- January 29, 2025

- 30 min read

Aroon Indicator – How to Use It

What is the Aroon Oscillator?

The Aroon Oscillator is a single line that plots the difference between the Aroon-Up and Aroon-Down lines. The Aroon Oscillator is one of the Aroon indicators that tracks the amount of time since a new high or low has been reached.

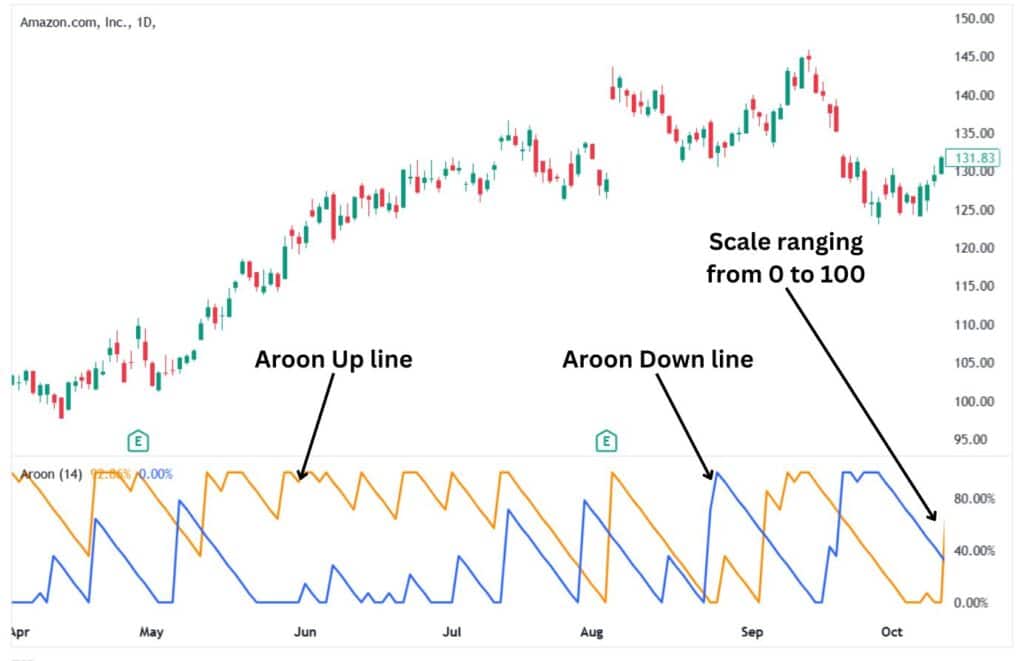

The Aroon-Up line tracks the time passed since the price hit a new high, while the Aroon-Down tracks the time passed since the price hit a new low. The Aroon indicator system is a trend-following indicator where the lines are plotted on a scale from 0 to 100. Values near 100 represent robust trends, and near zero represent a weak trend. The Aroon oscillator is straightforward to interpret since positive values usually indicate an uptrend, while negative values typically signal a downtrend. You can use the oscillator to judge the market’s current trend and momentum without looking at the two Aroon lines.

How Does the Aroon Indicator Work?

The Aroon indicators, developed by Tushar Chande in 1995, work by incorporating time and not just focusing on price to determine how strong a trend is. If the price is in a strong uptrend and keeps pushing into new highs, the Aroon Up indicator line will be positioned near the 100 level.

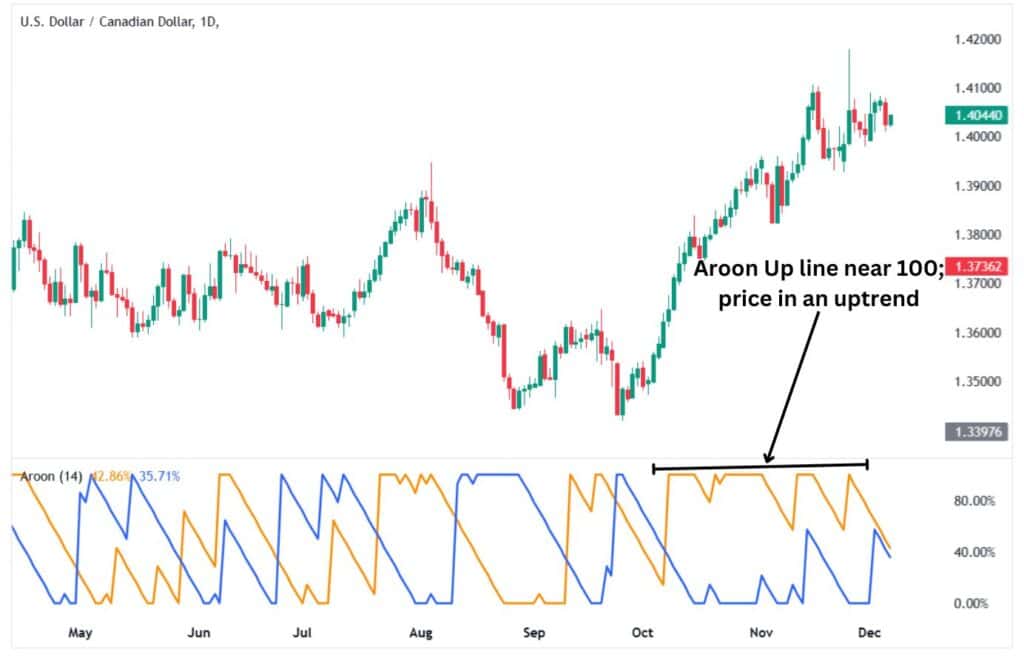

Conversely, since the price will not have reached a new low in a while, the Aroon Down indicator will be positioned near 0. An extended period of high Aroon Up line signals the presence of a robust uptrend, consistently printing new highs.

