Bearish

- August 7, 2024

- 15 min read

Evening Star Candlestick Pattern: A Trader’s Guide to Spotting Reversals

Looking to spot a potential downtrend in a market? The evening star is a technical analysis pattern that often predicts a switch from an uptrend to a downtrend. In this guide, you’ll learn how to identify this pattern and trade the evening star to reasonable price targets.

Key Takeaways

- The evening star is a three-candlestick pattern that signals a bearish trend reversal.

- This pattern has a 72% accuracy in detecting bearish reversals.

- Add strength to the signal using resistance levels and indicators like the RSI.

What is an Evening Star Candlestick Pattern?

The evening star pattern is a bearish candlestick pattern used in technical analysis to identify the potential end of an uptrend.

Traders use this pattern as a short trade entry signal or a long trade exit signal.

Evening star patterns are composed of three candles. The first being a long bullish candle, the second being a small candle, and the third candlestick being a long bearish candle.

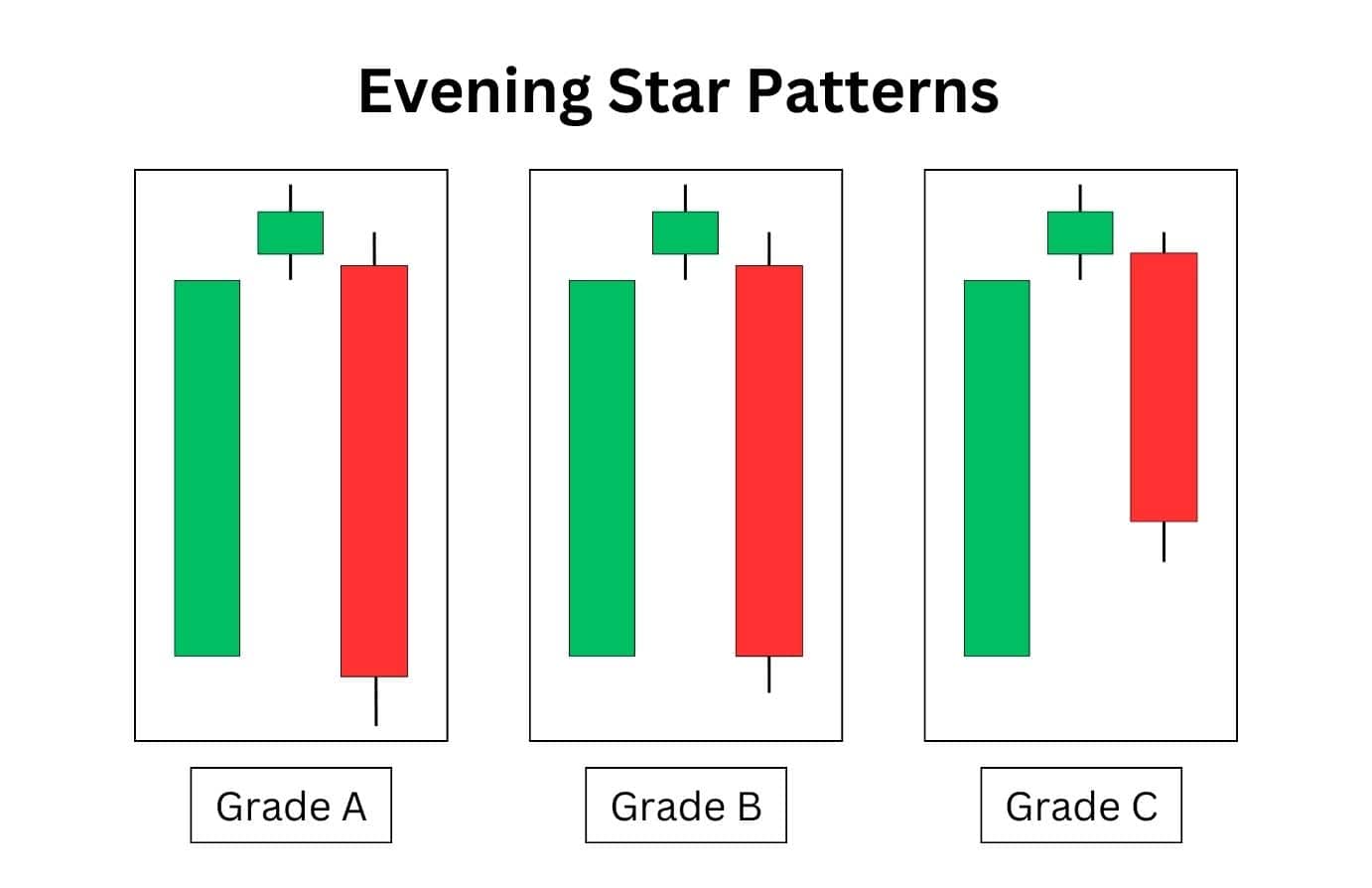

We can grade the strength of evening star patterns into three categories of strength. With “Grade A” being the most likely to result in a significant reversal:

Grade A: The third candle completely closes below the first candle’s body.

Grade B: The third candle closes at the bottom of the first candle’s body.

Grade C: The third candle closes beneath 50% of the first candle’s body.

How to Recognise an Evening Star Candlestick Pattern

To make recognising an evening star easier, it’s best to look for the pattern when an asset price reaches a resistance level.

These resistance levels can come in the form of:

- Historical resistances: A level that has acted as a support or resistance level in the past – for example, a level that the price has previously pivoted away from.

- Trend lines: A downward sloping diagonal trend line that can act as a resistance, either standalone by itself or as part of a chart pattern, such as the bear flag or triangle pattern etc.

- Fibonacci levels: A price level that aligns with a Fibonacci retracement, such as 0.236, 0.382, 0.50, 0.618, and 0.768.

- Moving Averages: Moving averages can act as dynamic support and resistance levels. The 20 and 50 EMA (exponential moving average) are well respected across a wide range of assets on the daily time frame.

Main Characteristics of the Evening Star Candlestick

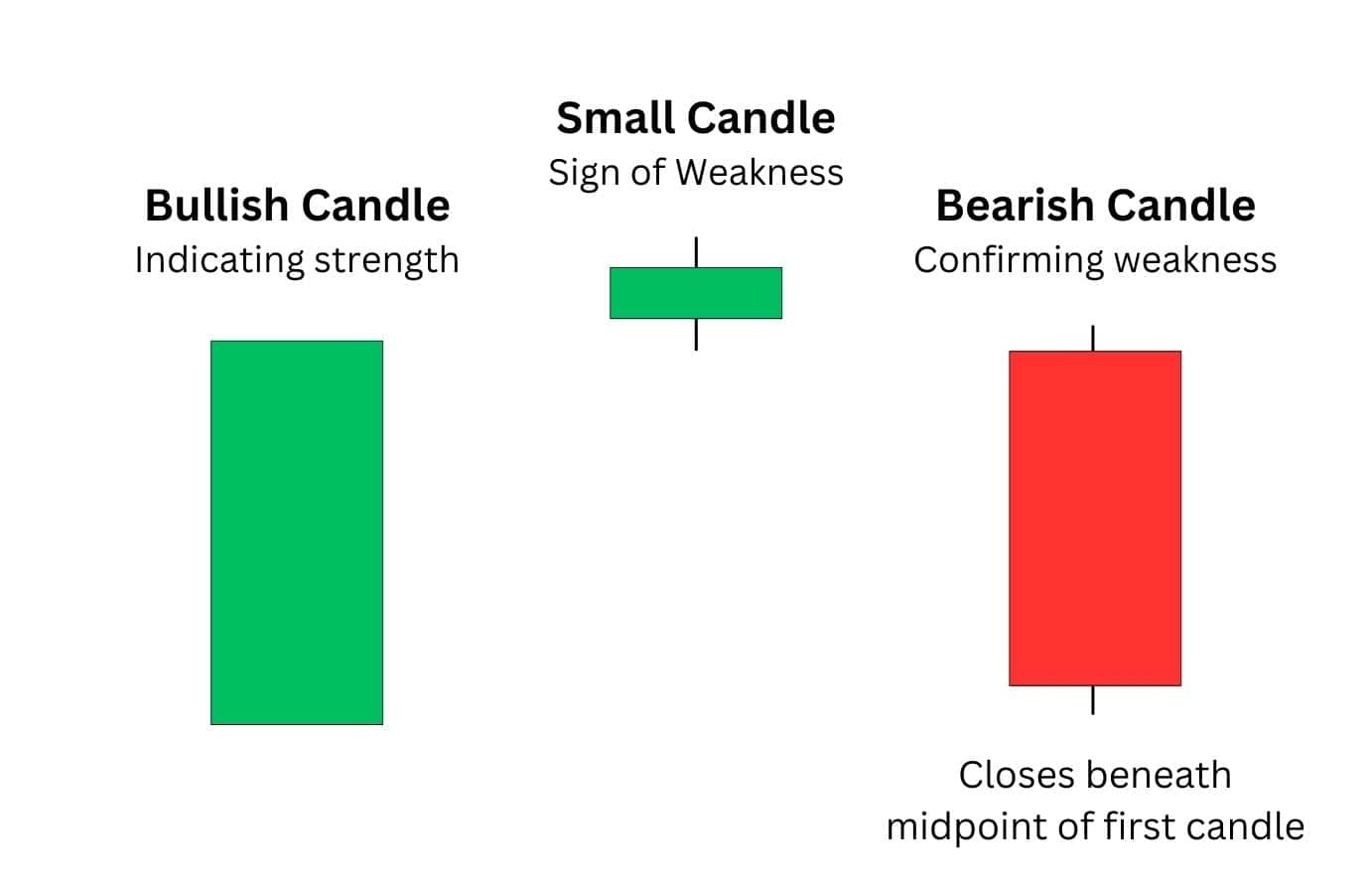

The evening star pattern consists of three candlesticks, which have the following characteristics:

- The first candle forms as a large bullish candle in an uptrend. It signals that there is a fast move up with strong buying power. It is always green.

- The second candle is a small-bodied candle near the top of the first candle. It signals a weakness in the buying momentum and hints at a reversal. It can be either green or red.

- The third candle is a large bearish candle which exceeds the midpoint of the first candle’s body. It confirms weakness in the asset and provides a clear entry or exit signal. It is always red.

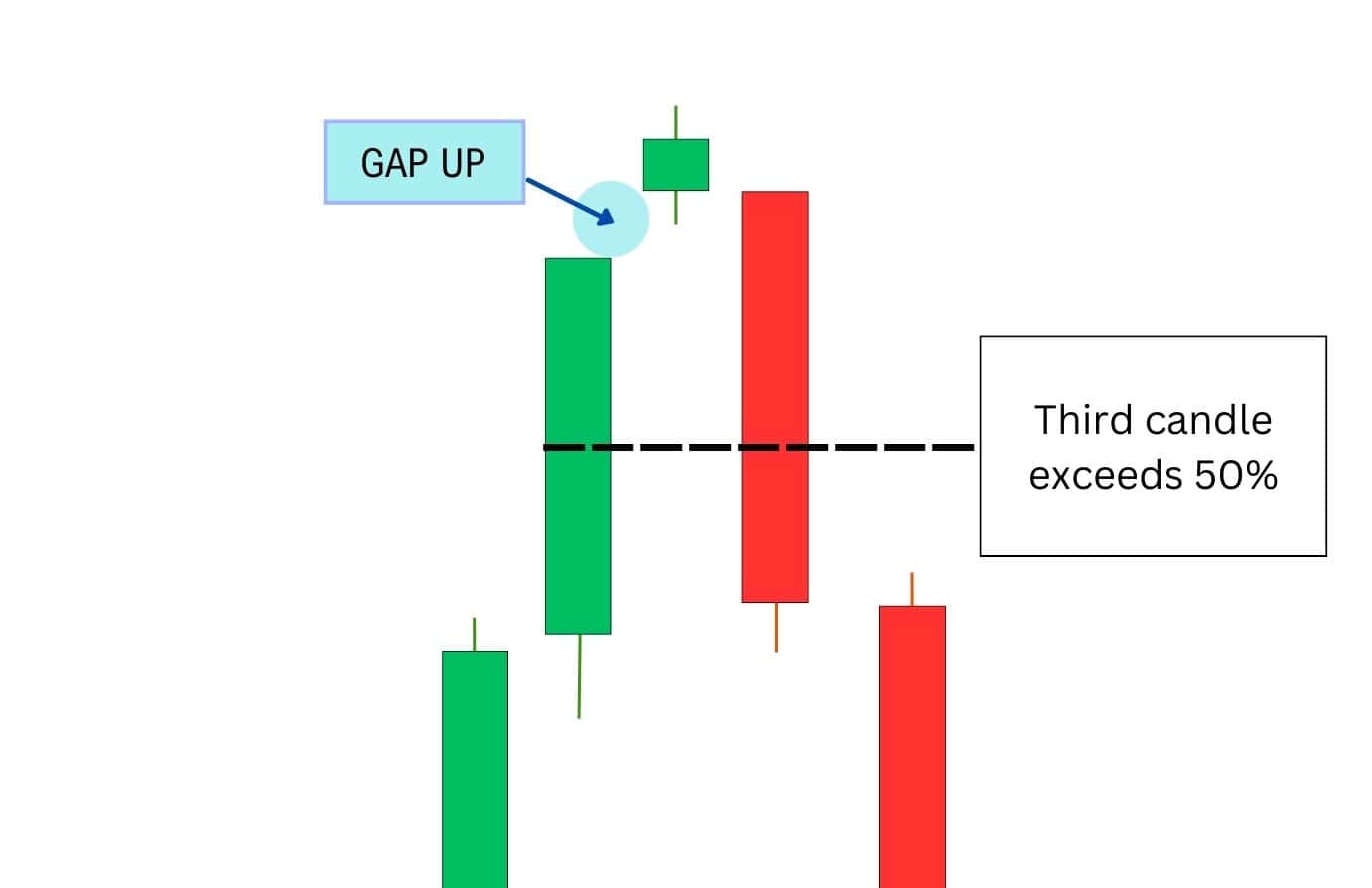

Price gaps can sometimes be observed in the evening star pattern, which usually occurs between the first and second candle as a gap up. This means the price is particularly bullish.

