- Chart of the Day

- October 6, 2025

- 2 min read

Bitcoin Surges to New All-Time Highs of $125K Over Weekend

The king of cryptocurrency surged to new all-time highs of $125,750 on Sunday; shocking the markets and sparking the question — “Is it finally time to buy?” — in the minds of many.

Well, Bitcoin is certainly still bullish, but there are a few signs traders should be cautious of.

Here’s the Quick Rundown:

- Bitcoin wicked into new highs, but technically closes under its previous ATH’s closing price

- Possibility of a frontrun of technical target at Fib Extension 1.618

- Asset is above daily EMA 50, which has acted as a reliable trend filter

- We’re getting close to a bearish stochastic RSI divergence & crossover signal

The key verdict here? Wait for a retrace. The daily EMA 50 has shown to be a reliable support/resistance, and currently sits at $115,233.11

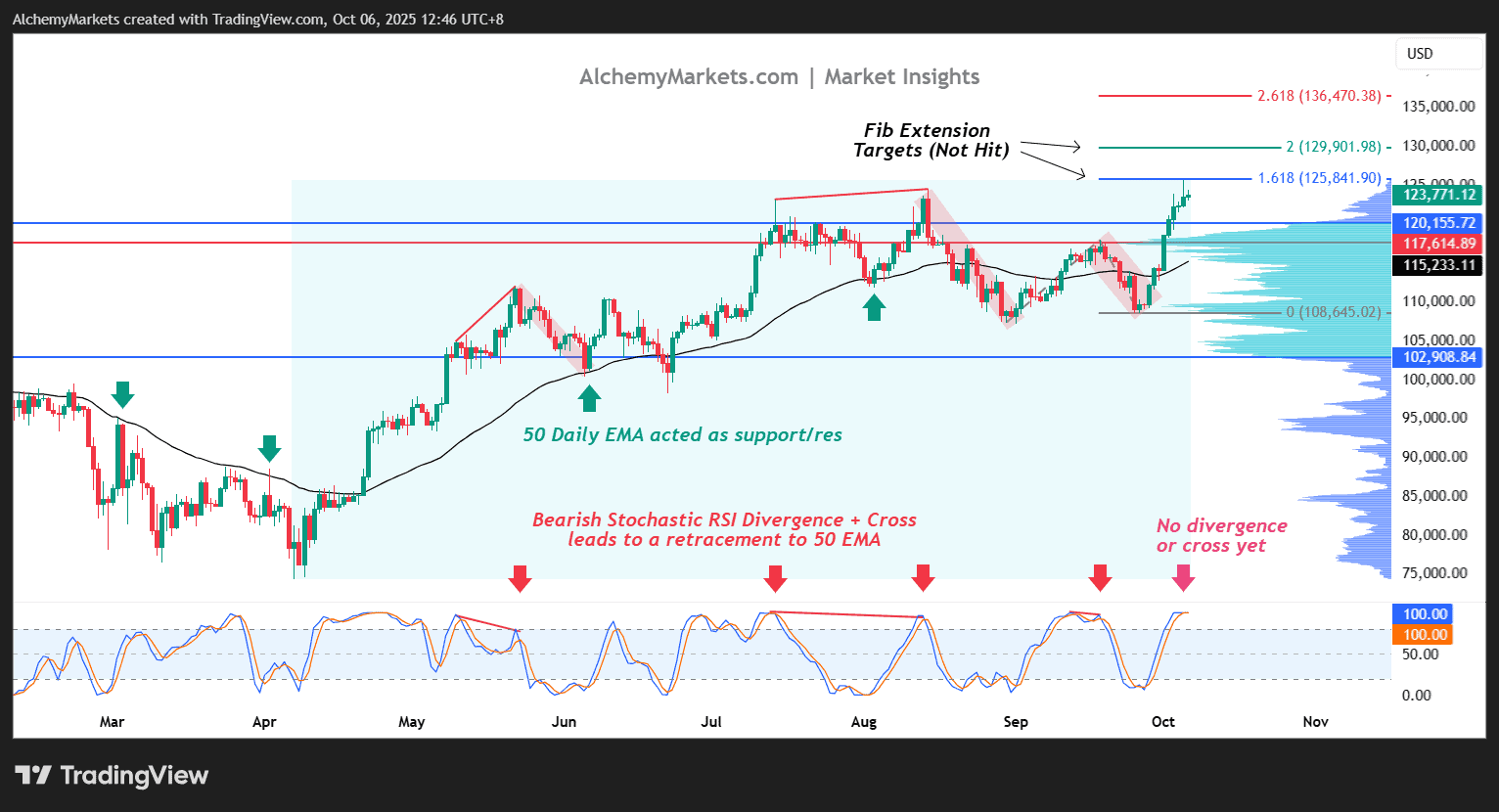

Technical Picture of Bitcoin — Continuation or Reversal

Bitcoin is currently bullish, trending above the daily 50 EMA. However, it is dangerously close to a critical Fib Extension of 1.618, which brings up the possibility of a frontrun.

It’s common for cryptos to frontrun or overshoot levels. Therefore, traders should keep an open mind to a retracement from here, or a climb higher to Fib extension 2 at $129,901.98.

