- Elliott Wave

- April 28, 2025

- 2 min read

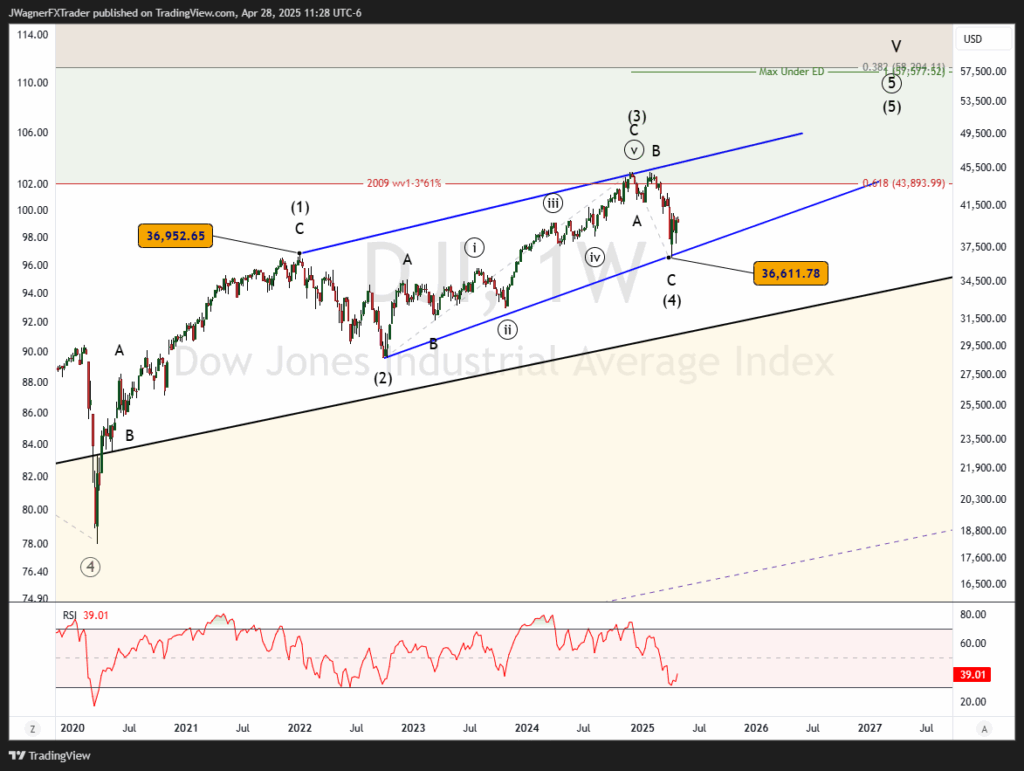

Dow Jones (DJI) Elliott Wave Forecast for 2025

Executive Summary

- Dow Jones Industrial Average (DJI) remains bullish in the medium-term to retest all-time highs.

- The April 2025 low appears to be wave (4) of an ending diagonal pattern that began in 2020.

- A break above 42,821 generates a series of higher highs confirming a wave (4) low.

Current Elliott Wave Analysis

The Dow Jones Industrial Average (DJI) appears to be carving out a long-term Elliott wave ending diagonal pattern that began in 2020.

The ending diagonal is a 5-wave motive structure where each of the five waves are zigzags or multiple zigzag patterns.

This type of structure is often seen after a long impulsive structure and looks like an incomplete rising wedge pattern. In this case, the ending diagonal would be making up the 5th wave of a larger impulse price structure that began in 2009.

If the April 2025 low of 36,612 is the end of wave (4), then DJI is rallying in a fifth and final wave of the pattern that began in 2009.

The fifth wave of an ending diagonal structure does not have to push to new highs, but will likely retest it.

There is a limit to how high the fifth wave of a diagonal would rally. DJI would need to hold below 57,577 for the ending diagonal pattern to remain valid.

The fifth wave of a diagonal would need to be a zigzag or multiple zigzag structure. So, we’ll count out the waves and if a zigzag appears to be terminating while DJI is at or above the recent all-time high, then we’ll be on high alert for a bearish reversal.

Bottom Line

DJI appears to have bottomed in wave (4) of an ending diagonal in April 2025. This implies a zigzag rally A-B-C in wave (5) to retest and possibly surpass the current all-time high.

Within the ending diagonal pattern, this wave (5) rally would need to hold below 57,577 so the ultimate target likely sits within 45,000 – 57,577.

You might be interested in…