However, if the price manages to fall beneath the 50% midpoint of the first candle, this means buyers have failed to push the price higher, and we may begin to reverse to the downside.

Significance of the Evening Star Pattern

For traders, being able to recognise evening star patterns is useful for finding short-trade opportunities, or exit signals for active long trades.

According to Thomas Bulkowski, a leading expert on chart patterns, the success rate of the evening star pattern in indicating a reversal is 72%. This is quite significant, but it should be noted that the pattern appears infrequently on the charts.

Evening Star Example

To better understand how the evening star pattern works, let’s take a look at a real-world example.

This is the WTI Crude Oil chart on the 1-week time frame in Q4 2018. At approximately $75, we see a valid evening star formation, highlighted yellow in the illustration above:

- The first candlestick is a long bullish candle, but it is also approaching a previous high that may act as resistance.

- The second candle pushes up but is quickly rejected to form a shooting star candle. This tells us that buying power is potentially weakening.

- The third candlestick is a large bearish candle, which acts as a bearish confirmation and provides us with a clear short signal or long exit signal.

After the formation of the evening star, we see the price fall to the previous support at approximately $52. This marks a significant drop of 30%.

Confirming the Validity of the Evening Star Pattern

According to Thomas Bulkowski’s research, this pattern accurately signals a reversal 72% of the time. So even though it’s fairly reliable, we can optimise our chances of winning with this pattern by looking for a few confluences.

Let’s consider some factors before rushing into a short trade:

- Make sure the third candle closes beneath the midpoint of the first candle’s body. This validates the evening star pattern.

- Consider if this pattern is forming at resistance. A bearish pattern has a higher chance of playing out when it is formed at a resistance.

However, it is much riskier to trade when formed at a support level, which can sometimes be hidden – like a trendline or moving average. - Check for overbought, bearish divergence conditions on oscillators. This can be paired with indicators like the RSI, stochastic RSI, or MFI. More on this in the strategy section.

- (Optional) Wait for price to retest, then reject from the midpoint of the third candle’s body. This can protect you from being stopped out prematurely. However, it can lead to worse entries or missed opportunities.

Entry and Exit Points

There are multiple ways to play the evening star pattern, with multiple entry methods and take profit zones. However, the underlying skill to trade this pattern lies in your ability to understand where the key levels of support and resistance are.

This will help you better identify a valid evening star pattern, and also where your trade targets are.

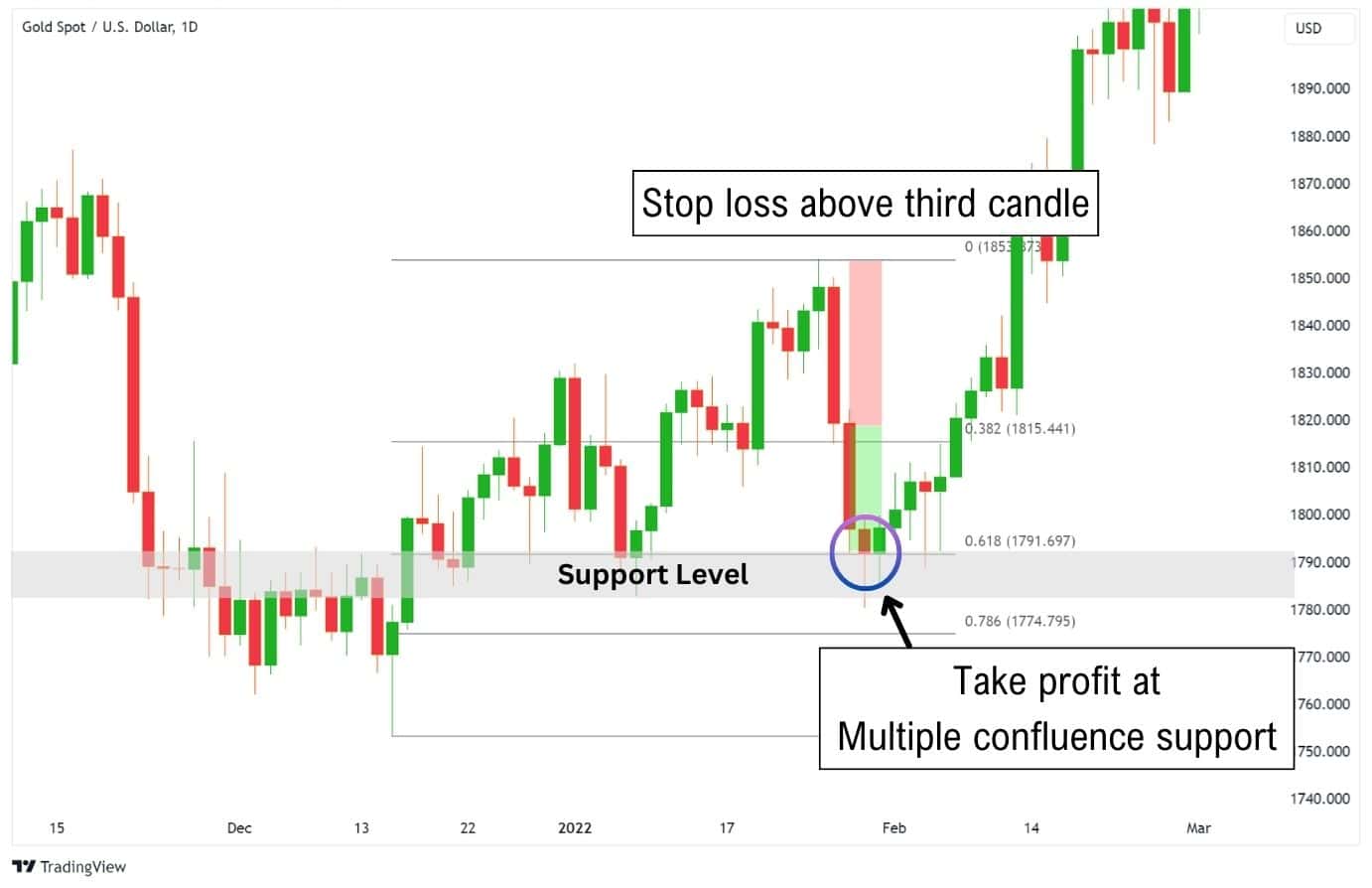

Where to Enter for Evening Star

You’ll enter a short trade whenever:

- An evening star pattern forms at a resistance level.

