending Triangle: How to Spot and Trade This Bullish Pattern

Inverse Head and Shoulders Pattern Trading Guide

Triple Top Candlestick Pattern – How to Trade it

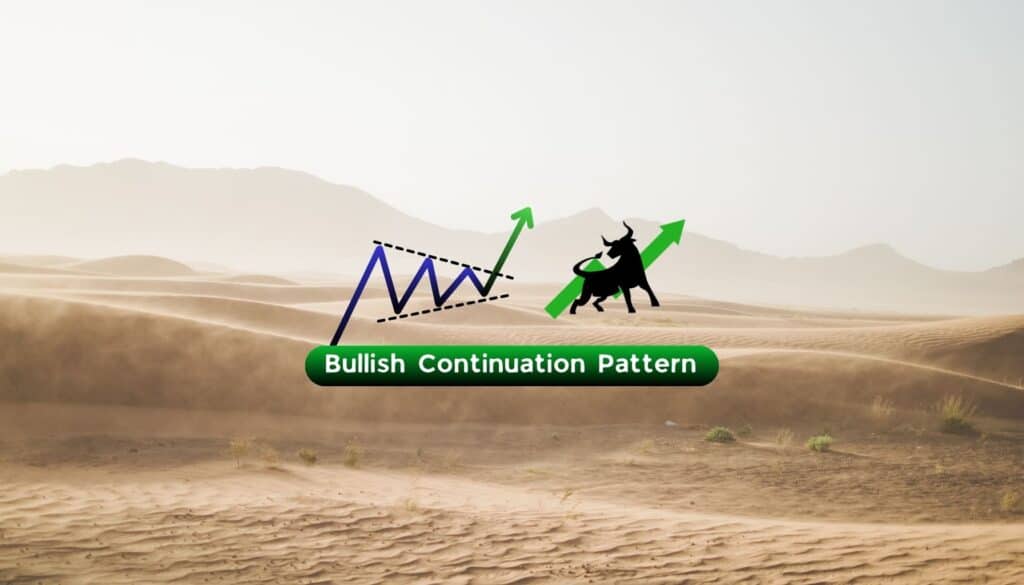

Bull Pennant Patterns Complete Trading Guide