- Weekly Outlook

- December 5, 2025

- 6 min read

Fed Cut Momentum, UK GDP Rebound, and BoC Pause Signal Key Moves Ahead

This week’s global economic calendar is stacked with pivotal events that could set the tone for the U.S. dollar and its major counterparts. With the Federal Reserve, Bank of England, and Bank of Canada all steering the macro narrative in different directions, traders can expect heightened volatility and trend-defining moves across EUR/USD, GBP/USD, and USD/CAD.

The key theme this week?

Divergence in monetary policy expectations — with the Fed leaning dovish, the BoE cautiously steady, and the BoC taking a temporary pause.

Let’s break down what each of these developments means for markets and how the charts align technically.

United States – Fed Rate Decision: Dovish Tilt Weakens USD

Macro Outlook

The Federal Reserve’s recent rhetoric has softened, with policymakers increasingly leaning toward another 25 basis-point rate cut in December — their third this year.

The driver? A cooling labor market and growing concern that tight conditions could tip the economy into a slowdown.

While officials remain wary about inflation persistence (especially with tariff-related cost pressures), the focus has shifted squarely to employment softness. The Fed’s updated economic projections may show just one more rate cut penciled in for 2026, but the market isn’t buying it — traders already price in two to three cuts for next year.

Adding a political layer, expectations that Donald Trump may replace Jerome Powell next year further cloud the Fed’s medium-term outlook. A potential change in leadership could steer the central bank toward a more accommodative stance, reinforcing the dovish market bias.

Net Impact: USD mildly bearish — softening bias likely to extend if Powell confirms the rate cut and hints at flexibility for further easing.

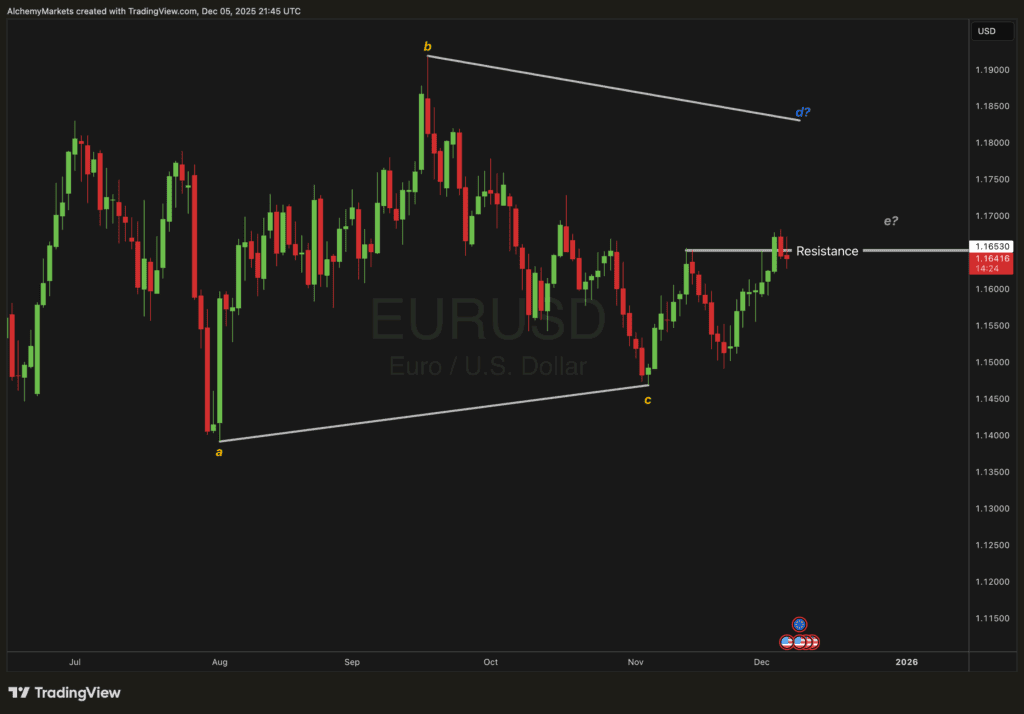

Technical Outlook – EUR/USD

The EUR/USD pair is showing early signs of bullish continuation, supported by the softening U.S. dollar backdrop.

- The pair recently tested and held above the 1.16530 resistance, suggesting momentum could carry it higher if the Fed delivers a dovish message.

