- Elliott Wave

- July 18, 2025

- 2 min read

200 Wall, 184 Fall: GBPJPY Elliott Wave Diagonal

Executive Summary:

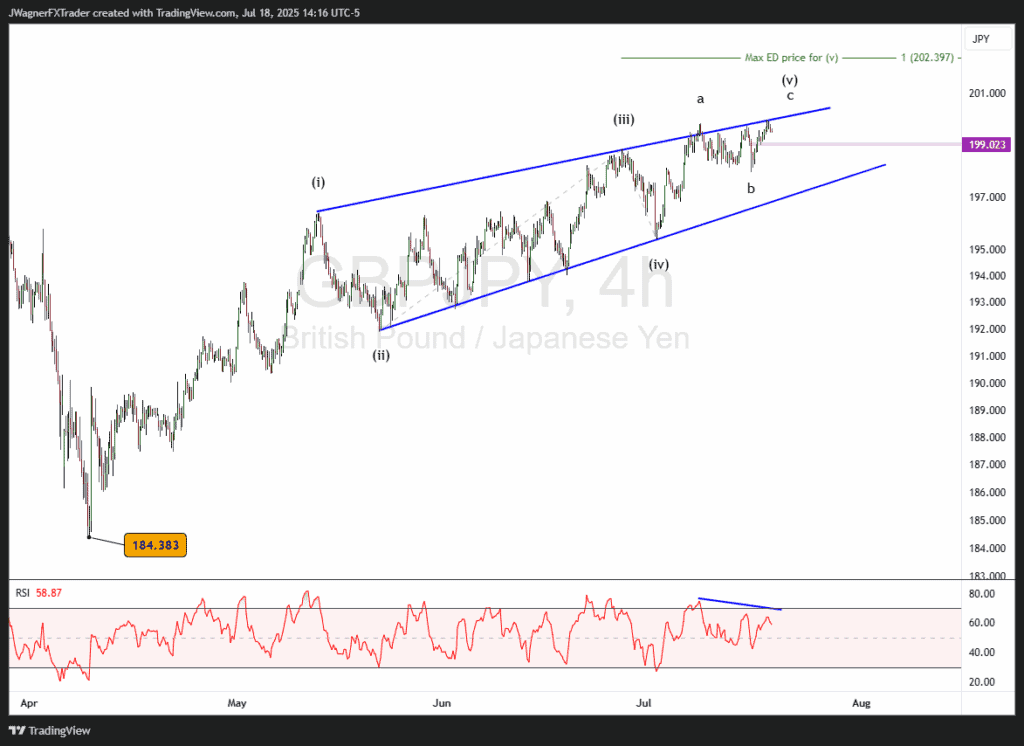

- GBPJPY shaping a diagonal pattern.

- Large bearish reversal could push down to 184.

- Above 202.40 voids the pattern as labeled.

I typically don’t conduct Elliott wave analysis on cross pairs simply because they are the children of the two main currencies involved. GBPJPY is the child of GBPUSD and USDJPY.

With that said, I still scroll through charts looking for compelling patterns and GBPJPY caught my attention.

First, it’s knocking on the door of 200…a nice round number for resistance.

Secondly, the rally from 184 in April to now appears to be a very mature Elliott wave ending diagonal pattern. The Elliott wave diagonal pattern is similar to common technical chart pattern like the rising wedge.

Diagonals shape in 5 waves. Remember, wave 3 cannot be the shortest of waves 1,3,5. Since wave 3 is shorter than wave 1, that means wave 5 cannot be longer than wave 3.

So we simply measure out wave 3 using the 100% Fibonacci extension level and apply it to the end of wave 4, and, voila, we have a maximum target for wave 5 at 202.40.

That maximum target doesn’t mean GBPJPY has to go that high, but this market is ripe for a large bearish turn. If GBPJPY does push above 202.40, then my wave labeling is incorrect.

Ending diagonals tend to be fully retraced which implies a decline back to 184.

GBJPY may dance around in the 199 handle for a day or two.

A break below 199 could be an early warning signal of the bearish reversal. A break below the blue support trend line adds more confirmation to the bearish reversal.

If this bearish reversal takes hold, then GBPUSD or USDJPY likely experience a large decline too as they are the ‘parents’ of GBPJPY.

You might be interested in…