Neutral

- May 9, 2024

- 14min read

Doji Candlestick Formations – How to Use Them in Trading

What is a Doji?

A doji is a single Japanese candlestick pattern that has an extremely small candle body and shadows extending to both sides. The “body” is so narrow, that it appear as a horizontal line – this means the opening and closing price of the candlestick is nearly identical.

The doji indicates indecision in the markets. The upper and lower shadows can vary in length, creating different looks like a cross or plus sign. Long shadows indicate stronger rejection levels, potentially signaling a stronger trend shift.

Doji Means Indecision

The formation of a doji candlestick patterns signals market indecision, with prices struggling to move in any direction. This indecision arises from a tug-of-war between bulls and bears or during periods of low volatility.

During this tug of war, the bears and bulls are equally matched, ultimately leaving the asset at the same price. These tug of wars can have varying volatility, with either small or large shadows extending to either side.

The doji tells us that the market is currently lacking strong buying or selling pressure to break a certain price point. When this concept is paired with a basic understanding of market structure, the doji candlestick can be a great entry or exit signal for a trade.

Highlighted above is a doji candlestick forming at a resistance level. This tells us that the buyers do not have enough strength to push past the resistance zone. It also hints at selling pressure potentially being able to push prices lower.

Doji After an Uptrend or Downtrend

Doji candlestick patterns reflect market indecision rather than a clear trading direction. Traders should use additional indicators for confirmation. For example, a doji at Fibonacci retracement levels, pivot points, or psychological price levels can serve as a more powerful reversal signal, than if the doji was traded at a non-significant price point.

After an Uptrend

When a doji appears after a prolonged uptrend, this signals that buying pressure may be weakening. In this case, the trend may slow down and form a price correction. This means that price may start to decrease until it hits a support level, before continuing its uptrend. Alternatively, the formation of a doji at a resistance level could indicate a potential price reversal.

After a Downtrend

A doji candle appearing after a downtrend may indicate weakening downward momentum. This suggests that the price may begin to reverse back into an uptrend, even if temporarily. When a doji forms at a horizontal support level, this reversal signal is strengthened even further.

Intra-day Doji Formations

The doji candlestick pattern can be better understood when we explore its creation in smaller timeframes.

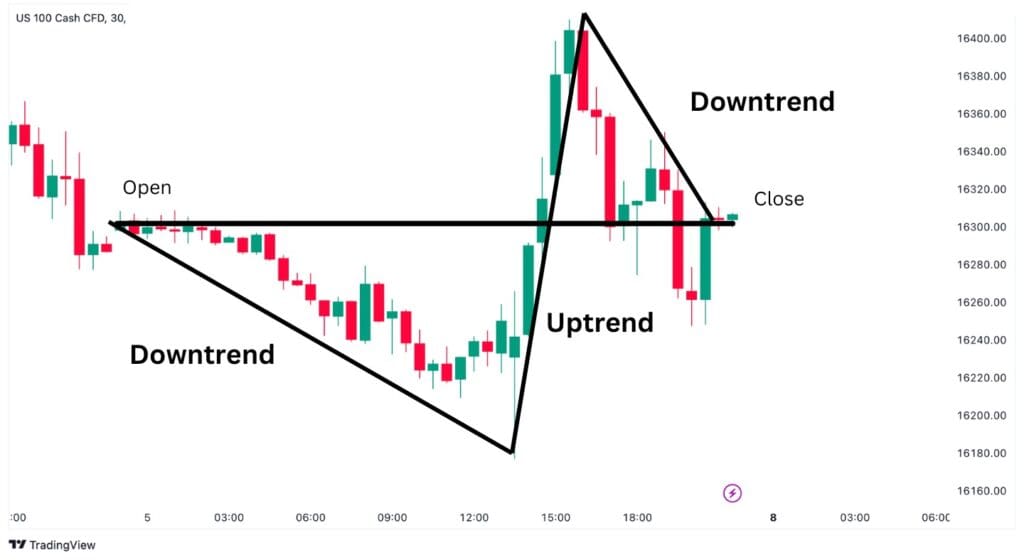

Low-High Doji: After an Uptrends

For example, the chart above is a 30 min US 100 chart. The candle opened with a downtrend then the buying pressure took control resulting in a high before sellers managed to regain strength and closed the price near opening. Notice how the price rally was sharp? Sometimes, news events create sharp movements that get retraced back to the original starting point creating a doji.

