- Chart of the Day

- September 17, 2025

- 3 min read

Post-FOMC Update: Fed Cuts 25bps, SPX Tests Upper Channel Resistance

The Federal Reserve delivered its first rate cut since December 2024, lowering the federal funds target range by 25 basis points to 4.00% – 4.25%. Officials signalled two additional cuts this year, citing slowing job growth, a modest uptick in unemployment, and inflation that remains above target but is seen as more manageable. The vote was not unanimous, with Governor Miran dissenting in favor of a larger 50bps move.

From a policy perspective, this marks the beginning of an easing cycle. The Fed is effectively shifting its balance of risks away from runaway inflation and toward concerns about a softening labour market. The implication for markets: monetary conditions are turning more supportive, but for reasons tied to weaker growth.

First-Order vs. Second-Order Market Impact

At first glance, equities welcomed the cut — lower borrowing costs and a steeper yield curve tend to support risk assets. Tech and growth sectors benefit directly from lower discount rates, while banks gain if the curve steepens. Rate-sensitive segments such as REITs and utilities also find near-term support.

However, the second-order implication is more nuanced. The Fed is cutting because the labour market is weakening. If jobs slow materially, that translates into earnings downgrades in coming quarters. In other words, the equity market may initially rally on liquidity, but it must eventually reckon with weaker fundamentals.

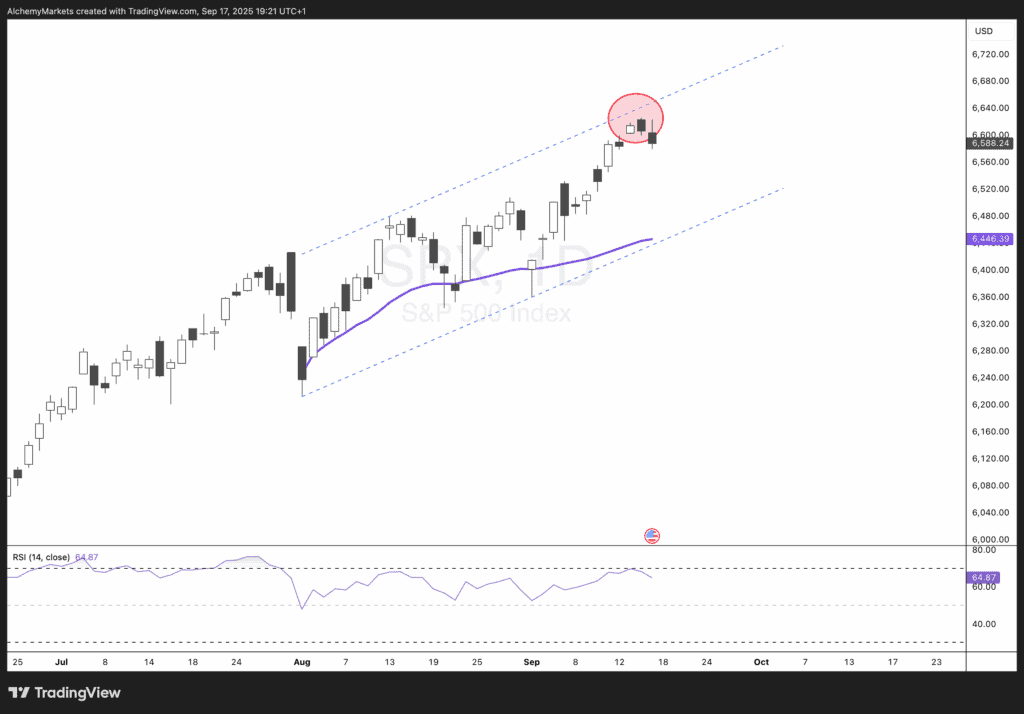

SPX Technical Setup: Rising to the Upper Bound

On the chart, the S&P 500 Index (SPX) has rallied sharply into the upper boundary of its rising channel. Price action is now pressing against resistance, highlighted by the recent cluster of candles near 6,600. This is a critical juncture:

- Scenario A – Rejection at Resistance

If SPX fails to break above the upper channel, a pullback toward the mid-channel line (~6,480) or even the lower boundary (~6,300) becomes likely. This would fit a narrative where the Fed’s cut is seen as a “growth scare,” and investors reassess earnings risk. - Scenario B – Breakout and Continuation

A clean break above the channel could trigger momentum flows, with systematic and trend-following strategies adding exposure. In that case, SPX could extend toward 6,700+ in the short term, effectively ignoring the technical ceiling as liquidity trumps fundamentals. - Scenario C – Riding the Pig

In a less probable but important scenario, SPX could entirely disregard the channel structure and grind higher despite weakening macro data. This would reflect excess liquidity and positioning rather than fundamentals — a “liquidity-driven melt-up.” While attractive in the short run, this path risks a sharper unwind later if growth disappoints further.

Bottom Line

The Fed has opened the door to easing, and equities are testing the upper bounds of optimism. The immediate direction of SPX hinges on whether liquidity flows dominate (Scenario B/C) or whether growth concerns take precedence (Scenario A).

Investors should respect the technical channel as a guide but remain aware that policy-driven markets often overshoot. In this environment, near-term rallies are tactical opportunities, not structural certainties. The sustainability of the move will ultimately depend on upcoming labor data, inflation prints, and how quickly earnings expectations adjust to the Fed’s new reality.