- The price structure, marked by a potential completion of the wave ‘e’ leg, hints that a breakout and sustained move above this level could trigger a run toward the next resistance zone near 1.1750–1.1800.

- Conversely, failure to hold above 1.1650 could see a retest toward 1.1550 before any renewed push higher.

Bias: Bullish continuation toward 1.1750 while above 1.1650

Catalyst: Dovish Fed confirmation → weaker USD → stronger EUR/USD

United Kingdom – Monthly GDP: Recovery from a One-Off Shock

Macro Outlook

The UK’s recent economic data appeared grim — but there’s an important catch.

The sharp dip in September’s manufacturing activity was largely due to a cyberattack at a major automaker, which temporarily halted production. That disruption has since been resolved, and output resumed in October, paving the way for a GDP rebound.

In other words, the slump wasn’t reflective of the broader economy but rather a temporary distortion.

While the UK remains structurally weak, this technical rebound means growth isn’t as dire as it appeared. As a result, traders might slightly push back their expectations for Bank of England rate cuts, supporting the British pound in the short term.

Net Impact: GBP mildly bullish to neutral — short-term strength on the data rebound, but broader macro headwinds still limit upside.

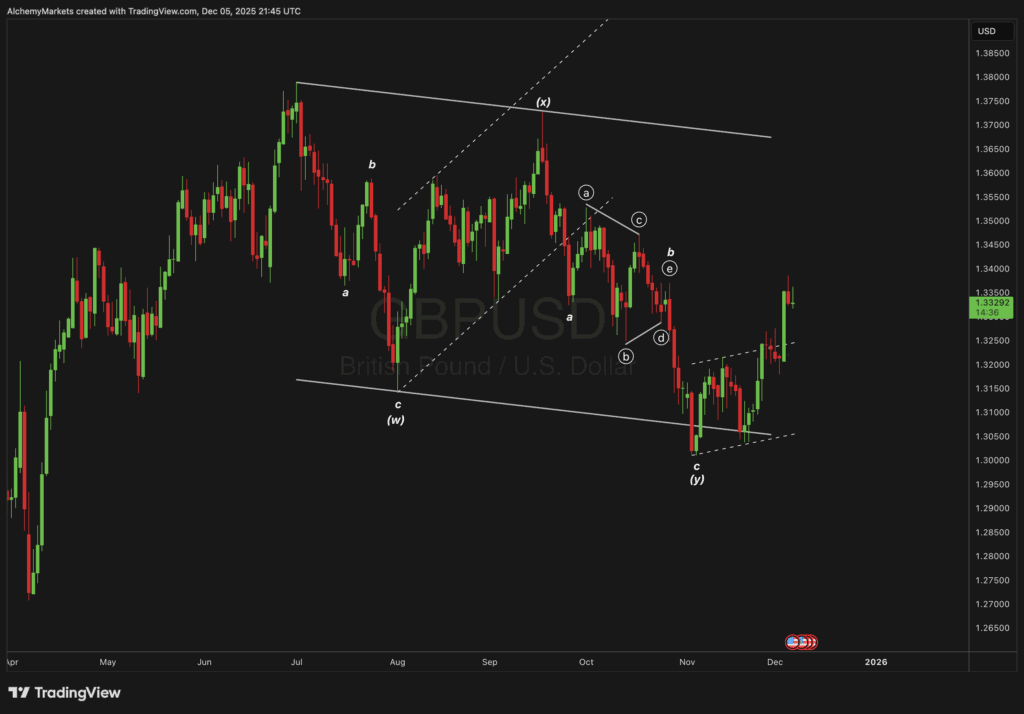

Technical Outlook – GBP/USD

The GBP/USD pair has shown solid bullish follow-through after finding support near the lower bound of its descending channel.

- The current rally suggests that the pair could extend toward the upper boundary of the channel, roughly near 1.3450–1.3500, as momentum continues.

- The structure aligns with the improving sentiment around UK data and fading immediate rate-cut expectations.

- However, macro divergence (Fed dovish, BoE still cautious) could create choppy conditions — so traders should watch for resistance reactions near the upper channel zone.

Bias: Bullish within the channel, targeting 1.3450–1.3500

Catalyst: GDP rebound removes near-term downside pressure → GBP steadies

Canada – BoC Rate Decision: A Pause Before One Final Cut

Macro Outlook

The Bank of Canada has been among the more aggressive cutters in recent years, but with recent data showing resilience — stronger job growth and GDP — policymakers are expected to pause rate cuts this week.

