- Elliott Wave

- May 21, 2025

- 3 min read

GBP/USD Elliott Wave: 2 Wave Scenarios

Executive Summary

- GBPUSD long-term trend remains up

- Two wave models we are closely monitoring.

- Key level distinguishing the short-term bull vs bear is 1.3565.

Elliott wave is often written off as not working or is subjective. In reality, Elliott wave is deductive. Any count that doesn’t break the Elliott wave rules is possible. Then we weigh those counts (or models) against one another to reach the higher possibility models.

The current situation in GBPUSD appears to have two higher probability options.

In no particular order…

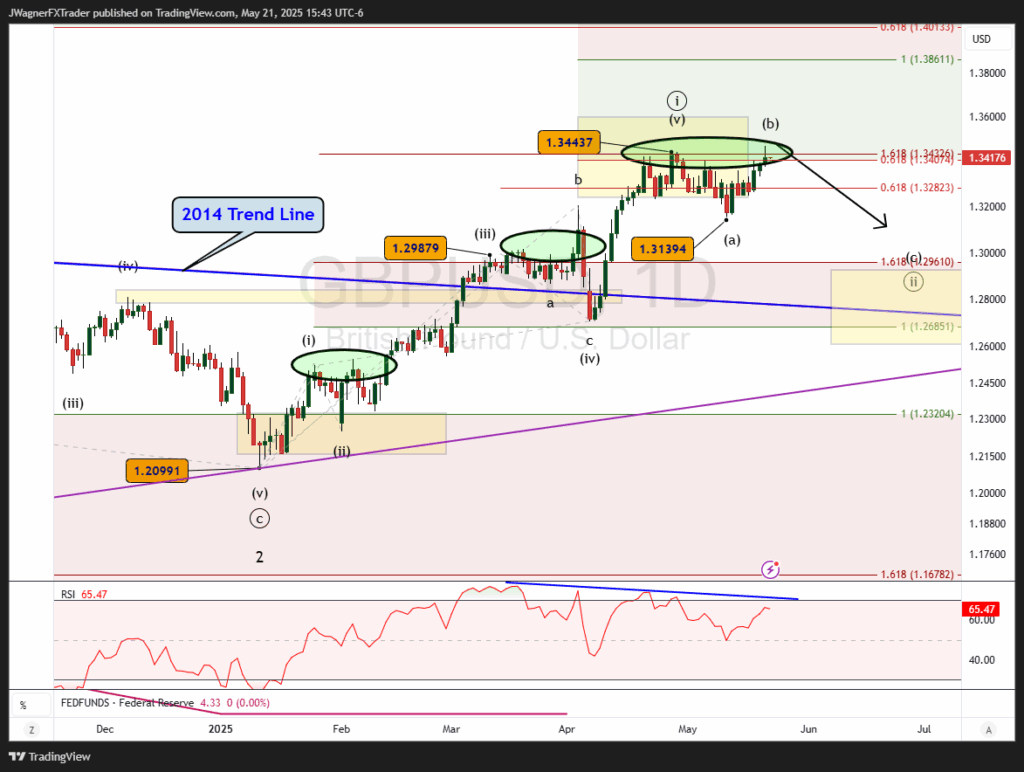

Bearish GBPUSD Elliott Wave Count

The first option is that the wave ((i)) topped and price is grinding sideways in a wave ((ii)) decline. The wave relationships match up well for the subwaves within wave ((i)). Wave ((ii)) decline was short in price and time relative to wave ((i)) and therefore needs more time or deeper declines to flush out and correct the longs.

Also, consider that after each motive rally within ((i)), notice how they all produced a ‘double top’ or ‘flat’ like structure (green circles).

The current rally may be viewed as wave (b) of ((ii)) leading to a wave (c) of ((ii)) decline to 1.27-1.31. The current rally under wave (b) could run up to 1.3565, the 1.382 expansion of wave (a). However, if the price continues higher, then the alternate scenario is likely at play.

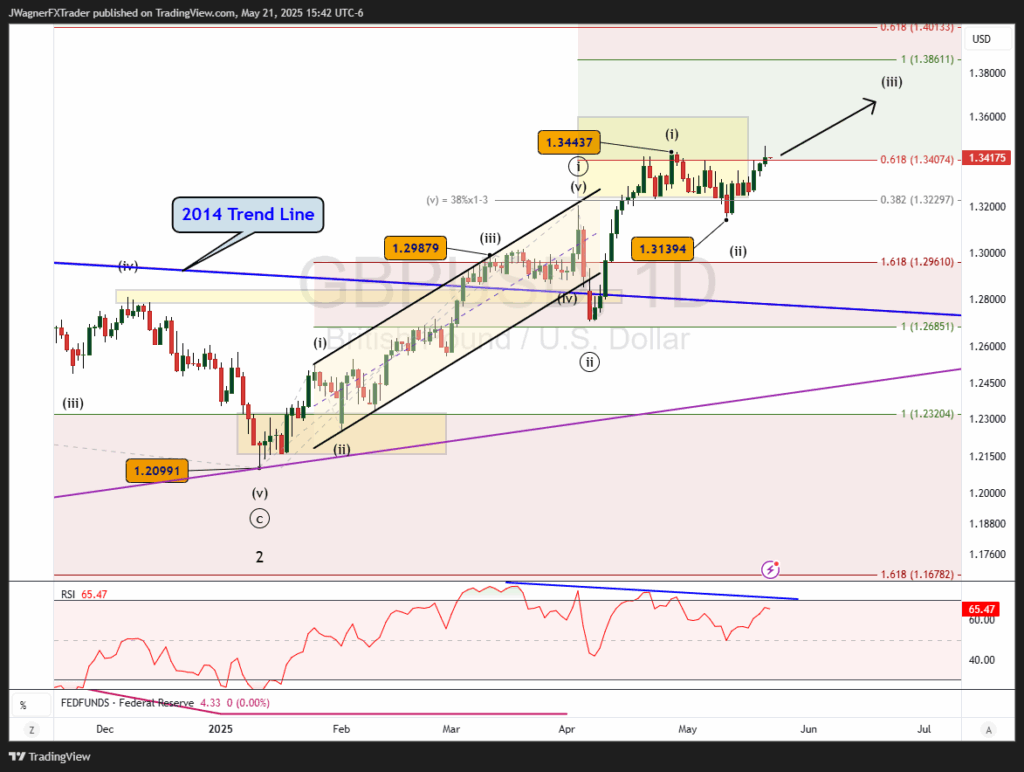

GBPUSD Bullish Elliott Wave Count

The alternate count is nearly equally viable. The impulse pattern wave ((i)) has good wave harmony within its subwaves. Wave (i) of ((iii)) is starting its rally to much higher levels.

The biggest knock against this model is that wave ((ii)) only lasted 2-3 days while wave ((i)) lasted for 2.5 months. The price correction in wave ((ii)) is satisfactory, but the time needed for such a correction was very short. No rules have been broken for this wave count. If it were correct, then it suggests the bullish sentiment is pent up so much that corrections are shallow in price and time.

Upside targets for this model using the Fibonacci extension tool project to 1.38, 1.46 and possibly higher.

Bottom Line

GBPUSD has progressed through the first wave of a larger degree wave 3. It is unclear whether the bearish or bullish count is preferred. The inability to break above 1.3565 opens the door for the bearish count and lower levels down to 1.27-1.31.

The blue trend line may offer support should Cable need to correct lower.

A break above 1.3565 gives preference to the bullish count with the potential for a continued rally to 1.38 and possibly 1.46.

You might also be interested in:

Previous GBPUSD Elliott Wave Report: