- Chart of the Day

- November 18, 2025

- 3 min read

Why Bitcoin Is Dropping – And What Must Change Before It Can Recover

Bitcoin’s recent decline hasn’t happened because of fear or sentiment alone. It’s happening because the global macro environment has shifted sharply against all risk assets — and Bitcoin sits at the furthest end of the risk curve.

To understand the sell-off, we need to look at two forces: real yields and Bitcoin’s technical structure.

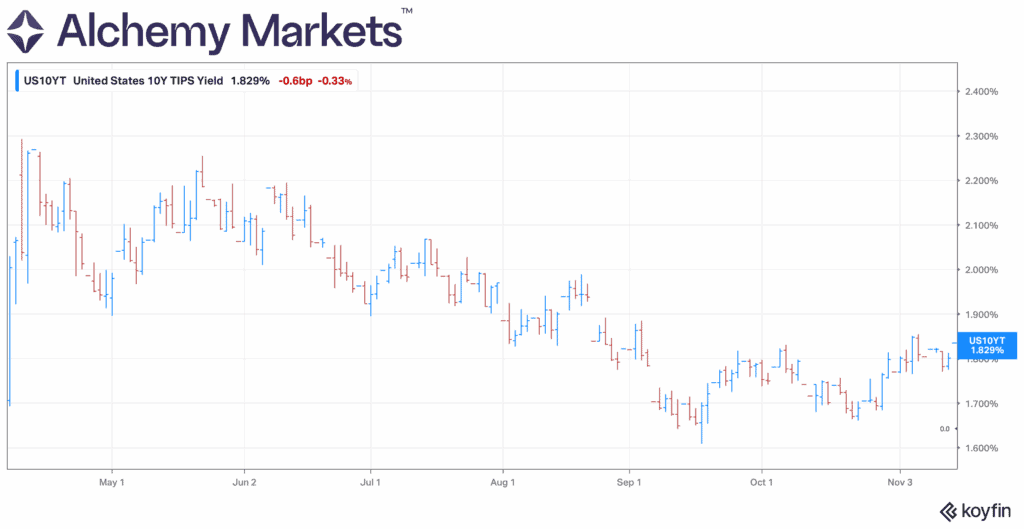

1. Rising Real Yields Are the Core Driver of Bitcoin’s Decline

Bitcoin performs best when real yields fall. Real yields are the inflation-adjusted return on government bonds, and they are one of the strongest indicators of global liquidity.

Right now, real yields are rising — and that creates a powerful headwind for Bitcoin because:

- borrowing becomes more expensive

- the US dollar strengthens

- safe bonds offer attractive real returns

- global liquidity contracts

- risk appetite drops

When institutions can earn appealing real returns on long-term Treasuries, they allocate less to volatile assets like Bitcoin. This is the single most important macro reason behind the current sell-off.

2. Why Real Yields Are Rising

Real yields rise when the bond market believes the Federal Reserve won’t be cutting rates soon.

That belief comes from two things:

A) Stronger-than-expected economic data

Growth has held up better than expected, reducing recession fears and lowering expectations for rapid policy easing.

B) Sticky forward-looking inflation expectations

The market still sees inflation as persistent. When inflation expectations don’t fall, the Fed stays restrictive, bonds sell off, and real yields climb.

Until either growth weakens or inflation expectations soften, real yields will remain elevated — and Bitcoin will stay under pressure.

3. What Needs to Change for Bitcoin to Recover

Bitcoin does not need a Fed pivot to recover. It simply needs falling real yields, which would signal easier liquidity conditions.

Real yields fall when:

- US 10-year Treasury yields start dropping

- inflation expectations cool

- the market begins pricing future rate cuts

These conditions increase global liquidity and push investors back toward high-beta assets like Bitcoin.

