- Opening Bell

- October 11, 2024

- 3 min read

USDCAD Analysis: What to Expect from Major Economic Data Today

USDCAD is currently still range bound from 2015, nearly 10 years ago! However, that doesn’t mean things aren’t exciting for the asset – Canadian Employment data, and US PPI data are coming out 12:30PM UTC today, which may very well shape the future trajectory of this asset.

With that on the horizon, what are some of the factors traders should consider when trading USDCAD?

Technical Analysis on USDCAD (October 11th, 2024)

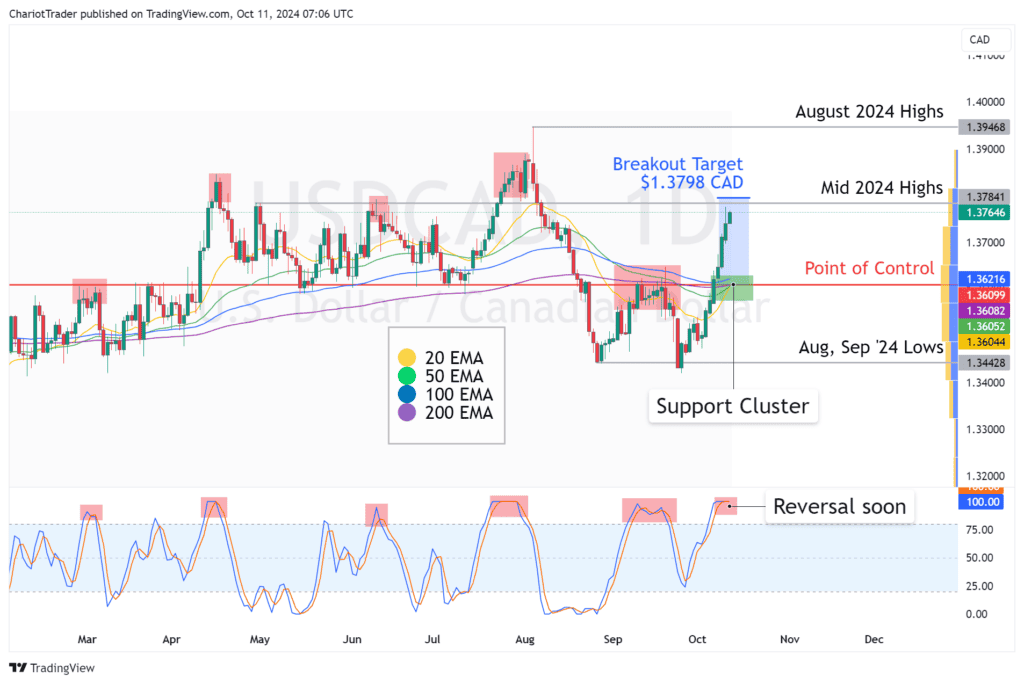

First, before we delve into the economic data, let’s look at the technical side of things on USDCAD. Currently, the asset has broken out of a double bottom pattern, and its eyes set on the breakout target of $1.3798 CAD. This area isn’t too far away from the current price, so USDCAD could very well reach the target sooner rather than later.

Turning to bearish signs, USDCAD is displaying overbought signals on the Daily Stochastic RSI. This, combined with nearby resistance at the Mid 2024 High pivots ($1.3784) and the breakout target ($1.3798) in the same area, signals a potential near-term reversal.

| Anchored Volume Profile: The volume profile is drawn from a significant pivot low in May 2021, which gives us the POC at $1.36099 CAD. |

In case of a decline, a strong support cluster has formed on the daily chart, with the EMA 20/50/100/200 aligning below the current USDCAD price near the Point of Control (POC) at $1.3610 CAD. Traders can watch for a potential bounce at this level.

Looking ahead, if USDCAD breaks and closes above its August 2024 highs at $1.3947, it would confirm a breakout of the 9-year range, opening the door for further upside targets, as highlighted in our Q4 Forex Forecast Report.

How to Read Employment Change, Unemployment Rate, and PPI

The markets are forward looking, and therefore, if the data released today are not according to expectations, USDCAD could see heightened volatility.

Currently, the expected forecasts are as follows:

| Event | Forecast | Previous | Implications |

| Canadian Employment Change | 29.8K | 22.1K | Bullish for USDCAD |

| Canadian Unemployment Rate | 6.7% | 6.6% | Bullish for USDCAD |

| US Core PPI m/m | 0.2% | 0.3% | Bullish for USDCAD |

| US PPI m/m | 0.1% | 0.2% | Bullish for USDCAD |

Overall, the data presents a slight leaning towards a bullish USDCAD in the coming weeks, as the lowering inflation in the US implies less pressure to cut rates.

Additionally, the Canadian unemployment rate is rising, so while the Employment Change is increasing, this signals a slowdown in the Canadian economy. Such a divergence also signals that Canadians are potentially taking on more than one job to make ends meet, further signalling a slowdown in the Canadian economy.

A slowdown in the Canadian economy could lead to more rate cuts by the Bank of Canada, weakening the Canadian Dollar and therefore boosting USDCAD’s prices.

Closing Thoughts

Technically, a bearish reversal from the current price zone or slightly higher on USDCAD is looming, but the fundamentals could support the price of USDCAD, especially at the EMA cluster/POC region of $1.36.

You may also be interested in:

Gold Flips Temporarily Bearish on 4H Timeframe