Bearish

Bullish

- November 12, 2025

- 29 min read

Mean Reversion Explained

In the financial markets, prices don’t just move in straight lines forever. A sharp rise or a sudden drop might catch attention, but sooner or later, prices often return to more stable, familiar levels.

Fortunately, there is a way to identify and even measure these moves. It is called mean reversion.

Mean reversion is simply the idea that prices don’t stay extreme forever. Traders use this to spot chances where the price is likely to return to its usual range.

In this guide, you’ll learn what mean reversion is, how it works, and how traders use it every day to make smart trading decisions, and what tools are used in it.

What Is Mean Reversion?

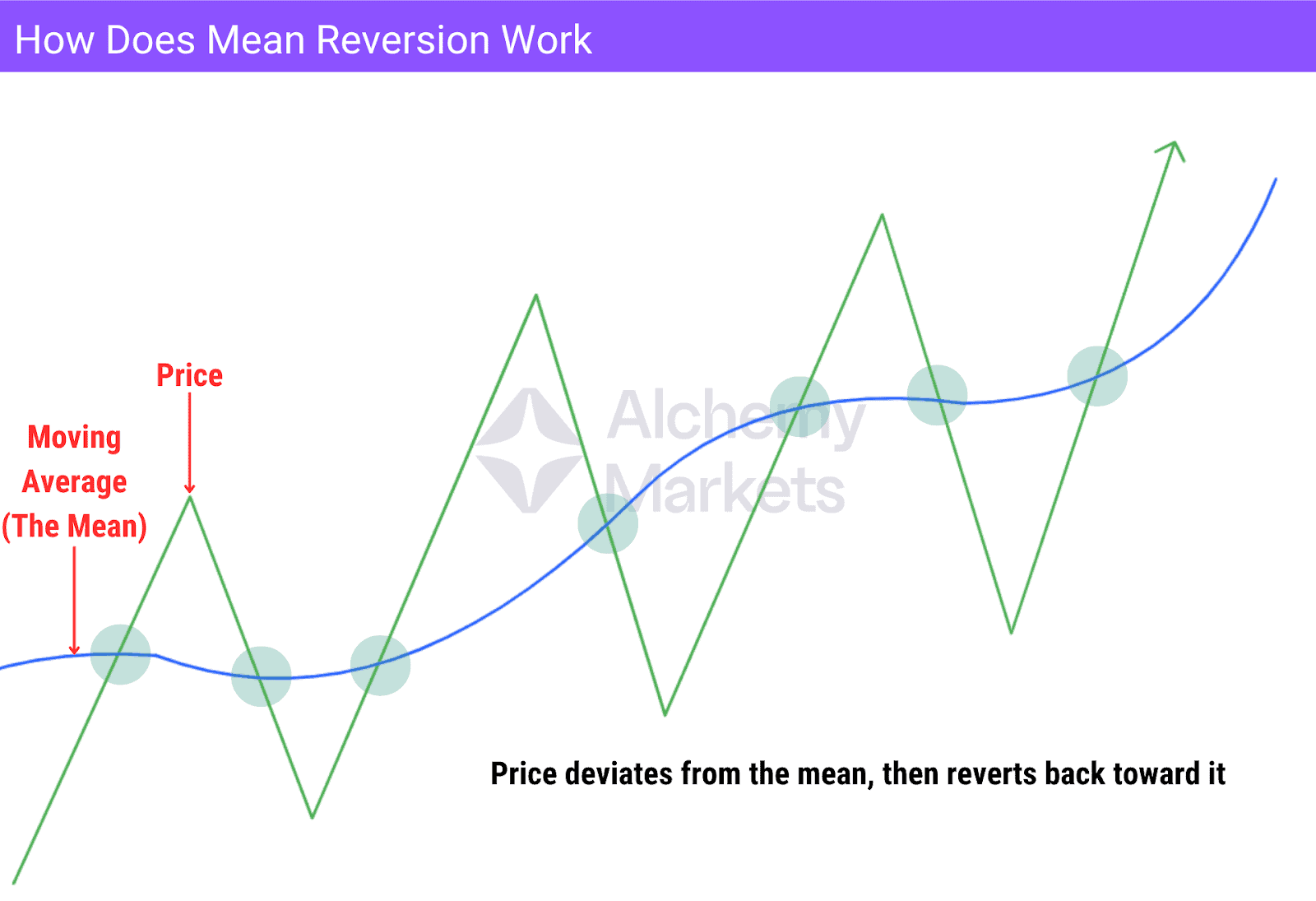

Mean reversion is a financial theory that suggests asset prices do not trend endlessly in one direction. Instead, they tend to return, or “revert,” to a historical average over time. This could be a fixed period average, such as a 200-period simple moving average (SMA), or other dynamic calculations based on recent price data.

Across markets including stocks, forex, and commodities, the pattern is similar: when prices move too far from their average, they rarely stay there for long and often drift back toward normal levels. This behaviour underpins many mean reversion trading strategies.

Think of it like a rubber band. The more it is stretched from its resting point, the stronger the pull to snap back. Prices act the same way; when they move too far up or down, they often reverse toward the mean.

Importantly, mean reversion does not guarantee prices will return to an exact level. It highlights a probability: extremes tend not to last forever, creating opportunities for traders to capitalise on price deviations and identify high probability setups.

How Does Mean Reversion Work in Trading?

Mean reversion trading assumes that when price moves too far from its long-term average, often due to market inefficiencies, panic, or speculative excess, it has a strong tendency to return toward that average. This deviation creates potential trading opportunities.

The process involves three stages:

- Identify the Mean: Use moving averages, such as the SMA (Simple Moving Average) or EMA (Exponential Moving Average) to define the mean. The 200-period SMA is a common benchmark for the historical average.

- Detect the Deviation: Watch for moments when price moves far from the mean. Oscillators and similar tools help identify overbought or oversold conditions, signalling when price may revert.

- Trade the Reversion: Once extremes are identified, trade against the prevailing move. In a bear market, if price moves far above the mean, short in anticipation of a decline. In a bull market, if price drops well below the mean, look for buying opportunities.

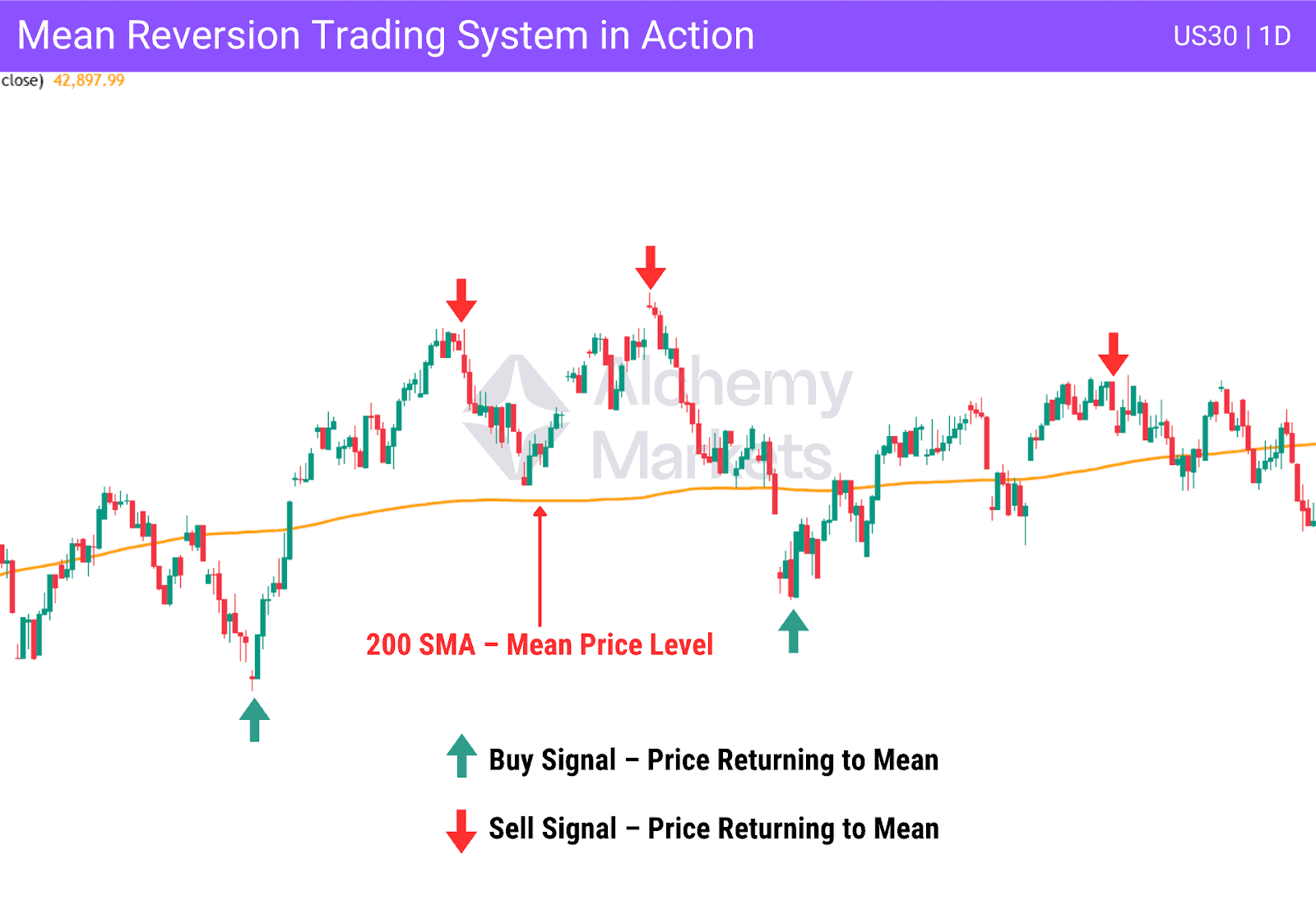

Mean Reversion Trading System

A strong mean reversion trading system combines precision, discipline, and clearly defined rules. It uses proven indicators to detect extremes, applies a rules-based entry criteria, and manages risk with predefined stops. This framework allows traders to exploit price deviations while maintaining consistent performance.