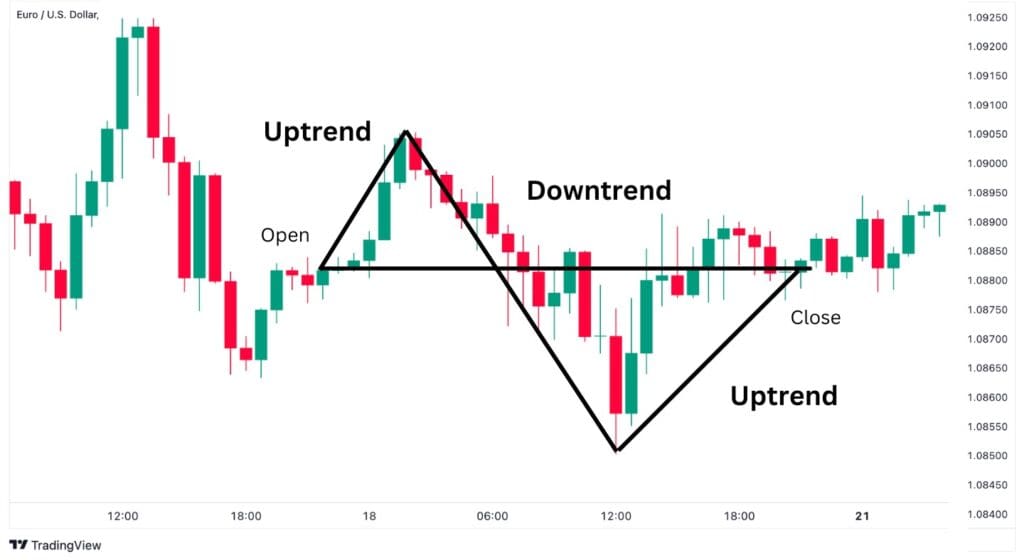

High-Low Doji: After a Downtrend

The intra-day chart above is a 45-minute EURUSD chart. At the opening, the bulls pushed pricing higher. However, the rally did not last long as there was a bearish reversal, which took over to cut pricing to new lows. By the end of the day, bulls felt the pricing was too cheap and pushed the pair back to the opening price of the day.

Types of Doji Candlesticks and how to trade them

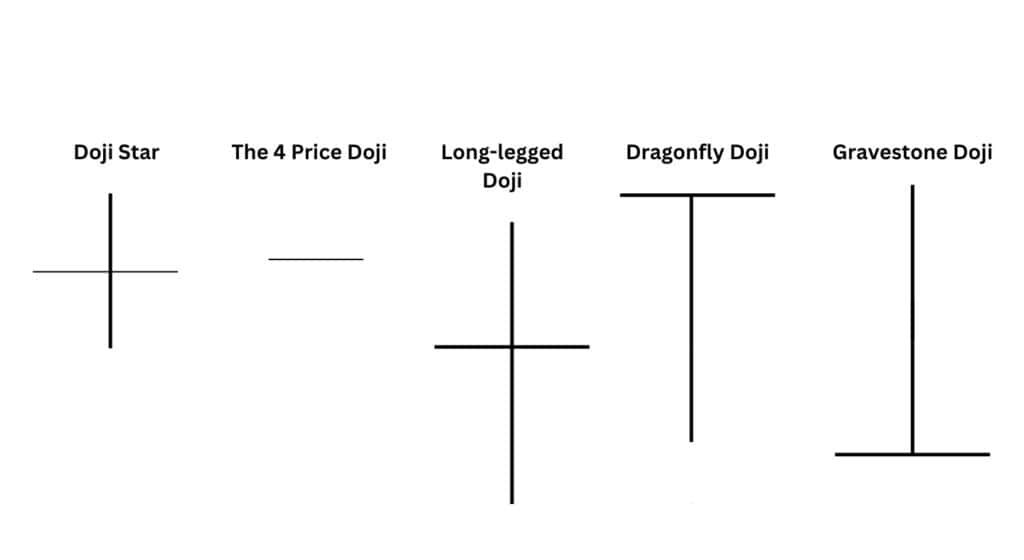

Doji patterns can vary depending on the position and length of the shadow. The most popular variations include doji star, 4-price doji, long-legged, dragonfly doji, and gravestone doji. Multiple doji patterns appearing subsequently can indicate a strong buildup of indecision, often resulting in a significant breakout

