- Chart of the Day

- March 12, 2025

- 3 min read

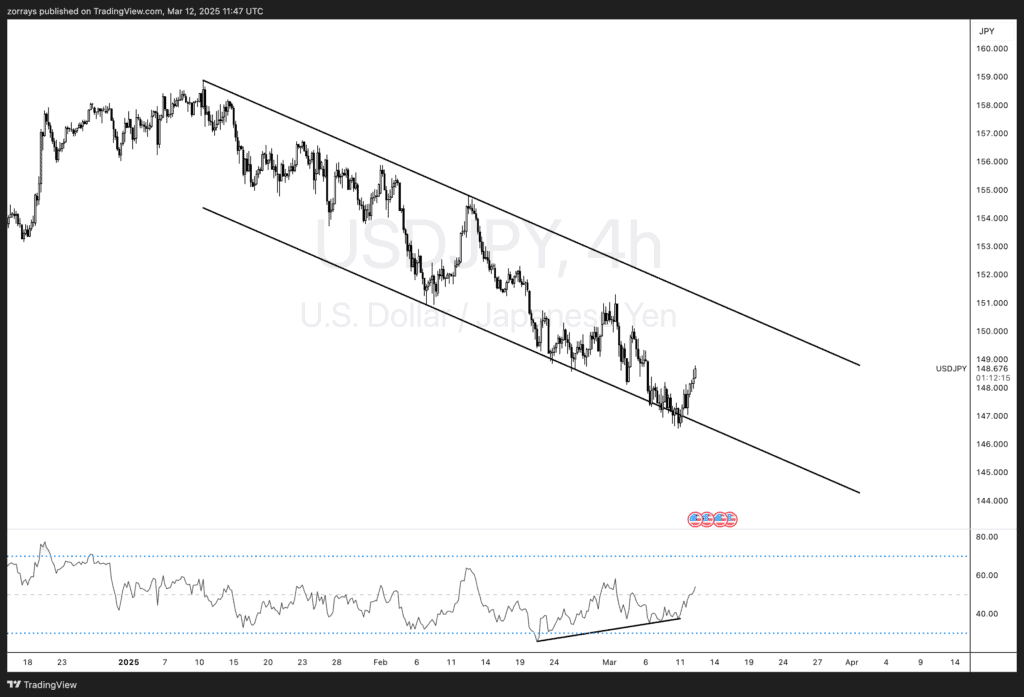

USD/JPY Rebounds from Lower Bound of Descending Channel

The USD/JPY currency pair has been caught in a well-defined descending channel on the 4-hour chart, consistently making lower highs and lower lows since its peak earlier this year. However, today’s price action suggests that a potential relief rally is underway, as USD/JPY bounces off the lower bound of the channel with strong confirmation from the Relative Strength Index (RSI).

Technical Breakdown

Descending Channel in Play

- The price action remains within a well-structured downward-sloping channel, clearly respecting both the upper and lower trendlines.

- The recent rejection at the lower boundary suggests that sellers have temporarily exhausted their momentum, allowing for a countertrend move.

RSI Bullish Divergence Signals a Reversal

- The RSI indicator has been forming a bullish divergence, meaning while price continued making lower lows, RSI was forming higher lows—a classic sign of weakening bearish momentum.

- The RSI has now climbed above the 50 mark, a key level that typically signals a transition from bearish to bullish momentum.

Upside Targets & Key Levels to Watch

- If momentum sustains, USD/JPY could challenge the upper bound of the descending channel, which currently aligns around the 150.00-151.00 zone.

- A clean break above the channel would invalidate the bearish structure and could open the door for a larger upside push.

Macro Factors Supporting the Move

- U.S. Inflation Expectations & Fed Rate Speculation

- The latest U.S. CPI data is closely watched by traders, with markets anticipating whether the Federal Reserve will maintain its hawkish stance or pivot towards rate cuts later this year.

- A stronger-than-expected inflation print could fuel renewed USD strength, supporting a breakout from the descending channel.

- Japanese Yen Strength & BoJ Policy Outlook

- The Bank of Japan (BoJ) has been signaling a potential shift in its ultra-loose monetary policy, but the yen remains under pressure as traders question how soon rate hikes could come.

- If the BoJ remains dovish, USD/JPY could find additional upside support as interest rate differentials continue to favor the dollar.

- Risk Sentiment & Safe-Haven Flows

- Market sentiment remains fragile amid ongoing global geopolitical tensions and uncertainty in financial markets.

- If risk appetite improves, the USD/JPY pair could see more upside momentum as investors rotate into higher-yielding assets.

Final Thoughts: Is USD/JPY Setting Up for a Rally?

With price bouncing off the lower bound of the channel, RSI showing a bullish divergence, and macroeconomic forces in play, USD/JPY appears to be making its way toward the upper bound of the descending channel.

Traders should keep an eye on the 149.50-150.00 zone, as a break above could indicate further bullish momentum, while failure to sustain gains could see the pair re-test the lower bound of the channel.

Key levels to watch:

- Support: 146.50-147.00

- Resistance: 149.50-150.50 (Upper Channel)