Core Indicators

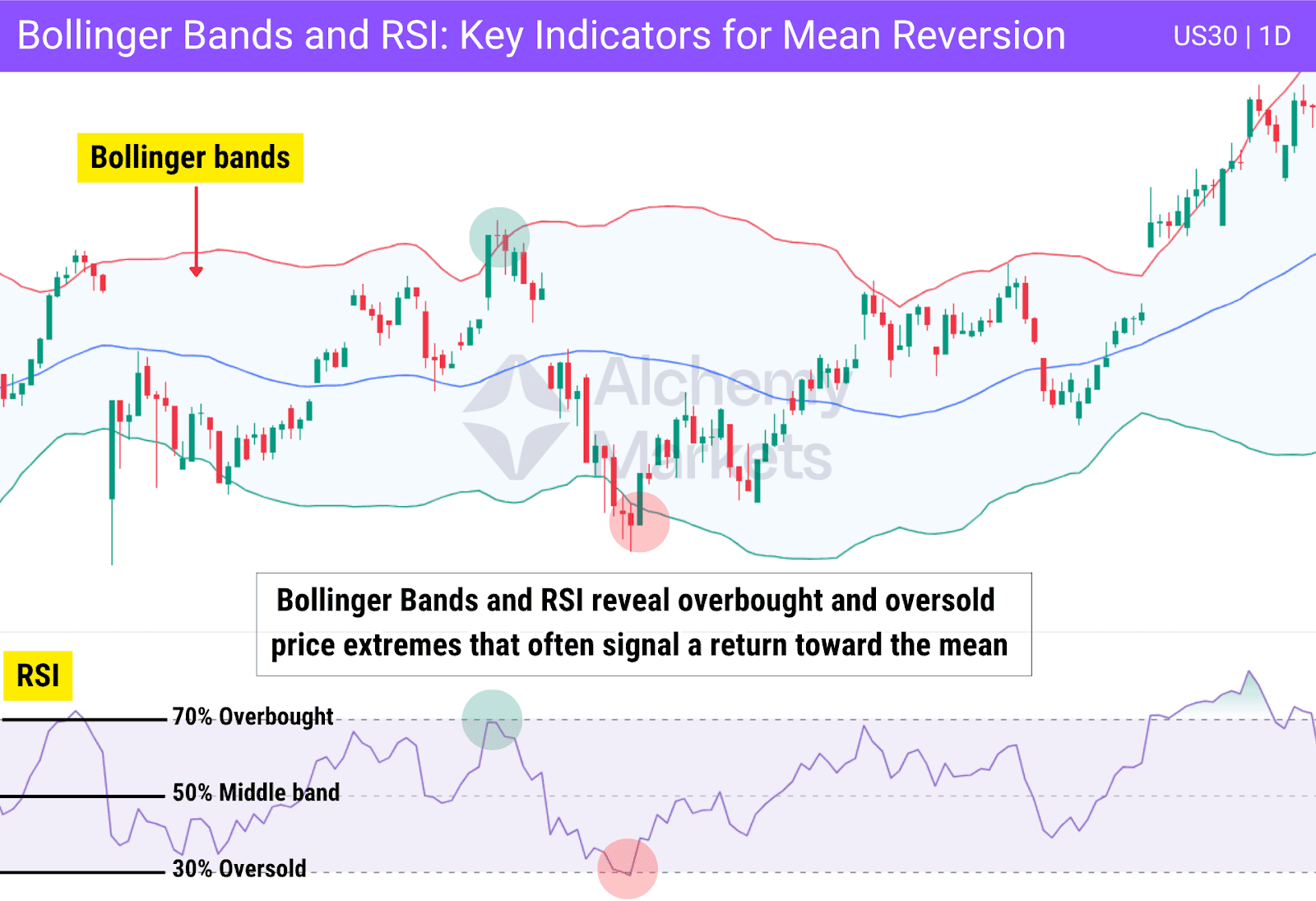

Traders use indicators to identify both the mean and potential reversal points. Bollinger Bands®, RSI, and Stochastic Oscillators highlight overbought and oversold conditions. MACD helps confirm momentum shifts, while the 200-period SMA provides a long-term reference for trend direction.

Entry Criteria

Entries involve opening a trade at the start of the next candle after detecting a potential reversal. This may be identified through overbought or oversold readings from oscillators, price touching extreme levels such as outer Bollinger Bands, or candlestick patterns signalling exhaustion and a likely return toward the mean.

The goal is to enter as early as possible in the reversion phase while still basing the decision on objective technical signals.

Risk Management

Stop losses are typically placed just beyond the nearest swing high when shorting, or below the nearest swing low when buying.

Take-profit targets are usually set at the mean, such as the middle line of the Bollinger Bands or the 200 SMA, balancing reward-to-risk and win rate. Some traders extend targets to the opposite band for larger moves, though this may reduce the win rate.

Timeframe Focus

The daily timeframe generally provides the cleanest and most reliable signals, as it filters short-term market noise. Intraday timeframes can also be used but require tighter stops, faster execution, and stricter filtering to avoid false signals.

Psychological Edge

Mean reversion often requires going against the crowd, such as buying during fear or selling during euphoria. Sticking to rules and trusting the system reduces hesitation and improves consistency over time.

Importance of Mean Reversion in Trading

Understanding the importance of mean reversion provides a clear trading edge. This approach exploits market inefficiencies, moments when asset prices move too far from their historical average and are likely to return.

Consistency in Market Cycles

Even in strong trends, prices naturally deviate from their average. Recognising these deviations can create high-probability trading opportunities in uptrends, downtrends, and ranging markets.

Clarity Through Structure

Mean reversion strategies use objective metrics to identify extremes. Oscillator-based indicators such as the Relative Strength Index (RSI) and Bollinger Bands help traders spot overbought and oversold conditions with less emotional bias.

Versatility Across Markets and Timeframes

The principles apply to forex, equities, commodities, and indices. They can be adapted to short-term intraday setups, swing trades, or long-term positions. In uptrends, traders may buy during oversold pullbacks; in downtrends, they may sell into overbought rallies; in ranges, the focus is on repeated oscillations between support and resistance levels.

Risk Management and Psychology

Targeting moves back toward equilibrium naturally defines entry and exit points, making risk easier to manage. Mean reversion also rewards contrarian thinking, buying when others panic and selling when others chase euphoria — a mindset shared by investors like Warren Buffett and Jim Simons.

Common Indicators Used in Mean Reversion

Mean reversion strategies rely on technical indicators that highlight when price has moved significantly away from its average, often signalling overbought or oversold conditions where a reversal toward the mean may occur.

Here’s a breakdown of the most commonly used tools:

Moving Averages (SMA / EMA)

The backbone of most mean reversion trading systems, moving averages represent the historical average of price movements over time. The 200-period SMA is a classic choice for identifying the mean price in long-term investors’ strategies.

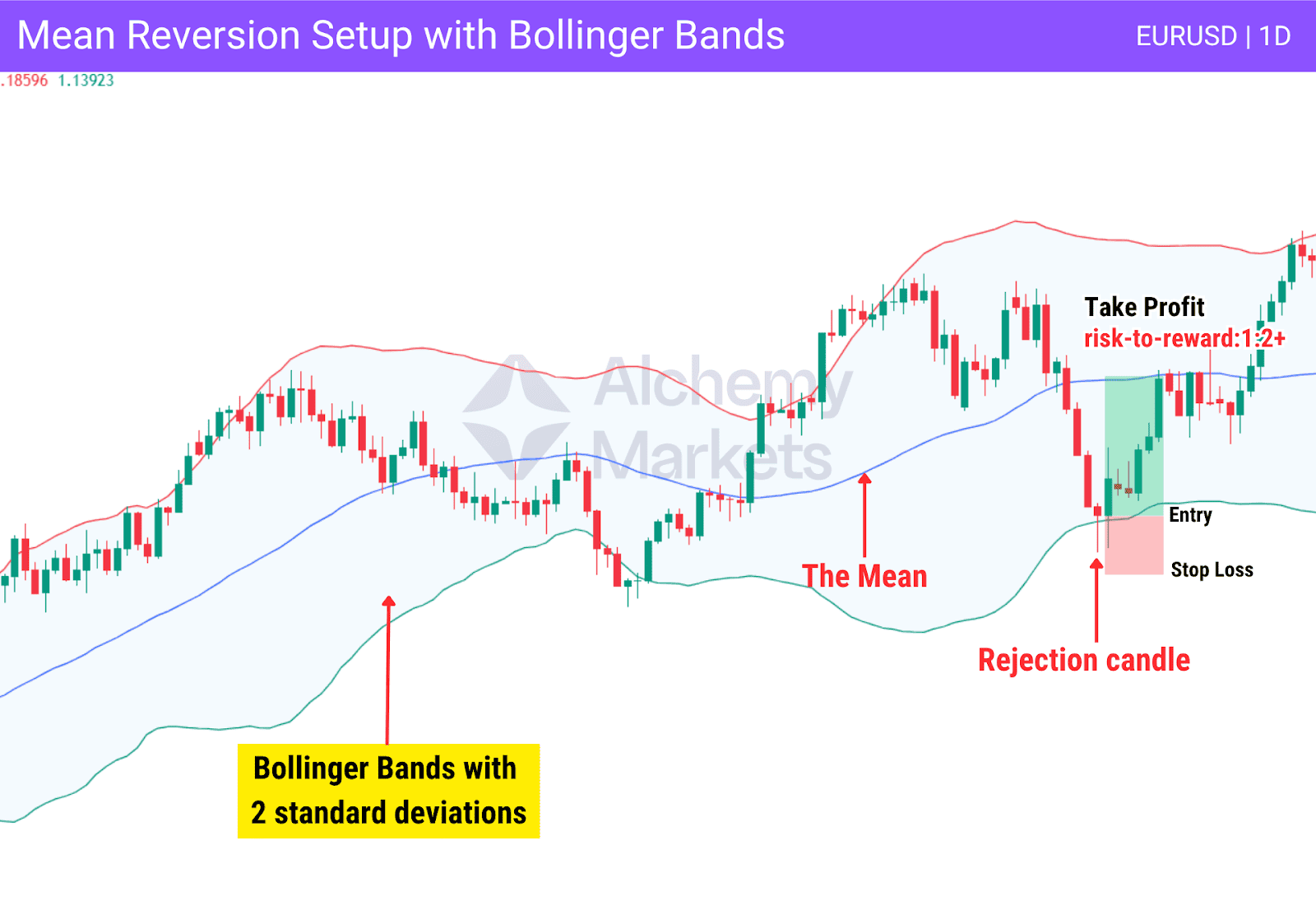

Bollinger Bands

Bollinger Bands consist of a moving average with two bands plotted above and below it, based on standard deviations. These bands help detect overbought and oversold conditions. A rejection from either band may indicate a potential mean reversion signal, suggesting that price could return toward the mean.

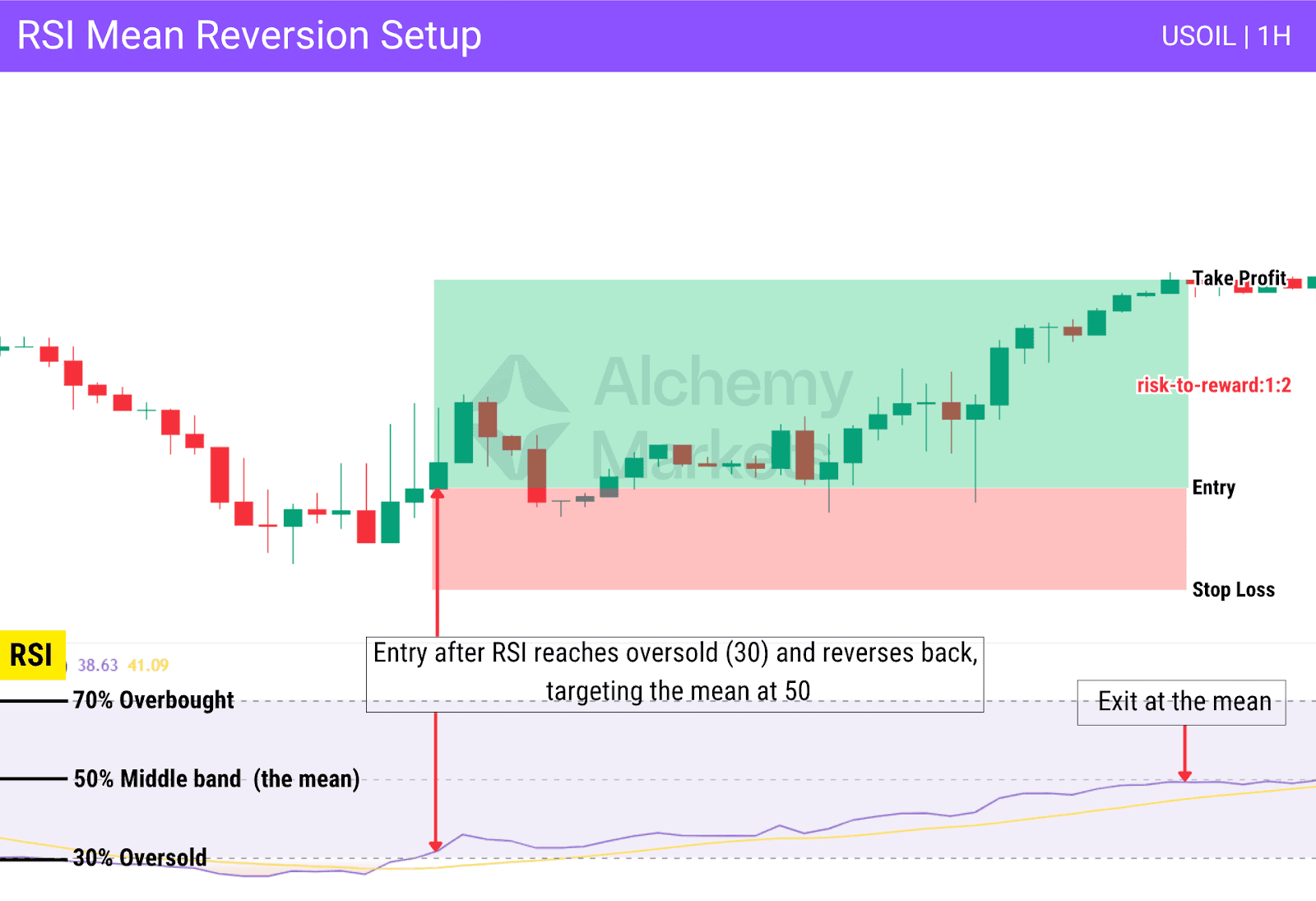

Relative Strength Index (RSI)

RSI measures price movements relative to recent gains and losses, identifying extremes via readings over 70 (overbought conditions) or below 30 (oversold conditions). It’s a cornerstone for spotting short term price fluctuations likely to revert.

