- March 25, 2025

- 22 min read

CFDs Commodities – Buy, Sell and Trade

Commodity CFDs allow market participants to trade assets like oil, gold, silver, and natural gas without the need for physical ownership or impact of commodities futures contract expiration dates.

What Are CFD Commodities?

Commodity CFDs (contracts for difference) are financial derivative products that give investors exposure to commodities without offering ownership rights. For those new to the markets, CFD trading for beginners provides a straightforward way to speculate on the price movements without the complexities of physical ownership or futures contracts. With a specialized CFD, such as a gold CFD or an oil CFD, an investor can speculate on the change in the price, and possibly the volatility, of the underlying asset without physically holding it.

These contracts aim to mirror the price change of the underlying commodity based on a 1:1 ratio, enabling traders to capitalize on short- and medium-term price movements either up or down.

For example, if you expect gold or oil prices to increase or decrease during a certain period, you can buy or sell their respective CFDs to profit from their trends. With commodity CFDs, you can easily open long or short positions without having to own the underlying asset at any time.

CFDs are part of a broader group of financial instrument derivatives that also include futures and options. Derivatives are financial products that enable investors to gain exposure to underlying assets without holding them – they follow the price change of the underlying asset but don’t provide any stake in the related asset. Commodity futures are particularly significant as they were designed specifically for trading in popular commodities. However, CFDs are more flexible and straightforward compared to other derivatives, as they are designed to be used in active trading. For example, CFDs allow you to set trade sizes as you like, unlike standardized futures contracts. That is just one main difference in a CFD vs Future contract.

Commodity CFDs are offered by CFD brokers, most of which also provide forex pairs trading and equity CFD products.

What Are Commodities?

Commodities are natural raw materials used to manufacture industrial and consumer products. Typically, they are used as inputs in the production of other goods rather than being sold directly to consumers. Think about gold, oil, natural gas, and agricultural products, including wheat, sugar, or soybean. Livestock, meat, and dairy products are also commodities.

There are some exceptions like Bitcoin, which is treated as a commodity by the Commodity Futures Trading Commission (CFTC), although it is not a physical material found in nature.

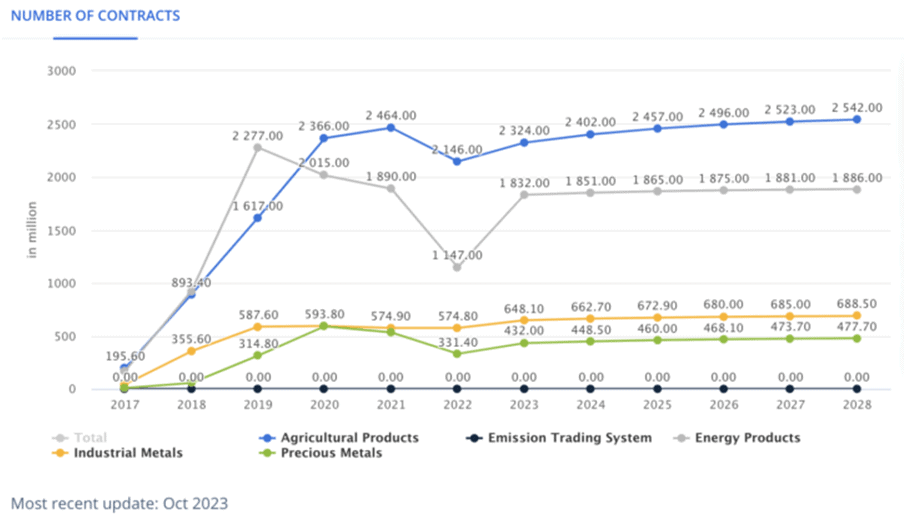

The most actively traded commodities by number of futures contracts with physical delivery are agricultural products, energy products, industrial metals, and precious metals.

Source: Asktraders.com

However, when it comes to trading volume in USD terms, the most traded commodities are corn, oil, gold, and natural gas.

Commodities play an essential role in global and regional economies, serving as key components of the macroeconomic puzzle. Strategic commodities, such as oil, natural gas, and gold, are strongly connected to geopolitics, often being leveraged as tools to reach certain political goals. For example, pricing strategies of oil-producing countries (OPEC) can influence the geopolitical landscape, putting economic pressure on certain regions and favoring others.

Types of Commodities

Commodities differ by their chemical and physical attributes, the way they’re priced, and their role in the economy. Still, we can distinguish two main types of commodities:

Soft Commodities

Soft commodities refer to products that must be grown and nurtured, such as agricultural products and livestock. Given that the production of soft commodities depends very much on external factors – including environmental conditions of a certain region – their prices are much more volatile.

Examples of soft commodities include corn, wheat, coffee, sugar, cocoa, soybeans, or tea.

Soft commodities are some of the oldest traded products, and they still account for a large share of trading volumes on multiple exchanges worldwide.

Hard Commodities

Hard commodities are natural resources that are already available after being extracted through mining or drilling. They are the building blocks of the global economy, and their supply and demand are more predictable compared to soft commodities.

The most important hard commodities are oil, gold, natural gas, and many precious and industrial metals.

Hard commodities are more vulnerable to geopolitical events, supply disruptions, and technological advancements.