5 Types of Dojis

Doji Star (Neutral Doji)

Doji star also referred to as neutral doji, forms with upper and lower wicks of similar lengths and an almost invisible body. The wicks are relatively small as it indicate a low volatility environment where there is not a lot of trading activity. It resembles the plus sign “+” and indicates that the buyers and sellers are at balance.

Four Price Doji

Four price doji looks like a minus sign and is a pattern that rarely appears on a candlestick chart except in low-volume conditions or shorter chart time frames. The presence of this pattern suggests little, if any, trading activity was taking place. The shape of the candlestick suggests that all four price indicators open, close, high, and low are at the same level over a given period.

The market has not made any move during the period covered by the four price doji. It is considered unreliable as it doesn’t represent the interest of traders and this indecision does not provide any hint of future price movements.

Long-Legged Doji candle

The long-legged doji has much longer wicks protruding from the top and bottom of the body. This means that buyers and sellers have tried to take control of the price action aggressively at some period within the candle’s timeframe, but neither was able to win. This doji pattern suggests a variety of different price movement possibilities depending on its closing price.

Bearish Bias: If the closing price of the long-legged doji is in the lower half of the candle and the top of the wick is near resistance, then the price may trend lower.

The 4-hour GBPJPY example above represents the doji formation carving near a resistance zone. This overhead supply of sellers ended up pushing the GBPJPY exchange rate lower by several hundred pips.

Bullish bias: The closing price is above the middle of the candle, as the formation resembles a bullish pin bar pattern.

The 4-hour USDCHF chart example above represents the doji formation at the nearest support zone, where the price indicates strong bullish momentum after its formation.

Trend continuation: If the closing price is in the centre of the doji pattern without significant support or resistance nearby, then traders look for a continuation trend. That means the direction of the trend entering into the pattern is likely to be the trend’s direction when the pattern is over.

For instance, on the daily chart above, AUDCAD had rallied a couple of hundred pips, and then a long-legged doji appeared. Absent any meaningful resistance nearby, a trader might anticipate a bullish continuation of the trend. Upon a break higher above the top of the doji, the AUDCAD trend continued to follow through another 150 pips.

Dragonfly Doji Candle

The dragonfly doji resembles a T-shaped candle with a long lower wick with little or no upper wick. This symbolises that the open, the close, and the high price are almost at the same level.

Based on previous price action, the dragonfly doji can signify a reversal to the downside or the upside. If the pattern forms at the end of a downtrend, it can be considered a buy signal whereas forming during an uptrend hints at a potential bearish signal.

Gravestone Doji Candle

A gravestone doji appears as an inverted T-shaped candlestick, with the open and close coinciding with the low. The candlestick signifies that the buyers tried to increase the price but could not sustain the bullish momentum.

The impact of the gravestone doji depends on where it occurs in the price chart. In an uptrend, its appearance can indicate a potential reversal to the downside. On the other hand, its occurrence in a downtrend hints at a potential upside retracement.

Using a Doji to Predict a Price Reversal

Doji Near Support

The formation of the doji near a support level during a downtrend indicates that the selling pressure is weakening and a potential bullish reversal is increasing. The support level acts as a psychological barrier where sellers stop selling and buyers begin to buy. As a result, the buyers overwhelm the sellers and begin pushing the prices higher.

We’ll never know for sure if the reversal holds until after the move is complete. However, a stronger clue to a potential reversal is to see bullish symptoms from technical indicators like the Relative Strength Index (RSI) and Bollinger Bands® (BB).

When using the RSI, traders can look out for a bullish divergence which occurs when the price makes a lower low, but the RSI makes a higher low. Another reliable consideration would be monitoring if the RSI crosses above the 30 level after experiencing an oversold condition.

