- Elliott Wave

- October 29, 2025

- 2min read

USD/CAD Elliott Wave: The Wake of a Double Rate Cuts

Executive Summary

- Bank of Canada and Fed both cut interest rates 25 basis points on Wednesday.

- Prices may be approaching a medium-term top.

- The bearish Elliott wave count hints at continued losses to 1.3538.

Earlier today, the Bank of Canada cut its central bank target rate 25 basis points to 2.25%. Then, this afternoon, the Federal Reserve cut the US target interest rate 25 basis points to 3.75-4.00%.

While market participants are anticipating another 25 basis point cut by the Fed in December, the Bank of Canada has signalled they’ll take a break until 2026.

This may create a diverging monetary policy between BOC and Fed as the interest rate spread between these two currencies may tighten further. This may help pull USD/CAD down over the medium term.

Elliott Wave Analysis

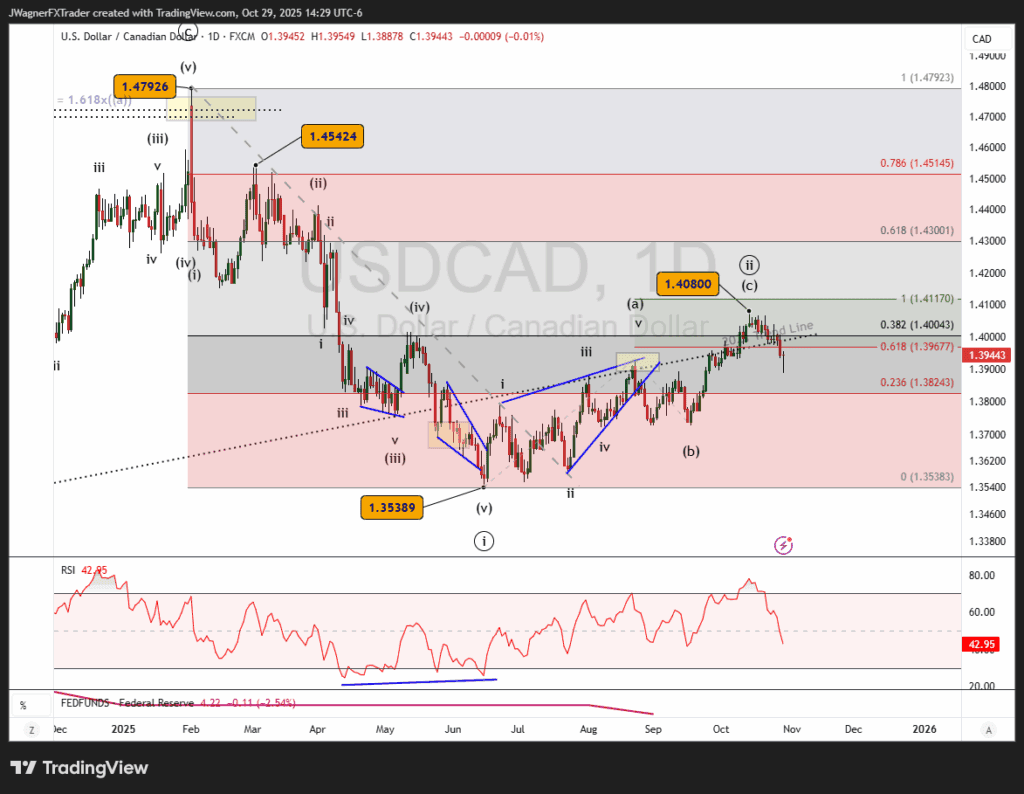

The rally from June 16 has stalled at 1.40800. The rally tracks best as a completed Elliott wave zigzag pattern labeled (a)-(b)-(c). The entire advance has pushed just beyond the 38% Fibonacci retracement level so it is possible to consider the advance a completed wave ((ii)).

After today’s dual central bank meetings, USD/CAD prices started the day lower, but have rebounded leaving behind a bullish hammer type of candlestick pattern.

If this is correct, then USD/CAD would push lower below today’s low in the coming days and below 1.3539 in the coming weeks. The key resistance level to this bearish forecast is the October 14 high of 1.4080.

If 1.4080 is broken to the upside, then we’ll consider wave ((ii)) extending higher, possibly in a double zigzag pattern.

Bottom Line

USD/CAD appears to have printed a medium term top that could lead to a bearish trend driving prices below 1.3539.

If 1.4080 is broken to the upside, then another pattern would be in development.