For example, political tensions and conflicts in OPEC countries can result in supply disruptions that lead to increasing oil prices.

| Soft commodities | Hard commodities | |

| Attributes | Agricultural and livestock products that have to be grown and nurtured. | Raw materials that can be mined or drilled. |

| Examples | Wheat, corn, sugar, coffee, tea, cocoa, and soybeans | Oil, gold, natural gas, silver, aluminum, copper, palladium |

| Market dynamics | Influenced by factors like weather and diseases | Influenced by geopolitical events, technological advancements |

| Volatility | High | Medium |

| Investment goals | Diversification | Inflation hedge and diversification |

Most CFD brokers classify their commodity offers by four main market types, including energy, metals, agricultural, and livestock.

How Does the CFD Commodities Work?

A commodity CFD, whether it represents oil, gold, or any other commodity, is an agreement between a trader and a CFD provider that stipulates that the broker has to pay the price difference of a position if the trader accurately predicts the direction of the price. If the price moves against the trader, closing the position would require the trader to pay the difference to the broker, in which case the trader records a loss deducted from the balance.

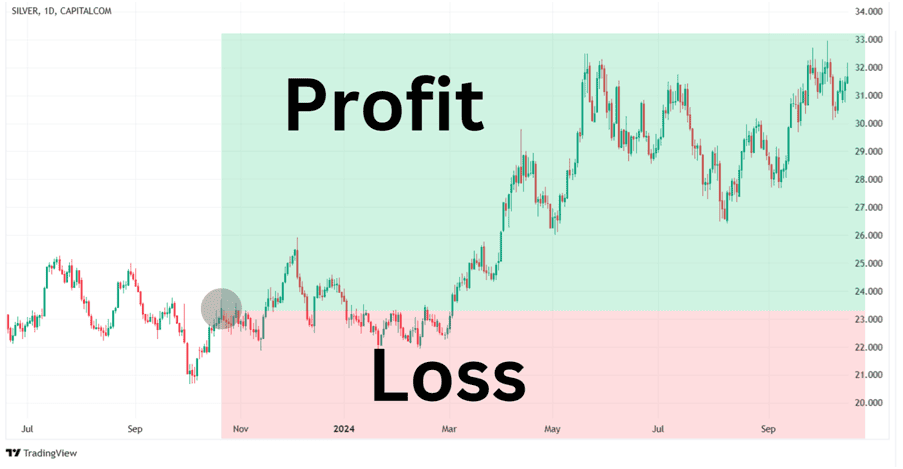

Traders can profit from both rising and falling commodity markets by buying and selling CFDs.

Purchasing a commodity CFD would generate profits if the position is closed above the purchase price. Buying is also referred to as “going long” or “opening a long position.”

Conversely, selling a commodity CFD would generate returns if the position is closed below the open price. Selling CFDs is also referred to as “going short” or “opening a short position.”

CFD brokers use standard symbols for supported commodity markets. For example, WTI and BRENT are the two main oil brands traded on regulated futures exchanges, XAU is the symbol for gold, while XAG stands for silver. Commodities are usually priced in USD for their respective units, such as barrels for oil, troy ounces for gold, or mmBtu for natural gas.

The Basics of Commodity CFDs

A commodity CFD consists of several basic elements, including:

- Ask price – represents the price at which traders can buy the CFD.

- Bid price – the price at which traders can sell the CFD.

- Spread – the difference between the bid and ask price, representing a hidden commission of the broker. The spread takes effect immediately after a position is opened.

Trading can boost potential gains by using margin, which implies borrowing funds from the broker to increase the position size. With margin trading, traders can select from different leverage ratios.

Leverage and margin trading will be discussed later in the document.

What Affects the Price of CFD Commodities?

Commodities trading is part of broader financial markets, offering traders opportunities to speculate on pricing influenced by supply, demand, and global events. Given that commodity CFDs mirror the price of the underlying commodities, their price is directly influenced by the factors impacting their respective markets.

The price of a particular commodity can be influenced by specific factors such as supply and demand changes, seasonal fluctuations, and developments in related industrial sectors.

Let’s explore some of these further.

Supply and Demand

Commodities behave like any other asset and follow the most fundamental economic rule stipulating that the price reflects the dynamics between supply and demand. The price is driven by demand and is inversely related to supply. Therefore, an increase in demand for a commodity leads to an increase in its price. On the other side, if supply expands, the price decreases due to the dilution effect.

Some commodities, such as gold, have predictable production rates, and their prices are mainly influenced by the demand side.

Elsewhere, the supply of many soft commodities varies from season to season, causing higher price volatility.

Politics Situations

National or international policies directly impact the price of commodities.

For example, governments can impose tariffs or trade restrictions on certain commodities, affecting their price in a particular region.

Some commodities can be affected by environmental regulations meant to reduce the carbon footprint. For instance, strict regulations on coal mining put pressure on its supply, leading to higher prices.

Organizations like OPEC, consisting of oil-producing countries, are one of the best examples demonstrating how policies can affect commodity prices. Representatives of OPEC countries meet a few times a year to decide oil production outputs, which directly affects the price of WTI and Brent futures.

