- Elliott Wave

- January 12, 2026

- 2 min read

Bitcoin Elliott Wave: DOJ Against Powell Can’t Spark Direction

- Rallies are choppy

- Another decline may be needed to flush out longs

- $87,142 is the bullish key level

The US Department of Justice served a subpoena on Friday threatening to open up an indictment against the Fed Chairman Jerome Powell.

This has spooked hard assets like gold and silver to continue their buying sprees as the Federal Reserve is the appointed coin and bill manager for the US government. Other hard assets like Bitcoin didn’t benefit from the buying spree today. Let’s dig into Bitcoin’s Elliott wave pattern.

Bitcoin Elliott Wave Analysis

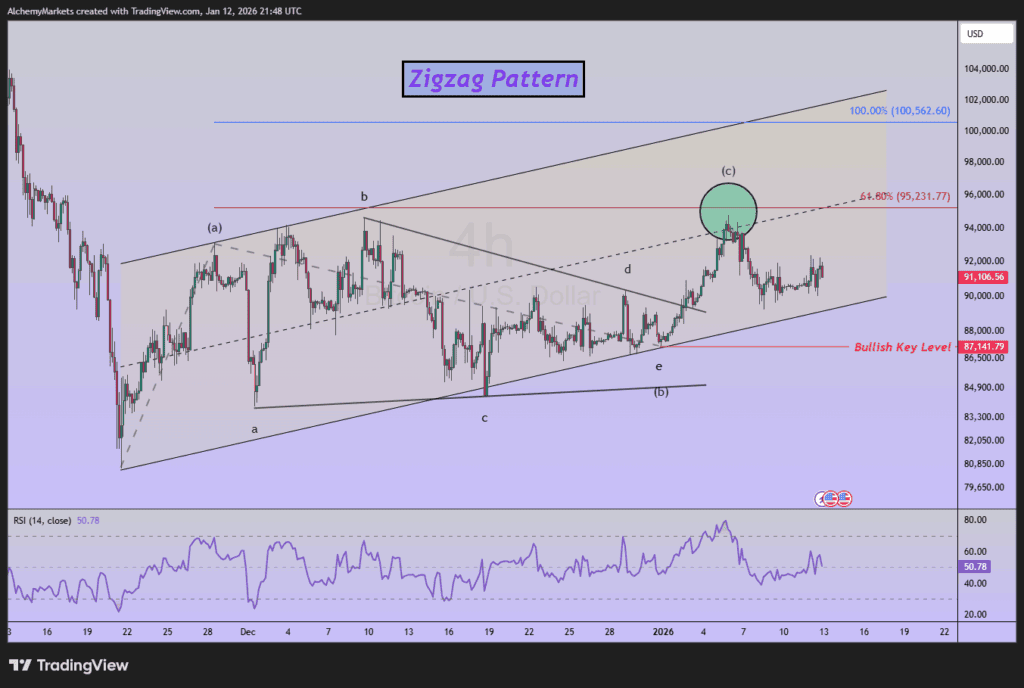

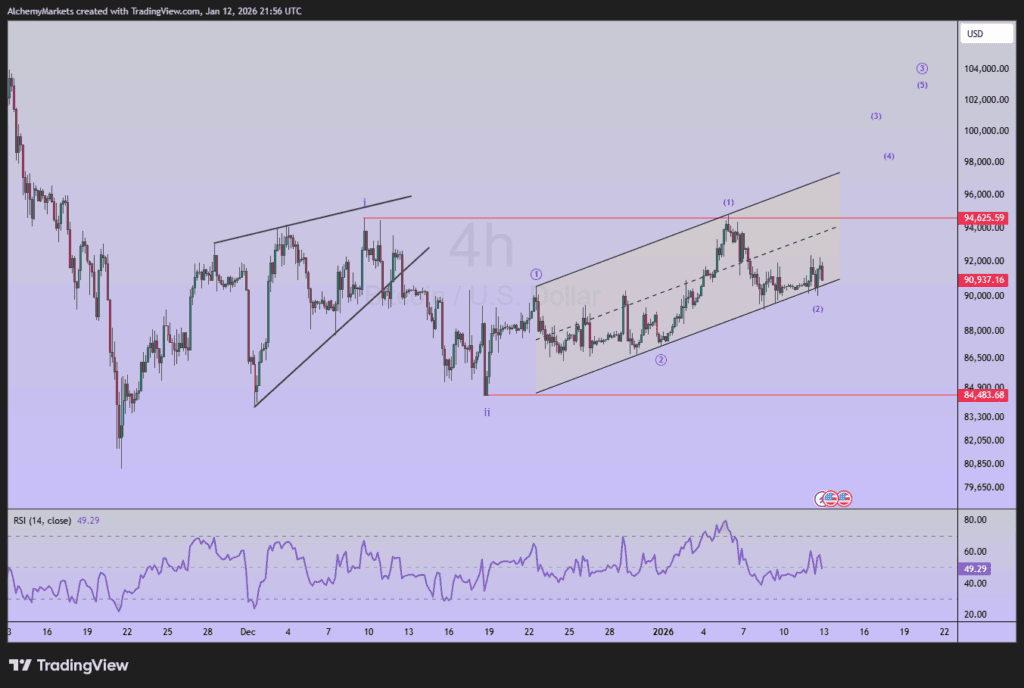

The Elliott wave analysis for Bitcoin shows the cryptocurrency may be entrenched within a corrective rally.

There are two Elliott wave counts we are following for Bitcoin.

The first count is suggesting Bitcoin is within a corrective rally and may decline to below $84k.

The reason we view this as a primary count is because the rallies appear choppy and not clean impulse patterns. The rally from the November low is viewed as an (a)-(b)-(c) zigzag pattern where wave (b) shapes as a symmetrical triangle.

The wave harmony does fit as wave (c) of the zigzag pattern is nearly .618 times the length of wave (a). That is a common wave relationship you can use the Fibonacci extension tool to determine the harmony.

If Bitcoin breaks below $87,142, then it will open the door for a decline below $80,620.

The secondary and alternative wave count we are following is a bullish count that eventually may propel Bitcoin up to new all-time highs.

The secondary count points to a building of 1-2 and 1-2 waves at three degrees of trend. Under this scenario, wave 3 would unfold at three degrees of trend and would be a strong and powerful trend higher. Price basically needs to accelerate immediately for this pattern to hold out.

Unfortunately, when bullish news like the Fed receiving notice from the DOJ doesn’t meaningfully push the price of Bitcoin higher, then it suggests a weak market.

A break above $94,625 would signal a continuation higher while the price holds above $84,484.

Bottom Line

Keep an eye on $94,625 and $87,142. If the $94k figure breaks first, then the secondary alternative count is biased towards the favorite. If the $87k figure breaks first, then, the primary count remains the favored view.