- Or when price retests, and rejects from the 50% price zone of the bearish candlestick (3rd candle).

Where to Take Profits for Evening Star

For your take profits, consider areas where the price has previously reacted:

- Previous support levels.

- Daily, weekly or monthly support.

- Previous pivot highs/lows.

- Trend line support, which can also be part of a bigger pattern such as an ascending triangle.

- Moving averages and vWAP support.

- Hidden levels such as the daily open, Fibonacci levels or fair value gaps.

A general tip is to watch where multiple support levels overlap. Prices are typically more likely to bounce from a support zone with multiple confluences – making it a good take-profit target.

Where to Set Stop Loss for Evening Star

Here are some stop-loss ideas to consider:

- Place the stop loss above the third candle.

- Place the stop loss above the entire pattern. This is riskier but potentially has a higher win rate.

- Set a trailing stop loss.

Alternatively, you may set a trailing stop loss, which can also serve as a take-profit order. A great indicator for this use case would be the Chandelier Exit. More on this in the strategy section.

Risk Management Techniques

When trading bearish reversal patterns in an aggressive uptrend, you run the risk of experiencing false signals with the evening star. Therefore, it is vital to cut your losses where possible and manage your exposure.

Consider incorporating the following when trading this pattern:

- Do not over leverage when trading.

- Ensure that you are only losing <2% of your account balance if you lose the trade.

- Let your stop loss determine your leverage and not the other way around. If your leverage is high, your stop loss is going to be tight to accommodate the 2% rule, which will likely result in a loss.

For more aggressive traders, consider limiting losses on all active trades to only <10% of your account balance. This is because the percentage you’d need to earn to break even is much smaller compared to if you lost 15%, 20%, and so on.

| Percent Loss | Percent to Break even |

| 5% | 5.3% |

| 10% | 11.1% |

| 15% | 17.6% |

| 20% | 25.0% |

| 25% | 33.3% |

| 30% | 42.9% |

| 35% | 53.8% |

| 40% | 66.7% |

| 45% | 81.8% |

| 50% | 100.0% |

Trading Strategies Using the Evening Star Pattern

This section delves into how you can improve the win rate of the evening star pattern. But first, let’s do a quick recap of what we’ve learned so far.

When trading the evening star, you should:

- Look for the evening star at resistance levels.

- Take profit at previous support levels.

- Place your stop loss above the 3rd candle (bearish candle).

- You can use the retest of the 3rd candlestick’s midpoint as an alternative entry zone.

Let’s look at how we can enhance upon these basic concepts, and improve our evening star trades.

Better Entries: Look for Divergences with the Evening Star Pattern

We can apply the use of oscillating indicators, such as the Relative Strength Index (RSI) and Money Flow Index (MFI) to improve our odds of trading this pattern.

These indicators can produce bearish divergence signals, which identify a weakening uptrend. Using this concept, we can find a stronger evening star reversal pattern to trade.

Here is how it works:

- After finding an evening star, look for a bearish divergence in either the RSI or MFI indicators.

- A bearish divergence is defined by the price making higher highs, while the indicator is making lower highs.

- Enter a short trade at the close of the evening star pattern, or at the successful bearish retest of the 3rd candlestick’s midpoint.

- Set the stop loss above the third candle, and target the previous support level.

Alternatively, you can use another indicator capable of producing bearish divergence signals. The general concept here is to use these divergences to find the most probable short trades.

