- Opening Bell

- February 12, 2026

- 3 min read

Sterling Under Pressure as UK Economy Stumbles into 2026

The UK economy closed out 2025 on a distinctly lacklustre note, setting a cautious tone for markets at the start of the new trading session. While the slowdown was not entirely unexpected, the weakness in construction and business investment stood out sharply — reinforcing concerns that momentum faded more quickly than policymakers had hoped.

Growth Loses Steam

With October and November data already in hand, December’s figures did not dramatically alter the narrative. However, they confirmed what many had suspected: the UK economy entered 2026 on softer footing.

Construction activity showed notable fragility, reflecting ongoing cost pressures and subdued demand. Meanwhile, business investment — often seen as a bellwether of corporate confidence — came in weaker than anticipated. Admittedly, part of this softness can be attributed to operational disruption caused by a cyberattack at a major UK car manufacturer toward the end of Q3. Still, even adjusting for that factor, the broader tone remains cautious.

Markets appear to be interpreting the data as confirmation that the UK growth cycle is cooling more meaningfully than previously thought.

Bank of England: Eyes on Jobs and Inflation

For the Bank of England, this latest GDP print doesn’t materially change the policy outlook. Policymakers had already signalled awareness that economic conditions were softening into year-end.

Instead, attention now shifts firmly to next week’s labour market and inflation data. These releases are likely to carry far greater weight for rate expectations.

Key themes to watch:

- Hiring momentum: Recent data shows a clear cooling in recruitment activity.

- Wage growth: The sharp slowdown in pay pressures suggests inflationary risks may be easing.

- Core inflation dynamics: Services inflation will remain particularly important.

If the trend of softer hiring and moderating wage growth persists, the path toward rate cuts becomes clearer.

Our base case remains for:

- A first rate cut in March

- A follow-up move in June

That would amount to two reductions by mid-year, aligning with growing evidence of easing domestic inflation pressures.

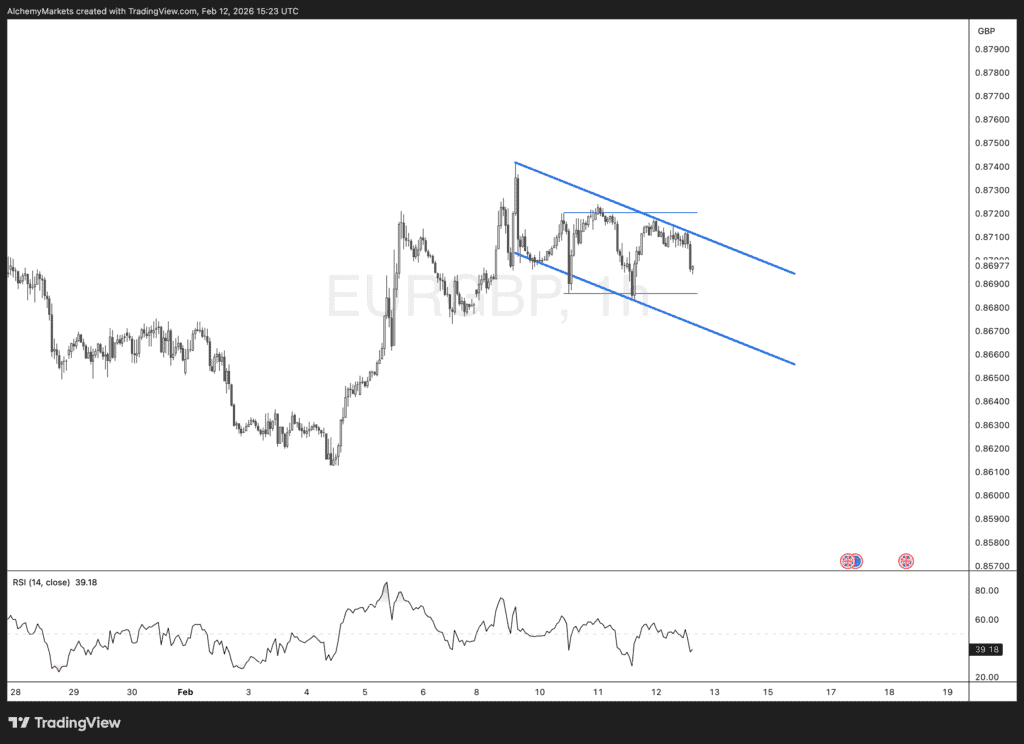

FX Focus: EUR/GBP Remains Supported

Against this macro backdrop, sterling is struggling to find support.

With the prospect of two Bank of England rate cuts by June increasingly priced into expectations, the interest rate differential narrative is shifting against the pound.

We remain broadly bullish on EUR/GBP, with 0.88 a realistic short- to medium-term target.

Technically, the pair is approaching a key juncture:

- A clean break of the current flag pattern would open the door for continued upside momentum.

- Alternatively, we could see one final pullback — completing a three-wave Elliott sequence — before an eventual breakout higher.

Either scenario ultimately favours upside extension, provided incoming UK data continues to justify a more dovish BoE stance.

Market Themes for the Session

As markets open, traders will be digesting:

- Softer UK growth data

- Building expectations of near-term BoE easing

- Ongoing sensitivity to wage and inflation trends

- Technical positioning in EUR/GBP near breakout territory

Volatility may remain contained ahead of next week’s labour and CPI releases, but directional bias appears to favour a weaker sterling backdrop in the near term.

Bottom Line

The UK economy’s sluggish finish to 2025 reinforces the view that monetary easing is drawing closer. While the latest data does not dramatically shift the policy landscape, it strengthens the case that the Bank of England will soon move to support growth.

For now, the balance of risks tilts against sterling — and EUR/GBP remains poised to test higher levels if incoming data continues to soften.

Stay sharp — the next round of inflation and jobs data could prove decisive.