Momentum is also supporting the idea of a nearing retracement. Every time this year, whenever the Stoch RSI has shown a bearish divergence and crossover, Bitcoin’s price has corrected roughly 8–15%.

Although the recent rally has not yet produced such signs, it is currently overbought, which could create the same setup in the near term.

Possible retrace zones:

- $120,155 (VAH)

- $117,614 (POC)

- $115,733 (50 EMA)

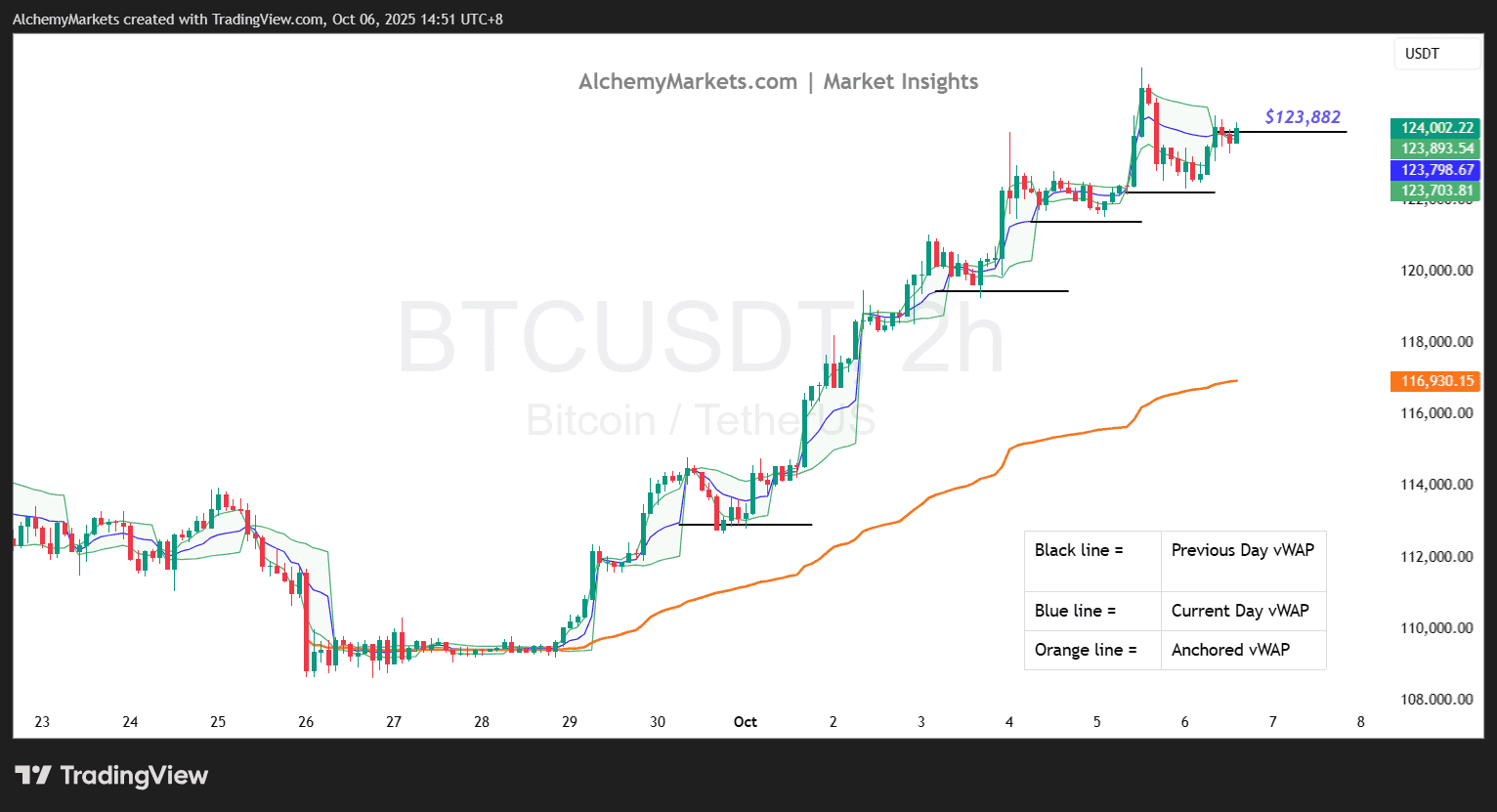

Trading Setup: The Previous Day VWAP Playbook

Since early October, the Previous-Day VWAP strategy has been highly reliable.

Notice how the black line (previous day VWAP close) has repeatedly served as support during pullbacks, guiding continuation entries within the trend.

Now, Bitcoin is consolidating below pdVWAP, creating two clear plays:

- Break higher = retrace to pdVWAP for a bounce

- Break lower = retrace to pdVWAP for a rejection

An anchored VWAP from 26 September (the start of this $110K–$125K rally) marks major support at $116,930 — a level to watch if pdVWAP bias flips bearish in the short term.

Outlook & Sentiment

Trend: Bullish

Momentum: Overextended

Plan: Wait for a reset before re-engaging long bias.

Bitcoin remains structurally bullish but overheated. A controlled retrace into VWAP or EMA support zones could provide cleaner entries for traders looking to ride the next wave higher.