- May 9, 2024

- 7min read

Understanding Commodity Trading: A Comprehensive Guide for Traders

Meta: Commodities form an essential part of the economy and in our everyday lives. Learn the basics and strategies for commodity trading.

In the vast expanse of financial markets, commodities hold a special place. These raw materials, which range from agricultural products to energy resources, are not only essential for daily life but also offer unique opportunities for traders. Understanding the commodities market can be a rewarding endeavor, providing insights into the global economy and offering avenues for diversification and profit.

This article aims to equip traders with the knowledge and strategies necessary to navigate the commodities market effectively.

The Pivotal Role of Commodities in the Global Economy

Commodities are the building blocks of the global economy, touching every aspect of our lives. From the food we eat to the energy that powers our world, commodities are omnipresent.

This inherent importance makes the commodities market a vibrant arena for trading, influenced by a myriad of factors including the health of the global economy, geopolitical events, and macroeconomic trends.

Under normal conditions, economic growth stimulates demand for energy and metals, while agricultural commodities are influenced by both consumption patterns and the unpredictability of weather conditions.

Observing fluctuations in commodity prices, such as those at the gas pump, provides tangible evidence of market dynamics at work, reflecting the interplay of supply and demand on a global scale.

For example, at the onset of the Coronavirus pandemic, global travel restrictions and lockdowns to prevent the spread of the virus halted demand for oil, causing oil futures to fall into negative territory for the first time in history.

This meant that oil suppliers who were meant to take physical delivery of oil when the futures contract expired were now forced to pay for storage as the demand for oil remained stagnant.

Source: TradingView

In response to the demand shock, members of the Organization of the Petroleum Exporting Countries and its allies (OPEC +) who make up a large portion of global oil production cut output, reducing the supply of the liquid commodity in an effort to drive prices higher.

CTA: Discover the role of OPEC in commodity markets

Commodities as a Economic Indicator

When travel restrictions were lifted and demand for oil surged, supply shortages and bottlenecks occurred which were further exacerbated when Russia invaded Ukraine in February 2022.

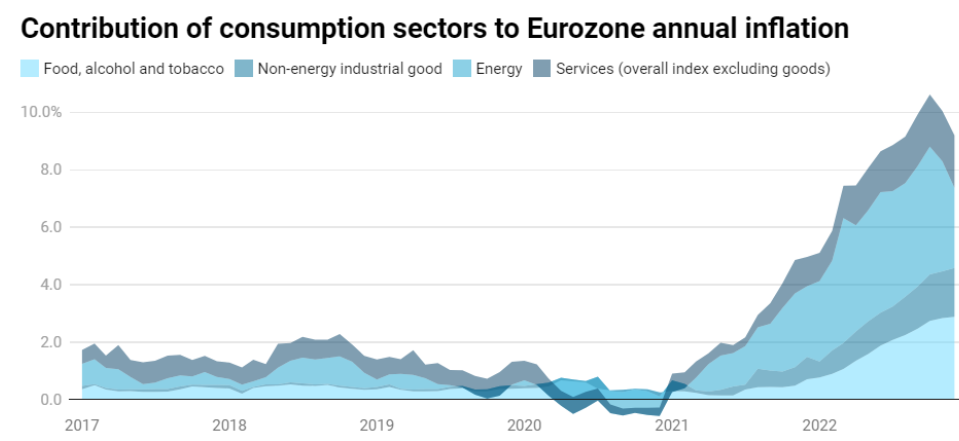

With sanctions against Russian energy products placing additional pressure on oil and gas supplies, prices continued to rise, driving inflation (the rate at which prices rise) to unprecedented levels.

However, even as prices rise, the necessity of these goods means they continue to be consumed, albeit at potentially reduced quantities. This reliance illustrates the inelastic nature of demand for many commodities.

The relationship between the inflation rate (y-axis) and commodity prices in the Eurozone

Source: The World Economic Forum

For traders, the commodities market offers a window into the global economic landscape. Price fluctuations at the gas pump or in the grocery store are daily reminders of the volatility and opportunity within the commodities market.

Consequently, the commodities market is a barometer of global economic health, reacting sensitively to changes in economic indicators, policy decisions, and societal trends.

This deep-rooted connection underscores not just the importance of commodities in the world economy but also highlights why engaging in their trading can be a strategic and insightful endeavor.