This isn’t a pivot, though.

The BoC is still likely to deliver one more cut in early 2026, especially as U.S.–Canada trade tensions remain a key downside risk. For now, the central bank’s pause is seen as a sign of confidence in near-term stability.

Net Impact: CAD mildly bullish in the short term, though medium-term softness could return once the BoC resumes easing.

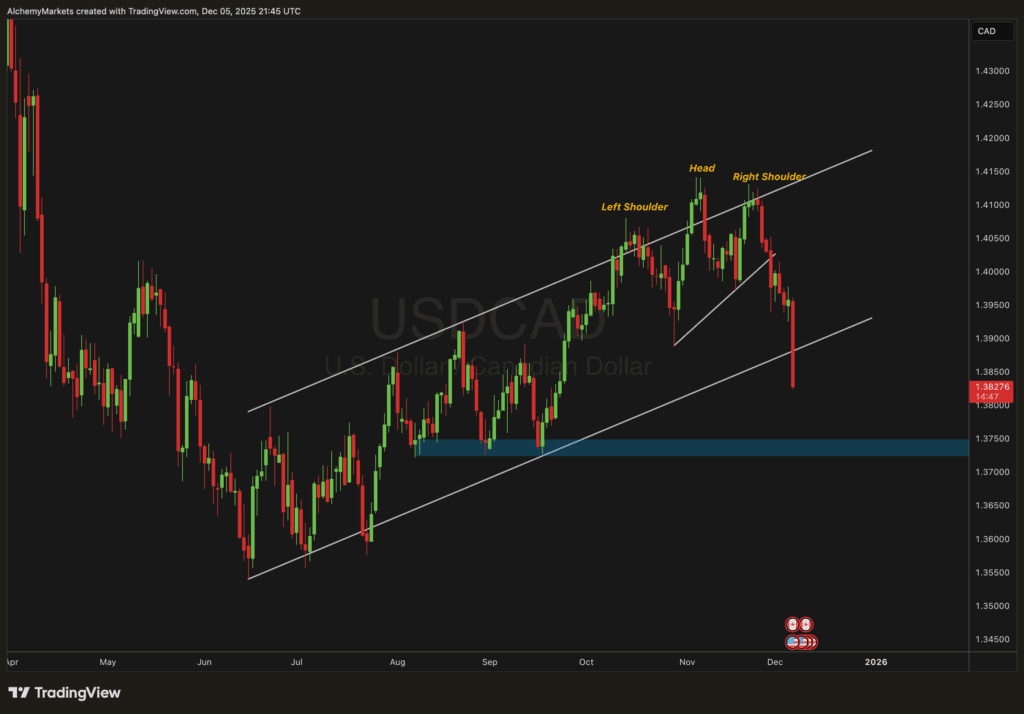

Technical Outlook – USD/CAD

The USD/CAD chart confirms a technical breakdown from its multi-month ascending channel.

- The pair’s sharp decline this week, following the right shoulder completion of a head-and-shoulders pattern, points to sustained downside momentum.

- The next major target lies around 1.3750, aligning with a key horizontal support zone and the base of the prior consolidation area.

- With the BoC expected to pause and the USD softening, the path of least resistance appears lower.

Bias: Bearish toward 1.3750

Catalyst: BoC pause + USD softness → further downside momentum

Summary Table

| Event | Policy Outlook | Currency Impact | Technical View |

|---|---|---|---|

| Fed Rate Decision | 25bp cut likely; dovish tone | USD bearish | EUR/USD breakout above 1.1650 |

| UK Monthly GDP | Temporary rebound post-cyber disruption | GBP mildly bullish | GBP/USD toward 1.3450–1.3500 |

| BoC Rate Decision | Likely pause, one more cut early 2026 | CAD mildly bullish (short-term) | USD/CAD toward 1.3750 |

Bottom Line

This week’s FX setup is defined by a softer USD backdrop, driven by the Fed’s dovish lean, while the UK and Canada enjoy short-term economic relief.

Technically, all three pairs — EUR/USD, GBP/USD, and USD/CAD — reflect this dynamic with EUR and GBP showing upside momentum and USD/CAD breaking lower.

As always, the key will be how firmly central banks anchor expectations in their communications.

If the Fed confirms the December cut and hints at more to come, the dollar’s slide could deepen, fueling bullish setups across the majors.