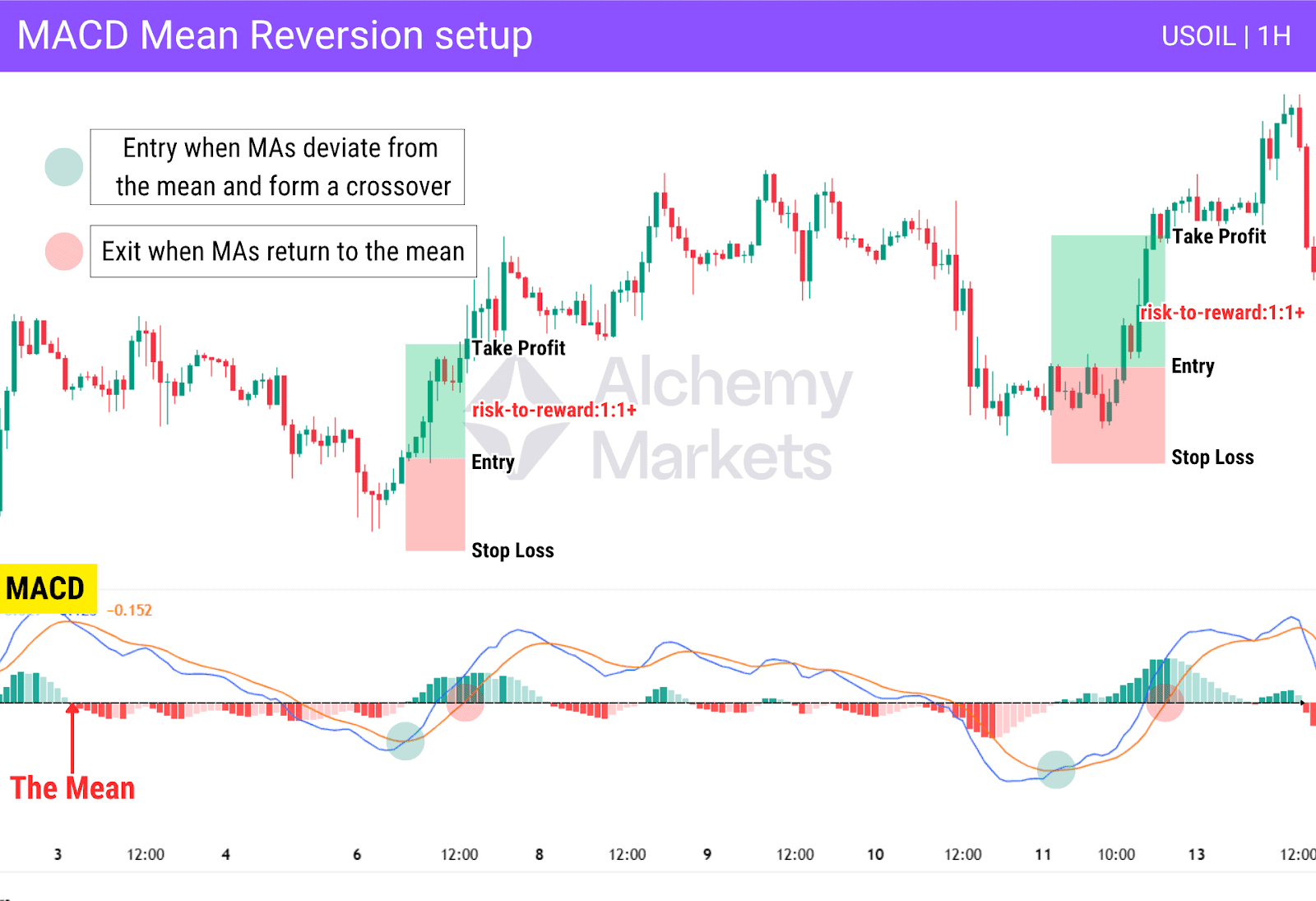

Moving Average Convergence Divergence (MACD)

MACD helps spot momentum shifts. Crossovers, divergences, or signs of fading momentum often hint that a price reversion could be coming.

Stochastic Oscillator

Stochastic indicator measures current price relative to its price series’ recent high-low range. Falling below certain thresholds in a bull market, or rising above in a bear market, signals potential reversion trading setups.

Together, these multiple indicators form the basis for identifying extreme market movements — the foundation of mean reversion strategies.

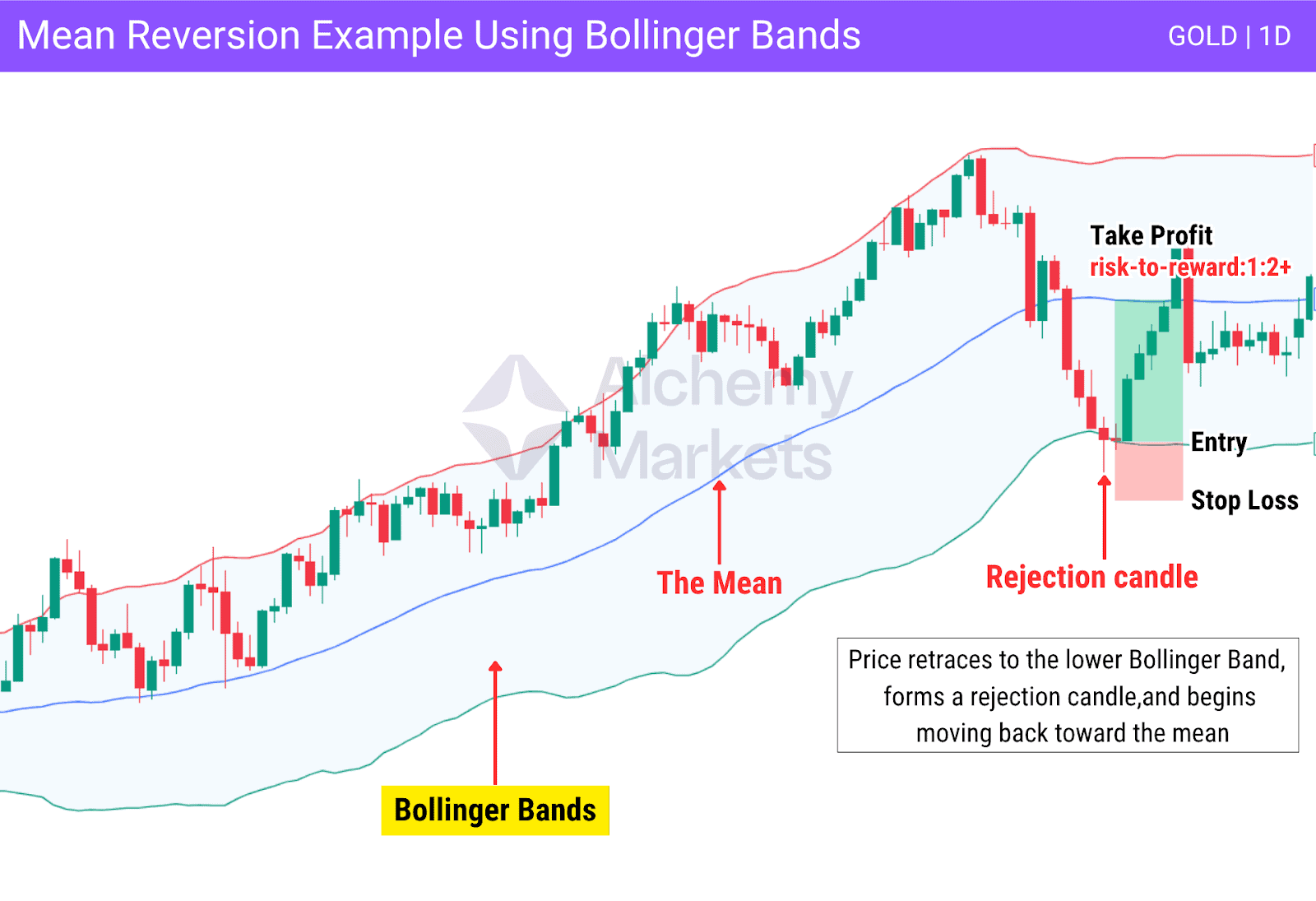

Mean Reversion Example

This example represents the GOLD price on the daily timeframe using Bollinger Bands. It shows an uptrend followed by a retracement into the lower band.

Identifying the Setup

- The lower band highlights oversold conditions. At this level, price forms a rejection candle, suggesting the corrective move may be ending. The mean, represented by the middle band, becomes the logical target for the next move.

Entry Criteria

- Enter long on the candle following the rejection candle, aligned with the lower band.

Stop Loss

- Place your stop just below the low of the rejection candle to minimise downside risk.

Take Profit

- Target the middle band (mean) to capture the move back toward equilibrium with a risk-to-reward ratio above 1:2.

Key Insight

- Bollinger Bands alone can define extremes, guide entry and exit levels, and provide a structured framework for mean reversion strategies without relying on additional indicators.

How to Calculate Mean Reversion

Calculating mean reversion involves measuring how far an asset’s price has moved from its historical average. This process combines simple arithmetic and basic statistics to identify potential trading opportunities.

| 1. Select a Timeframe Choose the period that will represent the historical mean. Long-term traders often use a 200-period simple moving average (SMA), while shorter-term strategies might use 20 or 50 periods. 2. Calculate the Mean (Average Price) Mean = Sum of Closing Prices ÷ Number of Observations This establishes the baseline price around which deviations are measured. 3. Measure Price Deviation Deviation = Price − Mean This shows how far the current price is from the average. 4. Determine Volatility (Standard Deviation) Standard Deviation = √( Sum of (Price − Mean)² ÷ (Number of Observations − 1) ) This defines the “normal range” around the mean and is used in indicators like Bollinger Bands. 5. Identify Extremes with Z‑Score Z‑Score = Deviation ÷ Standard Deviation A Z‑Score above +2 suggests potential overbought conditions, while a Z‑Score below −2 signals potential oversold conditions. 6. Apply the Insight When price deviates significantly from the mean and supporting indicators confirm exhaustion, mean reversion strategies look for opportunities to target the average price. |

Mean Reversion Formula

The foundation of mean reversion strategies is the calculation of the mean itself. The most common way to calculate the mean is with a Simple Moving Average (SMA):

| Mean = Sum of Closing Prices ÷ Number of Observations |

In mean reversion strategies, the average price (calculated by an SMA, EMA, or VWAP) serves as the central reference point for price movements. When price deviates too far from the average, it tends to revert back to the equilibrium.

This is where Bollinger Bands, regression channels, and other volatility-based tools come in. They visually mark overbought and oversold zones where price reversions are most likely to occur.

Mean Reversion Trading Strategies

Mean reversion trading strategies combine statistical and technical analysis to pinpoint when prices have strayed too far from their historical average.