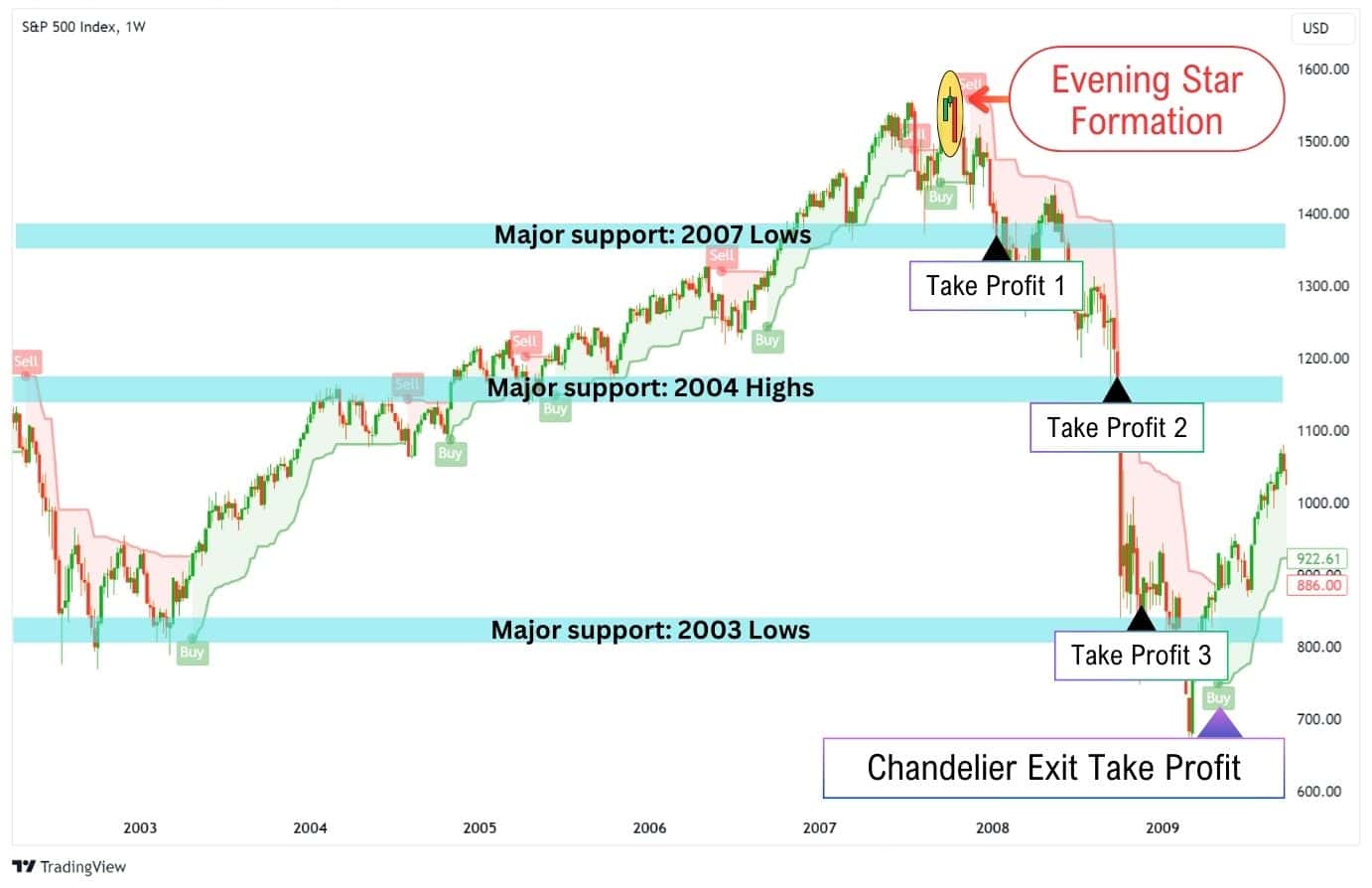

Better Exits: Use Multiple Take Profits with a Trailing Stop Loss

It’s worth noting that in a macro uptrend environment, bearish reversal patterns do not typically result in a large move. This is why it’s advised to be conservative when setting your take-profit targets.

However, there will be situations where an evening star catches the top of a macro uptrend, leading to a massive swing short. If you take profits too early, we would be missing out on extremely lucrative gains.

As such, many traders fear missing out (FOMO) on a big short opportunity and set their take profit too far. To combat our feelings of FOMO, we should set multiple take-profit targets, and we can also apply a trailing stop loss to capture the bulk of the bearish move.

Here’s how it works:

- Enter your short trade as usual.

- Split your profit targets to at least two orders. This can be a 50% take profit at an upcoming support level, paired with an additional trailing stop loss.

- When profit target 1 is reached, move your stop loss closer or equal to the trade entry.

- Whenever the Chandelier Exit flips from bearish to bullish, manually exit your trade.

*Note that the Chandelier Exit is not meant to be used as an entry signal.

Overall, this may improve your overall performance with the evening star, allowing you to capture profits when the trade is profitable, and also capture further moves if the downtrend continues.

Evening Star Doji

The evening star doji is a variation of the evening star candlestick pattern. The evening star doji also includes three candles with a doji candle in the second position. Likewise, it is a bearish reversal pattern signalling a shift to bearish sentiment in the market.

Like the standard evening star pattern, the evening star doji has a bullish first candle, a second small-bodied candle, and a bearish third candle closing below 50% of the first candle. This pattern is also known as the evening doji star pattern.

Advantages of Evening Star Pattern

The evening star is one of the most reliable bearish reversal patterns, so it’s always a fantastic pattern to include within your trading toolkit.

Here are some key points to consider:

- It is highly reliable, boasting 72% reliability according to Thomas Bulkowski’s research.

- It is flexible and can be applied in various market conditions.

- It generally offers a substantial move down to notable key levels.

Disadvantages of Evening Star Pattern

Despite its advantages, the evening star pattern comes with its own set of limitations.

Here are some key points to consider:

- The evening star pattern is quite rare as it requires a very specific formation of three candles.

- Despite its high reliability, this pattern can offer false signals in a macro uptrend.

- Traders need to thoroughly check if all conditions are met for a valid pattern.

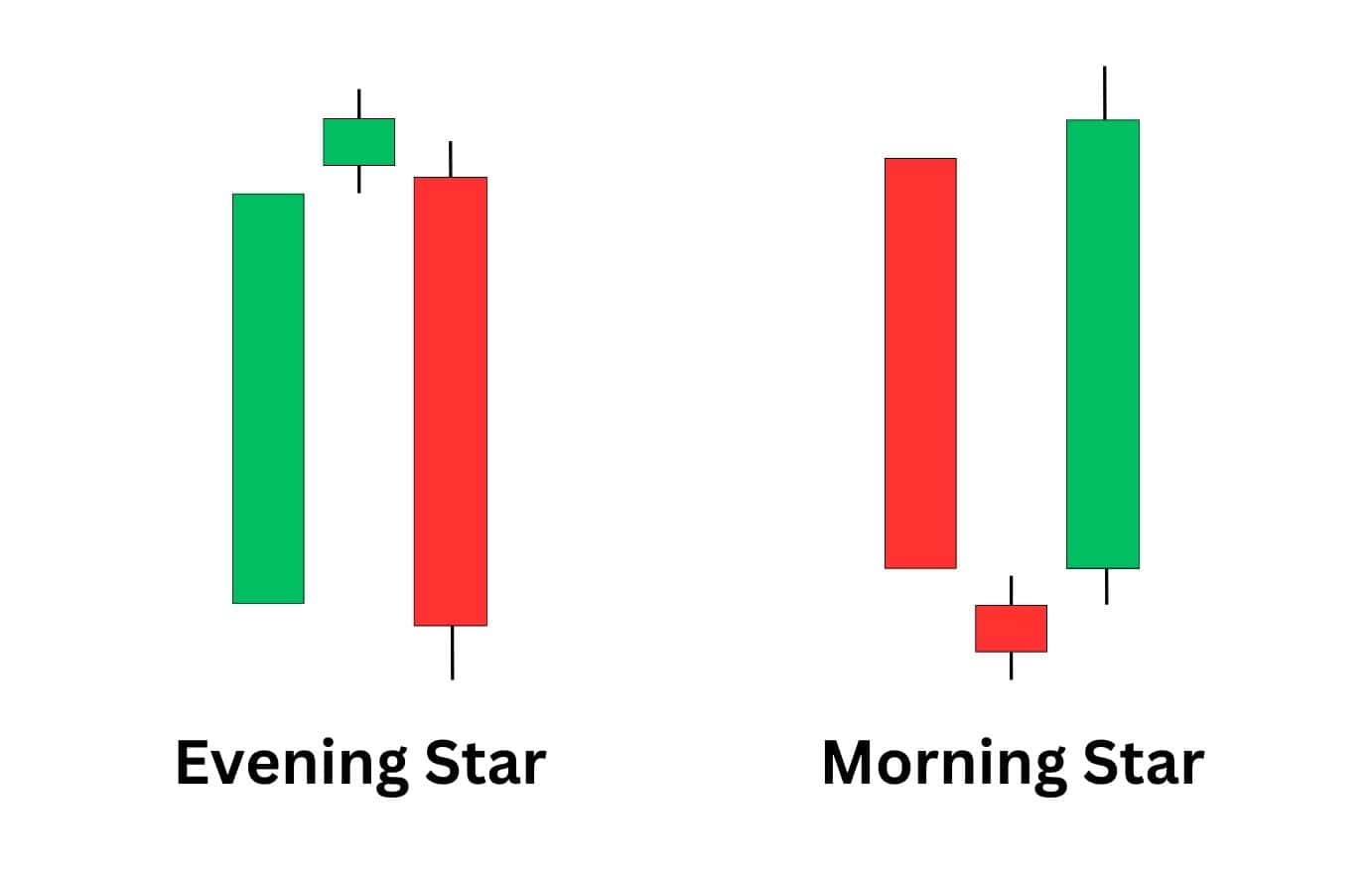

Evening Star vs Morning Star

The evening star pattern and morning star pattern are similar chart formations which act as trend-reversal patterns. However, the evening star is a bearish reversal pattern that appears at the peaks, while the morning star candlestick pattern is a bullish reversal pattern that appears at the lows.

