- Opening Bell

- August 12, 2025

- 3min read

DXY Firms Ahead of CPI: Market Braces for a Potentially Hotter Print

The US dollar is holding steady and even finding some support in early Tuesday trading ahead of the much-anticipated US CPI release. While market consensus sits at 0.3% MoM core CPI and 3.0% YoY, we believe the market is leaning toward the possibility of an above-consensus reading — and we suspect a 0.4% MoM print is more likely.

This pre-data bid for the dollar reflects a combination of profit-taking in still-crowded USD shorts and renewed geopolitical positioning. President Trump’s decision to extend the tariff pause on China by another 90 days adds a measure of temporary calm, while his attempt to temper expectations ahead of Friday’s summit with Putin — calling it a “feel-out meeting” — likely capped risk-on momentum.

Still, FX price action is data-sensitive, and today’s CPI release could shift the short-term USD narrative.

Our CPI Expectation: 0.4% MoM Core CPI

We anticipate a 0.4% MoM core CPI print, which would lift YoY core inflation from 2.9% to 3.1% and push headline inflation from 2.7% to 2.9%.

A hotter-than-expected print would challenge the market’s current view of roughly 20–25bps in September Fed cuts, potentially reducing cut expectations to below 15bps. That could give the dollar an initial lift, particularly against JPYand select EM currencies, though we doubt this will translate into a sustained USD rally without stronger labour market data.

Scenario Analysis

Scenario 1 — Consensus (~0.3% MoM / ~3.0% YoY)

Market read: Inflation on expected track → USD stays range-bound.

- DXY Reaction: Small intraday whipsaws, closing near unchanged.

- Drivers:

- Fed cut odds unchanged (~20–25bps in Sept).

- Positioning rather than fresh data remains the main driver.

- Tactical Bias: USD trades sideways; crosses driven by other central bank narratives (e.g., ECB policy for EUR/USD).

Scenario 2 — Hot Print (~0.4% MoM / ~3.1% YoY)

Market read: Sticky inflation = slower Fed easing → USD spikes short-term.

- DXY Reaction: Immediate +0.3% to +0.6% move higher.

- Drivers:

- Fed cut odds repriced lower (<15bps in Sept).

- Algo and fund flows chase rate differential.

- Tactical Bias: Gains short-lived if labour data remains weak; USD sellers may fade the rally within 48–72 hours. Strongest gains vs. JPY and EM FX; softer vs. CAD/AUD if commodities rally.

Scenario 3 — Cool Print (<0.3% MoM / <3.0% YoY)

Market read: Disinflation momentum intact → USD weakens.

- DXY Reaction: Drop of -0.3% to -0.6%, possible break of near-term support.

- Drivers:

- Fed cut odds rise (>30bps in Sept).

- US yield premium narrows, pressuring USD across G10 and EM.

- Tactical Bias: Weakness most pronounced vs. AUD, NZD, and high-carry EM FX. Potential for multi-session downside if followed by soft labour or retail sales prints.

Technical Backdrop

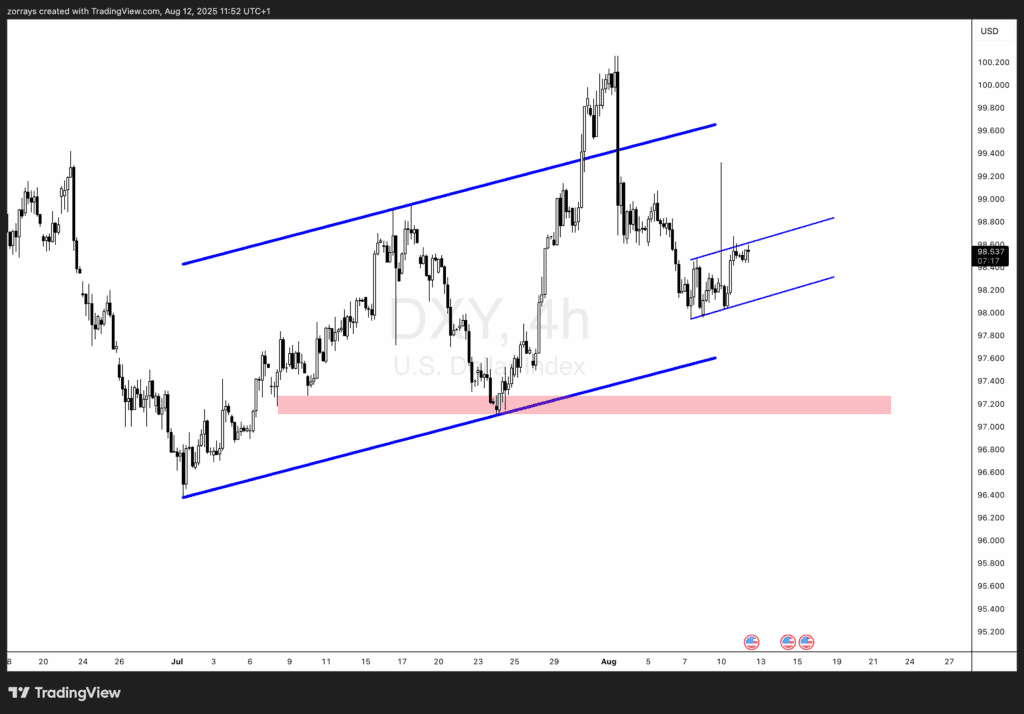

From a technical analysis perspective, the US Dollar Index (DXY) is currently trapped in a small ascending channel after rebounding from last week’s lows. This consolidation resembles a bullish flag, which, under normal circumstances, could resolve higher.

However, if inflation data meets or undershoots expectations, that pattern risks breaking to the downside, targeting the 97.200 support region (highlighted in red on the chart). This would align with Scenario 3, where disinflation momentum reasserts itself.

Conversely, a hotter-than-expected CPI could push DXY toward the upper bound of the short-term channel, with the next resistance aligning near the 99.00 handle.

Key takeaway: While we expect a 0.4% MoM core CPI print — hotter than consensus — labour market softness could limit USD upside to a short-lived spike. Traders should remain nimble, as technical structure suggests clear breakout/breakdown levels in the wake of today’s data.