- Elliott Wave

- November 5, 2025

- 1 min read

NZD/USD Elliott Wave: Kiwi Kicks Into Gear

Executive Summary

- NZDUSD declines in an ending diagonal pattern.

- We anticipate support to develop and drive the exchange rate up to .6100.

- Prices need to hold above .5485 for this bullish view to remain valid.

Elliott Wave Analysis

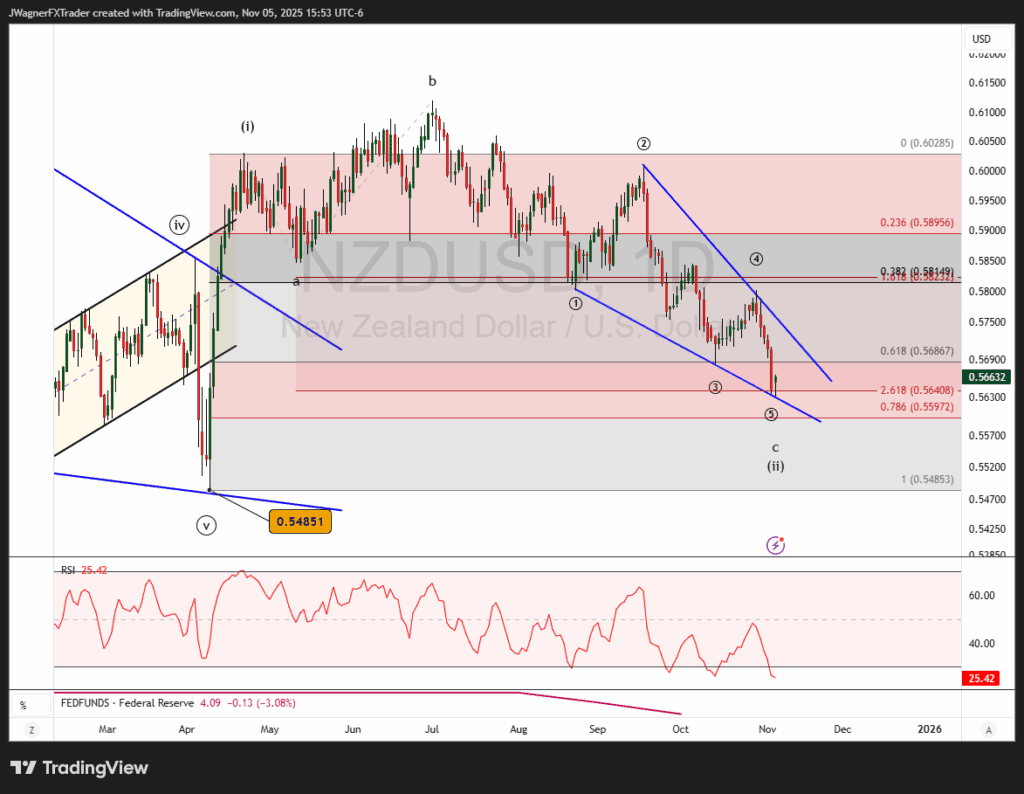

NZDUSD has been declining in choppy and overlapping waves since the July 1 high.

The Elliott wave pattern we are following is that NZDUSD is in the late stages of an expanded flat pattern labeled a-b-c. Wave ‘c’ of the pattern appears to be carving as an ending diagonal.

Ending diagonal’s are Elliott wave structures that appear like wedges, in this case a falling wedge.

There may be one more dip to finalize the pattern. Once the 5-waves from the diagonal are in place, then a booming rally is forecasted to carry NZDUSD up to the origination of the pattern near .6100.

Bottom Line

The trend lower for NZDUSD appears to be nearing the end of the correction that began in April. Once a rally begins, we anticipate a trend up to and exceeding .6100.

If .5485 support is broken to the downside, then we’ll consider alternate wave patterns.