- Weekly Outlook

- April 12, 2025

- 6min read

Tariff Turmoil & Market Mayhem: 7 Wild Days That Left Everything the Same

This past week in financial markets was nothing short of a rollercoaster ride. US 10-year Treasury yields soared by over 40 basis points – a move we haven’t seen since the early 2000s. The dollar weakened nearly 4% against the euro, and the S&P 500 surged almost 4%. On paper, it was one of the wildest weeks in recent memory. Yet, for all the noise and movement, the broader economic outlook remains almost exactly where it was seven days ago.

The standout drama was the 90-day tariff reprieve granted to several key US trading partners. While this created an initial sense of relief, it was quickly balanced out by a staggering escalation in tariffs on China. The effective average US tariff rate still stands at 28% – unchanged from the level before this week’s developments. For context, that’s the highest it’s been since the early 20th century.

Tariff Tensions: More Smoke Than Fire?

Despite the sharp change in direction, the actual impact of this week’s trade policy shakeup may be less meaningful than it first appeared. While some countries, especially in Europe and Southeast Asia, benefitted from a reduction to a 10% tariff rate, China saw its tariffs spike to 145%.

In practice, this won’t shift much for importers. Most businesses that could avoid Chinese goods have already done so. Those that can’t will have to absorb the cost or pass it along to consumers, raising inflationary pressure.

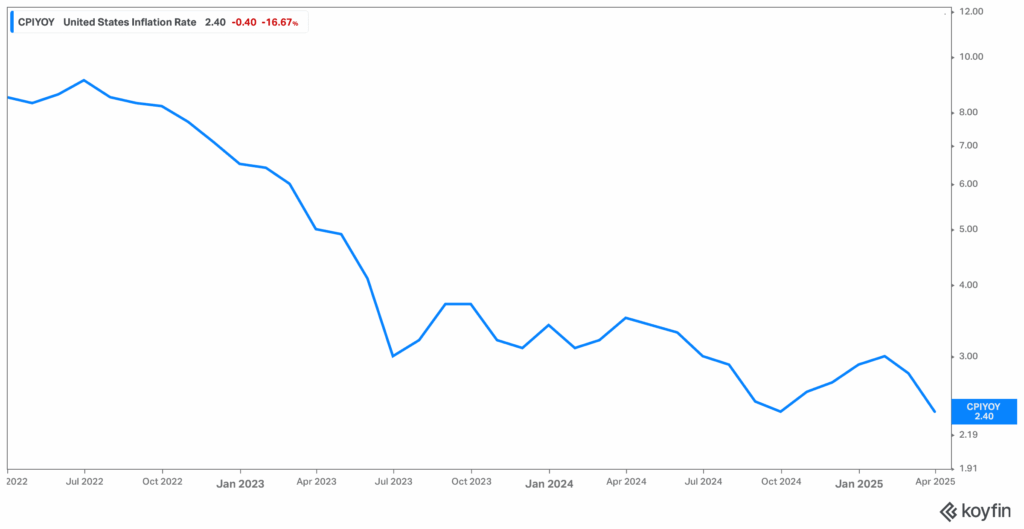

Inflation Pressure Is Building

US inflation is expected to rise despite the latest softer-than-expected consumer price data. The lag effect of tariffs means the impact on inflation could be felt within months. With consumers likely to front-load spending to avoid price hikes, a short-term retail boost is likely, but a subsequent slowdown remains a strong possibility.

Expect monetary policy to respond. The market is currently pricing in three to four rate cuts in the second half of the year – a shift from earlier expectations. The Federal Reserve’s focus will stay on inflation for now, but attention could turn toward growth risks by summer.

Europe Eyes Rate Cuts Amid US Uncertainty

The European Central Bank is still on course for a rate cut next week. Despite receiving a better-than-expected deal on US tariffs, Europe’s economic trajectory remains closely tied to the US. If the American economy starts to falter, export-heavy EU nations will feel the strain.

Though there’s long-term optimism about major fiscal spending across the eurozone, this won’t materialise until at least 2026. In the meantime, monetary policy will need to do the heavy lifting.

Markets Looking for Stability

Financial markets remain highly sensitive to signs of policy shifts. This week’s bounce in risk assets following the tariff reprieve highlights how jittery sentiment is. However, that initial rally faded quickly – a signal that investors remain wary of the uncertainty and abrupt policy changes still hanging over global markets.

Bond yields could push even higher in the near term, potentially approaching 4.75% on the US 10-year Treasury. In currency markets, the dollar’s decline may not yet have found a floor.

What to Watch for Next Week (April 14-20)

United States

- Retail Sales (Wed): Expect a strong reading for March, thanks to consumers rushing to beat impending tariff hikes. Auto sales rose sharply, and credit card spending on appliances and electronics was also solid. This may provide a temporary lift to Q1 GDP, but challenges loom.

