- Opening Bell

- August 26, 2024

- 3 min read

Consolidation for Nvidia as Markets Wait For Earnings Report

Nvidia’s next earnings report – Q2 FY2025, is coming out in just 2 days on Wednesday. The entire market is holding its breath to see if the semiconductors industry can once again send the markets soaring – possibly starting the final late cycle pump before the Fed Pivot.

Quick Tip: Fed Pivots are known to lead to large price declines in the market.Analysts expect NVIDIA to report revenues in the range of $11 billion to $11.3 billion for Q2 FY2025.

This would represent a substantial year-over-year increase, driven by continued demand for AI and data center products. The markets will be watching closely to see if expectations will be met, or even exceeded.

Scroll down further to find our analysis on the current price action.

Previous Report: Nvidia Q1 FY2025 Recap

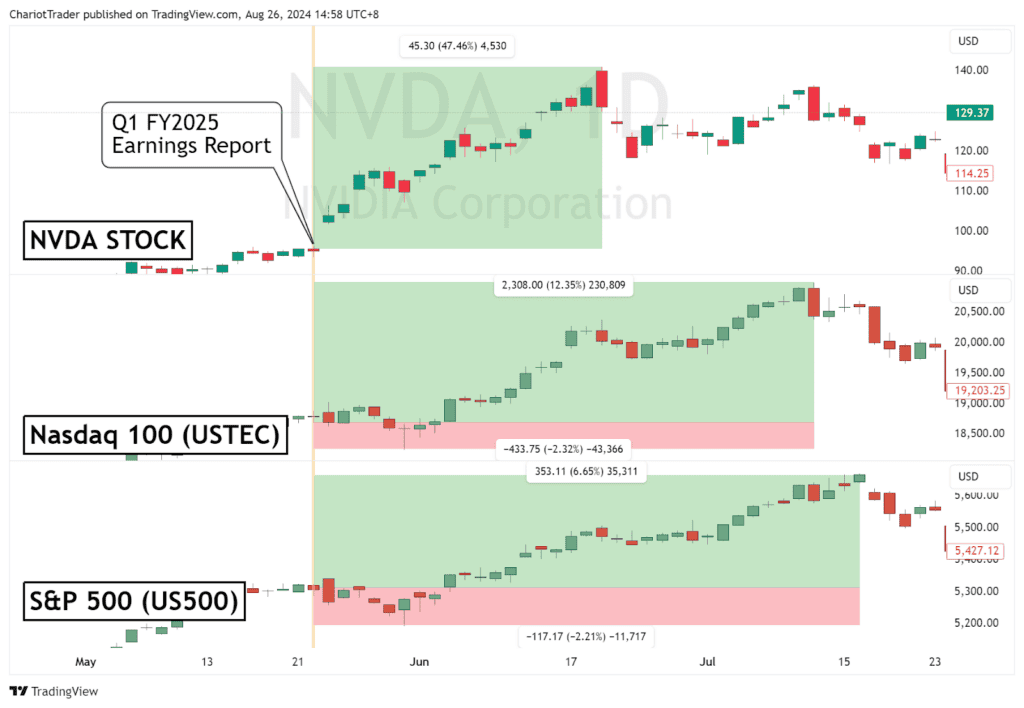

Nvidia’s previous Earning Report was released on May 22nd, coming in at a revenue report of $7.19 billion instead of analyst estimates of $6.52 billion.

- This significantly exceeded expectations and led to a 47.46% rally for the Nvidia stock.

- Nasdaq 100 and S&P 500 saw a rally of over 13% and 6% respectively.

- However, the indices first fell by approximately 2% for one trading week before rallying.

Technical Analysis of NVDA (August 26th, 2024)

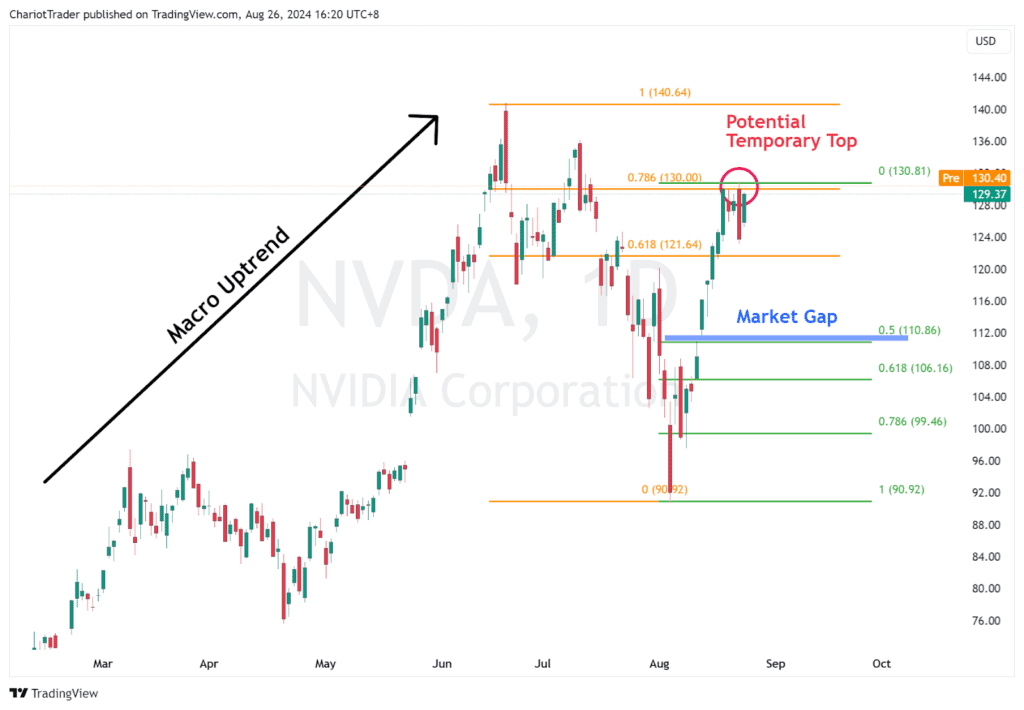

Current price action: After 10 consecutive days of uptrend, NVIDIA experienced a significant bearish signal with a bearish engulfing candle closing on Thursday, August 22nd, 2024. This was followed by a green inside bar on Friday, suggesting that the market is currently in a state of indecision.

How to interpret: Traders may be possibly waiting for the earnings outcome before committing to a new direction, therefore, the price may consolidate at the $130 region until Wednesday.

Trend direction: NVDA is currently in a macro uptrend, and in a local downtrend. The price is currently finding resistance at the 0.786 Fib retracement, drawn from the recent peak to the recent low. There is a possibility to price in a lower high here.

In the event NVDA does make a preemptive move, here are the key levels to watch.

| Support Levels to Watch • Market Gap: $111.00 – $111.75 • 0.5 Fibonacci Retracement: $110.86 • 0.618 Fibonacci Retracement: $106.16 |

| Resistance Levels to Watch • 0.786 Fibonacci Retracement: $130.00 • Previous Pivot High: $136.15 • All-Time High: $140.64 |

Closing Thoughts

If Nvidia’s Q2 FY2025 meets expectations, or is stronger than expected, I would personally expect Nvidia, Nasdaq 100, and the S&P 500 to make a significant rally and create new highs.

The caveat here is that the Nasdaq 100 and S&P 500 could first see a brief price decline, as they did back in May 2024.

However, if the Q2 FY2025 report on Wednesday is weaker than anticipated, then NVDA, US500, USTEC most likely will experience a price decline.

You may also be interested in:

To Cut or Not to Cut: Jerome Powell Speech Will Set Market Tone

Monetary Manoeuvres: What This Week’s Economic Data Could Mean for U.S. and Eurozone Rate Cuts