- Opening Bell

- October 8, 2025

- 3 min read

Alts Test Support as ETF Door Opens

Altcoin market cap is now grinding against critical resistance again at $1.71 trillion, while Bitcoin Dominance (BTC.D) appears to be bouncing from multi-month lows.

Now you’re thinking, “Wait, if BTC dominance is rising, isn’t that bad for alts?” Usually, yes — but this time the story runs deeper.

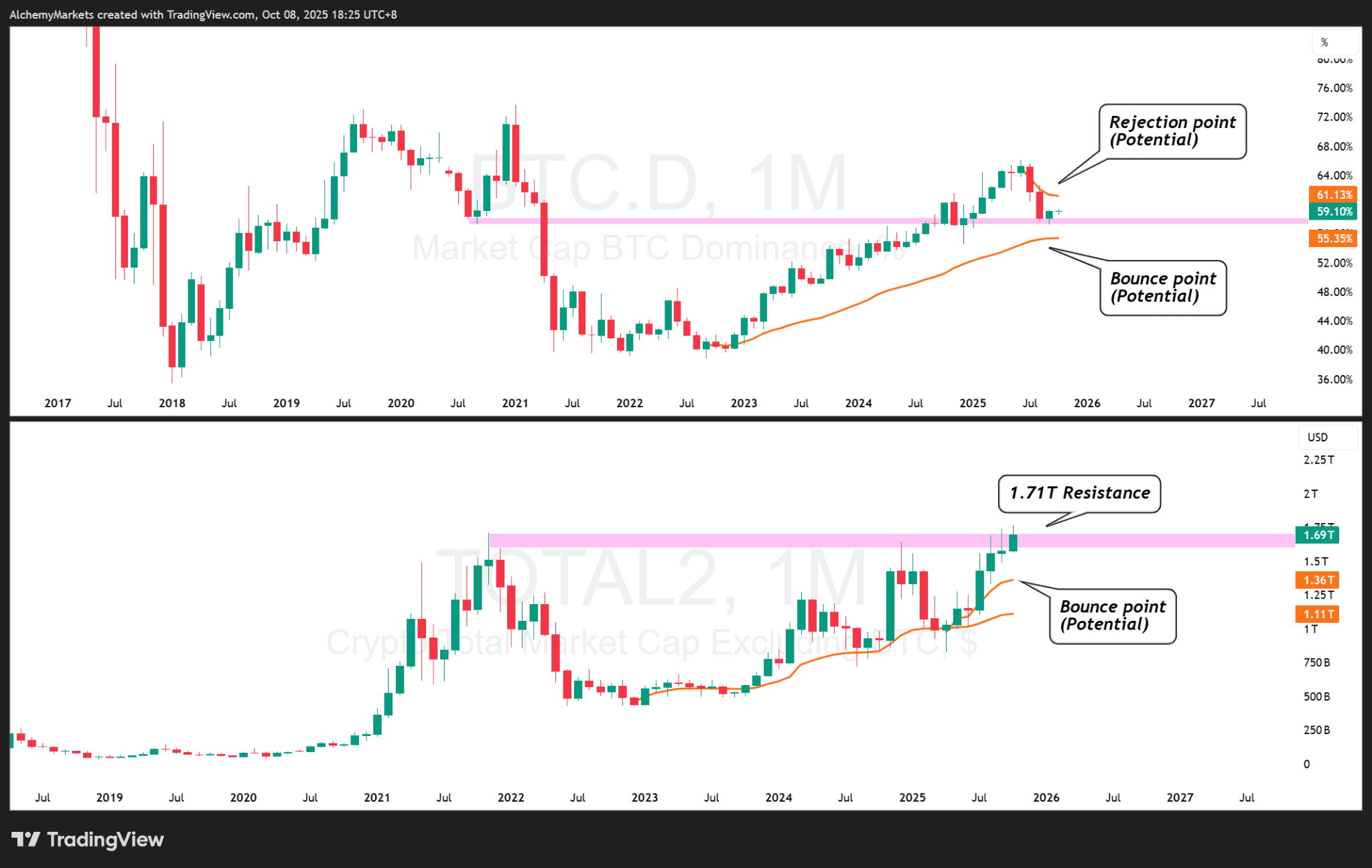

Monthly view of BTC.D vs TOTAL2 (Crypto Market Cap excluding Bitcoin)

This chart shows anchored VWAPs from 2025’s highs and lows painting a clear picture: TOTAL2 (Altcoins) is gearing for a clean breakout above its previous all-time high, while BTC dominance has been fading dramatically, with new resistance to watch at ~61.13%.

This tug-of-war comes as a new regulatory shift quietly opens the floodgates for altcoin ETFs.

⚖️ The New SEC Rule — What Changed

On 17 September 2025, the U.S. SEC approved the Generic Listing Standard for Commodity-Based Trust Shares; a rule that makes it significantly easier for crypto ETFs to be both filed and approved.

The significance of this new ruling:

- Before this, every ETF needed a separate 19b-4 filing and months of review.

- Now, if a token meets clear requirements for liquidity, surveillance, and transparent pricing, an exchange can list it without waiting for individual approval.

That’s why altcoin ETFs are suddenly back in play. Since the ruling took effect in late September, issuers have been re-filing and fast-tracking their products. Roughly 16 ETF applications are now under review for October deadlines, with Solana and XRP among the leading contenders.

| Requirement | What It Means | Threshold / Example |

| Liquidity | ETF must stay tradable and redeemable daily | ≥ 50 holders, ≥ 50 k shares, ≥ $1 m market value after 12 months |

| Readily Available Assets | 85% of holdings must be liquid for daily redemptions | Prevents staking-only funds |

| Surveillance Sharing | Market data must be monitored via ISG or CSSA | Futures ≥ 6 months on CME or Coinbase Derivatives qualifies |

| Transparent Pricing | Daily NAV, holdings, bid/ask spread, premium/discount chart | Publicly posted; halts if data breaks |

| Product Limits | No leverage or inverse ETFs | Plain-vanilla exposure only |

In short: the SEC just turned a slow approval maze into a rule-based checklist, and altcoins are lining up.

🌐 Why Solana Leads

Solana ticks every box that matters — liquidity, custody, price discovery, and surveillance.

- CME SOL futures > 6 months old → passes the surveillance test

- Institutional custody available (Coinbase, Fireblocks)

- ETPs already live in Europe (VanEck, 21Shares)

- High liquidity & stable spreads make it ETF-friendly

Solana therefore stands as the most prepared altcoin under the new framework.

🥇 Likely ETF Contenders

| Token | Status | Reason |

| Solana (SOL) | ✅ Ready | CME futures + custody + volume |

| XRP | ⚠️ Near | CME futures reach 6 months mid-Nov |

| LTC / BCH / DOGE / DOT | 🕓 Pending | Coinbase Derivatives futures approaching 6 months |

| ADA / MATIC / AVAX / LINK / HBAR / UNI / OP / ATOM | 🔴 Waiting | No U.S. DCM futures → need new route |

Market Takeaway

On a technical level, we could see Bitcoin dominance recover a little, but if that ~60% resistance provides a strong rejection (while crypto prices are still moving higher), it’s a clear indication that altcoin rotation has begun, and a clear fundamental catalyst would be this new SEC ruling.

- Alts are sitting on key support on their individual price charts.

- TOTAL2 is grinding at resistance.

- Bitcoin dominance, although bouncing, is rapidly approaching the 60-61% resistance.

If Solana’s ETF clears first, it could signal the start of regulated alt exposure and a rebound off this support zone.