- Opening Bell

- September 30, 2025

- 2 min read

USD/JPY: Downside Risks Mount as Shutdown Fears Weigh on Dollar

The U.S. dollar has been on the back foot in recent sessions, hit by the twin pressures of a looming U.S. government shutdown and sliding oil prices. The yen has emerged as the top performer, with traders increasingly eyeing lower USD/JPY as the favoured trade during periods of heightened political and economic uncertainty.

History provides a guide here: during the 2018-19 shutdown, USD/JPY shed about 1.5%. Today, the pair is trading roughly 1% above its short-term fair value, suggesting there’s still room for a corrective move lower.

On the commodities side, softer oil prices continue to weigh on the dollar and commodity-linked currencies like CAD, while offering support to the yen and euro. Into year-end, downside risks in energy markets remain a theme our commodities team has consistently flagged.

Macro data will be another key driver this week. The U.S. labor market is in focus, with JOLTS openings (after a weak July print) and Conference Board consumer confidence on deck. Later in the week, payrolls data could provide fresh direction — if it’s not delayed by a shutdown. For now, markets are pricing around 42bp of cuts into year-end, still above the Fed’s median Dot Plot. That leaves the bar high for more hawkish repricing and lowers it for dovish bets, skewing risks toward a weaker dollar.

Technical View: Bearish Tilt Emerging

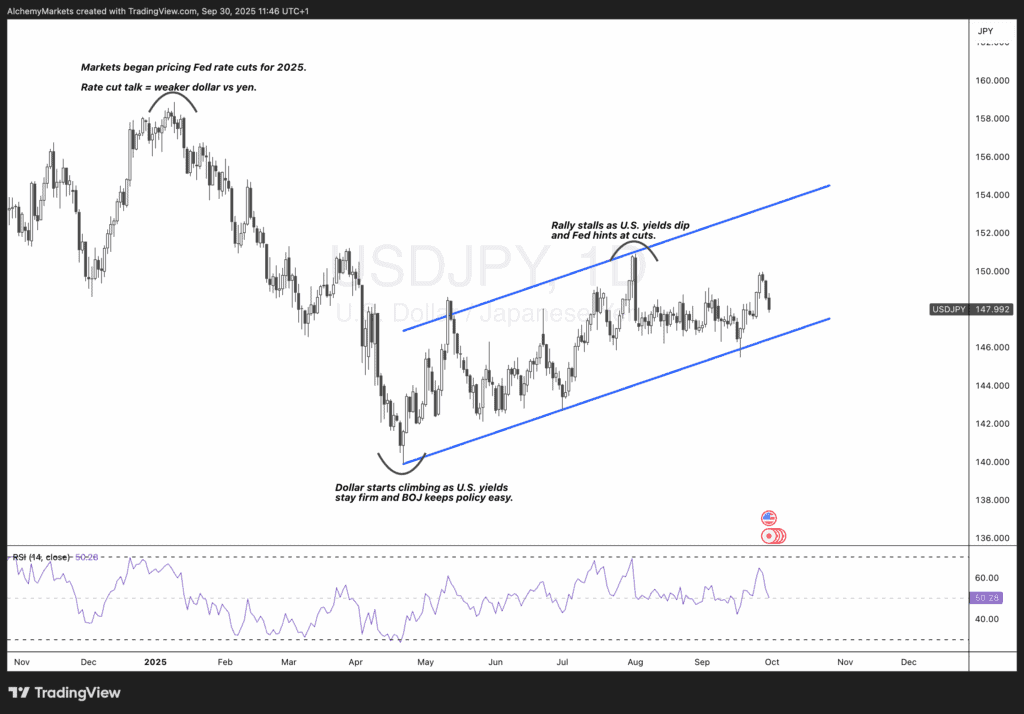

The USD/JPY chart tells a story of its own. Since April 2025, the pair has been trading inside a clear upward channel, repeatedly testing both support and resistance. However, recent price action shows the rally stalling near 152.00, with the pair rolling lower as Fed cut expectations re-emerge and U.S. yields soften.

The channel’s lower bound — now near 146.00 — has been tested multiple times. If this floor breaks, the technical picture turns decisively bearish. A move toward the 142.00 level in the near term looks increasingly plausible, particularly if shutdown headlines and weaker U.S. data drive risk-off flows into the yen.

Momentum indicators back this view, with RSI hovering around neutral but tilting lower, suggesting downside pressure is building.