Geopolitical Situations

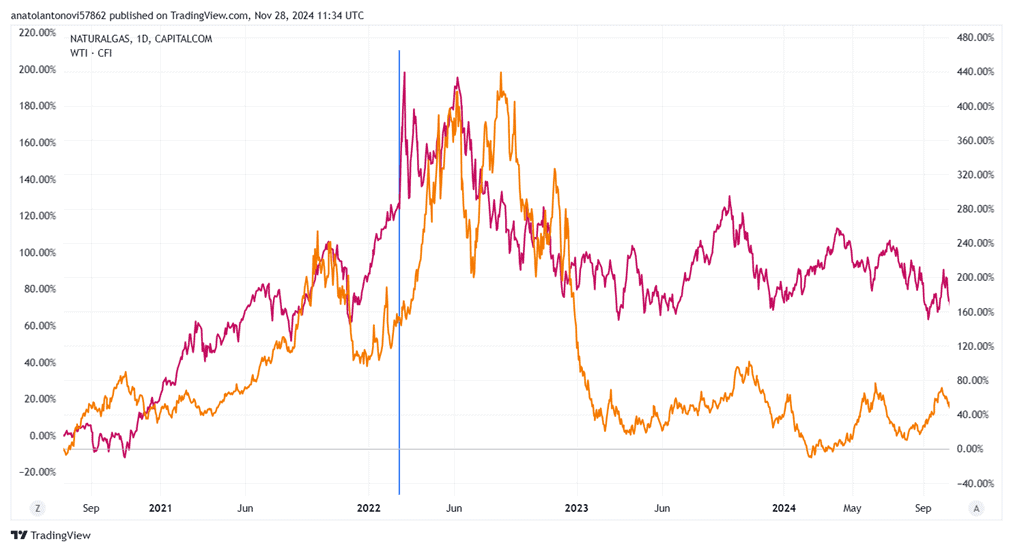

Geopolitics has always had a major impact on the price of essential commodities like oil and natural gas.

Economic sanctions, conflicts, and wars can disrupt commodity supplies, affecting prices.

For example, the start of the Russian-Ukrainian war in February 2022, followed by the West’s sanctions against Russia, sent oil and gas prices to record levels.

Also, global uncertainty and geopolitical tensions boost demand for safe-haven assets that can hedge against inflation, such as gold or other precious metals.

Macroeconomics

Macroeconomics affects commodity prices by influencing both the supply and demand dynamics of commodities.

When economies of developing countries grow fast, their industrial activity also increases, leading to higher demand for energy commodities, industrial metals, and agricultural commodities. This can push commodity prices higher in the respective regions. If developing countries are big, their demand for commodities can have a global impact on prices. Such was the case with China, whose economy has been accelerating since the 2000s, maintaining global demand for oil.

Conversely, if a major economy is weak and it has a low urbanization rate, its demand for oil and other commodities reduces, causing prices to drop.

Currency Movements

Most commodities are priced in USD, as it has the status of the world’s reserve currency, being used in international trade since the Bretton Woods agreement in 1944. This is especially true with oil as many OPEC nations sell their crude exclusively for the USD after reaching agreements with the US government.

Therefore, whenever the USD price fluctuates against major forex counterparts, so does the price of commodities.

For example, if the USD strengthens against forex major dollar pairs, more goods can be purchased per dollar than in the past. it becomes cheaper to buy commodities with it, and vice versa.

Why Trade CFD Commodities?

Here are the main reasons traders should consider commodity CFDs:

- Convenience – with CFDs, traders avoid the complexities of physical ownership. Oil, gold, and other commodities require transportation and storage. For this, investors opt for futures contracts, but they have an expiration date that requires them to settle at a predetermined price. CFDs offer a convenient and flexible way to trade commodities.

- Access to a Wide Range of Commodities – many CFD brokers support various markets, including energy (oil, natural gas), metals (gold, silver, copper), and agricultural products (wheat, soybeans).

- Leverage – CFDs allow traders to trade with a margin, meaning they can control a larger position with a smaller initial investment. This boosts potential returns, but the risks are amplified as well.

- Long and Short Trading – unlike holding physical commodities, CFDs enable traders to profit from falling markets with the same ease as going long. This flexibility is especially relevant during volatile market conditions or economic downturns.

- 24/5 Market Access – many commodity CFDs can be traded 24/5, leaving room for prompt reaction to global events in real time.

- Hedging – like futures, CFDs are ideal for hedging against risks in other investments caused by factors like inflation or supply chain disruptions.

- Lower Costs – CFD trading involves lower transaction costs compared to physical markets.

CFD Commodities Example

Let’s say you want to open a long position in oil. For this, you can trade the WTI brand, whose CFD ticker is often indicated as ‘USOIL’. The current bid/ask (sell/buy) price for oil is $70.00/$70.50 per barrel. One oil CFD typically represents 1,000 barrels of crude oil with most brokers.

You decide to use a 5:1 margin to purchase one-tenth of a CFD worth a total of $7,050. The CFD broker requires a 20% margin for this position, so you have to deposit $1,410 of your own funds to open the long position.

In this scenario, the price of oil increases to $72.00/$72.50. With leverage, this is not a small move. If you close the position at $72.00, it means that the total value of your position has increased from $7,050 to $7,200, resulting in a profit of $150. Therefore, while the oil price has increased by only about 2.14%, your personal investment has grown by 10.6% thanks to the 5:1 leverage.