CTA: Explore the wide range of commodities available on the Alchemy platform

Exploring the Types of Commodities

The commodities market is diverse, encompassing various goods that can be broadly categorized into three groups, each with its unique market dynamics:

- Soft Commodities: Include agricultural products like coffee, sugar, wheat, and cocoa. These commodities are renewable yet subject to high volatility due to factors like weather conditions and seasonal cycles, making their market particularly susceptible to changes in supply and demand.

- Metals: This group comprises precious metals such as gold and silver, often seen as safe-haven investments during times of economic uncertainty, and base metals like copper and aluminum, which are essential for various industries, including construction and manufacturing.

- Energy: Oil, natural gas, and coal are crucial for powering economies and everyday life. The energy commodities market is particularly volatile, with prices influenced by geopolitical tensions, changes in demand, and technological advancements, reflecting the complex interplay between global events and energy needs.

How to Trade Commodities

To effectively navigate the commodity trading landscape, understanding the different instruments and methods available is crucial. These include:

- Spot Contracts: Immediate agreements to buy or sell a commodity at the current market price, catering to those needing quick delivery.

- Futures Contracts: Standardized agreements for buying or selling commodities at a predetermined price on a future date, used for hedging against price fluctuations or speculative purposes.

- Commodity Stocks & ETFs: Offer exposure to commodity prices through investments in companies related to commodities or funds that track the prices of commodities or commodity indexes.

- Commodity CFDs: Financial derivatives that allow for speculation on commodity price movements without the need for owning the underlying assets, providing flexibility and leverage opportunities.

Each trading mechanism has its unique features, benefits, and risks, serving different needs and strategies of market participants.

Trading Commodities with CFDs

Contracts for Difference (CFDs) represent a significant advancement in commodity trading. They offer traders and investors a versatile tool for capitalizing on price movements, irrespective of market direction. The key advantages include:

- Leverage: Allows traders to control a larger position with a smaller amount of capital, potentially amplifying profits but also increasing the risk of losses.

- Going Long or Short: Traders can speculate on both rising and falling markets meaning that traders could “go long” or buy with expectations that the price of the commodity will rise or to “go short” or sell the commodity CFD expecting prices to fall.

- Hedging: CFDs can be used to hedge (protect a position by taking the opposite side) against potential losses in physical commodity positions or other investments, offering a strategic tool for risk management. For example, a small business owner who is required to transport goods on a regular basis may buy an oil CFD contract to hedge against the potential of higher fuel costs. If the price of fuel increased, the “long” position in oil would then rise simultaneously, helping reduce the financial burden of the higher transportation costs.

However, the use of leverage and the nature of CFD trading also introduce significant risks, emphasizing the need for careful strategy and risk management.

Strategies for Trading Commodities

Successful commodity trading combines analytical prowess, market knowledge, and strategic planning. Essential strategies include:

- Fundamental Analysis: This involves examining supply and demand factors, including weather events, geopolitical tensions, and economic indicators, to predict how they might influence commodity prices.

- Technical Analysis: Traders analyze price charts and historical data to identify patterns and trends that may suggest future price movements, employing tools like moving averages and momentum indicators to guide trading decisions.

- Diversification: By spreading investments across different commodities or asset classes, traders can reduce risk. Commodities often behave differently from stocks and bonds, providing a hedge against market volatility.

- Risk Management: Essential for managing the inherent volatility of commodity markets. Techniques include setting stop-loss orders to limit potential losses and only investing capital that one can afford to lose, thus protecting against market downturns.

Conclusion

Commodity trading offers a fascinating arena for those willing to dive into its complexities, providing a direct link to the global economy’s heartbeat. Understanding the market’s nuances, from the impact of agricultural and energy commodities on our daily lives to the strategic depths of futures trading, demands a comprehensive grasp of market forces and disciplined risk management. Whether through direct investment in physical commodities or speculative ventures in derivatives markets, traders contribute to the liquidity and stability of these essential markets, navigating a world where insight, strategy, and caution pave the way to potential rewards.

Embarking on this journey requires not only knowledge and strategy but also a deep understanding of the interconnectedness of global markets and economies. Aspiring traders should approach commodity trading with curiosity, diligence, and a readiness to continuously learn and adapt. In doing so, they unlock the door to a dynamic world of trading, offering both challenges and opportunities in equal measure.

By arming yourself with knowledge, strategy, and an understanding of the complexities of the commodities market, you can navigate this exciting trading landscape with confidence.