- Weekly Outlook

- October 3, 2025

- 3 min read

SPX Riding High, But Cracks Are Showing

Government Shutdown – Why It Matters

The U.S. government shutdown stopped the jobs report this week. It’s a political fight over spending, but the market cares because the data blackout means less visibility. No payrolls this Friday. We wait until Washington gets moving.

Next Week in Focus (date order)

Tuesday – Fed Speakers & NZ Survey

We kick off with the NZIER business survey (Mon night UK time). It often sets the tone for how weak or strong New Zealand feels before the RBNZ.

In the U.S., Fed governors Jefferson, Bowman, and Miran all speak. Markets will listen for hints after soft labor data and ADP showing job losses.

Wednesday – RBNZ Decision

The RBNZ meets Wednesday. Most expect a 25bp cut but some are calling for 50bp because of poor growth. That’s a big deal for NZD.

Thursday – More Fed Chatter

Powell gives remarks, joined by Bowman and Barr. It’s not the big FOMC yet, but this is where the tone gets set. If they sound dovish, it feeds the rate cut trade. If not, markets may wobble.

Friday – Michigan Sentiment & Delayed NFP

Finally, the University of Michigan consumer sentiment. Last month it dropped to the mid-50s. Inflation expectations crept up. That’s the real watch – do people think prices will stick higher?

And yes, the big one: Non-Farm Payrolls. It’s delayed, no set date. Street thinks ~50k jobs added, unemployment ~4.3%. Weak, but the timing is up to Washington.

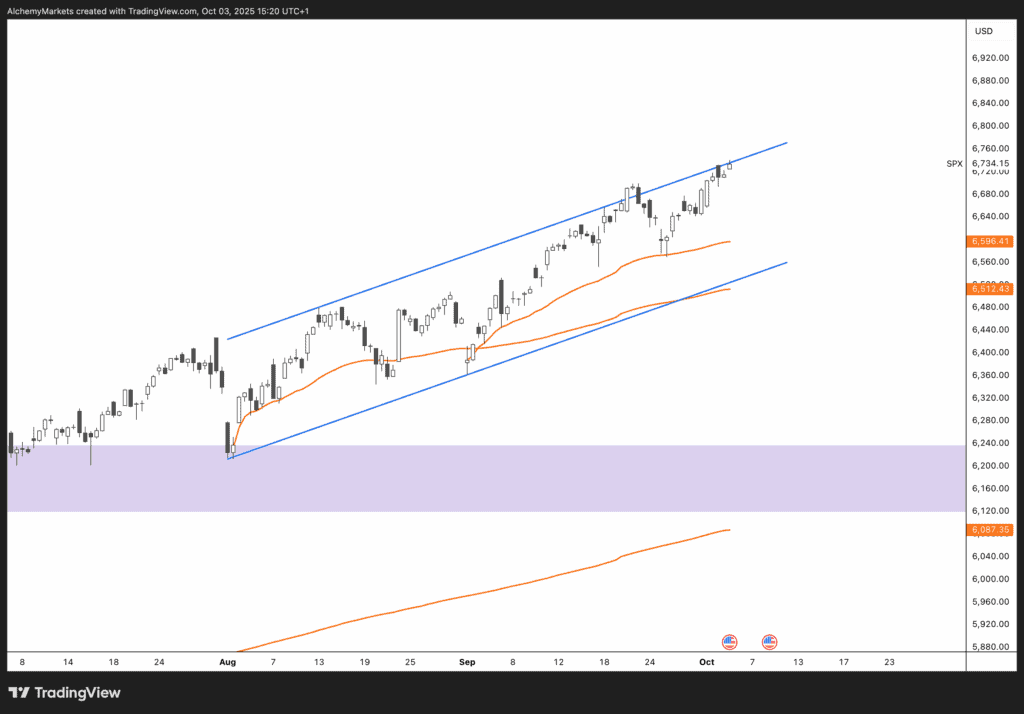

SPX Technical View

The SPX (chart above) has been climbing nicely inside a channel since August. Price is hugging the upper trend line.