Similar to the evening star, the morning star consists of a large first candle, followed by a small-bodied candle, and finally a large third candle. Different from the evening star pattern, the morning star starts with a bearish candle but closes with a long bullish candle.

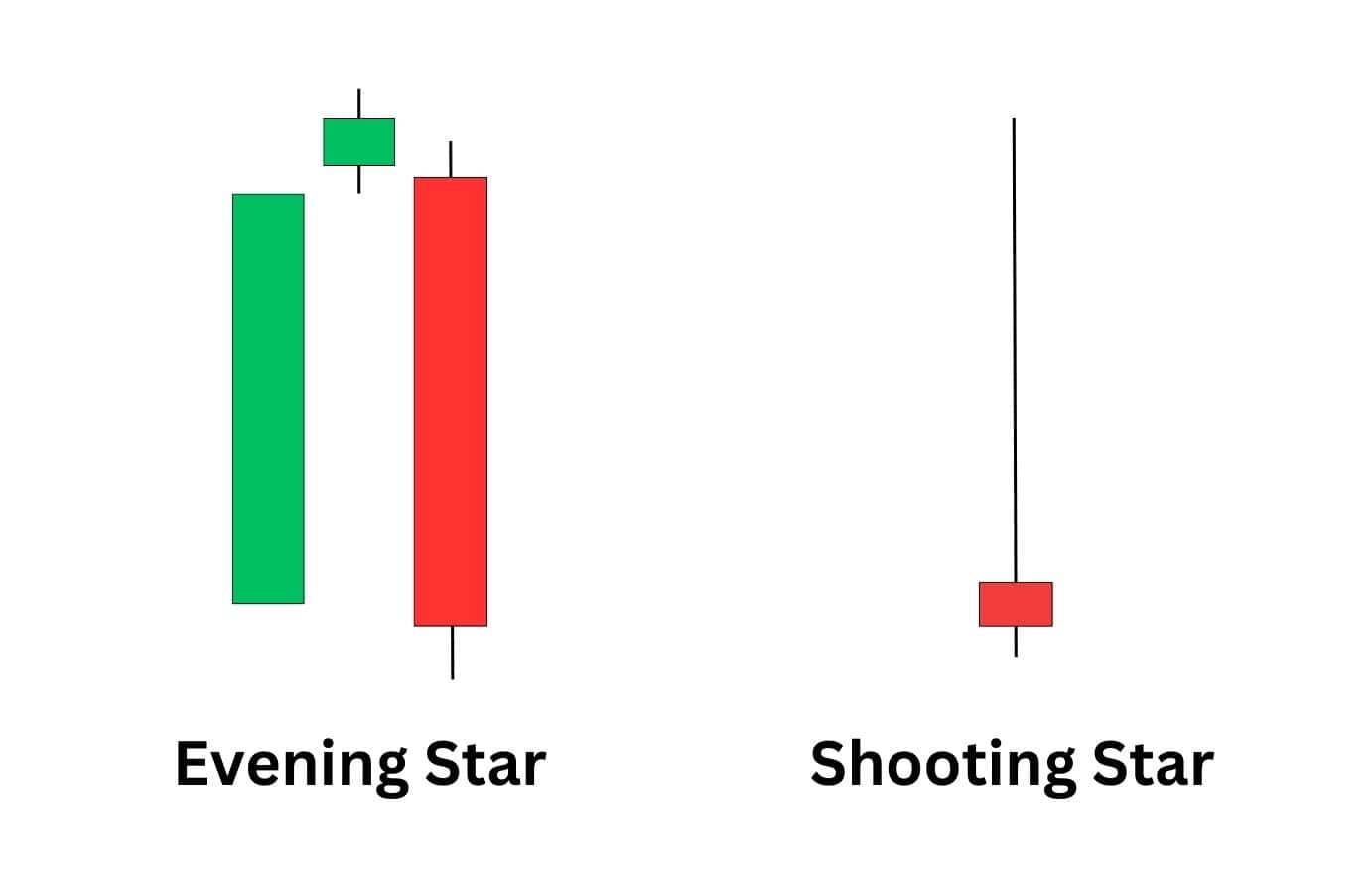

Evening Star vs Shooting Star

Unlike the evening star, which is a three-candle pattern, the shooting star is a single-candle setup, making it simpler to identify. It consists of:

- A single candlestick with a small body at the lower end

- A long upper shadow that is at least twice the length of the body

- A short or nonexistent lower shadow.