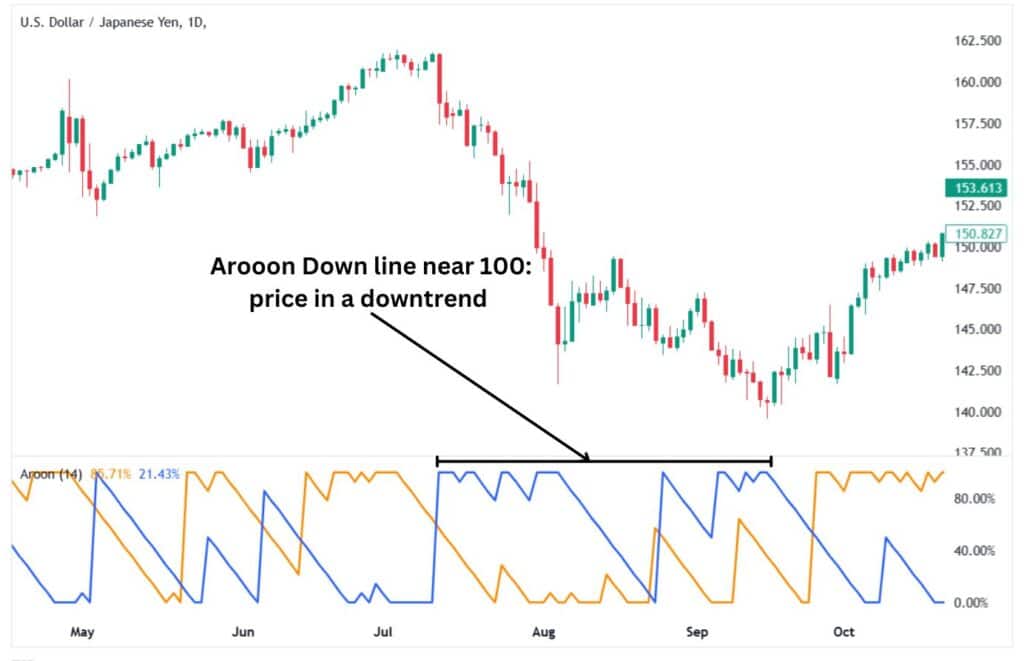

The same reasoning applies when the price trades in an extended downward trend. In such cases, the Aroon Down indicator will be trading near 100 as the price consistently prints new lows. On the other hand, the Aroon Up indicator will be trading near 0, given that the asset has not generated a new high for an extended period.

A robust trend is usually seen when the Aroon lines are on opposite ends of the scale when one is near 0 and the other is near 100.

Aroon Indicator Formula

Here is the Aroon indicator formula:

Aroon-Up Formula:

| Aroon-Up | (Number of periods – Periods Since Highest High) x 100 / Number of Periods |

Aroon-Down Formula:

| Aroon-Down | (Number of periods – Periods Since Lowest Low) x 100 / Number of Periods |

Calculating the Aroon Indicator: Step-by-Step

Here’s how you can calculate the Aroon indicator manually, step-by-step:

- Choose a time period:

Decide the number of periods to analyse, such as 14 days. This will act as the timeframe you will use to calculate the highs and lows.

- Identify the highest high and lowest low

Analyse the price data for your chosen period to find the highest price (highest high) and the lowest price (lowest low) within the selected period.

- Count days since the high and low

Determine the number of days that have passed since the printing of the highest high and the lowest low. within the past 14 days. This number cannot be larger than the number of periods…in this case the largest is 14.

- Apply the Aroon Up formula

Use the formula:

| Aroon-Up | (Number of periods – Periods Since Highest High) x 100 / Number of Periods |

This gives you a percentage showing how close the most recent high is.

- Apply the Aroon Down formula

Use the formula:

| Aroon-Down | (Number of periods – Periods Since Lowest Low) x 100 / Number of Periods |

This shows how recently the lowest low occurred.

- Plot the values

Plot the Aroon-Up and Aroon-Down values on a chart to visualise their movement over time. They’ll usually range between 0 and 100.

- Interpret the lines

If Aroon-Up is near 100 and Aroon-Down is near zero, it suggests a strong uptrend. If it’s the other way around, it signals a strong downtrend. Crossovers between the two lines can indicate potential trend changes.

By following these seven steps, you will have been able to calculate the Aroon indicator manually, and you can now use it to analyse market trends.

Importance of the Aroon Indicator

The Aroon Indicators are versatile and powerful technical indicators for traders, offering unique insights into market trends and momentum. Here are five key reasons why it’s essential:

Identifies and Confirms Trend Direction

The Aroon indicator can determine whether the market is trending up, down, or moving sideways. When the Aroon Down line hovers near 100, prices are creating new lows; hence, they are in a robust downtrend. At the same time, the Aroon Up line is usually hovering around 0, which signals that its been a while since the price printed a new high, thus, confirming the downward trend.

When the Aroon Up line hovers near 100, the price has printed new highs recently and is in an uptrend. Conversely, the Aroon Down line usually trades around zero, indicating that it has been a while since the price printed a new low, confirming the robust uptrend. Interpreting the position of the two lines allows traders to correctly confirm whether an asset is in an uptrend or downtrend.

Measures Trend Strength and Momentum

Beyond identifying the trend, the Aroon indicator shows how strong the trend is. High Aroon-Up values indicate that recent highs are fresh, signalling bullish strength, while high Aroon-Down values reflect bearish dominance.

Low values on the Aroon-Up line indicate a weak trend, suggesting the recent highs are not fresh and the uptrend is losing strength. Meanwhile, when the Aroon down remains at low values, this signals recent lows are not fresh and more pressure is likely to the upside.

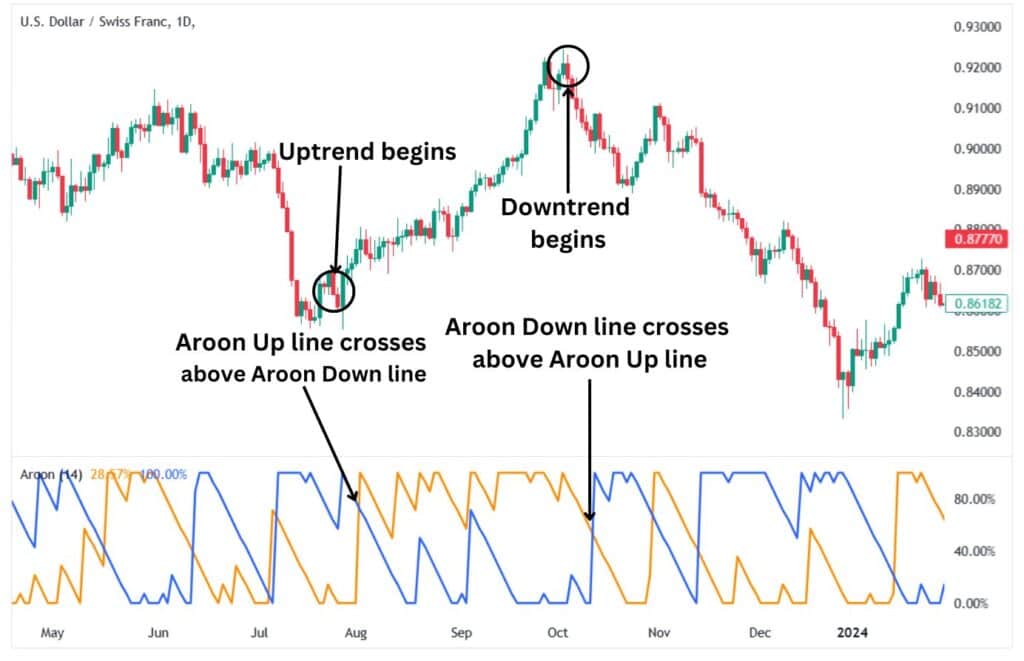

Spotting Early Trend Reversals and Breakouts

The indicator excels at detecting shifts in market dynamics, such as the start of a new trend or a breakout from a consolidation phase. Crossovers between the Aroon-Up and Aroon-Down lines often serve as early warning signs of potential reversals, giving traders an edge in timing their entries and exits. These crossovers should ideally occur above 50 and even towards 80, showing that an asset is switching from a robust trend to another in the opposite direction. For example, a crossover of the Aroon Up line above the Aroon Down line that is near 80 signals a changeover from a strong bearish to a strong bullish trend. However, crossovers below 50 and near 20 usually signal a change within a weak or sideways trend.