Tools like Bollinger Bands, RSI, moving averages, and volatility measures highlight overbought or oversold conditions. Below are the most common strategies used to capture mean reversion opportunities:

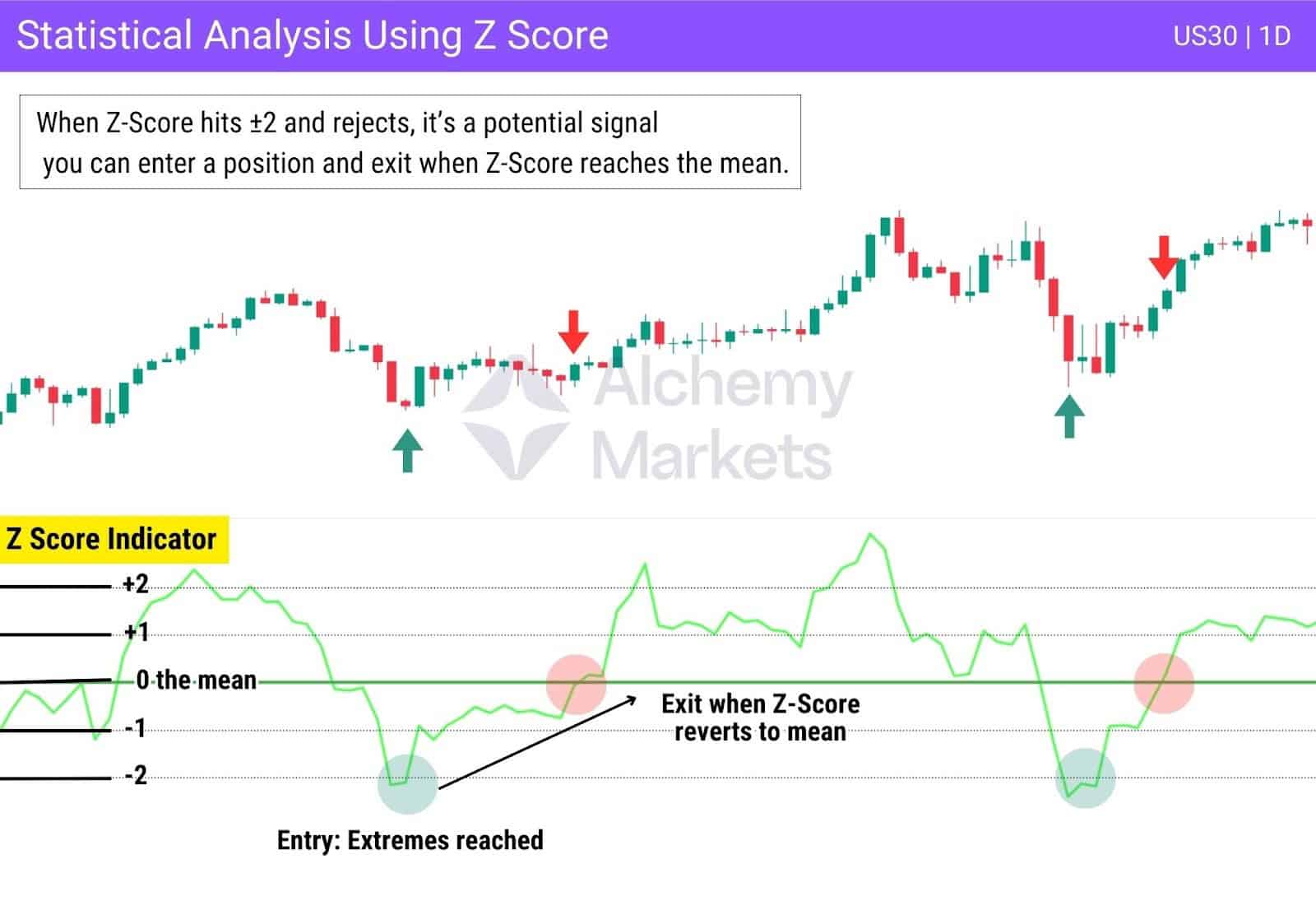

Statistical Analysis

Statistical analysis is the backbone of many mean reversion strategies. It measures how far an asset’s price has deviated from its historical average, using tools like Z-scores, standard deviations, and regression channels to quantify extremes.

After significant moves, prices are statistically more likely to revert toward the mean. This is especially common in algorithmic trading, where precision and speed are crucial.

The Z-score is one of the most widely used metrics for this, showing how many standard deviations the current price is from the mean:

- Zero (0) means the price is exactly at the mean.

- Positive values indicate the price is above the mean (potentially overbought).

- Negative values indicate the price is below the mean (potentially oversold).

The further the Z-score moves from zero, the more statistically extreme the price becomes. Readings around ±2 often signal an unusually high or low level, making a reversion toward the mean more probable. This makes it particularly valuable in algorithmic trading, where calculations can be done instantly to capture short-lived opportunities.

Entry Criteria

- Open a trade when the Z-score reaches ±2 and rejects that level, signalling a likely reversal toward the mean.

Stop Loss

- Place just beyond the recent extreme (high or low) that coincided with the Z-score rejection.

Take Profit

- Target the mean, exiting when the Z-score returns to zero to capture the full reversion while keeping a balanced reward-to-risk ratio.

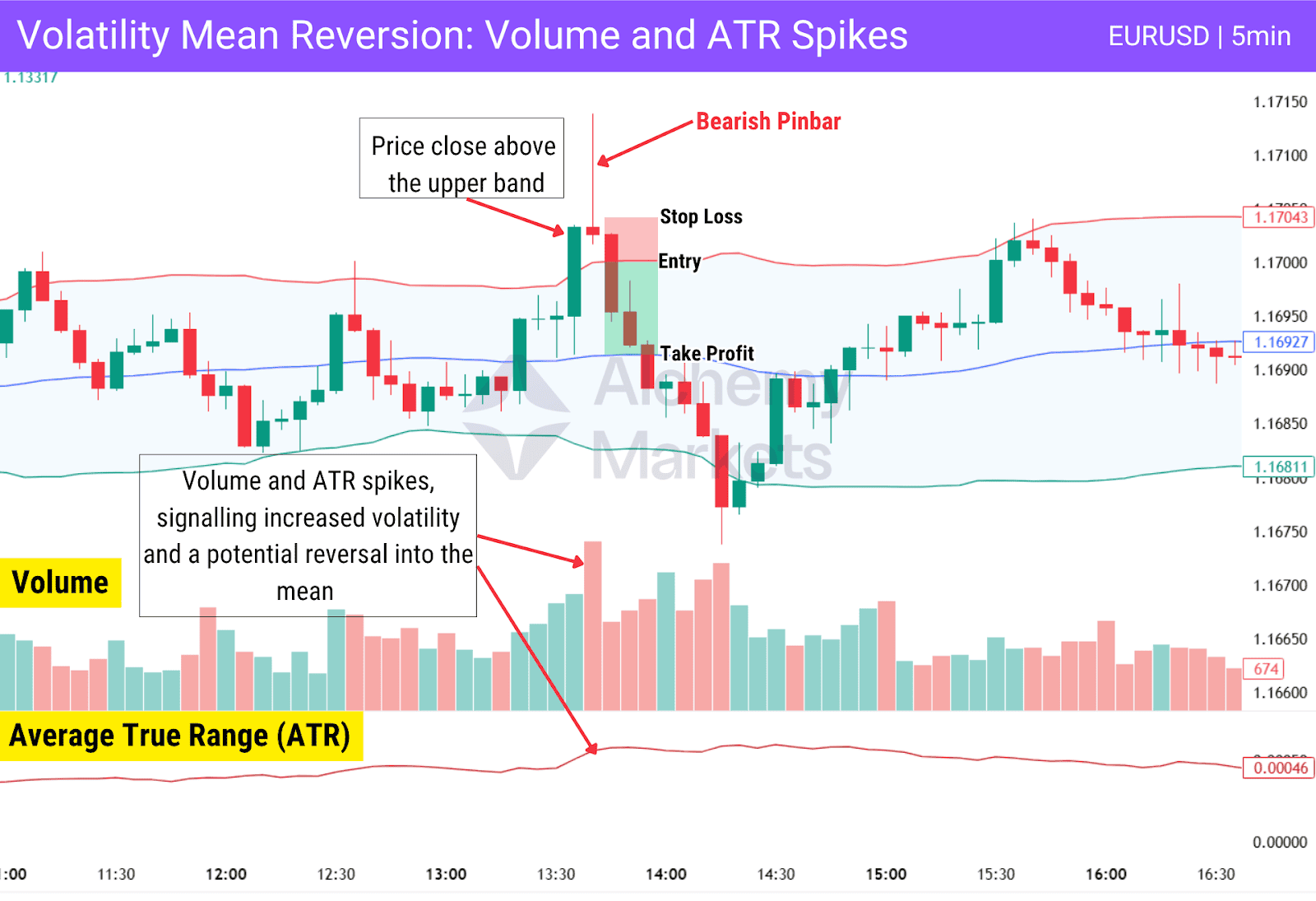

Volatility Mean Reversion Strategy

This approach focuses on price moves that exceed expected ranges. Bollinger Bands expand during volatile periods, marking extreme levels. ATR and volume can confirm whether a move is overstretched. A sharp expansion beyond the bands often signals exhaustion.

Average True Range measures the average value of the True Range (TR), which is a combination of the current high minus the current low, the current high’s distance from the previous close, and the current low’s distance to the previous close.

A rising ATR reflects increasing volatility, which can strengthen the case for a potential price reversion when extremes are reached.

Entry Criteria

- Enter when price closes outside a Bollinger Band, forms a rejection candle alongside higher ATR or volume, then moves back inside the band.

Stop Loss

- Place just outside the Bollinger Band rather than beyond the rejection candle, allowing room for normal fluctuations while keeping risk contained.

Take Profit

- Aim for the middle Bollinger Band (mean) with a typical risk-to-reward ratio between 1:1 and 1:2.

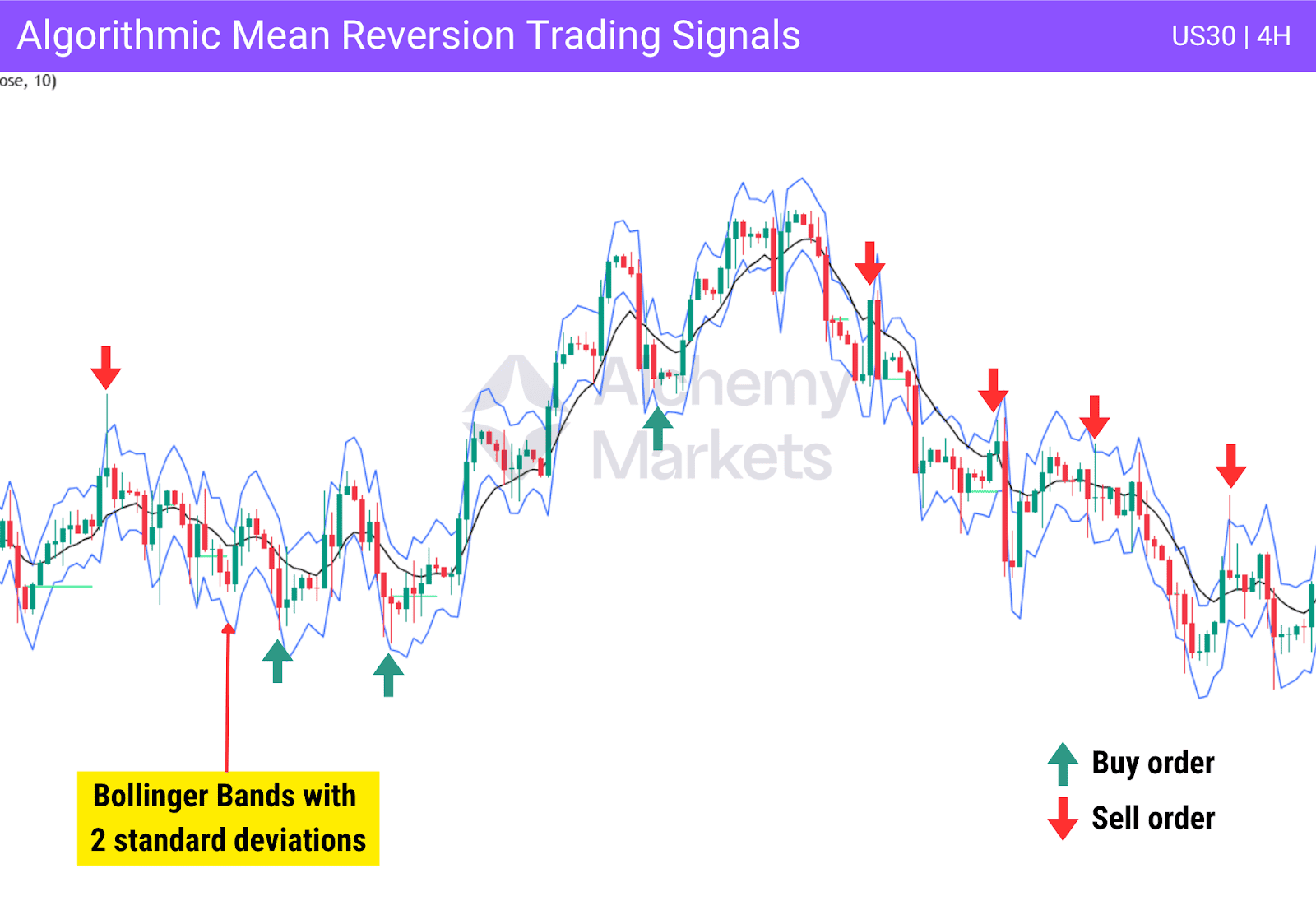

Algorithmic Trading

Algorithmic systems can automate mean reversion, instantly executing trades based on predefined conditions. These systems commonly use Bollinger Bands, Keltner Channels, or custom indicators.