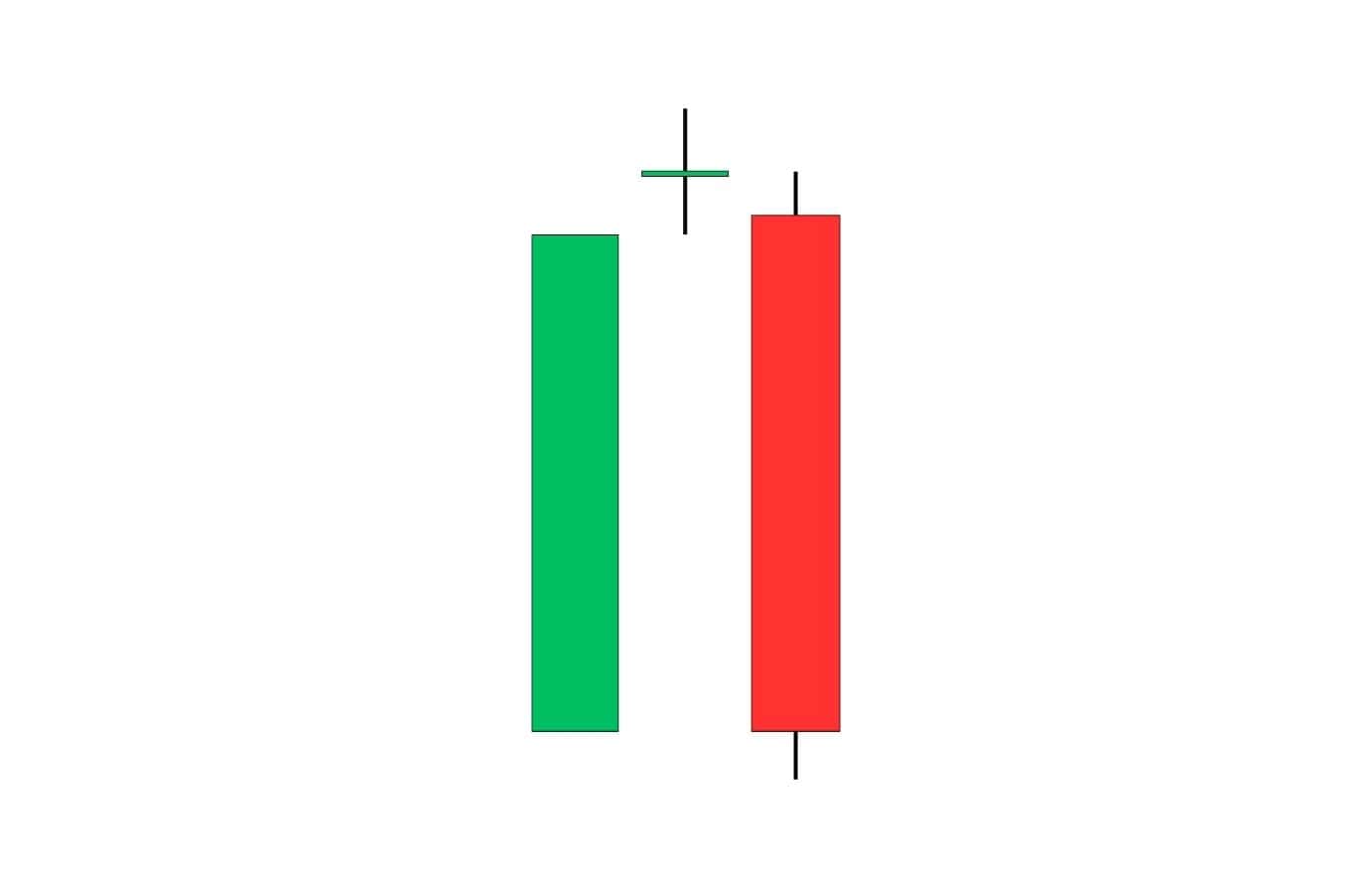

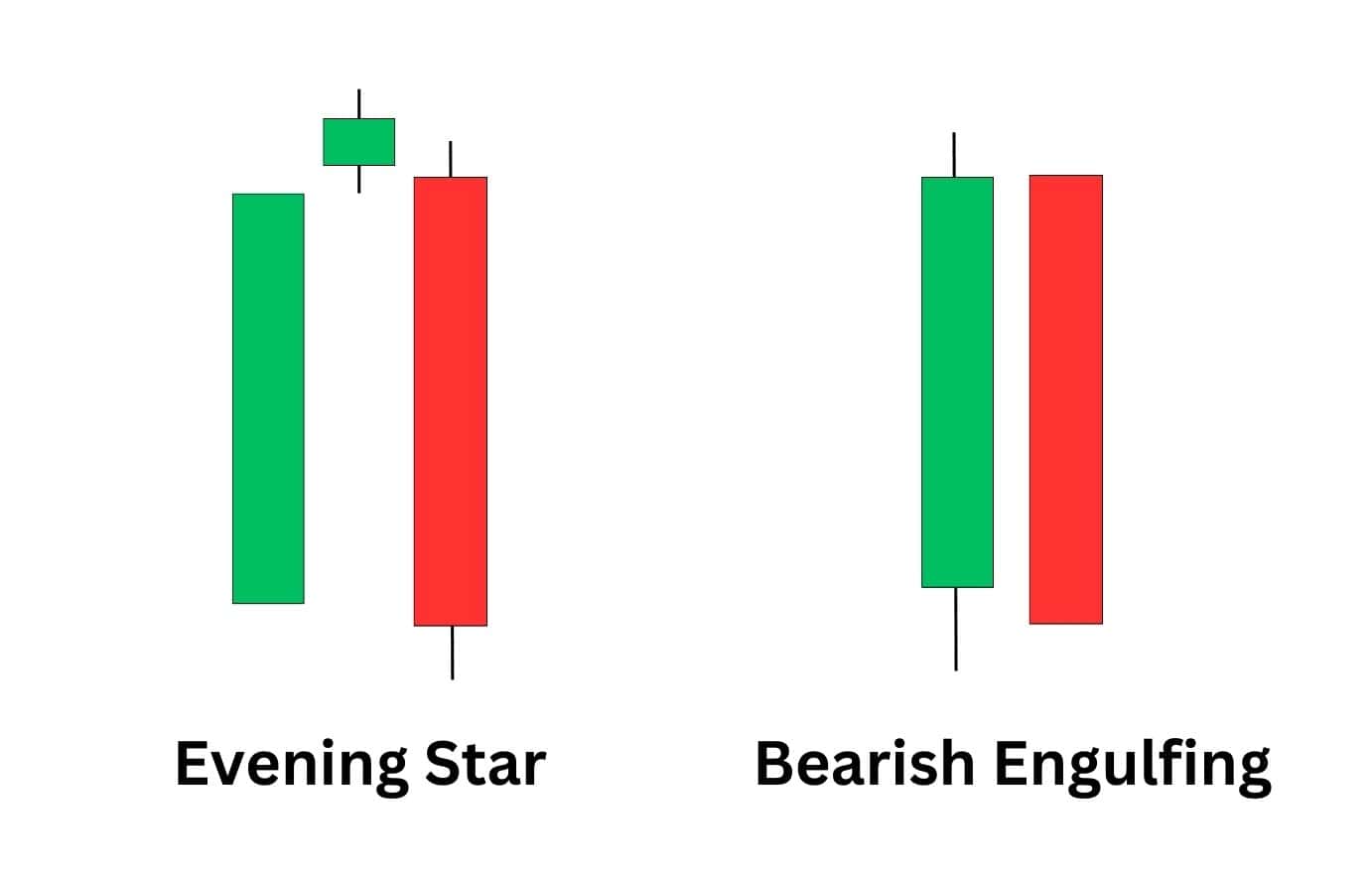

Evening Star vs Bearish Engulfing

The bearish engulfing pattern is a bearish trend reversal pattern typically found at the highs of an uptrend. It is created when the price forms a larger bearish candle, which has a closing price below the previous candle.

