- Opening Bell

- October 31, 2024

- 3 min read

Preview of Apple and Amazon Q3 2024 Earnings

Apple and Amazon, two of the most watched tech giants, are set to release their Q3 2024 earnings later today. Analysts and investors eagerly await these reports, as the companies’ performances will provide insights into the consumer tech and cloud markets, which are under increasing pressure from inflation and global economic uncertainties. Here’s a quick recap of their Q2 2024 results, what to expect this quarter, and a technical overview for each.

Apple Q2 2024 Recap and Q3 2024 Outlook

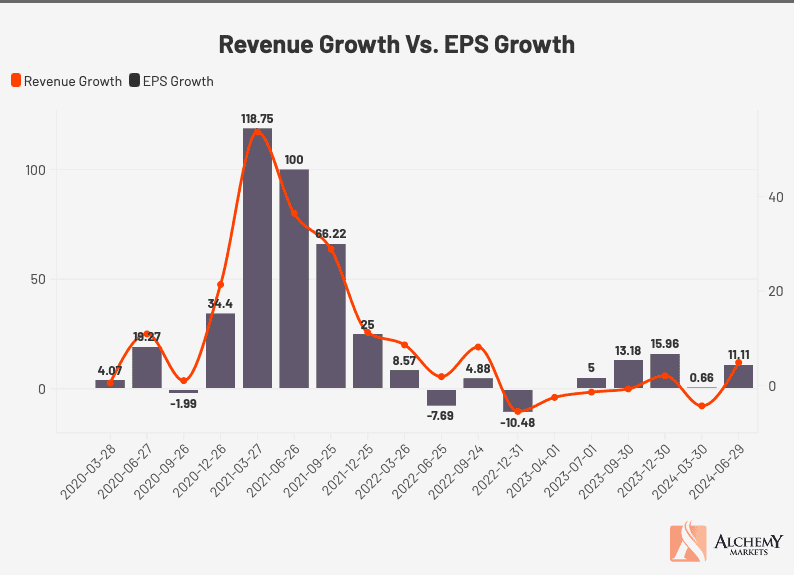

Data Source: Apple

In Q2 2024, Apple reported solid numbers with total net sales of $85.8 billion, up from $81.8 billion the previous year. This growth was driven by both product sales, including a strong performance in Mac and iPad segments, and services revenue, which grew to $24.2 billion. Net income reached $21.4 billion, showcasing Apple’s resilience despite a challenging market.

For Q3 2024, the focus will be on whether Apple can continue this momentum amid increased competition and potential supply chain issues. Market expectations are set at $94.51 billion in revenue and an EPS of $1.60. Analysts will be looking closely at Apple’s services revenue, which has become a core component of the company’s financial health, alongside sales performance in its flagship product categories.

Amazon Q2 2024 Recap and Q3 2024 Outlook

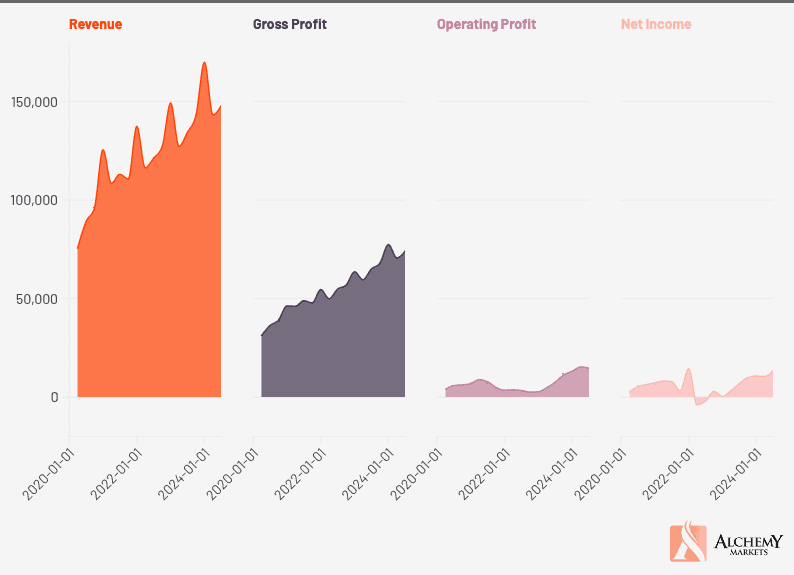

Data Source: Amazon

Amazon’s Q2 2024 report showed robust growth, with total net sales reaching $147.98 billion, up from $134.38 billion in Q2 2023. The company saw significant contributions from both its retail operations and AWS, its cloud services division, which continues to be a major driver of profitability with increasing service adoption.

In Q3, Amazon’s performance expectations are high, especially for AWS, which analysts anticipate will deliver strong revenue. Forward-looking guidance will also be key, as the company has been undergoing a wave of cost optimisation efforts. The market will closely watch Amazon’s strategic positioning in the cloud market and potential operational efficiencies in its retail segment.