They can scan multiple assets at once, removing emotional decision-making. However, parameters must be optimised for the specific market and volatility conditions.

Entry Criteria

- Target the mean after price touches an outer band for higher win rates, or aim for the opposite band for larger reward-to-risk potential.

Stop Loss

- Set beyond the extreme used for entry.

Take Profit

- Target either the mean or the opposite band, depending on the system’s objective and parameters.

Notes

Success with algorithmic mean reversion comes down to extensive backtesting. Backtesting provides the data needed to refine parameters, understand potential drawdowns, and optimise performance before deploying the system in live markets.

It’s important to note that live performance can differ from backtest results due to factors such as slippage, latency, and execution delays, all of which can affect profitability, especially in fast-moving markets.

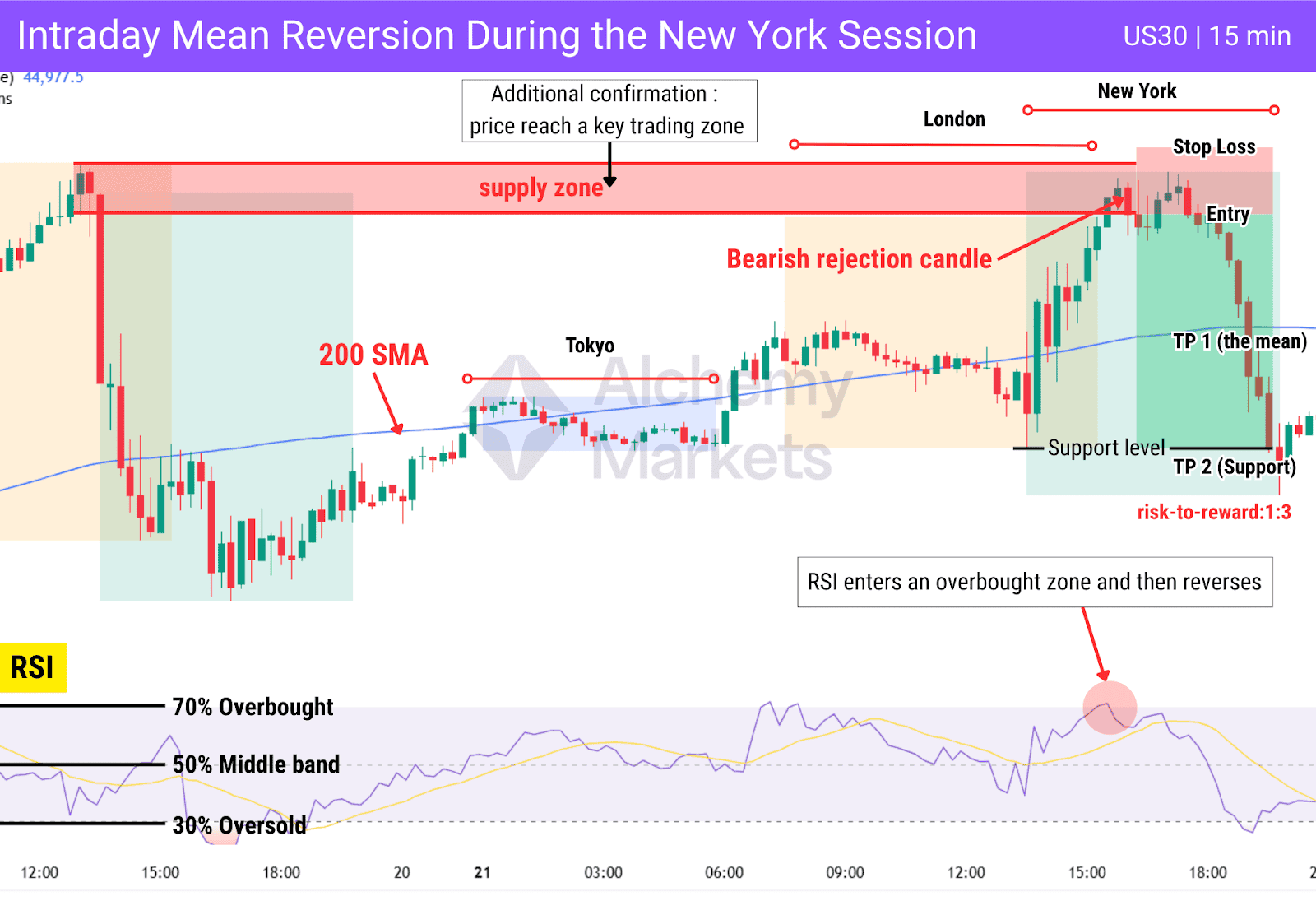

Intraday Mean Reversion Trading Strategy

This strategy captures short-term reversals within a single trading session. Moving averages such as the 200 SMA or Bollinger Bands identify the mean, while RSI or candlestick patterns confirm reversals.

High-liquidity periods like the London or New York sessions tend to produce cleaner setups.

Entry Criteria

- Enter when price extends far from the mean and reaches a key zone, confirmed by RSI overbought/oversold readings and a strong rejection candle.

Stop Loss

- Place just beyond the rejection candle’s extreme.

Take Profit

- Target the mean first, with the option to extend to the next structural level for risk-to-reward ratio, up to 1:3.

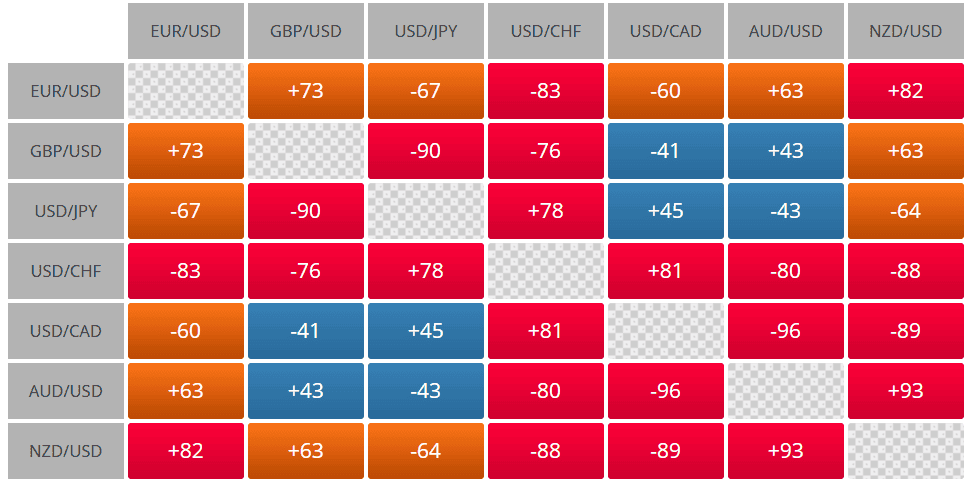

Mean Reversion in Pairs Trading

Pairs trading is a quant strategy, all about trading the correlation between two assets. You would take two assets that correlate (move similarly or in complete opposites), and trade their relationship.

Essentially, when that correlation breaks, we can long one asset, and short the other — betting on the idea that they’ll soon return to their norm.

| Note: Many FX pairs move in correlation because their economies are so intertwined. For example, take the Euro and the British Pound. Additionally, when closely tied currencies receive rate cuts, the other tends to follow suit. These moments allow us to trade the reversion to the norm. |

To set this up, traders must first identify correlating stocks, forex pairs, metals, or whichever asset they want to pair trade. You could use the FXBlue correlation matrix, to find a pair that correlates positively or negatively, at 75% or more:

- A positive correlation means they move together in the same direction at similar speeds.

- A negative correlation means they move oppositely at similar speeds.

So let’s say, we choose to trade EUR/USD and USD/CHF which shares a negative correlation of -0.83, which means they move in opposite directions for 83% of the time.

To map out how far EUR/USD is moving against USD/CHF, we can set up a chart showing EUR/CHF as the ticker. This represents how much stronger the Euro is against the Swiss Franc (CHF).

Then, we set up a Z-Score indicator — this calculates how far an asset has moved away from its average:

- 0 = Represents the mean or average.

- +2 = The asset has moved positively in two standard deviations away from its mean.

- -2 = The asset has moved negatively in two standard deviations away from its mean.

The core idea here is that if EUR/CHF has moved too far in one direction, breaking past +2 or -2 standard deviation, we can look to trade a mean reversion:

- If EUR/CHF Z>2, it means Euro is overvalued against the CHF, so we will short EUR, long CHF.

- If EUR/CHF Z<-2, it means CHF is overvalued instead, so we will long EUR, short CHF.

Let’s see how this plays out in the chart below:

Breakdown:

- The Z-score has appreciated beyond +2 — Euro is overvalued.

- We long CHF/USD, and short EUR/USD.

- Both trades work out in our favour.

Key thing to note here — We used the CHF/USD ticker in this example just to illustrate how pairs trading works (long asset 1 and short asset 2 at the same time). However in practice, we would be shorting USD/CHF and EUR/USD at the same time, as brokers mostly offer USD/CHF as the tradeable CFD.

This highlights the importance of understanding how a ticker symbol works, if you’re trying to pair trade.

| Final Note: Pairs trading is about spotting when correlations break, using z-scores to measure the stretch, and then shorting the rich side while longing the cheap side. |