Filters Sideways or Choppy Markets

During a sideways or range-bound market, the Aroon Up and Down lines spend little time near 100%. The sideways or choppy market conditions are visible because the Aroon lines spend minimal time near 100%. Each Aroon line briefly spikes higher but quickly falls back as the bulls and bears fight to control the price. Hence, the price is trading sideways. Identifying sideways trading markets is crucial since it helps one avoid trades in markets with no clear direction, reducing the risk of false signals and preserving capital for better opportunities.

Enhances Decision-Making and Reduces Emotional Bias

The Aroon indicator provides objective, data-driven, and clear trading signals to help traders determine where to enter and exit trades. For example, a crossover above 50 of the Aroon Down over the Aroon Up signals the beginning of a potential downtrend as the Up line moves higher near 100 and the Down line moves lower towards zero. The opposite is true when the Aroon Up crosses above the Aroon Down line, triggering a bullish trade signal.

The bullish trend gets underway as the Aroon Up line hovers near 100, and the Aroon Down line hovers around 0. The position of the two lines indicates a robust upward trend. The Aroon indicator’s effectiveness increases with other indicators, like the Donchian channels, for a comprehensive analysis.

The Single Line Aroon Indicator

The single-line Aroon indicator is commonly referred to as the Aroon oscillator. It is a streamlined version of the classic Aroon indicator. It simplifies the Aroon indicator by plotting a single line derived from the Aroon Up and Aroon Down indicator lines.

How the Single Line Aroon Indicator Works

The Single Line Aroon Indicator, or the Aroon Oscillator, is a trend-following indicator that calculates the difference between the Aroon Up and Aroon Down lines.

Aroon Oscillator = Aroon Up – Aroon Down

Positive values (above 0): Suggest an uptrend. The higher the value, the stronger the bullish momentum.

Negative values (below 0): Indicate a downtrend. The lower the value, the stronger the bearish momentum.

Near zero: Signals a lack of trend, suggesting the market might be moving sideways.

Why Use the Aroon Oscillator?

Quick Trend Insight: The oscillator’s single line gives a clear snapshot of market direction and trend strength without needing to track two separate lines.

Spotting Reversals: When the line crosses above or below zero, it can hint at a shift in trend. For example, moving from negative to positive suggests a potential bullish reversal.

Avoiding Noise: It filters out minor fluctuations, making focusing on the bigger picture easier.

When to Use the Single Line Aroon Indicator:

The Single Line Aroon Indicator is excellent for traders who want to quickly assess whether they’re in a trending or range-bound market. Pairing it with tools like the Donchian channels can strengthen its effectiveness and confirm trade setups.

By boiling down the complexity of the full Aroon Indicator into a single, actionable value, the Aroon Oscillator makes trend analysis faster and more efficient for traders at any level.

Aroon Indicator Examples

Understanding how to apply the Aroon Indicator in real-world scenarios can help clarify its trade entry and exit signals. Here are a few practical examples to show how it works:

Example 1: Identifying a Bullish Trend

Analysing a stock, you discover it has been rallying higher, keeping the Aroon Up line near 100 and the Aroon Down line languishing near zero. This means the stock is in a sustained uptrend and has printed new highs over time. It also indicates the stock has not printed any new lows, so traders should consider entering bullish trades. The trade signal would be more reliable if aligned with other indicators like Donchian channels

Example 2: Spotting a Bearish Trend

Looking at a forex pair, you notice that the Aroon Down line has spiked to 100, while the Aroon Up line has declined to zero. This signals that the recent lows have the forex pair in a downtrend as the recent highs disappear. Therefore, the forex pair is in a downtrend and could be headed much lower given the consistent lower lows with the Aroon Down line near 100. This could confirm potential selling opportunities and short trades.

Example: Detecting Trend Reversals

To detect trends, you should look for crossovers between the Aroon Up line and the Aroon Down line after a long time when one of the lines is dominant over the other. A crossover typically signals a shift in market direction. For example, the Aroon Up line crossing over the Aroon Down line could signal the beginning of an uptrend, while the Aroon Down line crossing above the Aroon Up line could suggest the start of a downtrend.

Example 4: Confirming a Breakout

To confirm a breakout in the cryptocurrency market, you see crypto trading in a narrow range, with both the Aroon Up and Down lines barely spending any time near 100. Suddenly, the Aroon Down line surges towards 100, and the Aroon Up line falls to 0. This confirms a bearish breakout, as recent lows dominate the price action. Traders could use this as confirmation to ride the bearish breakout trend.

The Aroon indicator is most effective when combined with other tools to validate its signals. These examples demonstrate its ability to highlight trends, reversals, and consolidation phases, making it a valuable tool for traders of all levels.

Using the Aroon Indicator as a Trading Strategy

The Aroon indicator is a trend-spotting technical indicator that helps traders determine if a market is trending and how strong that trend is. The indicator consists of the Aroon Up and Aroon Down lines. You can decide whether to ride the trend or wait for better opportunities by watching these lines. Here are some trading strategies you can implement based on the Aroon indicator.

