- Weekly Outlook

- September 19, 2025

- 4 min read

Fed Speech Outlook: What Powell Means for Markets, SPX Channel Risks, and NVDA’s Breakout Potential

Why Powell’s Tone Matters

The market’s takeaway from last week’s 25bp rate cut was straightforward: the easing cycle has begun, and futures are leaning toward two more cuts into year-end, with October looking like the next step. But Chair Powell was careful not to pre-commit. His language kept the balance:

- Inflation: “Not dead yet.”

- Growth: “Still looks okay.”

- Policy stance: “Two cuts penciled in, but data-dependent.”

That sets the stage for next week’s remarks.

- Base Case (most likely): Powell reiterates the dots — steady, not more dovish than the Fed’s projections. That likely cools the aggressive rate-cut trade and leaves equities choppy rather than trending.

- Upside Case: He leans dovish, implying October is effectively locked in → curve steepens, long-duration growth (tech, housing) catches a bid, dollar softens.

- Downside Case: He turns hawkish — talking up inflation risks or hinting at a higher neutral rate → yields pop, defensives and staples outperform.

The labour market framing will be critical. Powell has argued that cooling reflects immigration and supply expansion, not collapsing demand. If he sticks to that view, it gives the Fed cover to cut without fearing runaway unemployment. But if he pivots toward demand weakness, markets may price an acceleration in easing — a more volatile setup.

On inflation, Core PCE looks benign for now, but tariffs loom. If Powell calls them out, it’s a warning: don’t bet on aggressive cuts, cost-push risks remain alive.

In short: this isn’t about new information, it’s about how far Powell lets markets run with the easing story. Right now, futures are ahead of the Fed — and that gap is where the volatility lies.

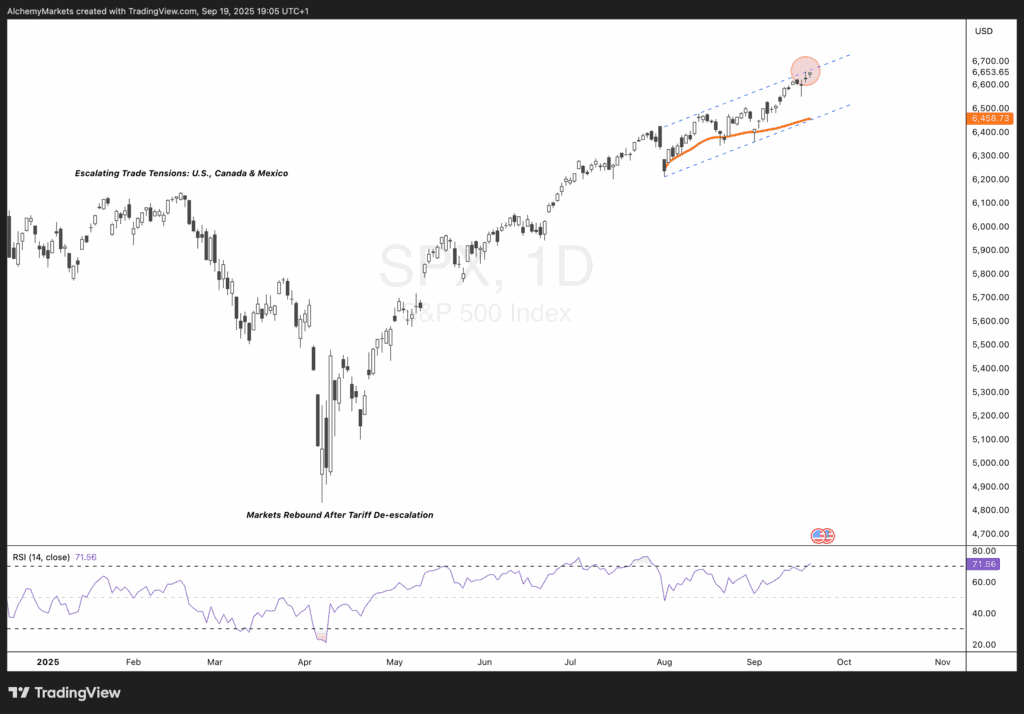

Technical Outlook: S&P 500 Index (SPX)

The S&P 500 continues to grind higher within a well-defined rising channel, with prices recently brushing the upper boundary. At the same time, we’re tracking a developing RSI divergence on the daily chart — momentum is slowing even as price extends.

- Bullish Scenario: If Powell validates October easing, SPX could punch through the upper channel, leading to an extension toward 6,650–6,700.

- Base Case: Price consolidates within the channel, with RSI divergence capping upside and keeping the index in a choppy holding pattern.