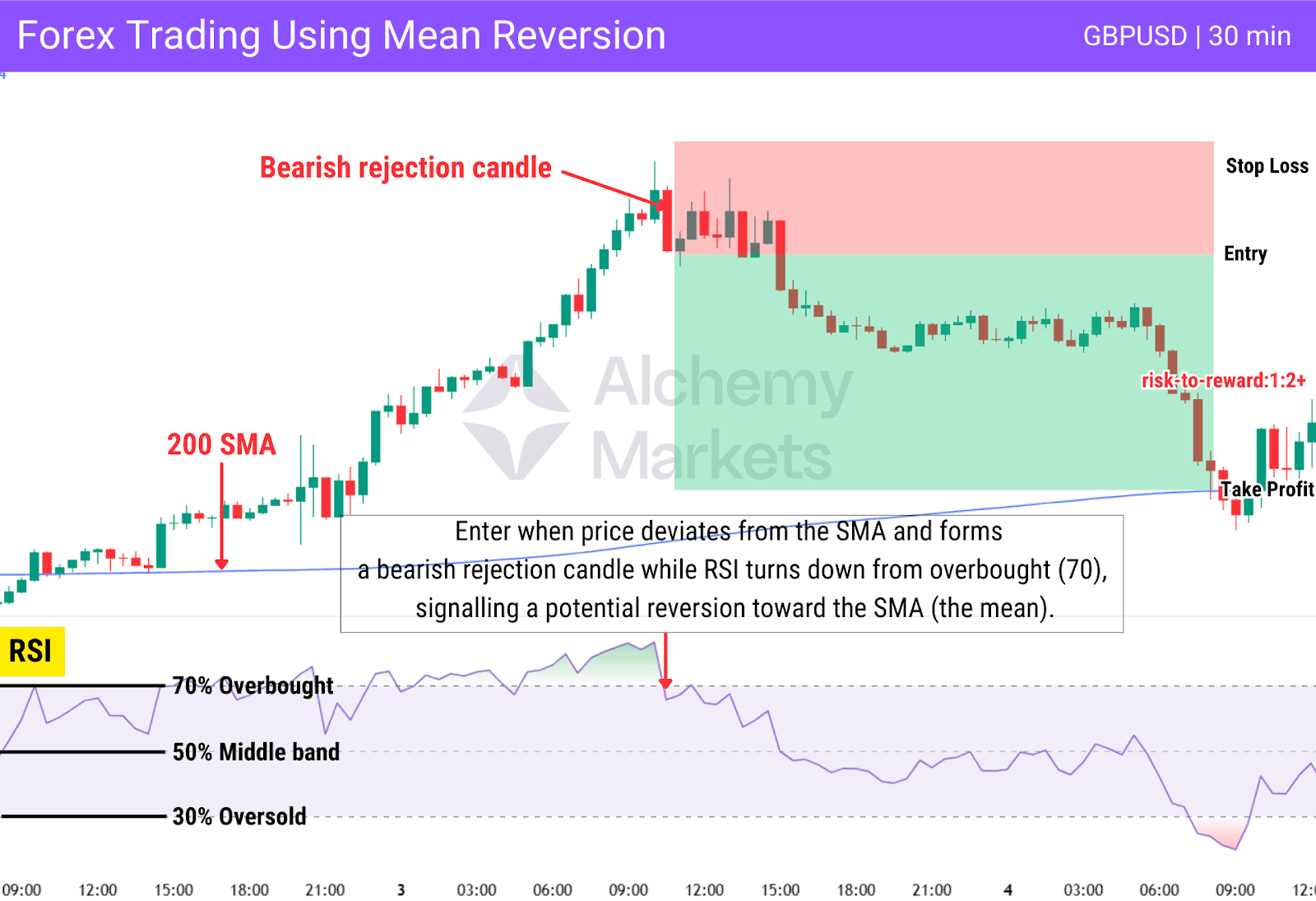

Forex Trading Using Mean Reversion

Mean reversion is widely applied in forex trading, where price often returns to its historical average after sharp moves caused by news or economic data.

The forex market’s high liquidity and round-the-clock activity can create frequent short-term extremes, as well as sharp moves during major events such as central bank announcements.

Entry Criteria

- Identify the mean using moving averages, and find overbought/oversold conditions with RSI, MACD, or Stochastic. Confirm entries with candlestick patterns or key levels, entering at the start of the next candle after the reversal signal.

Stop Loss

- Place beyond the extreme level used for entry.

Take Profit

- Target the mean, such as the middle Bollinger Band or moving average.

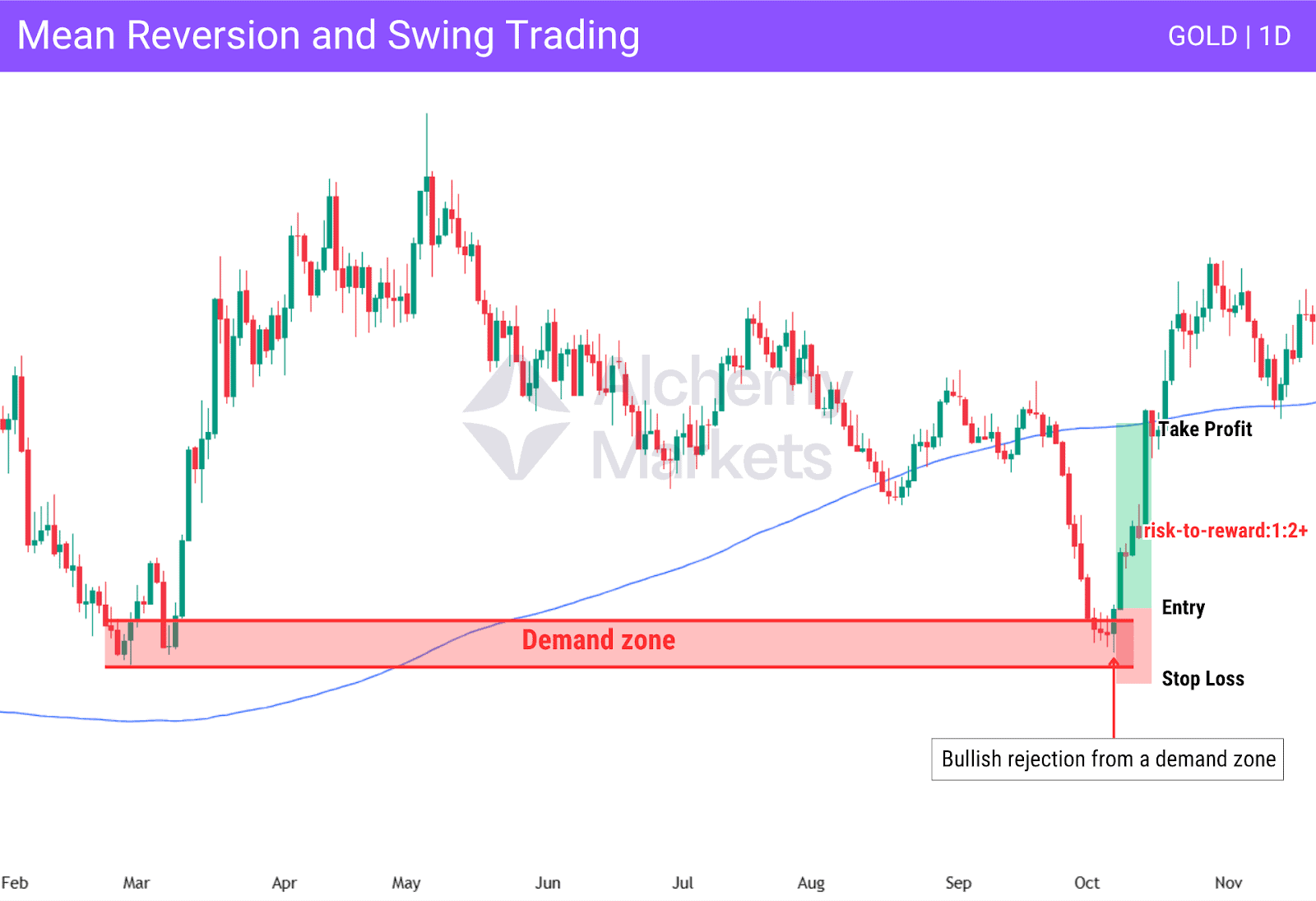

Mean Reversion and Swing Trading

Swing trading aligns well with mean reversion strategies, aiming to capture price fluctuations between extremes. Traders focus on price action at key levels, often confirmed by candlestick patterns such as rejection candles or engulfing formations.

Oscillators like RSI, Bollinger Bands, or Stochastic provide additional confirmation of overbought or oversold conditions. This layered approach helps filter false signals and increases the probability of identifying valid reversal points.

To define the mean, traders often rely on moving averages or Bollinger Bands, which also act as natural take profit references as price reverts. Positions are usually held for several days, giving price time to move back toward equilibrium.

This method is most effective for experienced traders who can anticipate reversals during market inefficiencies or sentiment extremes, while maintaining strict risk management to protect against prolonged deviations from the mean.

Entry Criteria

- Enter when oscillators show extremes, price rejects outer Bollinger Bands, or reversal candlestick patterns form.

Stop Loss

- Place beyond the recent swing high (short) or swing low (long).

Take Profit

- Target the mean, extending to the next structural level if momentum supports it.

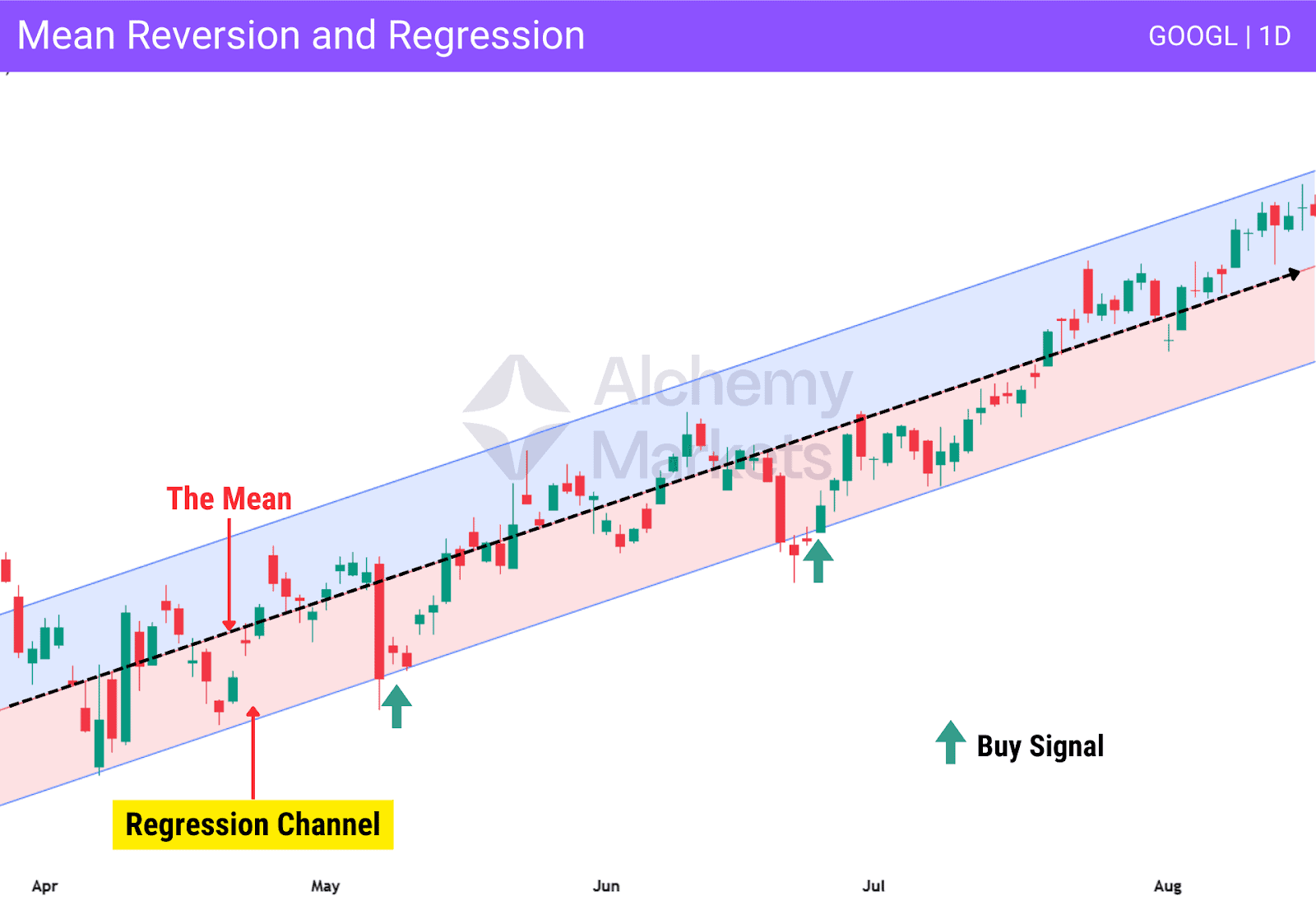

Mean Reversion and Regression

Regression channels are technical tools that use a linear regression line as a reference point for price movement. This line represents the best-fit trend through recent data, showing the prevailing directional bias of price over a chosen period.

Regression channels are then drawn at equal distances above and below this line, often based on standard deviation, to highlight how far price has moved away from its statistical trend.

For mean reversion traders, the outer boundaries of the regression channel mark areas where price may be stretched relative to its underlying trend. When price pushes into or beyond these limits, it suggests overextension.

Traders then anticipate a corrective move back toward the regression line, which serves as a statistical mean reference. This makes regression channels useful in both trending and range-bound markets, offering a clear framework for spotting extremes and planning reversion trades.