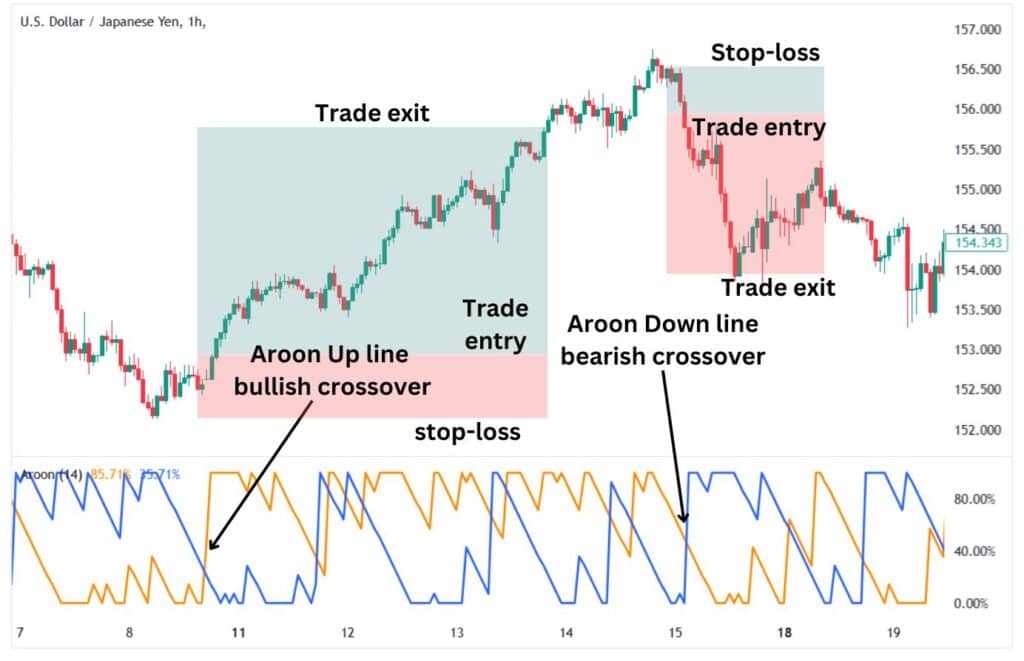

Crossover Strategy

The crossover strategy is like a “changing lanes” signal for trends. When the Aroon Up crosses above the Aroon Down, it’s a sign buyers might be taking over. On the flip side, if the Aroon Down crosses above the Aroon Up, sellers could be gaining the upper hand.

You can use these crossovers as potential trade entry and exit points. A bullish crossover occurs when the Aroon Up line crosses above the Aroon Down line, suggesting the beginning of an uptrend. Conversely, a bearish crossover occurs when the Aroon Down line crosses above the Aroon Up line, signalling the start of a bearish trend.

This strategy works best when paired with other tools to confirm the trend, like volume or support and resistance levels.

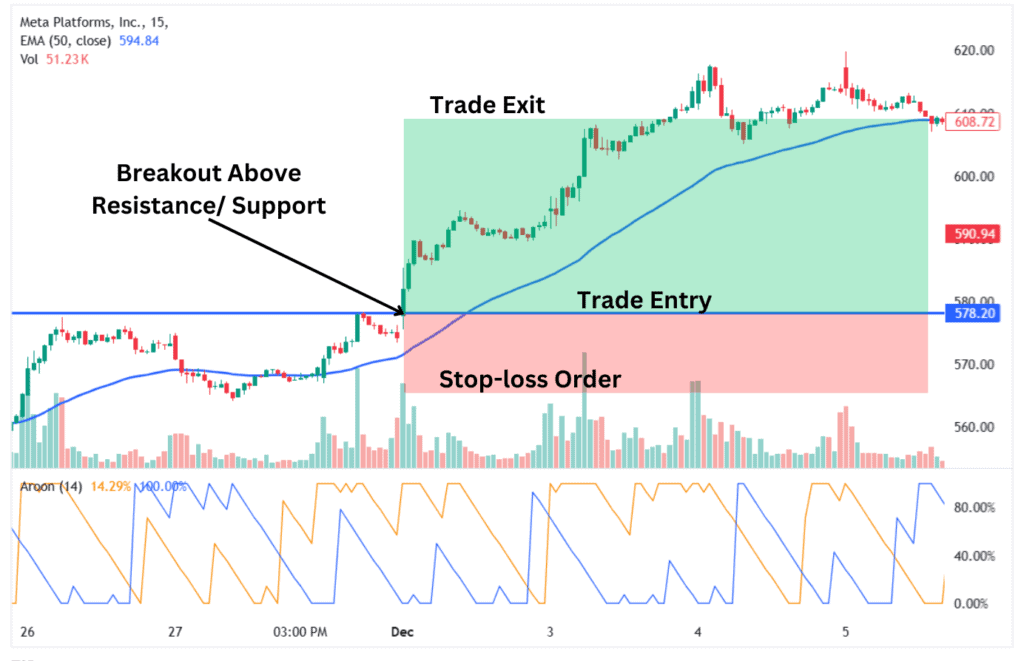

Breakout Trading Strategy

The breakout strategy focuses on catching big market moves when prices escape a tight range. When the Aroon Up shoots to 100 while the Aroon Down drops toward zero, it signals a strong upward breakout. The reverse scenario hints at a downward breakout, where the Aroon Down spikes to 100 and the Aroon Up drops to near zero.

Here is how you can trade this strategy:

- Wait for the Aroon indicator to confirm the breakout direction.

- Enter the trade when prices break key support or resistance levels.

- Place stop-loss orders to protect against false breakouts.

This approach is excellent for spotting explosive trends early.

Trend Strength Strategy

The Aroon indicator can also measure how strong a trend is. When one line stays near 100 while the other sticks close to zero, it means the trend is powerful and likely to continue. For example:

- Aroon Up near 100, Aroon Down near 0: A strong uptrend.

- Aroon Down near 100, Aroon Up near 0: A strong downtrend.

Use this strategy to stay in winning trades longer and avoid jumping ship too soon.

Trading Strategy for Binary Options

The Aroon indicator can be a simple yet effective tool for binary options trading, where timing is everything. This strategy is most suitable for In-the-Money (ITM) options to capitalise on high-probability setups.

Strategy Overview

- Market Type: Trending markets.

- Option Type: ITM binary options.

- Timeframe: 5-minute to 1-hour charts for short-term trades.

- Expiry Time: 3-5 candles of the chosen timeframe.

Trade Parameters

Call Option (Buy) Entry:

- Trend Confirmation:

- Aroon Up crosses above 70 and continues rising.

- Aroon Down crosses below 30 and continues falling.

- These values confirm a strong uptrend.

- Entry:

- Enter the trade as the Aroon Up crosses and remains above 70.

- Exit:

- Set the expiry time to 3-5 candles, depending on the timeframe.

Put Option (Sell) Entry:

- Trend Confirmation:

- Aroon Down crosses above 70 and continues rising.

- Aroon Up crosses below 30 and continues falling.

- These values confirm a strong downtrend.

- Entry:

- Enter the trade as the Aroon Down crosses and remains above 70.

- Exit:

- Set the expiry time to 3-5 candles, depending on the timeframe.