However, if the WTI price dropped by 2% instead, your investment would have lost over 10%. Higher leverage has its risks and forex and commodity CFD traders can face margin calls and see their positions wiped out entirely if it is not properly managed.

Nonetheless, consider that it is not uncommon for forex CFD brokers to provide leverage ranging from 5:1 to 100:1 leverage, depending on the trader’s jurisdiction..

To manage risk, it is crucial to use tools like stop-loss orders and alerts to help open positions.

CFD Commodities Trading Strategies

Whether a beginning or experienced CFD trader, you can tackle the CFDs Commodities market in a variety of ways; from scalping, to day trading, and even swing trading. Here are how these approaches differ:

- Scalping: Traders who prefer scalping will enter trades on the 1 minute to 5 minutes time frame, with the aim to enter multiple trades per day. Typically, scalpers will trade smaller moves in the market, but rely on the CFDs’ leverage feature to magnify those small wins.

- Daytrading: Day traders will prefer entering and exiting a trade on the same day, typically on the 15 minute to 1 hour timeframes. Note that with the hourly timeframe, some trades may become swing trades as profit targets tend to be further away.

- Swing Trading: Swing traders will hold trades across days or even weeks, preferring higher time frames starting from 1-hour to above.

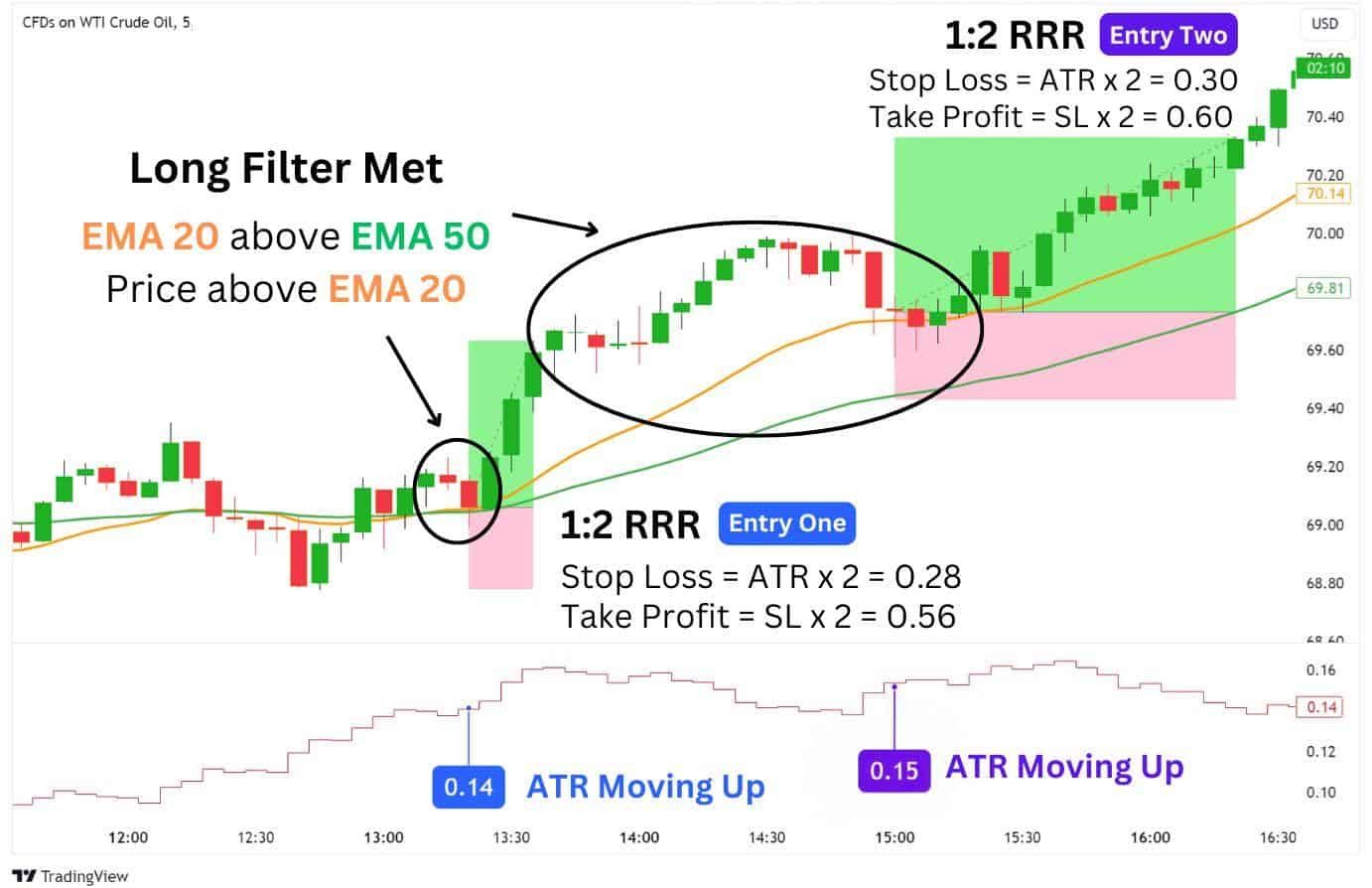

For Scalping: 20 and 50 EMA with ATR 5-Minute Strategy

Scalping typically results in smaller trade results but the goal is to obtain a greater frequency of trades throughout the day. As a result, inexpensive trade costs, like zero commissions from Alchemy Markets, make scalping a more viable strategy with our brokerage compared to others.