Technical Analysis

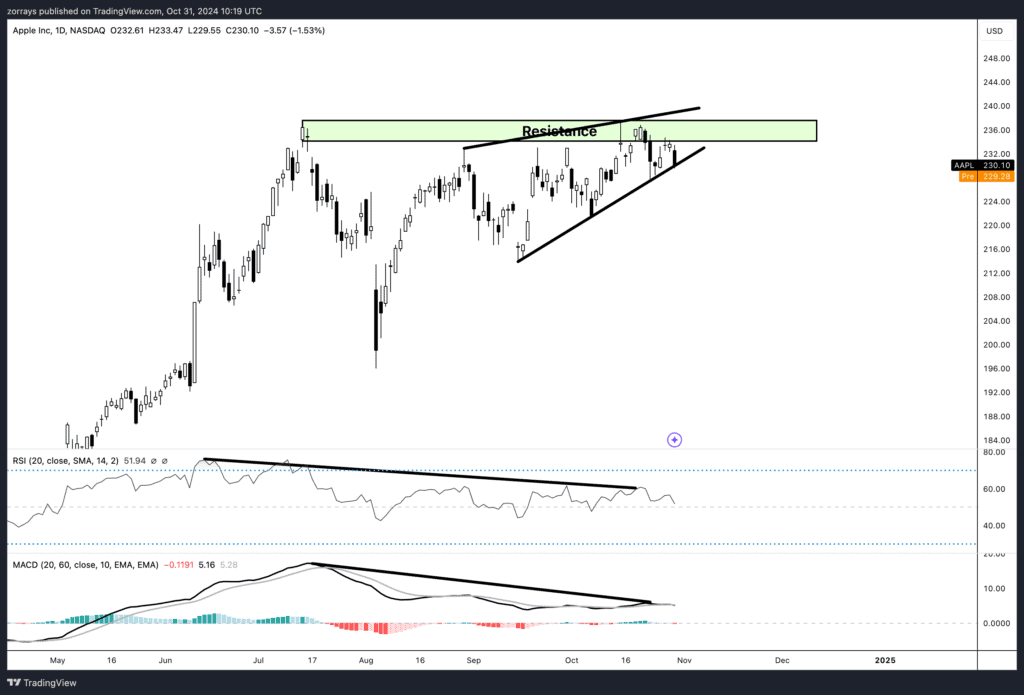

Apple (AAPL): Apple’s stock has been hovering around the critical $235 resistance level since July 2024. The stock revisited this level in mid-October but was met with bearish signals. Divergences in RSI and MACD indicators indicate potential exhaustion in buying momentum, suggesting that a clear breakout above $235 is necessary to sustain an uptrend. However, if Apple’s earnings fall short of the $94.51 billion revenue and EPS target of $1.60, we could see the stock continue to correct as bearish pressure mounts.

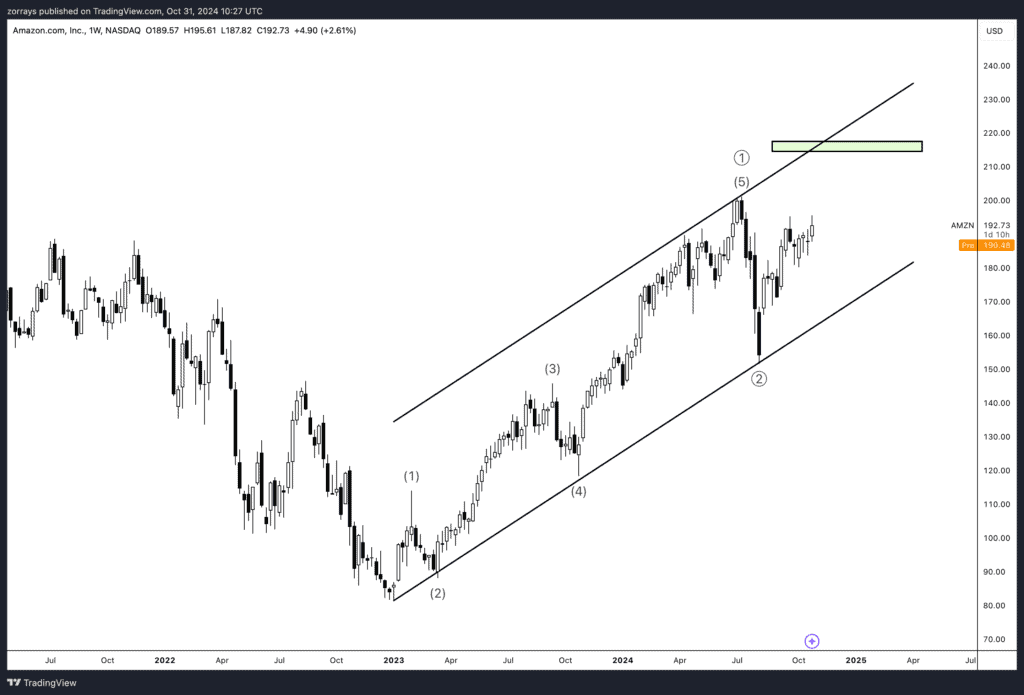

Amazon (AMZN): Amazon’s price has been following a five-wave sequence since its January 2023 lows, with a correction phase noted in July 2024. Depending on the Q3 earnings and forward guidance, the stock may resume its upward trend, breaking above its base channel into wave 3. In the near term, a bullish outcome could drive the stock toward the $215 target, signalling a continuation of the growth wave. However, disappointing guidance could lead to a deeper correction within wave ((2)).

With the Q3 2024 reports set to impact both companies’ technical outlooks, a positive earnings surprise could spark a bullish rally, while missed expectations may reinforce recent technical signals indicating correction phases.