Entry Criteria

- Enter when price reaches the outer boundary of the regression channel. For additional confirmation, look for a rejection candle at the channel’s edge and supporting signals from indicators such as MACD or RSI to confirm overbought or oversold conditions.

Take Profit

- Set the target at the mean line of the channel to capture the anticipated reversion toward equilibrium.

Stop Loss

- Place the stop loss just beyond the candle that tested or rejected the channel boundary to protect against a breakout.

Moving Average Mean Reversion Trading Strategy

One of the most classic mean reversion strategies uses the 200-period SMA. When price moves far above or below this average, it often signals a likely return to the mean.

This approach works well in bear markets when prices are overbought and in bull markets when they are oversold. Traders often enhance accuracy by confirming signals with indicators or candlestick patterns.

Entry Criteria

- Enter when price deviates from the 200 SMA and begins to reverse, using indicators and candlestick patterns to confirm potential reversals and overbought or oversold conditions.

Take Profit

- Target the moving average itself (the mean).

Stop Loss

- Place beyond the candle that triggered the reversal.

Bollinger Bands® Trading Strategy

Bollinger Bands are a cornerstone tool for identifying price deviations from the historical mean. They expand during periods of high volatility and contract when markets are quiet, providing a visual map of overbought and oversold zones.

When price closes outside the bands, it often signals an extreme condition where a snapback toward the mean is likely.

Entry Criteria

- Enter when price closes outside the Bollinger Bands, forms a rejection candle, and then moves back inside.

Stop Loss

- Place just beyond the Bollinger Band to give the trade enough room while controlling risk.

Take Profit

- Target the middle Bollinger Band (the mean).

Notes

Using 3 standard deviations instead of the common 2 can improve accuracy by highlighting only the most stretched market conditions, though this reduces the number of signals.

Conversely, 2 standard deviations generate more frequent opportunities because the bands are tighter, but accuracy may drop as some signals occur during normal volatility.

This flexibility allows traders to adjust settings to suit their style, prioritising either a higher win rate or more trade opportunities.

RSI Trading Strategy

The Relative Strength Index (RSI) is a momentum oscillator that highlights overbought and oversold conditions, making it one of the most effective mean reversion tools. Readings below 30 typically signal oversold conditions, while readings above 70 indicate overbought levels.

In uptrends, traders focus on buying oversold dips, anticipating a move back toward the mean. In downtrends, they short overbought rallies, expecting prices to revert lower. Combining RSI with other tools such as candlestick patterns or volume can improve accuracy and filter out false signals.

Entry Criteria

- Go long when RSI drops below 30 (oversold) and then reverses upward in a bullish market.

- Go short when RSI rises above 70 (overbought) and turns lower in a bearish market.

- Confirm with candlestick patterns or volume.

Stop Loss

- Set below the recent swing low for long positions or above the recent swing high for short positions.

Take Profit

- Target the RSI mean at 50 or use a price-based level aligned with your risk-to-reward plan.

Notes

Works best when combined with trend context to avoid false reversals. Effective across multiple timeframes and asset classes due to its adaptability.

MACD Trading Strategy

The Moving Average Convergence Divergence (MACD) tracks momentum through the relationship between two moving averages and a signal line. In mean reversion trading, a strong move away from the mean followed by a MACD crossover often signals a potential reversal.

This strategy works best when the crossover occurs after an extended move, showing momentum exhaustion. Trades tend to be more reliable when aligned with the broader market context and confirmed with other tools such as RSI, Bollinger Bands, volume, or candlestick patterns.

Entry Criteria

- Enter when the MACD moving averages cross after a clear deviation from the mean, confirming the signal with other indicators or price action.

Stop Loss

- Place beyond the recent swing high for shorts or swing low for longs.

Take Profit

- Exit when the MACD lines return to the mean.

Notes

Most effective after sharp moves that show momentum exhaustion, especially when combined with trend confirmation.

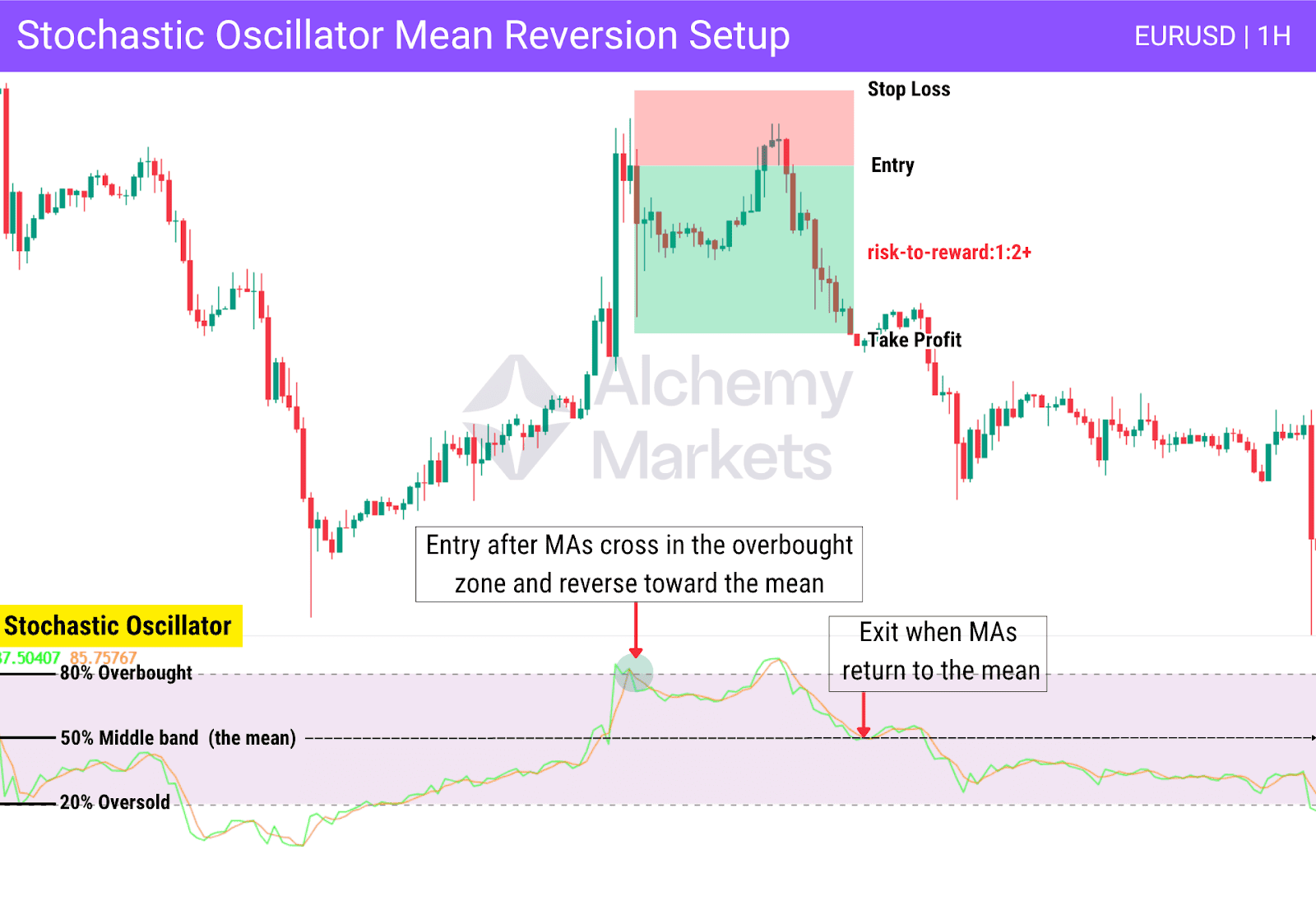

Stochastic Oscillator Trading Strategy

The stochastic oscillator measures momentum by comparing a security’s closing price to its price range over a set period. It identifies overbought conditions above 80 and oversold conditions below 20, making it effective for mean reversion setups.

Because it reacts faster than RSI, it is especially useful in fast-moving or intraday markets. For higher accuracy, traders often wait for confirmation, which comes from a crossover of the stochastics moving averages within the overbought or oversold zone, followed by a reversal back toward the mean.

Entry Criteria

- Enter when the stochastic’s moving averages cross within the overbought or oversold zone and start reversing toward the mean.

Stop Loss

- Place above the recent swing high for shorts or below the recent swing low for longs.

Take Profit

- Exit when the stochastic’s moving averages return to the mean around the 50 level.

Statistical Arbitrage

Statistical arbitrage, or “stat arb,” is like the bigger cousin of pairs trading.

The idea is the same at its core: you’re betting on relationships between assets snapping back to normal when they drift apart, but instead of focusing on just two assets, stat arb can cover a whole basket, from a few dozen stocks to entire indices.

Stat arb takes that same principle, scales it up, and adds more probability models to help create a macro statistical edge.

Hedge funds and quants run complex models — factor analysis, regression, sometimes even machine learning — to spot tiny inefficiencies across dozens or hundreds of assets at once.

Instead of a single spread like EUR/USD vs USD/CHF, you’re long undervalued assets and short overvalued ones across an entire portfolio, constantly rebalancing.

In short: pairs trading is the entry-level version of stat arb, and stat arb is the hedge-fund version. Same principle, just broader, faster, and more model-driven.

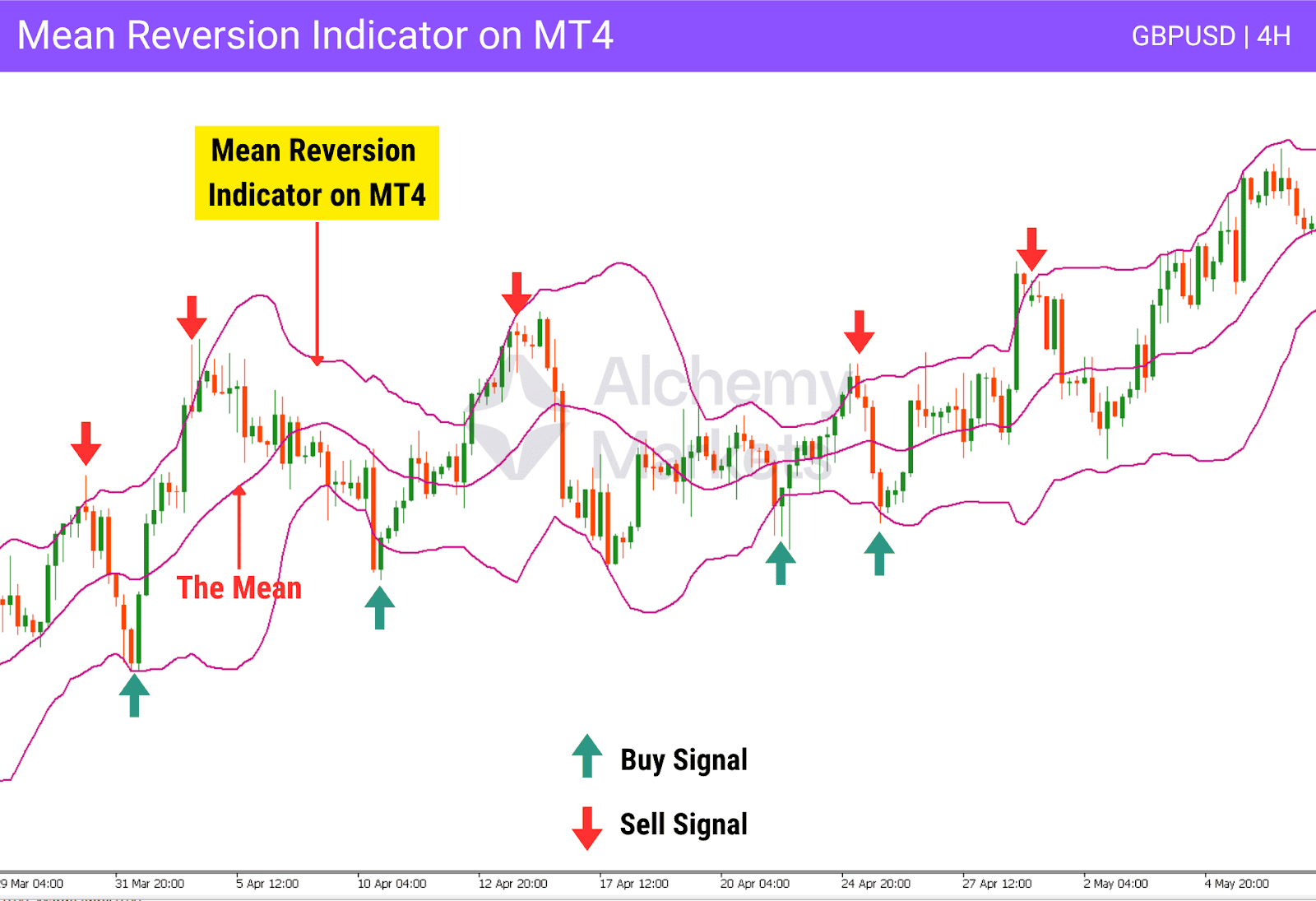

Mean Reversion Indicator on MT4

On MT4, a typical mean reversion indicator combines tools like Bollinger Bands and moving averages to highlight when price has moved too far from its average. Traders can customise the settings, such as the moving average period or the Bollinger Band deviations, to suit different timeframes and strategies.