The moving averages (orange lines) are still pointing higher, so trend is alive. That keeps us mildly bullish short term.

But… there are warning signs.

- Hugging the top of the channel often comes before a pullback.

- Delayed jobs data = more uncertainty.

- Fed speakers + Michigan sentiment could be the catalyst for volatility.

If SPX does correct, first support sits around 6,596–6,512 (shorter moving averages). Stronger support is the purple zone near 6,200.

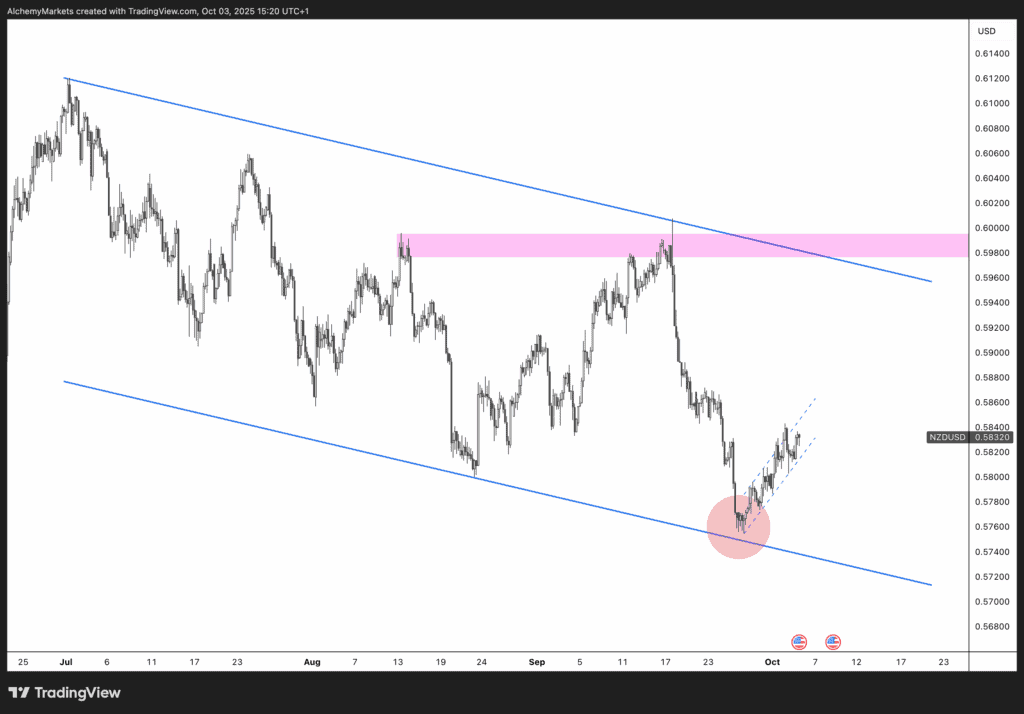

NZDUSD Technical View

We flagged this in our Thursday Chart of the Day – NZDUSD may be on its way back toward 0.6000. The pair did a clean “kiss and run” off the lower bound of the descending channel (red circle on chart). Since then, it’s been climbing in a small rising channel.

Technically, this looks like a relief rally after being heavily sold. The bounce makes sense with RBNZ on deck next week. If the central bank surprises with a bigger cut (50bp), the rally may stall. But if they stick to 25bp and sound less dovish, the momentum could extend higher.

Key resistance sits around the 0.5980–0.6000 zone (pink band + upper channel). That’s where the bears will test it again. Support remains down at the recent low near 0.5750.

Bottom line: short-term upside potential, but the broader downtrend is still alive unless 0.6000 is broken cleanly.

Bottom Line

SPX still looks fine, but the mix of delayed payrolls, Fed chatter, and weak consumer vibes could finally push it into correction mode. Mildly bullish today, cautious tomorrow.