Bollinger Band observations include monitoring if the price moves towards the upper BB after a doji has formed. A narrowing of the bands (squeeze) can often precede a period of heightened volatility. If this squeeze occurs near the doji, followed by a price move toward the upper band, it may indicate an upcoming bullish reversal.

Doji Near Resistance

A doji appearing near a resistance zone in an uptrend suggests that the buying momentum is weakening and a potential bearish reversal can be expected. These resistance levels represent a historic price point where buyers stop buying and sellers start selling. As a result, the sellers enter the market and overwhelm the buyers pushing prices lower. A possible confirmation is when the doji is followed by a bearish reversal candlestick pattern or a decrease in buying volume.

Doji Candles In Determining Risk vs. Reward

Risk versus reward considerations when trading with doji candlesticks can be simplified by using nearby support or resistance levels. If a resistance zone is above the high price of the doji as seen in the image below, placing the stop loss just beyond this resistance zone would be prudent. This ensures that the trade is protected from temporary fluctuations within the resistance zone.

Similarly, if there is a support zone level at the low of the doji in a downtrend, the stop loss for a long trade should be placed below this support zone. This strategy helps in setting a more robust stop loss that aligns with market structure and historical price behavior.

The reward target is typically set at a minimum of twice the risk (1:2 risk-reward ratio). For instance, the USDJPY chart above has a formation of the long-legged doji in a resistance zone indicating a potential downtrend. The stop-loss level is set above the resistance level (40 pips) while the take-profit level is set twice the SL distance (80 pips). This approach ensures that the potential gains outweigh the risks.

Summary of Doji Examples

The above is a 2-hour XAUUSD chart that has a formation of doji during a downtrend at the nearest support zone. There was a strong bullish trend reversal after the formation of the doji.

The above is a chart of USD/CHF in the 4-hour chart. The market was in an uptrend before the formation of doji at the resistance zone. The doji was followed by a strong sell candle and eventually the market experienced bearish reversal. Traders are also able to identify a Double-top formation which further strengthens the bearish momentum.

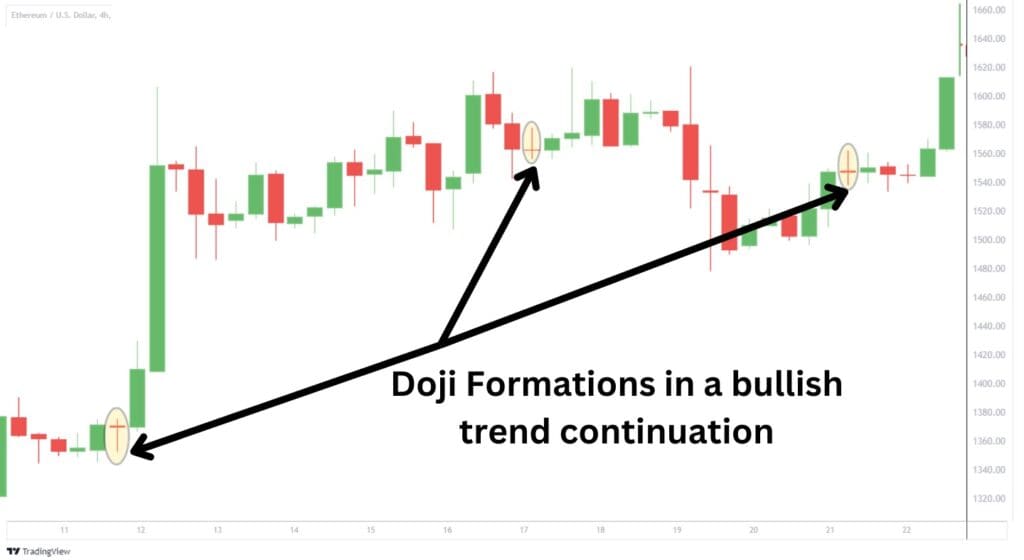

An example of trend continuation during a doji formation can be seen in the ETHUSD chart above. This 4-hour chart showed the formation of multiple doji during a strong rally, this further strengthened the bullish trend continuation.