Entry Criteria

- Enter a buy trade when price reaches the lower Bollinger Band, or a sell trade when it reaches the upper Bollinger Band. Use confirmation tools to help filter false signals.

Stop Loss

- Place the stop loss just beyond the recent swing high for sell trades or swing low for buy trades to protect against breakouts continuing beyond the bands.

Take Profit

- Target the moving average line (the mean) as the primary exit level.

Notes

You should not rely 100% on the indicator, as false signals can occur. Combine it with additional confirmation tools such as candlestick patterns, the Relative Strength Index (RSI), or MACD to validate trade setups before entering.

✅ Advantages of Mean Reversion

Mean reversion strategies offer clear benefits to traders who understand market inefficiencies and price behaviour. They can be applied in a variety of market conditions including ranges, uptrends and downtrends, making them versatile for different trading environments. These strategies appeal to both short-term traders and long-term investors seeking to exploit extremes in asset prices.

1- Systematic and Objective

Mean reversion trading follows a rules based approach. By using well defined indicators such as moving averages, RSI and Bollinger Bands, traders make decisions based on data rather than emotion. This structure reduces guesswork and improves consistency.

2- Suitable for Various Market Conditions

While mean reversion thrives in ranging markets, it can also perform during short term fluctuations within broader trends. Some markets are more mean reverting than others, so it is important to identify where the strategy has the highest probability of success.

3- Customisable Parameters for Risk and Opportunity

With Bollinger Bands, using 3 standard deviations produces wider bands, fewer signals and generally higher accuracy. Using 2 standard deviations produces more signals but with a lower win rate. Traders can adjust these settings to balance opportunity and reliability.

4- Exploits Market Overreactions

Markets often overreact to news or events, causing prices to deviate sharply from the mean. Traders can position to profit as prices revert, taking advantage of the fear and greed cycles that drive these extremes.

5- Complements Other Strategies

Mean reversion pairs well with trend following approaches. While trend strategies capture momentum, mean reversion focuses on corrections, creating a balanced trading plan across varying market conditions.

When used in the right market conditions with disciplined rules, mean reversion can provide consistent opportunities by capitalising on price extremes. Its flexibility and structured approach make it a valuable tool for traders seeking balanced market exposure.

❌ Disadvantages of Mean Reversion

Despite its benefits, mean reversion trading comes with distinct limitations, especially if applied without a clear understanding of market conditions.

1- Vulnerable in Strong Trending Markets

Mean reversion may work more effectively in efficient markets such as forex, where frequent corrections create regular opportunities for prices to return to the mean. In less efficient and often strongly trending markets such as cryptocurrencies, the approach may be less reliable, as prices can rally or decline very quickly without significant pullbacks. In strong trends, some traders use mean reversion only for short-term countertrend scalps or to trade within pullbacks, rather than expecting a complete move back to the mean. Testing across different market types is essential before applying the strategy.

2- Timeframe and Asset Sensitivity

A strategy that works on one asset and timeframe may fail on another. Some combinations of market type and timeframe are more reliable than others, while certain conditions produce excessive noise or false signals. Backtesting is essential to determine where and when the strategy is most effective.

3- Requires Psychological Discipline

Executing reversion strategies demands a contrarian mindset. Traders must often buy during oversold conditions and sell during overbought conditions, actions that can feel counterintuitive when fear or greed dominates the market.

4- Potential for False Signals

Indicators such as Bollinger Bands or RSI can generate signals that do not lead to a reversion, especially in volatile or inefficient markets. Without confirmation from additional tools, traders risk premature entries.

5- Higher Transaction Costs

Frequent trading, particularly in intraday setups, can lead to significant transaction costs, Spreads and commissions can reduce overall profitability.

6- Lower Reward to Risk Ratio

Compared to strategies that rely on trend following, mean reversion often produces a lower reward to risk ratio because trades usually target the mean, which is closer to the entry point. This limits potential profit distance, with typical ratios around 1:1 or 2:1, and in the best scenarios up to 3:1.

Mean reversion can be a powerful approach, but its effectiveness depends heavily on the market, asset, and timeframe. Without proper testing, confirmation, and risk management, traders risk falling into common pitfalls that can erode performance.

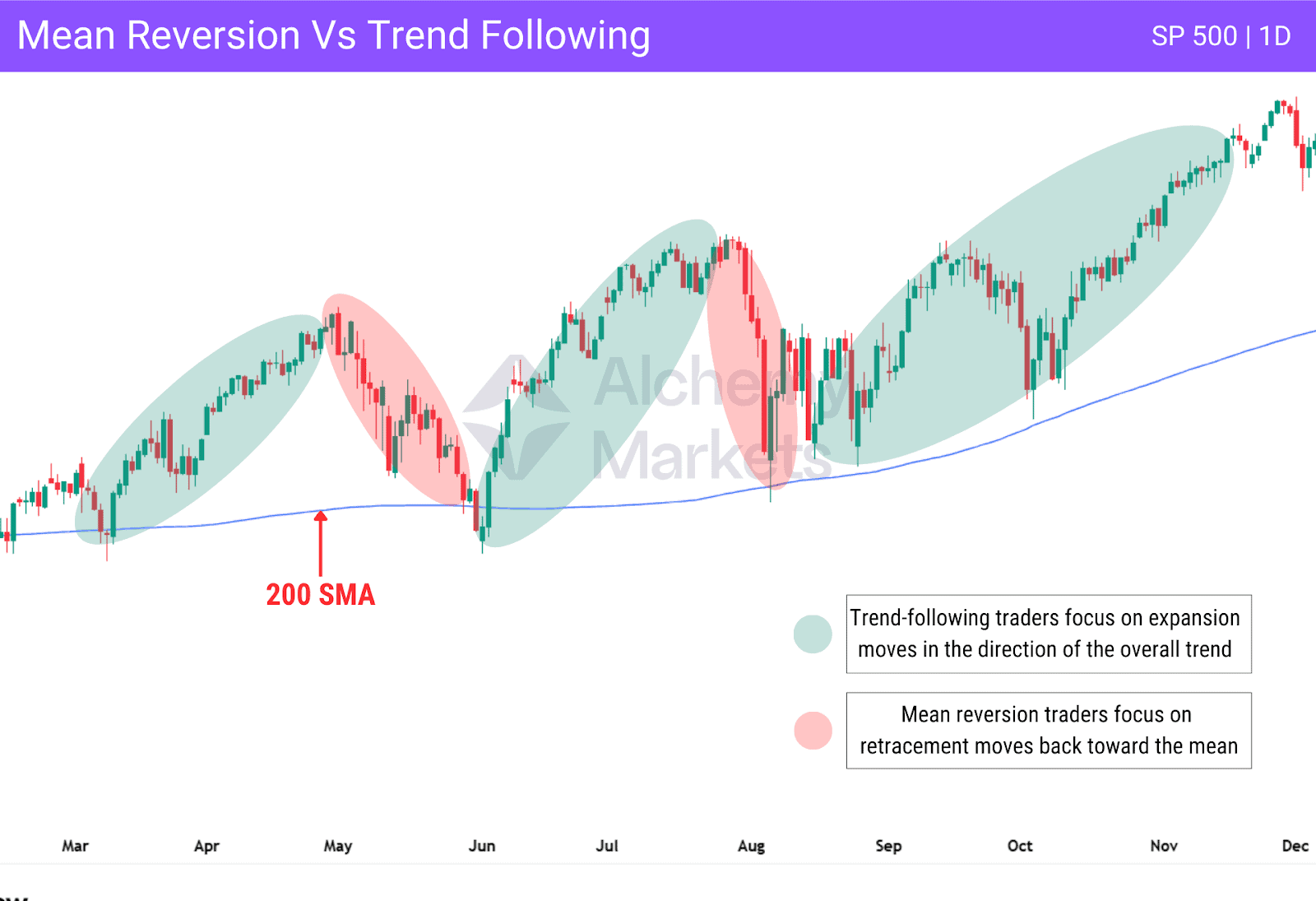

Mean Reversion vs Trend-Following

Mean reversion targets price extremes, aiming for retracement moves back toward the mean. It works best in range-bound markets or corrective phases within broader trends. Trend-following seeks to ride expansion moves in the direction of the overall trend, thriving in strongly trending markets. While one fades extremes and the other rides momentum, each has strengths suited to different market conditions.

The table below highlights the key differences between mean reversion and trend-following strategies:

| Aspect | Mean Reversion | Trend-Following |

| Goal | Exploit retracement moves back toward the mean price | Capture expansion moves in the direction of the overall trend |

| Ideal Market | Range-bound markets or corrective phases within a trend (retracements) | Strongly trending markets (expansions) |

| Tools | Moving averages, RSI, Bollinger Bands, MACD | Moving averages, market structure, trend lines |

| Risk | Price remaining extreme for extended periods without reverting | False breakouts and whipsaws that shake traders out before the trend resumes. |

| Psychology | Contrarian | Momentum-driven |

FAQ

What is the best timeframe for mean reversion?

The daily timeframe is often considered the most reliable for mean reversion. It reduces market noise while still capturing meaningful price deviations, making it ideal for applying tools such as the SMA 200 and Bollinger Bands.

What is the best asset to trade using mean reversion?

Forex major pairs, major indices, and large-cap stocks tend to work well for mean reversion due to their historical tendency to oscillate around an average price. These are generally more efficient markets, which naturally move through cycles of expansion and retracement, creating clear and repeatable patterns that suit mean reversion strategies.

They also tend to display more reliable overbought and oversold conditions, especially on higher timeframes where price movements are cleaner and market noise is reduced.

What is the best strategy for mean reversion?

There is no single “best” strategy, but a combination of moving averages to define the mean, RSI to identify overbought or oversold levels, and Bollinger Bands to visualise standard deviations can provide strong setups. Using candlestick patterns or other technical analysis tools alongside these indicators can further confirm entries, helping reduce false signals and improve consistency.

Does mean reversion work in crypto?

Yes, since crypto often overshoots support and resistance levels, it allows for mean reversion trades to need tighter risk controls and confirmation signals to avoid getting caught in momentum-driven breakouts.

How do you backtest a mean reversion strategy?

Backtesting involves applying your entry and exit rules to historical price data to see how the strategy would have performed. It’s important to include transaction costs, slippage, and different market conditions (trending vs ranging) to get a realistic picture of performance.

Is mean reversion suitable for beginners or algo trading only?

Mean-reversion strategies are more advanced to execute, as timing is critical. But of course, beginners can still use them with strict discipline around profit targets and stop losses. As for algos, they often run mean reversion with greater consistency, but the core principles remain accessible to manual traders.

How do I know if a market is range-bound enough for reversion trades?

Look for flat-moving averages, overlapping candlesticks, and low momentum environments (such as the Average Directional Index being under 20, signalling weak trend strength). Decreasing volume also suggests that price is consolidating, favouring mean reversion setups.