- Weekly Outlook

- January 30, 2026

- 5 min read

From Fed Fears to NFP: A Weekly Gold & Silver Outlook with the Gold–Silver Ratio in Focus

Why gold and silver dropped

The precious metals complex enters the new week bruised but not broken. Gold and silver have both suffered sharp pullbacks after a powerful multi-month run, catching many participants off guard. What makes this moment particularly important is that fundamentals, macro events, and technicals are all converging at once.

This article brings those strands together into a weekly outlook calendar, framed as a short, easy-to-follow market story. We begin with the fundamentals behind the recent selloff, move through the key economic events that could define the week ahead, and finish with a technical deep dive into the gold-to-silver ratio, which is now testing a critical level.

Why gold and silver dropped

The recent drop in gold and silver was not driven by one single factor, but by a cluster of shifts in narrative and positioning.

First, markets reacted to renewed uncertainty around the future direction of U.S. monetary policy. Speculation surrounding the next Federal Reserve Chair reintroduced the idea that policy could remain tighter—or at least less predictable—than markets had grown comfortable with. Gold and silver, which thrive when real rates are falling and policy is clearly easing, tend to struggle when that clarity disappears.

Second, the U.S. dollar strengthened. Because gold and silver are priced in dollars, a stronger dollar acts like gravity: it makes metals more expensive for global buyers and often triggers short-term selling. Even modest dollar strength can have an outsized impact when positioning is crowded.

Third, this move was amplified by profit-taking. Both gold and especially silver had rallied aggressively. Silver, in particular, had shown signs of speculative excess. When markets get stretched, they don’t need bad news—just “less good” news—to spark sharp corrections.

Finally, silver assumed its usual role as the volatile cousin. Silver is both a precious metal and an industrial input, which makes it more sensitive to shifts in growth expectations and risk appetite. When confidence wobbles, silver often falls faster than gold.

In simple terms: this was not a collapse in the long-term metals story, but a reset driven by dollar strength, policy uncertainty, and crowded positioning—with silver exaggerating the move.

Weekly outlook calendar: events that matter

Monday – United States: ISM surveys

The week opens with the ISM reports, offering an early read on growth momentum.

- Why it matters: Strong ISM data can lift yields and the dollar, pressuring gold and silver. Weak data does the opposite by reinforcing rate-cut expectations.

- Market focus: Does weakness confirm a slowing economy, or does resilience keep pressure on metals?

Midweek – Eurozone: inflation and the ECB

Wednesday: Eurozone inflation

Inflation has remained anchored near the ECB’s 2% target, with core inflation easing steadily. A modest uptick due to energy prices would not be shocking.

Thursday: ECB rate decision

No policy change is expected, but the tone will matter—especially with the euro having strengthened recently.

- Why it matters: Stable inflation supports the case for steady policy, but any renewed discussion of rate cuts can influence global yields and currencies.

- Impact on metals: Indirect but important—via euro–dollar dynamics and global risk sentiment.

Thursday – United Kingdom: Bank of England

The Bank of England is expected to hold rates, likely with a 7–2 vote split.

- Key risk: Any hint from Governor Bailey that a March cut is becoming more likely.

- Why it matters: Softer UK policy expectations can contribute to a broader “easier policy ahead” narrative, which is generally supportive for gold.

Friday – The main event: U.S. Non-Farm Payrolls

This is the defining moment of the week.

Despite the Fed’s more optimistic tone on employment, the labour market remains fragile beneath the surface. Hiring outside of government and a few service sectors has been weak, and markets remain unconvinced that the jobs picture is truly robust.

- Soft NFP: Reinforces rate-cut expectations → weaker dollar → supportive for gold and silver.

- Strong NFP: Pushes yields and the dollar higher → renewed pressure on metals, particularly silver.

Friday – Canada: unemployment rate

Canadian data is secondary but still relevant for broader risk sentiment and commodity-linked currencies.

- Base case: Stable employment and steady policy expectations.

- Impact: Modest, but contributes to the overall macro tone.

