- Chart of the Day

- November 11, 2025

- 2 min read

Markets Cheer as US Senate Moves to End Shutdown — AUD/USD Eyes Breakout Amid Risk-On Mood

A Political Boost for Markets

The long-awaited progress in Washington has sparked a wave of relief across financial markets. With the Senate passing the bill to reopen the government, attention now turns to the House of Representatives, where the vote is expected in the coming days. Although not yet guaranteed, the likelihood of approval has been enough to buoy investor confidence.

Equity-sensitive currencies such as the Australian (AUD) and New Zealand dollar (NZD) have led gains, while the Japanese yen — the traditional safe haven — has softened as risk appetite improves. The US dollar’s overall reaction remains muted, reflecting a balance between optimism and caution.

Cautious Optimism Ahead

While reopening prospects reduce near-term economic risks, they also mean the return of key US data releases — which could highlight deeper cracks in the economy. Markets may be underpricing the potential softness in the labour market and the implications for short-term US rates. These factors could weigh on the dollar heading into year-end, even if volatility stays contained for now.

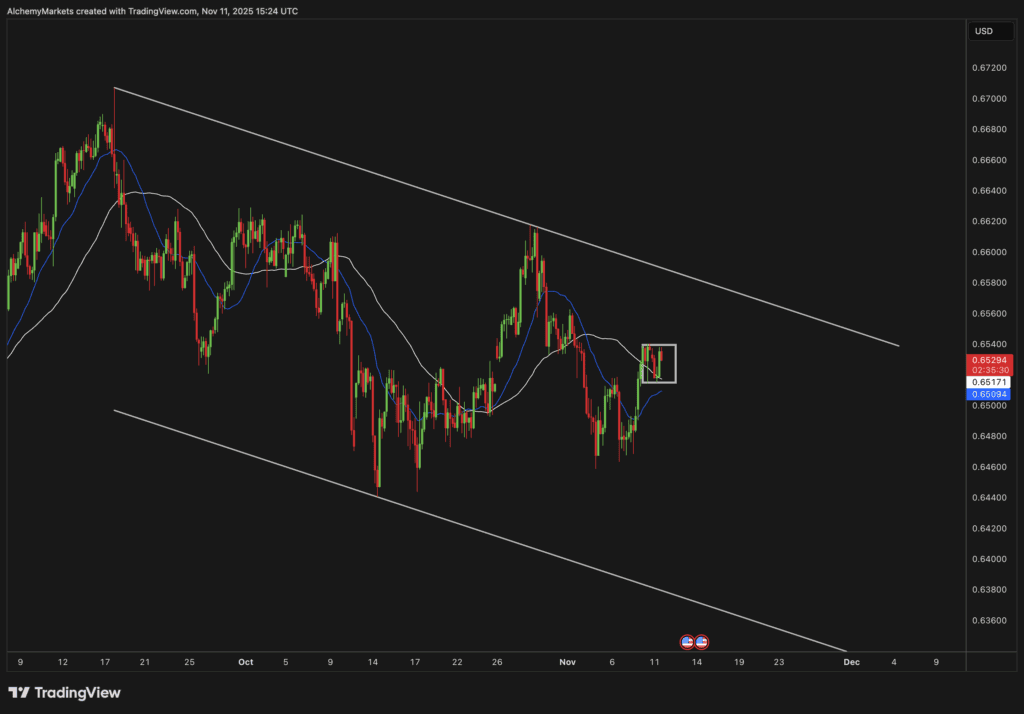

AUD/USD Technical Outlook: Ready to Break Higher?

Technically, AUD/USD continues to trade within a broad descending channel, but momentum has turned slightly more positive. The pair sits above both the 20-day and 50-day simple moving averages, consolidating in a tight range that hints at a potential upside breakout.

If bullish sentiment persists, a move toward the upper boundary of the channel looks likely — aligning with the broader “risk-on” tone across global markets. Until then, the Aussie remains comfortably supported, reflecting cautious optimism that could extend into the coming sessions.