This strategy utilises two Exponential Moving Averages (EMAs) and the Average True Range (ATR) indicator to take advantage of smaller trending moves on the 5-minute timeframe. On average, each trade should take less than an hour to reach its target.

Here’s an example of this strategy in action:

The simple gist of this strategy boils down to four key considerations:

- LONG FILTER: Price is above the EMA 20, and EMA 20 is above EMA 50, signals an uptrend.

- SHORT FILTER: Price is below the EMA 20, and EMA 20 is below EMA 50, signals a downtrend.

- ATR MOVING HIGHER: The ATR should be moving higher, which signals growing momentum.

- RETEST OF EMA 20: Enter a trade when the price touches and bounces off the EMA 20.

We will look to essentially trade the EMA 20 as a dynamic support or resistance, as long as the long filter or short filter conditions are met. The candle body should not overlap with the EMA 20 to be valid entry.

The ATR should also be moving up, to help us confirm the strength of the trend. Additionally, we will be using the ATR to set a realistic stop loss and take profit area to improve this strategy’s consistency.

| How it works: 1. Look for a long filter or short filter condition to be met. 2. Watch for a retest of the EMA 20, where price rejects and closes above or below the EMA. 3. The ATR value should be higher than its previous value, or in an uptrend. 4. Enter a trade with 1:2 risk-to-reward, with stop loss equal to the ATR value times two. For better trade confirmations, consider looking for the doji, hammer, or engulfing candlestick patterns at the retest of the EMA 20. |

Avoid making these mistakes when trading this strategy:

- Not confirming the filter condition

- Not confirming the ATR’s direction (should be moving higher)