Risk Management

- Only trade during active market sessions (e.g., London or New York).

- Use at most 1% of your trading capital per trade.

- Avoid trading during major news events to minimise unexpected volatility.

This strategy uses the Aroon indicator to ensure trades align with strong directional trends, making ITM options reliable for achieving high win rates.

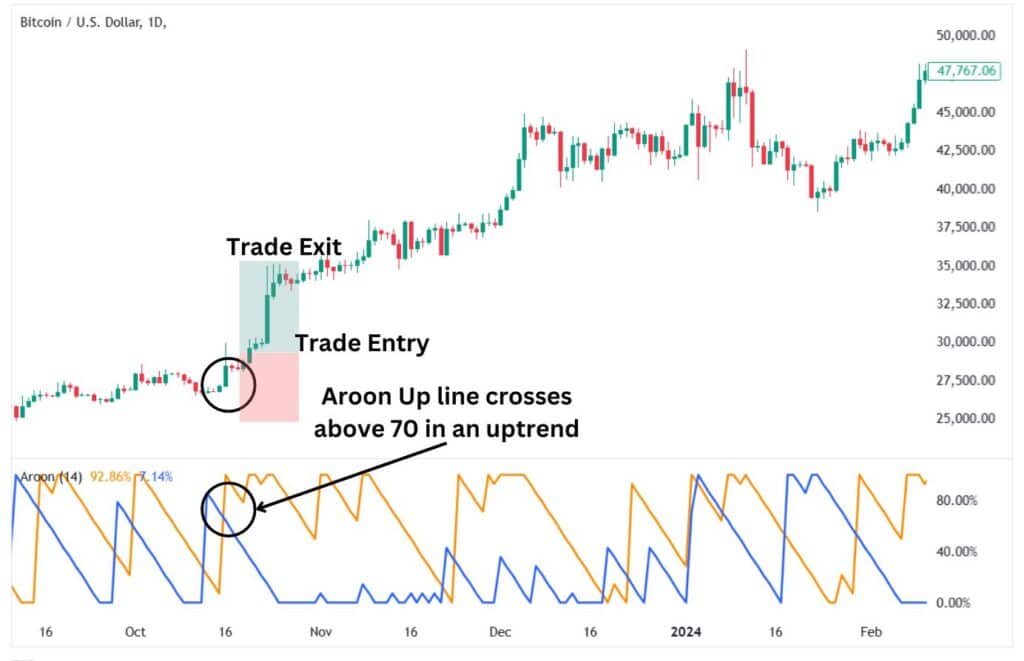

Aroon Indicator in Day Trading

Aroon is a versatile indicator that can be used on a variety of time frames, even for day trading. When day trading, apply the Aroon indicator with its default 14-period setting, the 50-period exponential moving average, and the volume indicator.

Bullish Trade Signal:

- The Aroon Up line should cross above 70, indicating strong upward momentum.

- The Aroon Down line should be below the Up line, preferably below 30, confirming weakening downward pressure.

- Confirm the breakout with an uptick in volume.

- The price should also be above the 50-period EMA.

Bearish Trade Signal:

- The Aroon Down line crosses above 70, indicating strong downward momentum.

- The Aroon Up line is below the Down line, ideally below 30, confirming weakening upward pressure.

- Confirm the breakout with a volume uptick.

- The price should be trading below the 50-period EMA.

Exit Rules:

Utilize the 50-period EMA as a trailing stop-loss order. When the price crosses the 50-EMA, then exit the trade.

Use the 5-minute or 15-minute charts as your trading timeframes for the Aroon indicator.

Backtest the trading strategy using historical data to fine-tune your trade entries and exits.

Advantages of Using the Aroon Indicator

Here are five advantages of using the Aroon indicator.

Clear Trend Signals

The Aroon indicator is a simple but effective tool to help traders identify whether the market is trending up, down, or flat. This clarity is invaluable for beginners—it removes the guesswork and provides a clear visual representation of market direction.

Early Warning Signs for Trend Changes

One of the standout benefits of the Aroon indicator is its ability to signal potential trend reversals before they’re apparent to everyone else. For instance, when the Aroon Up and Aroon Down lines cross, it can indicate a shift in market sentiment, giving traders a chance to position themselves accordingly.

Measures Trend Strength

Beyond just identifying a trend, the Aroon Indicator gauges how strong that trend is. If the Aroon Up line is near 100 while the Aroon Down stays close to zero, it’s a sign of a strong uptrend and vice versa for a downtrend. This added layer of analysis helps traders stay confident in their trades when the trend is robust.

Simple and Beginner-Friendly

Unlike some indicators that require understanding complex calculations or settings, the Aroon Indicator is straightforward. With just two lines—Aroon Up and Aroon Down—it’s simple to interpret, even for those new to trading.

Versatile Across Markets

Whether you’re trading forex, stocks, or commodities, the Aroon Indicator adapts seamlessly. Its universal application makes it a go-to tool for traders who want consistency across different asset classes.

Disadvantages of Using the Aroon Indicator

Here are five disadvantages of using the Aroon indicator.

Struggles in Choppy Market Conditions

In range-bound or sideways markets, the Aroon indicator often provides mixed signals. For example, both lines may hover around the middle range, making it difficult to distinguish whether buyers or sellers have the upper hand. This can lead to indecision or false trades.

Not a Complete Solution

While the Aroon indicator is helpful, it’s not a magic wand. On its own, it may not provide enough confirmation for high-confidence trades. Combining it with other indicators, like the Donchian channels, is essential for a well-rounded strategy.

False Breakouts

The Aroon Indicator can sometimes exaggerate trends, particularly when price movements are short-lived. Traders might mistake a temporary spike in the Aroon lines for a long-term trend, leading to premature entries or exits.

Limited Predictive Ability

It’s important to remember that the Aroon Indicator doesn’t predict future price movements. Instead, it reflects trends based on historical data. While it’s useful for identifying current market conditions, traders need to remain flexible and prepared for sudden changes.