Another example of trend continuation in a doji can be seen above, it is a 1-hour WTI (Crude Oil) chart that is on a downtrend. The formation of doji followed by subsequent bear candles respectively reflects the strong bearish momentum of the oil.

Advantages of Trading the Doji Chart

Doji is a formation that occurs quite frequently in price charts. In terms of trading, the pattern has several advantages that allow traders to place effective trades such as:

- Trade Precaution: Doji does not necessarily indicate reversal but its occurrence reflects a pause or potential shift in the market’s momentum. Traders can use the doji as a sign to tighten stop losses or take partial profits as an early exit to prepare for a possible change in direction.

- Easy Identification: Due to their unique shape, a small or nonexistent body with shadows, doji is easy to spot on charts. This can alert traders to closely monitor subsequent price action and other technical indicators for clues on its direction, which is especially useful if they are already in a trade.

- Wick Analysis: The length and direction of a doji’s wick is a good indicator of market volatility as long wicks on both sides might suggest a strong competition between the bulls and bears resulting in increased volatility. In contrast, a long wick in one direction, especially after a trend, could hint at a weakening momentum and potential reversal. These allow traders to adjust their existing trades or prepare for new setups

Disadvantages of Trading the Doji Chart

There are also several disadvantages when trading doji such as:

- Unclear Direction: The formation of doji lacks clear direction, particularly in the case of shorter wick dojis like the four price doji. These formations often suggest minimal trading activity and less market volatility. In such scenarios, the market may not make any significant moves until more active trading resumes, making the doji less useful as a predictive tool.

- Missed Opportunities: The effectiveness of a doji pattern often requires waiting for subsequent candlesticks to provide confirmations. This extra process involves patience and can result in missed opportunities due to the waiting time.

- Heavy Dependence on Indicators: The doji formation as a standalone is unreliable unless other technical indicators are used. Traders looking to trade solely based on chart pattern formations would avoid trading doji due to its complexity.

Common Doji Pattern Mistakes to Watch out

- Premature Entry: Traders often rush into a trade when they see the formation of a doji in a chart without considering the overall market trend and other confirmations.

- Ignoring Market Condition: Traders at times fail to properly understand or ignore the market conditions. A doji has a greater impact when spotted in a strongly trending market with strong volatility compared to a low volatile or sideways market.

- Overestimating Reversal: Traders will overestimate that every doji will lead to a significant market reversal. This results in unrealistic expectations and missed opportunities.

What Is the Difference Between a Doji and a Spinning Top?

The doji and spinning top are both candlestick patterns that imply market indecision, but they have distinct differences in their appearance and potential implications.

A doji is characterized by a very small or nonexistent body, meaning the opening and closing prices are virtually the same with long shadows. This showed that prices fluctuated significantly within the trading period, but closed near the opening price.

A spinning top has a small but noticeable body, with prices closing and opening at slightly different values. Like the doji, it also features shadows or wicks that are longer than its body but with some directional movement. A spinning top could imply a slightly stronger movement in a particular direction but like the doji is best paired with other confirmation signals and patterns.

FAQs

How reliable is the doji candle pattern?

The doji candle pattern can be considered less reliable as a standalone signal unless it is used alongside other confirmations and technical indicators such as support and resistance levels, RSI, and Bollinger Bands.

Where did the doji candlestick get its name?

The doji candlestick pattern originated from the Japanese word “dōji”. It refers to or “similar” reflecting the pattern’s nature where the opening and closing prices are almost the same.

Is a doji bullish or bearish?

A doji candlestick pattern is neither inherently bullish nor bearish. The interpretation of a doji as bullish or bearish depends on the preceding price action and the market context in which it appears.

Is doji a reversal pattern?

A doji can be a reversal pattern but does not always indicate a reversal as it represents market indecision. Only when a doji appears after a strong uptrend or downtrend, it may signal a potential reversal.

Is doji red or green?

In theory, the doji should not have a colour as the opening and closing prices are equal. In practicality, there might be a very slight difference between the opening and closing prices giving the candlestick a red or green color. The colour of the doji candlestick pattern does not matter.