- Chart of the Day

- April 10, 2025

- 5min read

EUR/GBP Breaks Multi-Year Trendline: Shocking Gilt Sell-Off Signals Sterling Weakness

Overview of the EUR/GBP Rally

EUR/GBP surprised many traders yesterday by spiking to 0.8650, breaking decisively through a multi-year descending trendline. This breakout didn’t happen in isolation—it coincided with a significant sell-off in UK gilts, marking the kind of market stress that has historically shaken investor confidence in the British pound.

Such a strong upward move in EUR/GBP suggests a change in underlying market dynamics. It’s not just a technical breakout; it’s rooted in deeper macroeconomic and fiscal concerns.

UK Gilt Market Sell-Off: What Happened?

UK gilts underperformed not only relative to their usual risk-free counterparts but also compared to US Treasuries—despite recent US inflation fears. That’s remarkable. It suggests something more localized and systemic is weighing on UK debt instruments.

Behind the scenes, the UK Debt Management Office (DMO) is under pressure. With over £300bn in new gilt issuance expected this year, concerns are rising that investor demand may not keep pace—especially if the UK economy weakens and public borrowing rises to fund welfare costs. That prospect is rattling the gilt market—and by extension, the pound.

Why UK Gilts Matter for Sterling

Gilt yields and GBP are tightly linked. A sharp rise in gilt yields without corresponding economic strength tends to signal investor unease. That erodes foreign confidence in GBP-denominated assets.

The current weakness in gilts is seen as an Achilles heel for the pound. If the DMO is perceived to be near its funding limits, and UK growth falters, then investor confidence in UK fiscal sustainability will weaken further. That puts downside pressure on GBP—making EUR/GBP an attractive long for many macro traders.

Bank of England Rate Cut Expectations

Markets are now pricing in roughly three interest rate cuts from the Bank of England (BoE) in 2025. These expectations align with the dovish tone coming from recent BoE communications.

This diverging monetary policy path between the BoE and ECB—where rate cuts may be more gradual—adds upward momentum to EUR/GBP. Lower UK rates generally reduce GBP attractiveness, making EUR relatively more appealing in the cross.

US Data Influence on FX & Bond Markets

While local UK concerns are driving EUR/GBP higher, global macro risks also play a role. The upcoming US CPI report could influence global bond sentiment. If inflation comes in hot, it might push yields higher in the US too—potentially creating spillover volatility.

However, strong demand for US Treasuries in recent auctions, including the 10-year, and expectations for a solid 30-year auction today, could provide some relief to global bond markets. But UK gilts may remain the weak link.

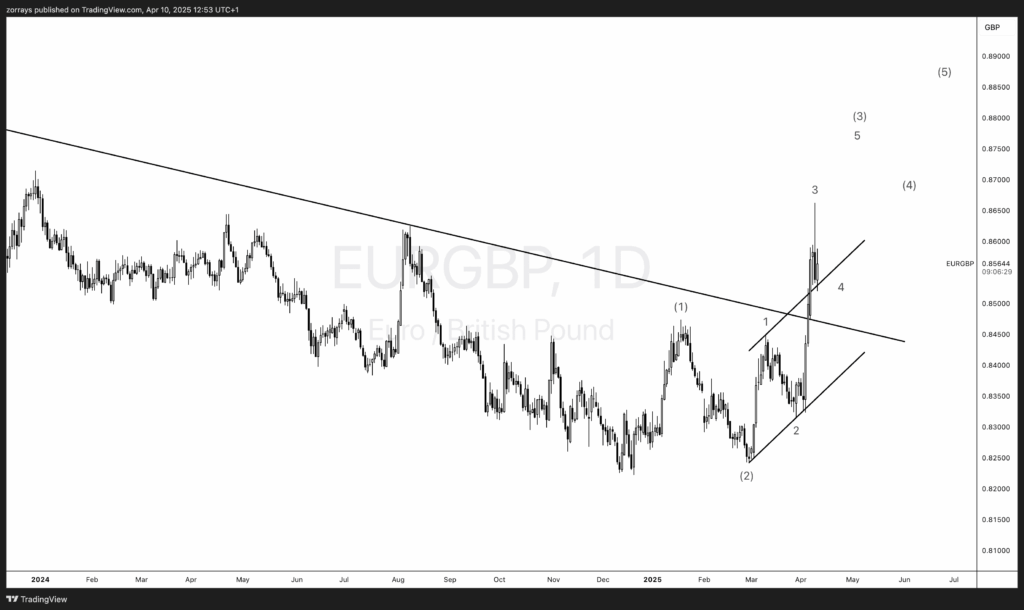

Technical Analysis: EUR/GBP Correcting Into Trendline in Wave 4

The latest EUR/GBP chart reveals a more nuanced and bullish technical setup than previously considered. Not only has price action broken decisively above a multi-year descending trendline, but it’s also unfolding a classic five-wave impulsive structure—adding confluence to the bullish outlook.

According to this updated view, the breakout marked Wave 3 of a larger Elliott Wave sequence, and the current price pullback is a Wave 4 correction, now retesting the previously broken trendline. This retest aligns with both the technical and psychological principles of trend continuation.

From a structural standpoint, Wave 3 has shown the typical characteristics of an explosive move: a strong upward surge on expanding volume with minimal pullbacks. That momentum has now cooled as Wave 4 begins to form—a healthy consolidation phase within the larger bullish trend.

Trendline Retest Confluence

The broken multi-year descending trendline, which previously served as dynamic resistance, is now acting as potential support. The correction is unfolding precisely into this zone, suggesting a high-probability support bounce area.

This convergence of Elliott Wave analysis and classical trendline dynamics offers a compelling case for bullish continuation. If the trendline holds firm, it would validate this structure and potentially launch Wave 5, targeting levels above 0.8700 and possibly toward 0.8850.

Wave 4 Characteristics and Bullish Setup

Wave 4s tend to be complex, sideways, or zigzag-type corrections. The current pattern appears to be forming a modest flag or wedge, suggesting limited downside potential if support holds.

The internal subdivisions also suggest that Wave 4 is nearing completion. Once this consolidation matures, the next leg higher—Wave 5—could resume, offering a renewed bullish impulse.

Risk-Reward and Invalidation Levels

The ideal bullish setup would be a strong candle rejection off the trendline, signaling that buyers are stepping back in. Invalidation of this structure would occur if the price dips significantly back below 0.8450, thereby breaking the structure and invalidating Wave 4 as a shallow correction.

On the upside, resistance targets for Wave 5 include:

- 0.8700 – the high from Wave 3

- 0.8800 – psychological resistance and a historical supply zone

- 0.8850-0.8900 – completion zone for a full five-wave move

Intermarket Relationships and EUR/GBP

The interaction between bond markets, FX, and broader risk assets cannot be ignored. As UK bonds wobble, GBP suffers. As EUR remains relatively stable, the EUR/GBP cross finds strong upward momentum.

Gilt Supply Concerns and Fiscal Risk

A £300bn issuance plan is bold, but potentially destabilizing if the market isn’t ready to absorb that volume—especially if fiscal credibility is in doubt. A slowing UK economy, with rising social safety net costs, only exacerbates the risk.

Market Sentiment: Sterling’s Achilles Heel

Gilt fragility is undermining sterling’s position as a reliable asset. Until these concerns are addressed—either through fiscal discipline or clearer central bank support—GBP may struggle to attract capital.

Historical Context: Previous Gilt Crises

This isn’t the first time UK gilts have scared the market. The infamous 2022 mini-budget under Liz Truss caused a sharp yield spike and forced the BoE to step in. Investors remember. That legacy still hangs over the gilt market today.