In contrast to the evening star, the bearish engulfing pattern is a two-candlestick pattern that is more commonly found.

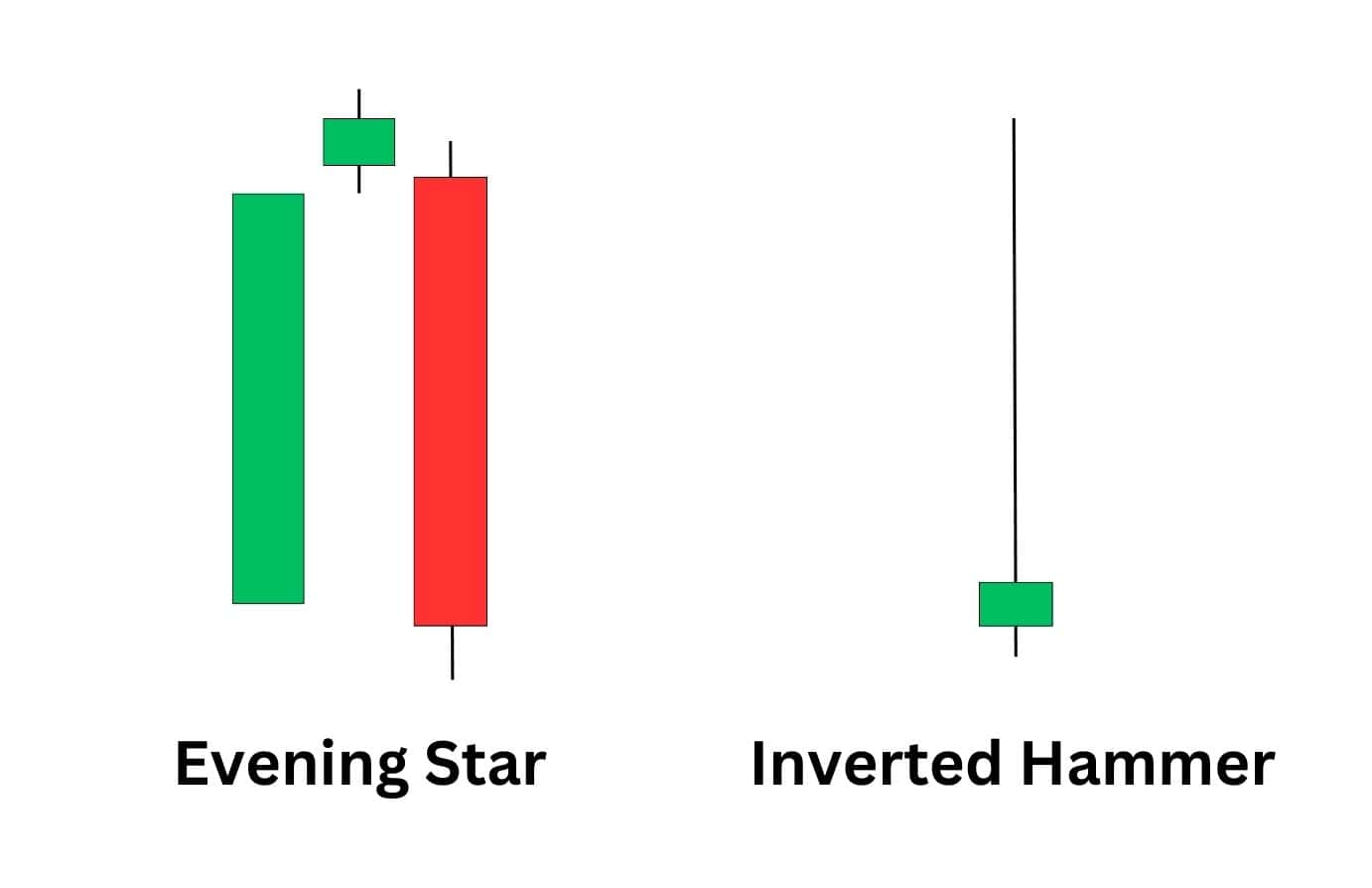

Evening Star vs Inverted Hammer

The inverted hammer is a bullish reversal candlestick pattern that occurs at the end of a downtrend, indicating that the price may start to rise. It features a short body, a long upper shadow, and little to no lower shadow.

Unlike the evening star, a three-candle pattern, the inverted hammer is a single-candle pattern, making it simpler to identify.

Frequently Asked Questions

How Reliable is the Evening Star Pattern?

The evening star pattern is viewed as a fairly reliable predictor of a bearish reversal with 72% accuracy, according to Bulkowski’s Pattern Site.

However, the price movement following the reversal indicated by an evening star pattern is moderate, with a 57% chance of hitting the price target. Its effectiveness, like other visual patterns, can be enhanced by using other technical indicators such as volume or support levels.

Does It Matter if an Evening Star Candlestick Is Red or Green?

In an evening star pattern, the colour of the second candlestick, which can be either bullish or bearish, is not as important as its shape and position within the pattern.

The bearish signal of the evening star pattern is more significantly reinforced by the size and placement of the candles rather than the colour of the second candle.

What does Green Evening Star Candlestick tell?

If the second candle of the evening star is green, it suggests that upward momentum is still present, and we can see the price potentially push up.

Ultimately, the formation of the third candle tells us that a bearish reversal is likely, and we should be cautious in our expectations for a continued uptrend.

What does Red Evening Star Candlestick tell?

Conversely, if the second candle of the evening star is red – rather than green – it suggests that upward momentum is weakening.

It also suggests that the third candle is likely to close bearish, leading to an evening star formation.

How does the Evening Star Pattern’s trend location impact its predictive power?

The location of the evening star pattern within a trend significantly impacts its predictive power. The evening star pattern has increased predictive power when it appears at the end of a prolonged uptrend, indicating a likely reversal.

However, the pattern may be less reliable if it appears in the middle of an uptrend, suggesting that the location within the trend is crucial for its predictive accuracy.

When is the best time to trade using Evening Star Candlestick?

The best time to trade using evening star patterns is when they appear at the top of an uptrend, indicating a potential trend reversal to the downside. Look for any potential support levels the pattern may be sitting on, as this could cause the pattern to fail.

For a successful trade, it’s crucial to wait for confirmation such as a proper close of the third candle, or even wait for a retest of the final candle’s midpoint before entering a trade.

How does the Evening Star compare to other trend-reversal patterns?

In comparison to other trend reversal patterns, the evening star pattern stands out for its high reliability, but also its incredible rarity. When compared to other candlestick patterns, such as the shooting star, it is much more accurate in detecting a reversal.

This pattern is more comparable to a chart pattern such as the head and shoulders pattern, which has an 81% chance of playing out, according to research by Liberated Stock Trader.