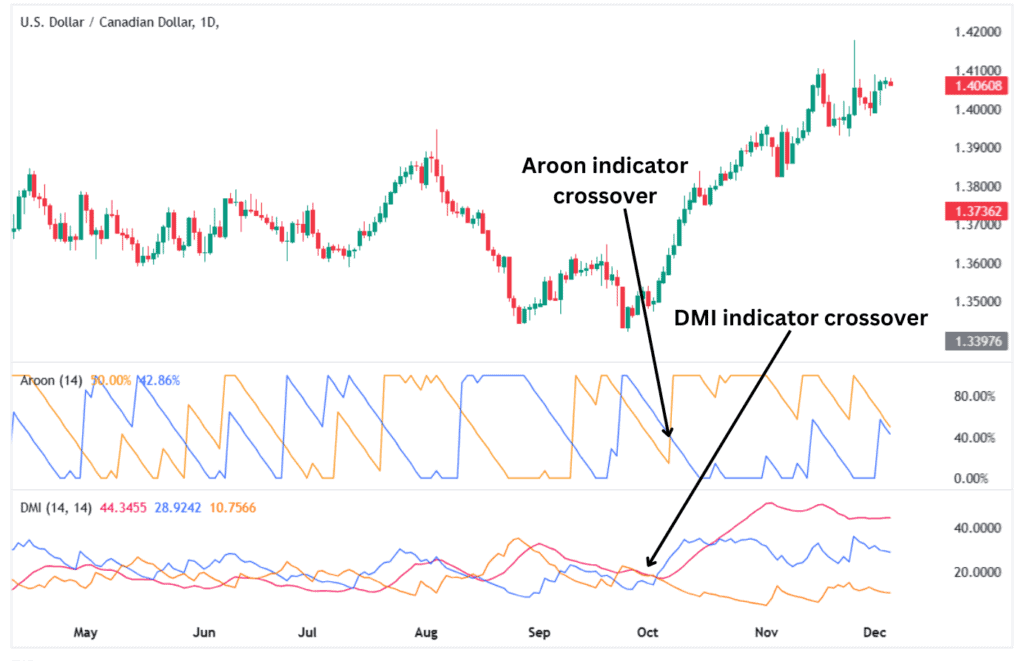

Aroon Indicator vs Directional Movement Index (DMI)

The Aroon Indicator and Directional Movement Index (DMI) are tools traders use to understand trends, but they focus on different aspects of market behaviour. Let’s compare their similarities and differences below.

Similarities Between the Aroon Indicator and the DMI

- Trend-Focused

Both indicators are designed to help traders identify trends. They let you know if the market is moving up, down, or sideways, which is critical for making informed trading decisions.

- Visual Representation

Both tools use lines on a chart to provide insights. The Aroon indicator uses two lines (Aroon Up and Aroon Down). At the same time, the DMI includes the Positive Directional Index (+DI), Negative Directional Index (−DI), and sometimes the Average Directional Index (ADX) for trend strength.

- Works Across Markets

Whether you’re trading forex, stocks, or commodities, both indicators are versatile and can be applied to various asset classes.

- Great for Trend Strength

Both indicators go beyond just showing direction—they also provide an idea of how strong a trend is, helping traders decide whether to ride the wave or stay on the sidelines.

Differences Between the Aroon Indicator and the DMI

- Purpose

Aroon Indicator: Focuses on time. It measures how long it’s been since a high or low occurred within a specific period. This makes it ideal for spotting when trends might be weakening or reversing.

DMI: Focuses on price movement. It compares the current price’s upward and downward movements to gauge trend direction and strength.

- Signal Interpretation

Aroon Indicator: Generates signals when Aroon Up crosses Aroon Down or when one line stays near 100 (strong trend).

DMI: Uses crossovers of +DI and −DI for signals. The ADX confirms trend strength but doesn’t indicate direction.

- Complexity

Aroon Indicator: It is straightforward and beginner-friendly. Great for traders just getting started with technical analysis.

DMI: It is more nuanced and often paired with other tools for deeper analysis, making it better suited for intermediate or advanced traders.

- Market Noise Handling

Aroon Indicator: It may struggle in choppy, sideways markets, providing less reliable signals.

DMI: It handles noise better with the ADX, which helps traders avoid false signals in low-trend conditions.

When to Use Each Indicator?

- Use the Aroon indicator if you want a simple way to spot trends or reversals based on timing. It’s perfect for beginners who need clarity in identifying market trends.

- Use the DMI if you’re looking for a more detailed view of price movement and want to confirm both direction and trend strength. It’s especially useful for avoiding false signals in volatile markets.

Aroon Indicator vs ADX

The Aroon Indicator and the Average Directional Index (ADX) both help traders understand market trends, but they approach the task in different ways. Let’s compare them by highlighting their similarities and differences to gain a better understanding of each indicator.

Similarities of the Aroon and ADX Indicators

Here are some of the similarities shared by the Aroon and ADX indicators.

- Trend-Focused Tools

Both the Aroon indicator and ADX are used to analyse trends. They help traders figure out whether the market is trending and, if so, how strong the trend is.

- Works Across Markets

Whether you’re trading forex, stocks, or commodities, these indicators are versatile and can be applied to any chart, making them useful to all types of traders.

- Visual Representation

Both indicators use lines plotted on a chart. These lines simplify complex market data into clear signals for traders to interpret.

- Useful for Trend Strength

Both tools provide insight into trend strength, helping traders decide whether to enter a trade, stay in, or exit.

Differences Between the Aroon and ADX indicators

- Purpose

Aroon Indicator: Focuses on time. It measures how long it’s been since a high or low occurred during a given period, making it ideal for spotting trends and potential reversals.

ADX: Focuses on trend strength. It shows how strong a trend is, regardless of its direction (up or down). It doesn’t indicate whether the market is bullish or bearish—just whether the trend is strong.

- Signal Interpretation

Aroon Indicator: Generates signals when Aroon Up and Aroon Down cross. For example, if Aroon Up crosses above Aroon Down, it signals a bullish trend.

ADX: A rising ADX (usually above 25) signals a strong trend, while a falling ADX indicates a weakening trend. The ADX doesn’t specify direction, so traders often use +DI and −DI for that.

- Calculation

Aroon Indicator: Relies on time since recent highs or lows, making it time-centric.

ADX: Based on price movement and directional changes, making it price-centric.

- Handling Choppy Markets

Aroon Indicator: Struggles in sideways or range-bound markets, where signals can become unclear.

ADX: Handles choppy markets better by showing low ADX values, indicating a lack of a strong trend.

When to Use Each Indicator?

- Use the Aroon Indicator if you’re a beginner looking for a straightforward way to spot trends and reversals based on timing.

- Use ADX if you’re focused on gauging the strength of a trend and are comfortable interpreting additional lines to confirm direction.

Combining the Two Indicators

For a more robust approach, some traders use the Aroon Indicator to identify trend direction and reversals, then confirm the trend’s strength with the ADX. This helps you see the market’s direction and strength.

Aroon Indicator vs Donchian Channels

The Aroon indicator and Donchian Channels are tools that help traders analyse market trends, but they do it in distinct ways. Let’s break down how these two compare by focusing on their similarities and differences.

