- Weekly Outlook

- January 31, 2025

- 3min read

BoE Rate Cut Incoming? Cable and FTSE100

The Bank of England (BoE) is widely expected to cut interest rates at its upcoming meeting on Thursday, February 6. The key question for retail traders is: how will this decision impact markets, and what should you be prepared for?

Key Expectations for the BoE Meeting

- The BoE is expected to cut rates by 25 basis points (bps) with an 8-1 vote in favor.

- Market sentiment is increasingly pricing in four rate cuts in 2025, one per quarter.

- The Bank may downplay future rate guidance, leaving room for flexibility.

- Potential surprises: If a typically hawkish committee member, such as Catherine Mann, votes for a cut, markets may react with a dovish rally.

Why is the BoE Cutting Rates?

The UK economy is showing signs of weakness, with a softening jobs market and slowing inflation. While inflation remains above the BoE’s 2% target, recent data suggests that services inflation is moderating, and private-sector employment is declining. These factors make a rate cut more likely.

Market Impact – What to Watch

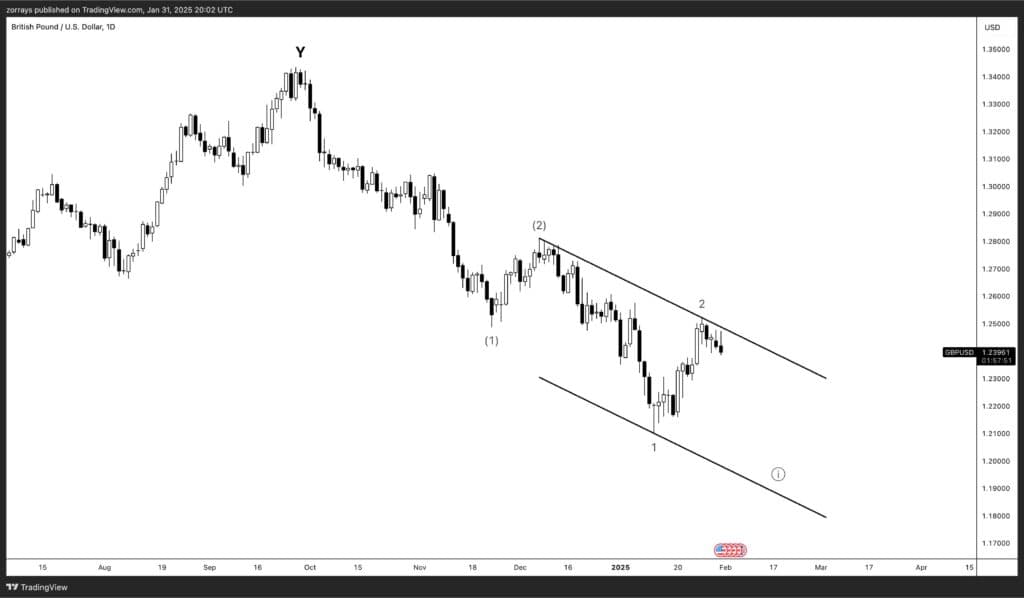

1. GBP Volatility

- The pound (GBP) has rebounded slightly but remains vulnerable.

- A rate cut could lead to short-term weakness in GBP/USD, with a potential move toward 1.20 in the coming months.

- Market focus will be on the vote split and economic forecasts, which could drive GBP sentiment.

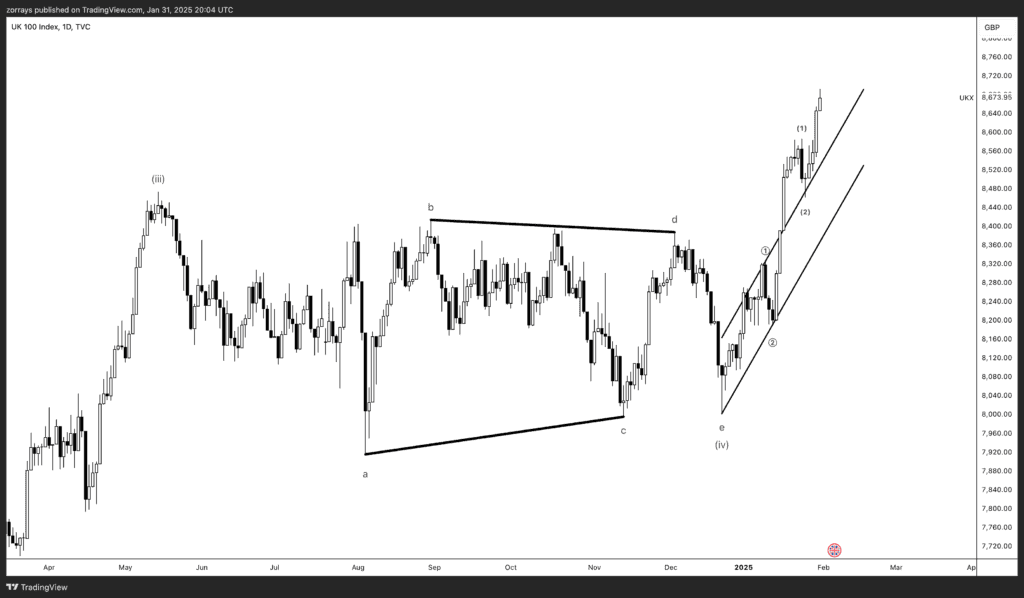

2. Equity Market Reactions

- A dovish BoE could provide support for UK equities, especially rate-sensitive sectors like real estate and consumer discretionary stocks.

- However, concerns over slower growth forecasts may limit gains.

Base Case Scenario: Gradual Rate Cuts with Cautious Guidance

The BoE is likely to maintain a measured approach, signaling that further cuts are possible but not committing to an aggressive easing cycle. This aligns with current market expectations of four rate cuts this year.

However, traders should be aware of two key risks:

- More aggressive cuts: If economic data worsens, the BoE may accelerate its pace of easing.

- Market mispricing: If markets have already priced in cuts, the reaction may be muted unless the BoE surprises with a more dovish tone.

Final Thoughts for Retail Traders

- Expect volatility in GBP around the decision. Watch the vote split and forward guidance for market direction.

- Bond yields may continue to ease, particularly at the short end of the curve.

- UK equities could benefit from easier monetary policy, but weak growth forecasts may limit upside potential.

Stay agile and monitor the market reaction closely – the BoE’s tone will be just as important as the decision itself.