- Not confirming a candle close above or below the EMA 20

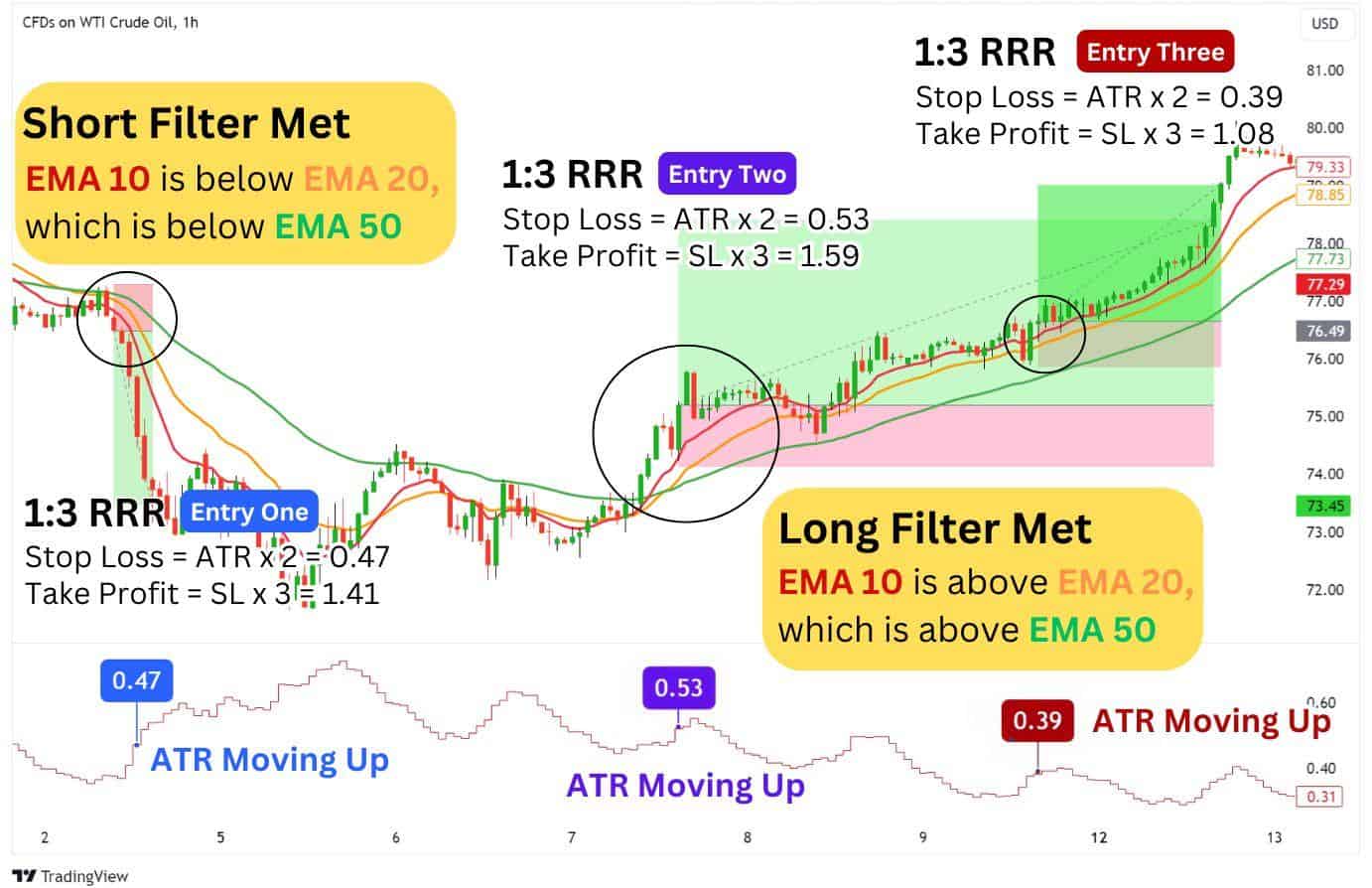

For Day Trading and Swing Trading: Triple EMA with ATR 1-Hour Strategy

For traders who find scalp trading too demanding, day trading or swing trading may be better alternatives. These approaches generate fewer trade signals but require less constant monitoring, and generally have larger swings per trade.

This strategy is similar to our scalping approach but adds a 10 EMA into the equation. This will serve as an additional trend filter, and also act as our key dynamic support or resistance to watch for an entry.

Quick note: Although the timeframe has increased to 1-hour, some trades may take two or three days to complete, making this strategy suitable for both swing trading and day trading.

Here’s an example of this strategy in action:

The gist of this strategy boils down to four key considerations:

- LONG FILTER: Price is above EMA 10. EMA 10 is above EMA 20, and EMA 20 is above EMA 50.

- SHORT FILTER: Price is below EMA 10. EMA 10 is below EMA 20, and EMA 20 is below EMA 50.

- ATR MOVING HIGHER: The ATR should be moving higher, which signals growing momentum.

- RETEST OF EMA 10: Enter a trade when the price touches and bounces off the EMA 10.

Similar to the scalping strategy, we will be looking to trade a powerful trending move. The difference here is that we will be using the EMA 10 as our basis for taking a long or short position, once a rejection from this EMA occurs with a filter condition met.

The ATR should be moving higher, which can be better observed if you change your ATR settings to a step line view. Next, we will be using a 1:3 risk-to-reward ratio (instead of the scalping strategy’s 1:2 RRR) as theoretically, trending moves on higher time frames will result in larger swings.

| How it works: 1. Look for a long filter or short filter condition to be met. 2. Watch for a retest of the EMA 20, where price rejects and closes above or below the EMA. 3. The ATR value should be higher than its previous value, or in an uptrend. 4. Enter a trade with 1:3 risk-to-reward, with stop loss equal to the ATR value times two. For better trade confirmations, consider looking for the doji, hammer, or engulfing candlestick patterns at the retest of the EMA 20. |

Avoid making these mistakes when trading this strategy:

- Not confirming the filter condition

- Not confirming the ATR’s direction (should be moving higher)

- Not confirming a candle close above or below the EMA 10

Truth be told, there are many ways to trade commodity products. These are just two strategies for trading CFD Commodities to help you get started.

It’s recommended to test them through paper trading first to ensure they suit your trading style, schedule, and preferred timeframes.

Advantages of CFD Commodities

- Short selling – unlike buying gold or physical commodities or related exchange-traded funds (ETFs), CFDs allow traders to profit during bearish markets.

- Margin trading – traders are able to use leverage to multiply potential profits. With leverage, they can open large positions with a fraction of personal deposits. The maximum leverage for commodity CFDs ranges from 5:1 to 100:1, depending on the broker. Alchemy Markets offers commodity CFDs with up to 5:1 leverage.

- No physical ownership – there’s no need to store or handle physical commodities, which avoids logistical and storage costs.

- Regulated environment – reputable CFD brokers, such as Alchemy, are licensed and authorized to operate in multiple jurisdictions.

- Advanced terminals & tools – Alchemy offers advanced trading terminals, trading tools, and educational materials to enhance the trading experience.

- Diverse Markets – CFDs provide access to a broad range of commodities, including oil, gold, silver, agricultural products, and more, all from a single platform. Moreover, CFD brokers usually support multiple asset classes, including forex, stocks, indices, and cryptocurrencies, helping commodity traders diversify their exposure.

Disadvantages of CFD Commodities

- Margin trading risks – leverage multiplies both profits and losses, carrying a higher risk of losses if the CFD price moves against the position.

- CFDs are illegal in some jurisdictions – CFD trading is banned in several countries, including the US, due to regulatory restrictions.

- Overnight costs – holding CFD positions overnight often may incur additional costs, which can affect profits over time.

What Are the Risks of CFD Trading

Trading and speculating in the financial markets, regardless of the product vehicle, is inherently risky as traders navigate market volatility and gapping risk. However, there are a few risks that are unique to trading CFDs. While beginning CFD traders are excited about the flexibility and accessibility, CFD trading also carries unique risks. Let’s look at the top three.

Counterparty Risk – Since CFDs are not traded on centralized exchanges, traders rely on the broker to honor trades. That trading platform could experience financial struggles placing your account funds and trades at risk. A broker’s financial stability and regulatory status are important factors. This is why it is smart to trade with regulated brokers like Alchemy Markets.

Overnight Fees & Costs – Holding CFD positions overnight incurs financing costs, which can accumulate over time impacting profitability.

