- Opening Bell

- October 24, 2024

- 4min read

GBPJPY in Focus: Japanese Inflation Data and GBP Flash PMI Data

This article has been updated with the released statistics.

GBPJPY is taking center stage today with the releases of the Tokyo Core CPI year-over-year data, and the UK’s Flash Manufacturing and Services PMI data.

As a cherry on top, the head of the central Bank of England (BOE), Gov Bailey, will be speaking today on short term interest rate decisions.

Traders will be closely listening for clues of a hawkish or dovish tone in his speech, while also forming expectations based on the Flash PMI data released today.

Key Data Releases for Japan and UK

| Data | Actual | Forecast | Previous |

| GBP Flash Manufacturing PMI | 50.3, LOWER | 51.5 | 51.5 |

| GBP Flash Services PMI | 51.8, LOWER | 52.3 | 52.4 |

| Tokyo Core CPI y/y | 1.8%, HIGHER | 1.7% | 2.0% |

How to Interpret the Economic Data

GBP Flash Manufacturing PMI

This is a survey among ~650 purchasing managers in the manufacturing sector to capture their sentiment on employment, production, new orders, and general business conditions in recent times.

This is a leading indicator of economic health in the United Kingdom. A reading above 50.0 indicates that businesses are expanding. Below 50.0 indicates a slowing down.

Current forecast is 51.5, no changes from the previous 51.5 reading.

Actual statistic is 50.3, lower than forecasted – Bearish for GBPJPY.

If the readings come in lower than forecasted, then the value of GBP may take a hit because this would incentivise the BOE to rate cuts, in order to revitalise economic growth.

- Bearish for GBP: If actual data comes in lower than expected.

- Bullish for GBP: If actual data comes in higher than expected.

GBP Flash Services PMI

This is a survey among ~650 purchasing managers in the services sector to capture their sentiment on employment, production, new orders, and general business conditions in recent times.

This is a leading indicator of economic health in the United Kingdom. A reading above 50.0 indicates that businesses are expanding. Below 50.0 indicates a slowing down.

Current forecast is 52.3, while the previous reading was 52.4.

Actual statistic is 51.8, lower than forecasted – Bearish for GBPJPY.

If the readings are higher than forecasted, then it is bullish for GBP. If they are lower, then the BOE may step in to cut rate cuts to revitalise the economy.

- Bearish for GBP: If actual data comes in lower than expected.

- Bullish for GBP: If actual data comes in higher than expected.

Tokyo Core CPI Year-Over-Year

The Tokyo Core CPI y/y data is a representation of inflation in consumer products in Japan. The higher the numbers are, the more incentivised the BOJ (Bank of Japan) is to hike rates. Conversely, lower readings means inflation is slowing down, and the BOJ is more incentivised to keep rates where they are, or even cut rates.

Current forecast is 1.70%, while the previous reading was 2.0%.

Actual statistic is 1.80%, higher than forecasted – Bearish for GBPJPY.

- Bearish for JPY: If actual data comes in lower than expected.

- Bullish for JPY: If actual data comes in higher than expected.

Closing Thoughts with Technicals

If the data remains the same as forecasted, what we have here is a mixed bag of data:

- Tokyo Core CPI y/y is coming lower, which is bearish for JPY as the BOJ is incentivised to hold or cut rates.

- GBP Flash Services PMI is coming lower, which is bearish for GBP as the BOE is incentivised to cut rates to stimulate the economy.

As the data remains murky in terms of bias, traders will be watching Gov Bailey’s speech for further insights into BOE’s decision to hold or cut interest rates.

If the general tone is hawkish, then GBP could rise further and bolster the price of GBPJPY. If the tone is bearish, then GBP would decline and put bearish pressure on GBPJPY.

Actual stats imply further rate cuts for GBP, and rate holds for JPY.

