- Weekly Outlook

- February 21, 2025

- 3min read

Will Inflation Cool or Heat Up? Key Economic Data to Watch Next Week

As we approach the final week of February 2025, several key economic indicators are slated for release, offering insights into the current state of the economy and potential future trends. Investors, policymakers, and market participants will be closely monitoring these developments to inform their decisions.

Tuesday: Consumer Confidence Report

The week begins with the Conference Board’s Consumer Confidence Index release on Tuesday. Analysts project a slight decline in the index for February to 102.6, down from January’s 104.1. Despite this anticipated dip, consumer confidence has remained relatively robust, even amidst ongoing inflationary pressures. This resilience suggests that consumers continue to engage in economic activities, although with cautious optimism.

Wednesday: New Home Sales Data

On Wednesday, the Commerce Department will publish data on new home sales for January. Economists forecast a modest decrease to a seasonally adjusted annual rate of 680,000 homes, slightly below December’s 698,000. The housing market faces challenges, including elevated mortgage rates and limited inventory, which may contribute to this projected decline. However, demand for housing remains relatively strong, indicating potential resilience in the sector.

Friday: Personal Income and Spending Report

The most anticipated release this week is Friday’s January Personal Income and Spending Report from the Bureau of Economic Analysis. This comprehensive report provides insights into consumer behavior, income trends, and inflationary pressures.

Personal Income and Outlays

In December 2024, personal income increased by 0.4% month-over-month, while personal consumption expenditures (PCE) rose by 0.7%. These figures suggest that consumers were willing to spend, possibly drawing from savings or credit, as spending outpaced income growth. Analysts will examine January’s data to determine if this trend continued into the new year.

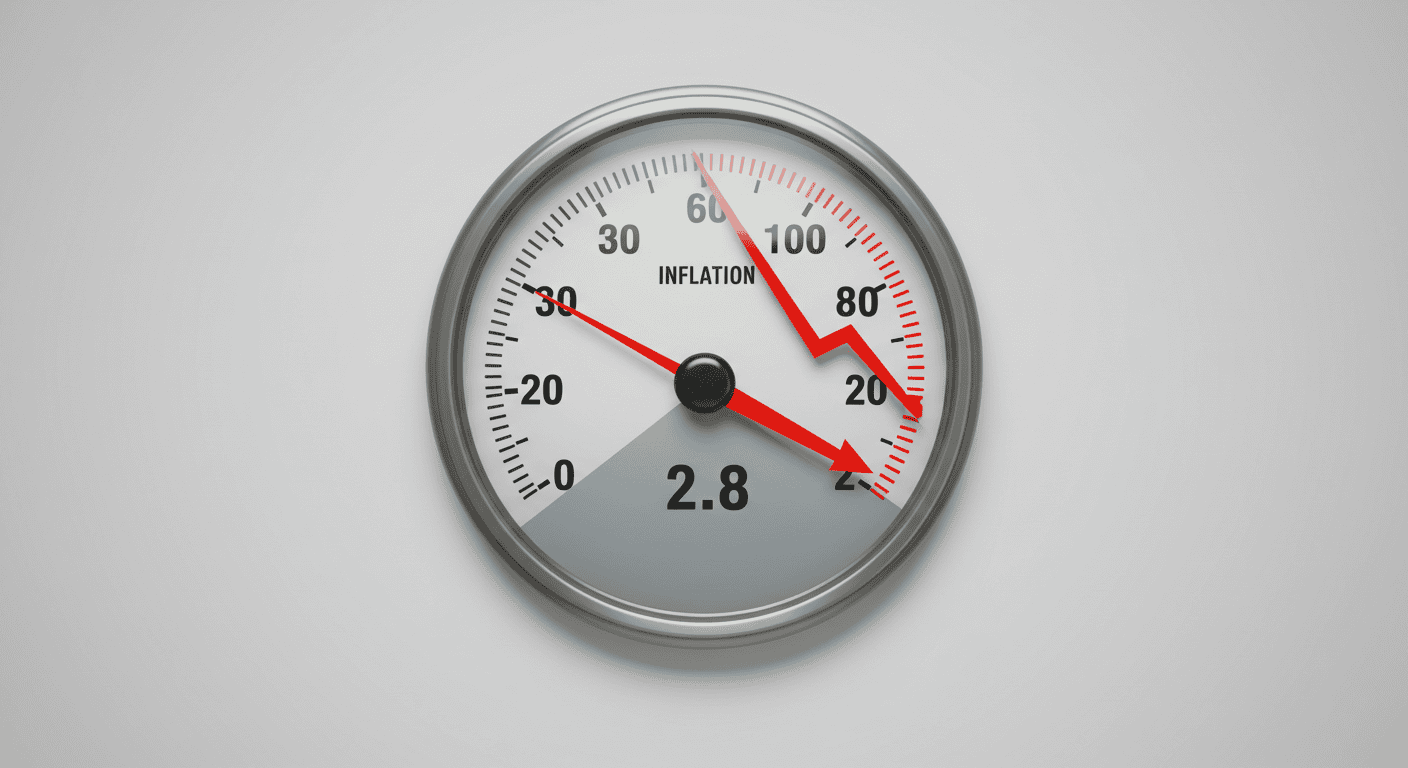

Inflation Metrics

The report also includes the Federal Reserve’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index. In December, the core PCE price index rose by 0.2% month-over-month, maintaining an annual rate of 2.8%. This steady rate suggests that while inflation remains above the Fed’s 2% target, it is not accelerating. Market participants will scrutinize January’s core PCE data for signs of inflationary trends, especially in light of recent policy decisions and external economic factors.

Market Implications

The data releases this week will provide critical insights into the health of the economy and the effectiveness of current monetary policies. Stable consumer confidence and spending could signal sustained economic growth, while any unexpected changes in inflation metrics may influence future Federal Reserve policy decisions. Investors should stay informed on these developments, as they could impact financial markets and investment strategies in the near term.