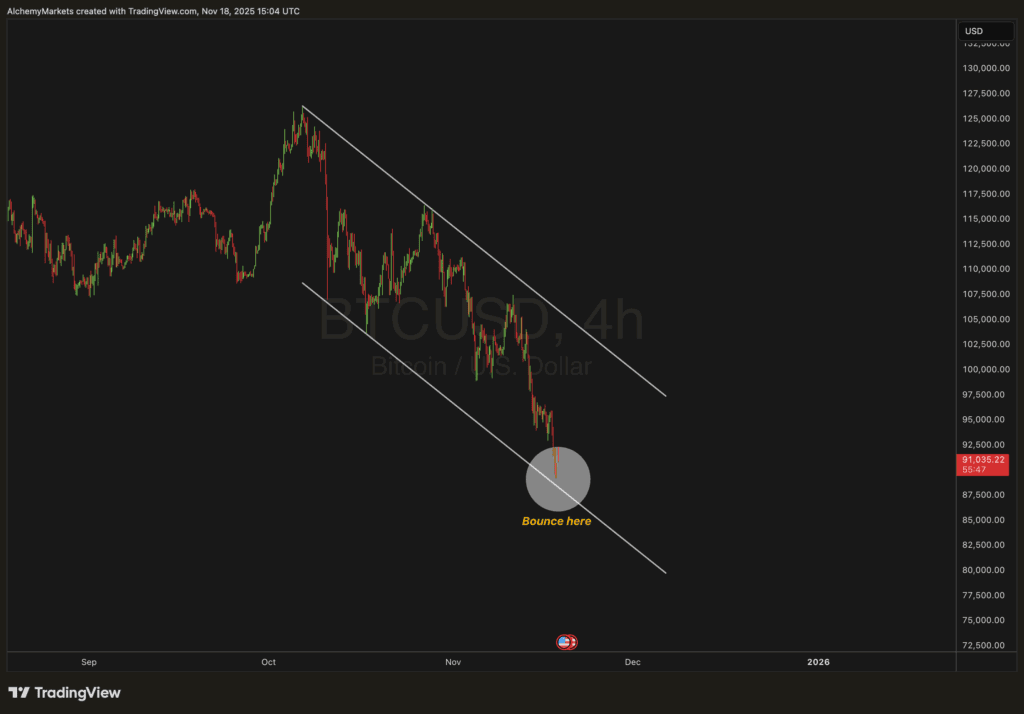

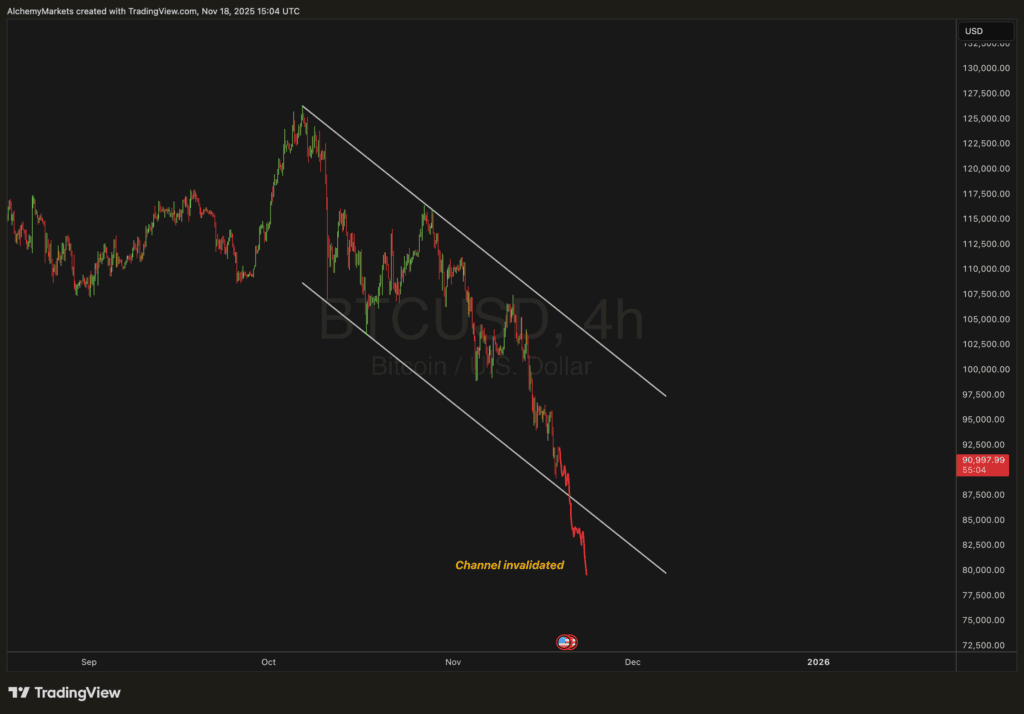

4. Technical Picture: Bitcoin Is Testing the Bottom of Its Descending Channel

Your chart shows Bitcoin trading inside a clear descending channel that has been respected since early October. Price is now pressing the lower boundary of that channel — a critical technical decision point.

Two scenarios emerge:

Bullish Scenario

If real yields soften, Bitcoin may bounce off channel support and move back toward the mid-range.

Bearish Scenario

If macro pressures stay tight, Bitcoin could break below the channel and accelerate downward.

The technical and macro landscapes are now aligned — and both are telling the same story: this is a high-pressure inflection zone.

5. Final Thoughts

Bitcoin’s decline is not irrational — it’s a logical response to tighter liquidity, rising real yields, firm Treasury rates, and sticky inflation expectations. These forces push capital toward safe real returns and away from speculative assets.

The turning point will come when real yields fall. When the bond market begins pricing future easing or sees softer inflation ahead, liquidity improves and Bitcoin becomes attractive again.

Until then, the downtrend remains orderly, macro-driven, and technically contained within its descending channel.