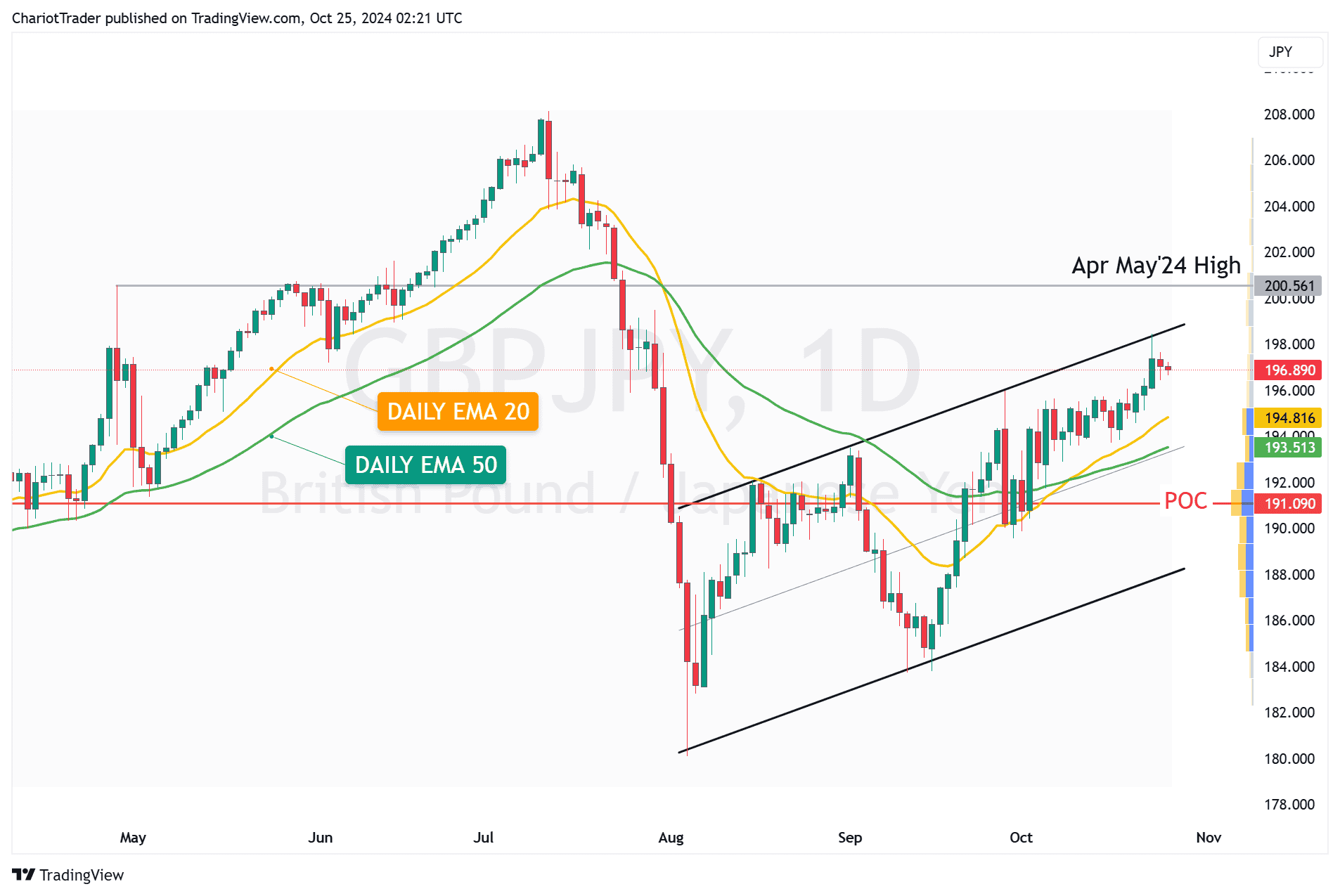

GBPJPY is in a Bear Flag

Going over to the technical charts, GBPJPY is currently in a rising parallel channel, following an impulsive bearish move from July to August 2024. This forms a classic bear flag, which has a bearish bias if the price breaks the lower trendline.

For now the price remains in a local uptrend, and could find support on the Daily EMA 20 and 50, which has acted as reliable dynamic support in the past.

You may also be interested in: