- Weekly Outlook

- December 19, 2025

- 4 min read

Markets Eye GDP Report as Fed’s Rate Cuts Face Renewed Scrutiny — SPX Holds Steady Within Uptrend Channel

Macro Overview: Growth, Policy, and Market Sentiment

The upcoming third-quarter GDP report, delayed due to October’s U.S. government shutdown, is unlikely to shake markets significantly — but it could reignite debate about the Federal Reserve’s policy direction. A second straight quarter of 3%+ GDP growth would raise eyebrows, especially considering the Fed’s three rate cuts this year amid persistent inflation and record-high equities.

With inflation still running around 3%, above the Fed’s 2% target, and unemployment remaining historically low, questions persist: Why did the Fed feel compelled to ease policy?

The answer, according to Fed officials, lies in risk management. Despite solid economic data, policymakers maintain that monetary conditions remain “slightly restrictive.” By lowering the Fed Funds rate closer to 3%, they aim to buffer the economy against potential downside risks — especially given uncertainties around trade, global demand, and domestic fiscal strains.

GDP Breakdown: What to Watch

When the GDP data is finally released, attention will focus on two key components:

- Tech Investment:

The technology sector continues to be the primary engine of U.S. growth. Corporate spending on AI infrastructure, cloud computing, and semiconductor manufacturing has surged, providing strong tailwinds to capital investment. - Consumer Spending:

Household consumption, though robust, has become increasingly bifurcated. High-income households are sustaining spending momentum, while middle- and lower-income consumers are beginning to feel the pinch from higher costs and tighter credit conditions.

Looking ahead, fourth-quarter growth is expected to moderate sharply toward 1%, largely due to lingering disruption from the government shutdown and slower consumer activity heading into the winter months. Nonetheless, the overall picture remains one of resilient but cooling momentum.

Federal Reserve: Between Confidence and Caution

The Fed’s narrative — that rate cuts are a precautionary measure, not a stimulus response — is under renewed scrutiny. With GDP running above trend and financial conditions easing, critics argue that policy risks tilting too dovish. Yet, the Fed insists that its actions are aimed at sustaining long-term stability, not fueling excesses.

Fed Chair Jerome Powell has reiterated that while inflation is moderating slower than desired, the overall trend remains favorable. Market participants now anticipate that policy will remain steady through early 2026 unless growth slows more dramatically than expected.

Market Reaction: Calm but Focused

Equity markets remain buoyant, with major indices near record highs. Investors are digesting a landscape where economic resilience coexists with cautious monetary easing — a combination that continues to support risk appetite.

However, volatility could rise around the GDP release as traders reassess the Fed’s policy path heading into 2026. Should the report confirm another 3%+ growth print, it may prompt speculation that the central bank could pause or even reverse its easing cycle sooner than expected.

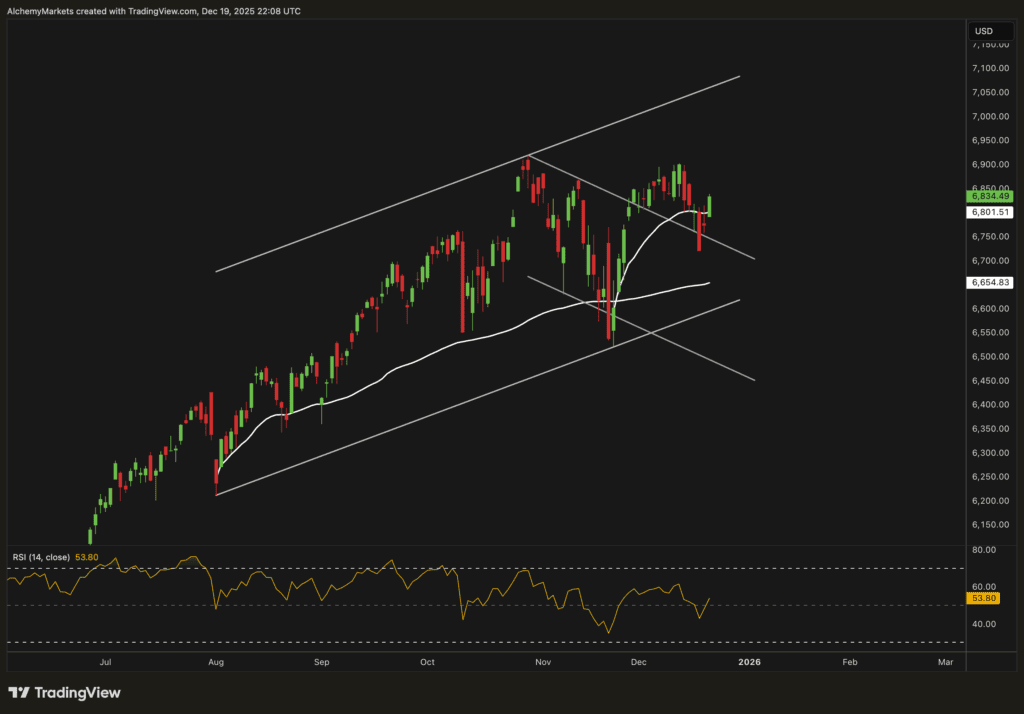

Technical Analysis: S&P 500 (SPX)

The S&P 500 remains firmly within its ascending channel, suggesting that the broader uptrend remains intact. The chart indicates that the index is currently consolidating near mid-channel but is showing signs of regaining upward momentum.

- Trend Structure:

Price action continues to respect the rising parallel channel (white lines). As long as the SPX trades above its anchored VWAP support lines (in white), the prevailing bullish structure remains valid. - Anchored VWAP:

The short-term Anchored VWAP (in white) continues to act as dynamic support, reinforcing the bias for a gradual climb toward the upper bound of the channel near the 7,000–7,100 area. - Momentum:

The RSI (14) currently sits around 53.8, signalling neutral momentum with potential for further upside before approaching overbought conditions. A push above 60 on RSI could confirm renewed bullish strength. - Support Levels:

- Primary Support: 6,650–6,700 (anchored VWAP zone)

- Secondary Support: 6,550

- Resistance Levels:

- Near-Term Resistance: 6,900

- Channel Top: ~7,100

As long as SPX remains above the anchored VWAP supports, the path of least resistance remains upward. Short-term pullbacks within the channel should be viewed as potential buying opportunities rather than trend reversals.

Outlook Summary

| Factor | Current View | Implication |

|---|---|---|

| GDP Growth | Strong Q3, slower Q4 | Mixed macro sentiment |

| Inflation | 3% (above target) | Fed remains cautious |

| Fed Policy | Risk management cuts | Policy steady into 2026 |

| Equities | At record highs | Momentum intact |

| SPX Technicals | Above VWAP, inside channel | Bullish bias preserved |

Conclusion

The coming week’s GDP release will be a test of credibility for the Fed’s dovish stance. A strong print may not move markets dramatically but will sharpen focus on whether the central bank’s risk management narrative still holds water. Meanwhile, the S&P 500’s steady technical posture reinforces confidence that the market remains in a healthy, if gradual, uptrend heading into year-end.