Leverage Risk – CFDs allow traders to use leverage, where they control a large position with a small deposit. While this can amplify gains, it also increases potential losses. More on this in the next section.

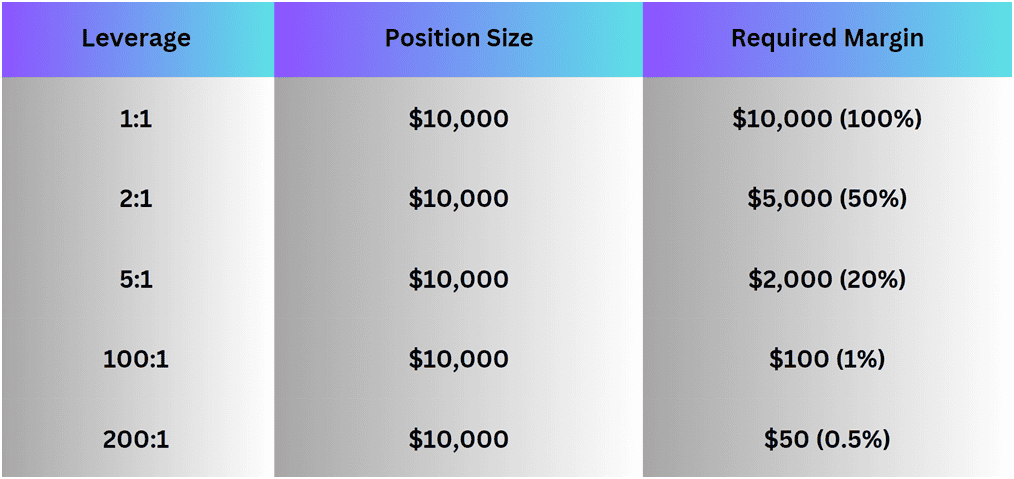

Leverage in Commodity CFDs

As mentioned earlier, commodity CFD traders can use leverage to magnify potential gains. It represents a ratio showing how much margin (personal deposit) traders need to be able to open a position. With leverage, traders can invest only a fraction of personal deposits to initiate a larger trade. Technically, traders use borrowed funds from the broker.

For example, a position with 10:1 leverage requires a 10% margin. In this case, the trader must deposit $100 to open a $1,000 position.

The table below shows margin requirements corresponding to the main leverage scenarios:

Note that the leverage works against traders if the market moves against their position, augmenting pending losses. To avoid losses, traders have to either add more funds to maintain the margin requirement or close their position with a loss.

To avoid significant losses, it’s recommended to implement risk management tools like stop and limit orders.

Commodities CFDs vs Futures Contracts

Commodity CFDs and futures are two types of derivatives that allow traders to gain exposure to underlying assets.

Futures markets facilitate one of the earliest forms of commodity derivatives trading. In the past, they were the only financial instrument enabling traders to get exposure to certain commodities, as physical ownership is not convenient and doesn’t allow short selling, nor an easy ability to buy and sell to multiple market participants

With the rapid development of the Internet and online trading instruments offered by CFD brokers, more and more traders prefer commodity CFDs due to their flexibility.

The main difference between trading CFDs and futures contracts is that CFDs have no expiration while the latter have a fixed expiration date during which traders are required to settle at the predetermined price.

Despite being settled differently, both CFDs and futures contracts allow short-selling, making them great hedging instruments.

In the US, futures trading is mostly facilitated by specialized platforms or brokers connected to futures exchanges, including the Chicago Board Options Exchange (CBOE), CME Group, and the Intercontinental Exchange (ICE), among others. Futures are highly regulated markets in most jurisdictions. In the US, futures trading is regulated by the Commodity Futures Trading Commission (CFTC). Elsewhere, CFDs are over-the-counter products offered by independent brokers.

How to Trade Commodities

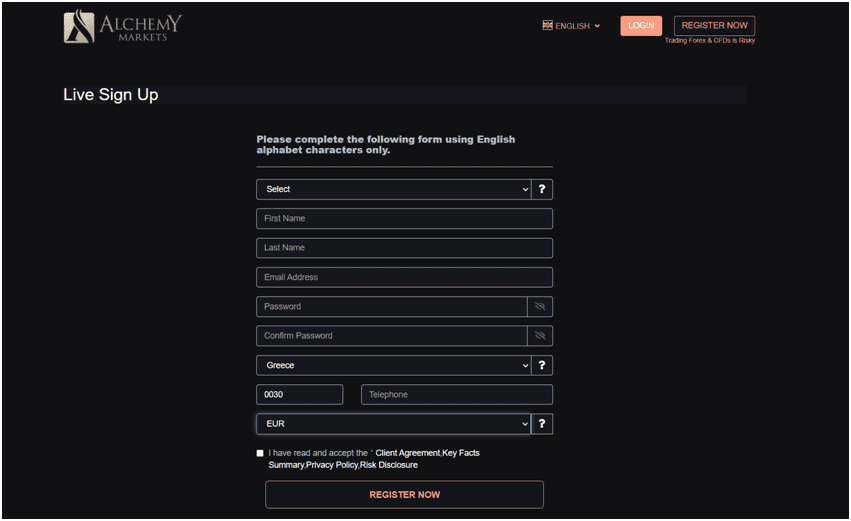

You can start trading commodity CFDs with Alchemy Markets, a regulated CFD broker that supports a wide range of asset classes. Here are the main steps to follow:

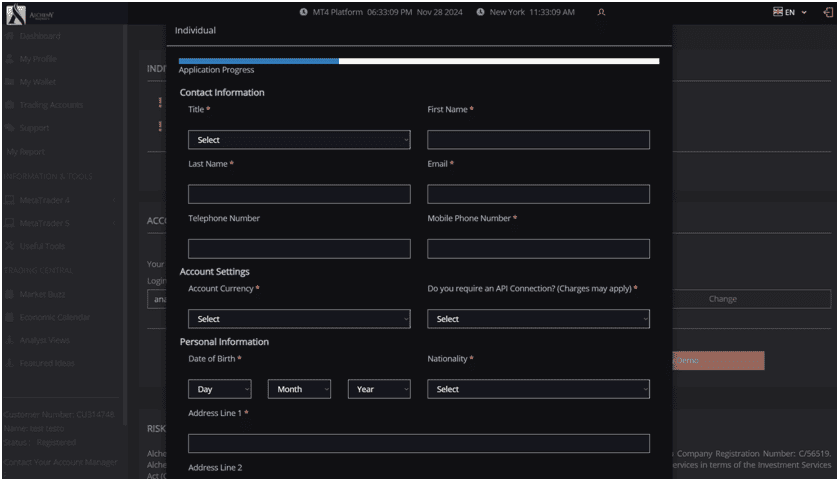

Step 1: Open an account

Start by signing up with Alchemy. You’ll have to share basic personal and contact information.

Here, you can also select the preferred currency from the USD, EUR, and GBP.

Next, after verifying your email, you can open an individual account. For this, you will have to answer a few questions related to your trading goals, income, residence, etc. As a regulated broker, Alchemy will ask you to pass through a KYC procedure by sharing an ID document and taking a picture of yourself.

Step 2: Fund the account

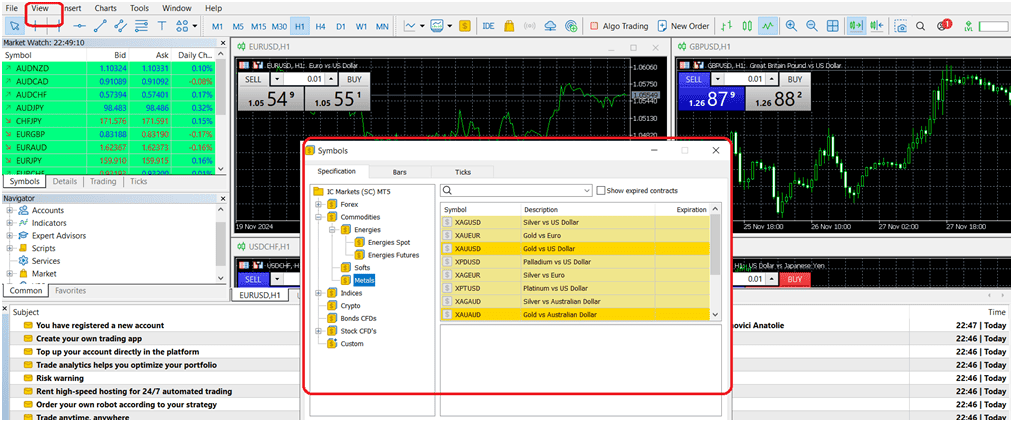

When you’re done with the KYC, you can fund your account via wire transfer or credit/debit card. Next, you can download one of the trading terminals that you prefer, selecting from MT4 and MT5. Install the app on your desktop.

Step 3: Select the commodity you are interested in trading

On the trading terminal, click on ‘view’ then ‘symbols’ and add the commodities that you prefer.

If you already know the symbols, you can add them on the left window.

Step 4: Determine risk tolerance based on your account size

After selecting the commodity, prepare yourself to open the position. Make sure to analyze the market and determine your risk tolerance.

Step 5: Execute the trade according to your strategy

When you’re ready with the leverage, lot size, and trading strategy, you can open the position by clicking SELL or BUY, depending on your expectations. The trading terminals offer several order types to customize your trading experience.

FAQ

What are the best times to trade CFD commodities?

The best times to trade commodity CFDs are during high volatility and market liquidity. This usually may happen when the London and New York market sessions overlap. This applies to commodity trading hours during the weekdays.

What are the fees in CFD Commodities trading?

Trading fees may include:

- Spreads: The difference between the bid and ask price.

- Commissions: Broker fees per trade.

- Market Data Fees: Charges for real-time market access.

- Holding Charges: Overnight fees for positions that are left open overnight.

How much capital do you need to trade CFD commodities?

Capital requirements depend on the broker’s minimum deposit requirement and margin rates. Leverage allows smaller personal investments to control larger positions, but traders must meet both initial and maintenance margins. Beginners can start with a $100 deposit with 5:1 leverage to test their skills.

What is the size of a CFD commodities contract?

Contract sizes vary by broker and commodity. For example, one gold CFD may represent 100 troy ounces and one oil CFD may represent 1,000 barrels. Always check the broker’s specifications.