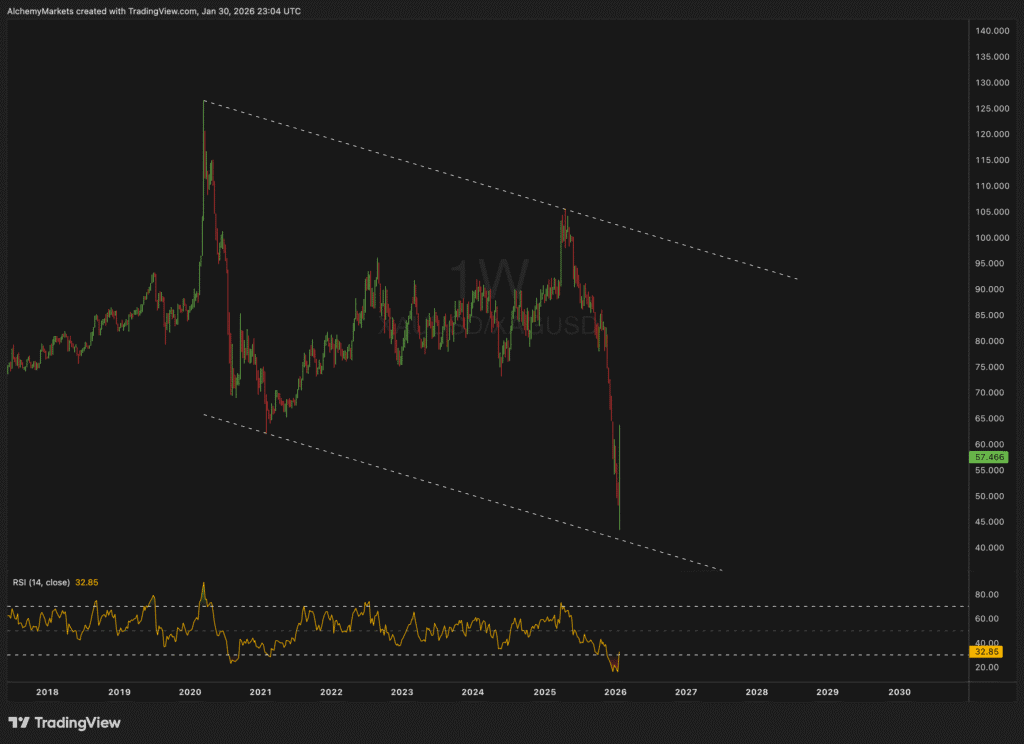

Technicals in focus: the gold-to-silver ratio‘

The gold-to-silver ratio offers a powerful lens through which to view the current environment.

What the chart is telling us

- The ratio has been trading inside a descending channel for an extended period.

- Recently, it has fallen sharply toward the lower boundary of that channel.

- Momentum indicators, such as RSI, are now near oversold territory, suggesting downside momentum may be tiring.

This is exactly the type of area where markets often pause—and sometimes reverse.

Why a bounce here matters

If the ratio holds the lower bound and begins to rise, it would suggest:

- Gold is regaining relative strength versus silver, or

- Silver’s recent excesses are unwinding faster than gold’s.

In practical terms, this would signal a shift back toward defensive leadership, with gold once again outperforming.

The alternative scenario

If the ratio breaks cleanly below the channel:

- Silver continues to outperform gold,

- Risk appetite remains strong, and

- The recent selloff in metals could extend further before stabilising.

This makes the current level a clear decision point.

Bringing it all together

This week is about confirmation.

- Fundamentals tell us the selloff was driven by narrative shifts, not structural damage.

- The economic calendar—especially U.S. data—will decide whether rate-cut expectations survive.

- Technicals, via the gold-to-silver ratio, show the market sitting at a level where leadership could change.

If macro data disappoints and the dollar softens, the conditions are in place for a ratio bounce and renewed gold leadership. If data surprises to the upside, metals may remain under pressure—but even then, the ratio will tell us whether silver’s dominance is fading.

In short: the metals market isn’t just reacting anymore—it’s choosing a direction.