Similarities Between the Aroon Indicator and Donchian Channels

- Trend Identification

Both the Aroon Indicator and Donchian Channels are designed to spot trends. They help traders determine whether the market is trending up, down, or flat.

- Time-Based Calculations

Both tools rely on a specific lookback period to analyse price movements. This means they work best when you choose the right time frame for your trading style.

- Universal Application

These indicators can be applied across various markets, including forex, stocks, and commodities, making them versatile tools for all types of traders.

- Visual Simplicity

Both tools simplify data into easy-to-read visuals: the Aroon uses two lines (Aroon Up and Aroon Down), while Donchian Channels draw upper and lower boundaries around price action.

Differences Between the Aroon Indicator and Donchian channels

- Purpose

Aroon Indicator: Focuses on the timing of highs and lows. It’s great for spotting potential trend reversals by showing how long it has been since the highest high or lowest low occurred within a chosen period.

Donchian Channels: Focus on price boundaries. They create a “channel” that shows the highest high and lowest low over a set period, helping traders spot breakouts or assess price volatility.

- Signal Interpretation

Aroon Indicator: When Aroon Up crosses above Aroon Down, it suggests a bullish trend is starting. When Aroon Down crosses above Aroon Up, it hints at a bearish trend.

Donchian Channels: Signals are triggered when the price breaks above the upper channel (bullish breakout) or below the lower channel (bearish breakout). Traders use these breakouts to enter trades.

- Focus Area

Aroon Indicator: Primarily looks at trend strength and reversal potential over time.

Donchian Channels: Concentrate on price action and breakouts, making them a favourite for traders focused on volatility and momentum.

- Range vs. Trend

Aroon Indicator: Struggles in sideways or range-bound markets, where crossovers may not produce reliable signals.

Donchian Channels: Shine in volatile markets, as they highlight price breakouts from ranges, making them more adaptable in such conditions.

When to Use Each Indicator

- Aroon Indicator: Ideal for traders who want a simple tool to assess trend direction and strength, especially if their strategy revolves around spotting reversals.

- Donchian Channels: Better suited for breakout traders who focus on capturing big moves when the price breaks key levels of support or resistance.

Combining the Two Indicators

For a comprehensive approach, you could use the Aroon Indicator to identify whether the market is trending and the Donchian Channels to confirm breakout opportunities. For example:

- If the Aroon Up is high, indicating a strong uptrend, and the price breaks the upper Donchian Channel, it’s a strong buy signal.

- Similarly, if the Aroon Down is high (indicating a strong downtrend) and the price falls below the lower channel, it supports a sell signal.

By understanding these similarities and differences, you can choose the right tool based on your trading style—or combine them for better insights into trends and price movements.

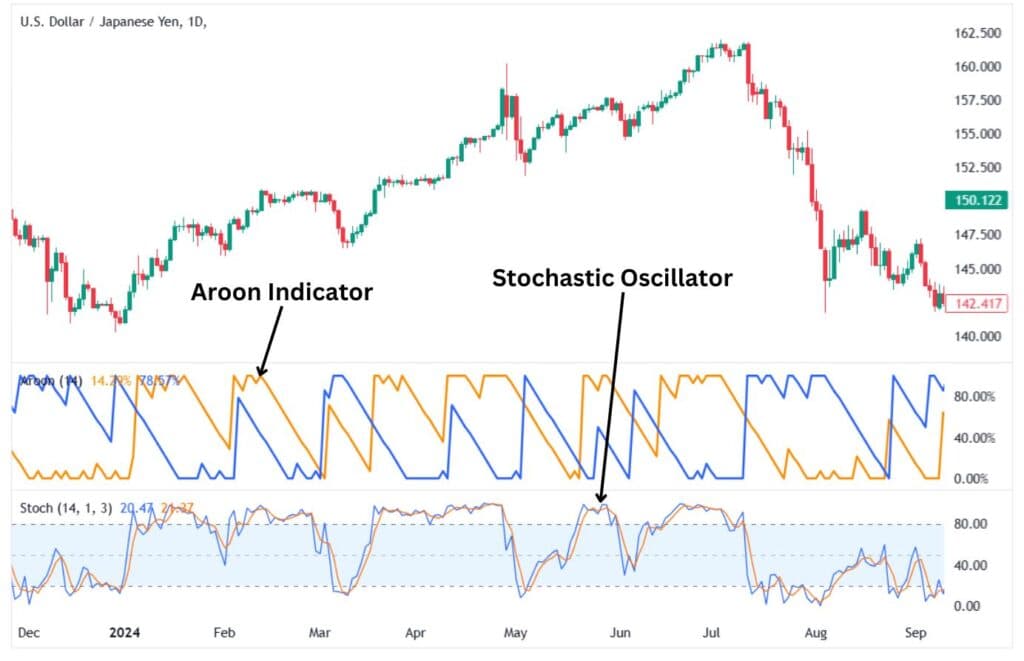

Aroon Indicator vs Stochastics Oscillator

The Aroon indicator and Stochastics Oscillator help traders analyse market trends and identify potential reversals. Let’s delve deeper into how these two indicators work by analysing their similarities and differences.

Similarities between the Aroon Indicator and Stochastics Oscillator

- Identify Trends and Reversals

Both tools help traders spot potential trend changes or confirm existing trends, giving you clues about the market’s next move.

- Range-Bound Oscillators

Each operates within a defined range. The Aroon moves between 0 and 100, while Stochastics swings between 0 and 100 as well, making it easy to interpret their signals visually.

- Best in Sideways Markets

Both indicators shine when markets are less volatile. They’re designed to signal overbought or oversold conditions or trend strength, which is especially useful when prices aren’t making extreme moves.

Differences Between the Aroon Indicator and the Stochastic Oscillator

Here are some of the differences between the Aroon Indicator and the Stochastic Oscillator as outlined in the table below.

| Aspect | Aroon Indicator | Stochastic Oscillator |

| Purpose | Measures the strength of a trend and how recent a high or low is. | Identifies overbought/oversold conditions and momentum. |

| Focus | Evaluates whether the market is trending or losing momentum. | Evaluates how close the closing price is to the recent range. |

| Best Use Case | Confirming whether a trend is strong or fading. | Spotting price reversals at overbought (above 80) or oversold (below 20) levels. |

| Calculation Basis | Based on time elapsed since recent highs and lows. | Based on price relative to its range over a set period. |

When to Use Each Indicator

- Aroon Indicator: If you’re trying to gauge whether the market is in a trend or losing direction, Aroon is your friend. It’s perfect for trend-following strategies.

- Stochastic Oscillator: If you’re looking for precise entry and exit points based on momentum, Stochastics is your go-to. It works best in choppy, range-bound markets.