- Industrial Production (Wed): Focus will be on whether businesses are responding to government pressure to “reshore” manufacturing. However, ongoing trade uncertainty and fears of retaliation may be holding back business investment.

- Federal Reserve Commentary: Markets are currently pricing around 90 basis points of rate cuts in 2025, after a brief dip following the tariff reversal earlier this month. Further clarity on the Fed’s response to inflation and trade disruptions will be crucial.

Canada

- Interest Rate Decision (Wed): The Bank of Canada is walking a tightrope. While some economic indicators are looking better than expected and inflation is ticking up, concerns about exports to the US and a softer labor market may tip the scales. Odds slightly favour a hold at 2.50%, but a cut can’t be ruled out.

United Kingdom

- Jobs Data (Tues): Watch closely to see if the recent increase in employer national insurance contributions is cooling the labor market. Redundancies haven’t increased yet, but a drop in vacancies or payroll numbers could be telling.

- Inflation Data (Wed): Lower fuel prices should bring headline inflation down, but the spotlight will be on services inflation. A modest easing is expected, with more noticeable improvements likely in Q2. Rate cuts are still anticipated quarterly into 2026.

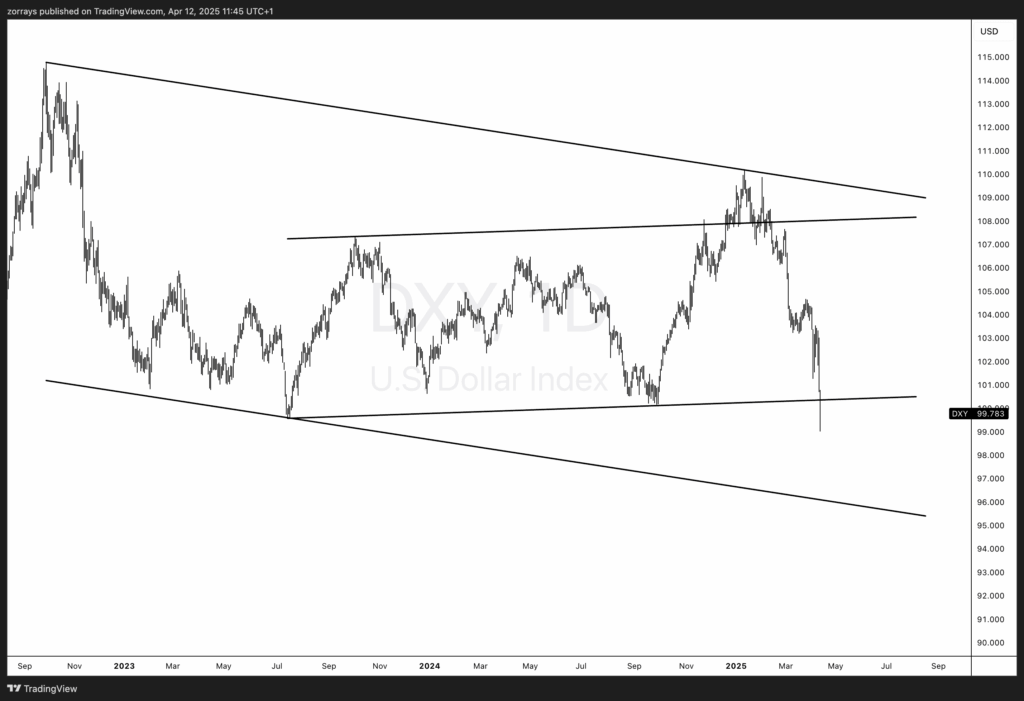

Dollar at the Edge: Approaching the Lower Bound of the Channel

The US Dollar Index (DXY) has seen a dramatic slide over the past week, aligning with heightened volatility across global financial markets. As shown in the chart, the DXY has broken below the key 101 level and is now trading around 99.78, approaching the lower boundary of a long-term bull flag formation that has been intact since late 2022.

This move comes amid rapidly shifting sentiment around US trade policy and interest rate expectations. While US tariffs on some allies were reduced, China saw a sharp increase, keeping the average US tariff rate elevated at 28%. At the same time, markets have begun to price in aggressive rate cuts later in the year, putting additional downward pressure on the dollar.

Technically, the DXY is testing a significant support zone. A clean break below the lower bound of this channel could signal further downside for the greenback, potentially pushing it toward the mid-90s. However, a bounce from this support could also occur if market sentiment shifts again – especially if the Fed changes tone or geopolitical dynamics evolve.

Key Takeaway

This was the week where everything changed – and yet nothing really did. Tariff chaos, wild market swings, and surprising resilience all defined the past few days. But the outlook for the global economy remains largely the same: inflation risks are rising, central banks are preparing to pivot, and uncertainty is keeping markets on edge.

As we move into a new week, investors, businesses, and policymakers alike will need to stay buckled in. The ride is far from over.