- Bearish Risk: A hawkish Powell → failure to hold channel support near 6,450, opening the door to a retracement toward 6,300.

For now, patience is warranted. The setup remains constructive, but RSI divergence suggests the market is stretched into resistance.

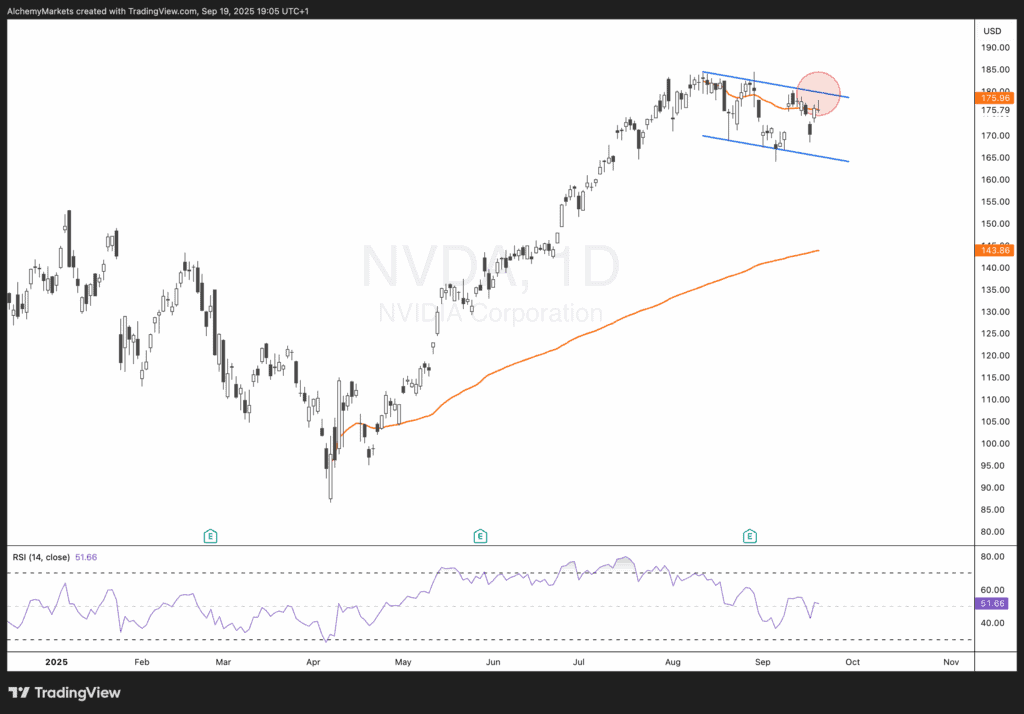

Technical & Fundamental Outlook: NVIDIA (NVDA)

NVIDIA remains the flag-bearer for AI-driven growth, and its stock is consolidating within a flag pattern after a strong run from April 2025 lows.

Bullish Base Case (Most Likely)

- Technical: A breakout above the flag and the anchored VWAP from the highs would confirm renewed upside momentum. This aligns with Powell sounding dovish, which would fuel long-duration growth assets.

- Fundamentals: Recent earnings showed strong data center demand, driven by hyperscalers and sovereign AI investments. Margins remain resilient despite supply chain costs. The company’s leadership in accelerated computing and AI chips is intact, with new product cycles extending visibility.

- Macro tie-in: Lower rates benefit high-duration tech by reducing discount rates on future cash flows. NVDA is positioned to be the primary beneficiary of AI capex, making dips attractive for long-term allocators.

Bearish Alternative (Risk Case)

- Technical: If NVDA fails to break higher, price could retrace into the medium-term anchored VWAP tied to the April 2025 lows (around $155–160 zone).

- Fundamentals: While demand is strong, there are risks:

- Export restrictions limiting China sales.

- Rising competition from AMD and custom chips (e.g., Amazon, Google).

- Tariff risks adding incremental cost pressures.

- Macro tie-in: A hawkish Powell (or rising front-end yields) would hit NVDA disproportionately — it’s one of the most rate-sensitive growth names.

Bottom Line

Next week’s Powell speech is less about what’s new, and more about how much room he gives markets to price in cuts.

- For SPX, the rising channel holds for now, but RSI divergence suggests upside is slowing.

- For NVDA, the bullish base case remains intact — AI demand, strong fundamentals, and a breakout setup all align if Powell leans dovish. But the bearish alternative is a real risk if yields back up and the breakout fails.

In other words, the macro and micro are converging: Powell’s tone could be the catalyst for the next leg in equities — or the trigger for a tactical pullback.