Differences Between Aroon Indicator vs. Aroon Oscillator

The Aroon Indicator and Aroon Oscillator are closely related indicators, as you can tell from their names. However, the two indicators have distinct characteristics that separate them from each other. Let’s explore these differences in greater detail.

What They Are

- Aroon Indicator

Think of this as two teammates working together:- Aroon-Up: Tracks how recently the highest price occurred.

- Aroon-Down: Tracks how recently the lowest price occurred.

The goal? To measure whether a market is trending and how strong that trend is.

- Aroon Oscillator

This is a single number derived from the Aroon-Up and Aroon-Down indicators. It simplifies things by subtracting the Aroon-Down from the Aroon-Up to give you a quick snapshot of trend strength and direction.

Key Differences

| Aspect | Aroon Indicator | Aroon Oscillator |

| Structure | Two separate lines: Aroon-Up and Aroon-Down. | A single line that combines Aroon-Up and Aroon-Down. |

| Purpose | Provides detailed insight into highs and lows separately. | Offers a simplified view of overall trend strength. |

| Range | Each line moves between 0 and 100. | Oscillator ranges from -100 to +100. |

| Interpretation | Focuses on the relationship between two lines. | Focuses on whether the oscillator is above or below 0. |

| Usage | Used to confirm whether a trend exists and its strength. | Used to quickly gauge the trend’s momentum and direction. |

How to Read And Interpret the Two Indicators

- Aroon Indicator:

- Aroon-Up near 100: Recent highs = strong uptrend.

- Aroon-Down near 100: Recent lows = strong downtrend.

- Both near 50 or below: The market may lack a clear trend.

- Aroon Oscillator:

- Above 0: Uptrend gaining strength.

- Below 0: Downtrend gaining strength.

- Near 0: The market is indecisive or consolidating.

When to Use Each Indicator

- Aroon Indicator: You can use it if you want a detailed breakdown of highs and lows to analyse market trends.

- Aroon Oscillator: You can apply it if you’re looking for a quick snapshot to decide whether the trend is worth following.

The Aroon indicator is like reading a full weather forecast—it gives you detailed updates on both sunshine (uptrend) and storms (downtrend). The Aroon Oscillator is like a quick weather app—it simplifies everything into one number: sunny, stormy, or calm.

What Indicators Work Best with Aroon?

When combining the Aroon Indicator with other tools, the goal is to enhance its trend-detection abilities and reduce false signals. Here are some of the indicators that complement Aroon for a well-rounded trading strategy:

1. Donchian Channels

Donchian Channels identify breakouts and trend direction by tracking the highest high and lowest low over a period, signalling bullish momentum above the upper channel or bearish momentum below the lower channel. The Aroon indicator complements this by measuring the time since price hit its highest high or lowest low, indicating trend strength. High Aroon Up or Down values confirm strong trends, while crossovers signal potential reversals.

How to Use Them Together:

- A breakout above the Donchian upper channel confirmed by a high Aroon Up value reinforces bullish sentiment and reduces false breakout risk.

- A breakdown below the Donchian lower channel confirmed by a high Aroon Down value supports bearish sentiment.

2. Moving Averages

Why They Work Well:

Moving averages smooth out price action and confirm trends. While the Aroon Indicator signals if a trend is forming, moving averages can validate its direction and longevity.

How to Use Them Together:

- Use the Aroon-Up and the Aroon-Down to identify potential trend changes.

- Check if the price is above (uptrend) or below (downtrend) the moving average to confirm the trend.

3. Relative Strength Index (RSI)

Why They Work Well:

The Relative Strength Index (RSI) measures momentum, helping traders spot overbought or oversold conditions. The Aroon indicator shows trend strength, but the RSI adds a layer of insight into whether a trend might reverse soon.

How to Use Them Together:

- If the Aroon-Up is near 100 (strong uptrend), but the RSI is in overbought territory, a reversal might be on the horizon.

- If the Aroon-Down is near 100 (a robust downtrend) and the RSI is oversold, a bounce could follow.

4. MACD (Moving Average Convergence Divergence)

Why They Work Well:

The MACD tracks momentum and signals potential reversals with crossovers. When combined with the Aroon indicator, it helps confirm trend changes and potential trade entry/exit points.

How to Use Them Together:

- Look for MACD crossovers to align with Aroon’s trend signals.

- A bullish MACD crossover with a high Aroon-Up confirms a strong uptrend.

- A bearish MACD crossover with a high Aroon-Down signals a solid downtrend.

5. Bollinger Bands

Why They Work Well:

Bollinger Bands® highlight volatility and potential breakout zones. While Aroon signals trend strength, Bollinger Bands help gauge if the trend has room to run or if the price might pull back.

How to Use Them Together:

- If the Aroon indicates a strong uptrend and the price is near the upper Bollinger Band, expect potential resistance.

- If the Aroon signals a downtrend and the price is near the lower band, be cautious of a reversal.

6. Average Directional Index (ADX)

Why They Work Well:

The Average Directional Index (ADX) measures trend strength, just like Aroon. Combining them ensures you’re not acting on weak trends or false signals.

How to Use Together:

- High ADX values (>25) alongside a dominant Aroon-Up or Aroon-Down confirm a strong trend.

- If ADX is low (<20), even a strong Aroon reading might not lead to sustained price movement.

7. Fibonacci Retracements

Why They Work Well:

Aroon indicates trends, but Fibonacci retracements pinpoint potential reversal or continuation zones within those trends.

How to Use Together:

- Use Aroon to identify the trend direction.

- Plot Fibonacci levels to find areas of support (in an uptrend) or resistance (in a downtrend).

FAQ

What is the best Aroon settings?

The default 14-period setting works well for most traders, balancing sensitivity and reliability. Short-term traders can use 7-10 periods for quicker signals, while long-term traders may prefer 20-25 periods for smoother trends. Adjust the setting based on your trading style and timeframe.

How reliable is Aroon?

Aroon is reliable for spotting trends and their strength but can give false signals in sideways markets. It works best in trending markets and is more effective when paired with other tools like RSI or MACD. While useful, it’s not foolproof and should be part of a broader strategy.

Is Aroon a Leading or Lagging Indicator?

Aroon is a leading indicator, as it predicts trend changes based on recent highs and lows. It signals when trends may start or lose strength, helping traders anticipate moves. However, as a predictive tool, it’s not always perfect and needs confirmation.

What is the origin of Aroon?

The Aroon Indicator, developed by Tushar Chande in 1995, is a trend-following tool. Its name, “Aroon,” means “dawn’s early light” in Sanskrit, symbolizing its purpose of spotting the start of new trends. Chande created it to measure trend strength and direction effectively.