- January 28, 2025

- 24 min read

Weighted Moving Average

The Weighted Moving Average (WMA) smooths out price data to identify price trends in the financial markets. Like all moving averages, its output value changes each time an asset prints a new price, with recent prices given higher weight than older prices. The WMA reacts much quicker to current price trends than the regular simple moving average (SMA).

What is the Weighted Moving Average (WMA)?

The Weighted Moving Average (WMA) is a technical analysis tool that assigns higher weights to recent prices allowing traders to identify trends and spot trade entries and exits. This results in a smoother moving average line that paints a clearer picture of the underlying trend. The WMA reacts much faster to price changes than the SMA but is much slower than the EMA.

How Does the Weighted Moving Average Indicator Work?

The Weighted Moving Average works by multiplying each price in a given period by a weight. The weight tends to decline the further away the data point is from the current price. Therefore, recent prices have a higher weight than older ones. For example, a 10-period WMA would allocate a weight of ten to the latest price, with the previous data point’s price weighting 9, and so on. The formula allows current prices to influence the results more heavily while still incorporating older prices.

As a result, the WMA is much faster than the SMA because the SMA assigns equal value to all prices. This allows traders to identify shifting trends quickly. The WMA can also help traders identify potential trade entry and exit points and determine trend direction and strength.

Importance of Weighted Moving Average Indicator

Quick Reaction to Price Changes

The WMA tends to react quickly to new price data, making it ideal for fast-moving financial markets like the forex and stock markets. All types of traders can apply the indicator to catch market moves.

Trend Confirmation

The WMA helps confirm a trend’s direction by assessing whether the price is above or below the WMA. The price is considered in an uptrend if it is above the WMA and in a downtrend if it is below the WMA. The indicator helps determine whether the market is in an uptrend or downtrend.

Strategic Entry and Exit Points

Traders can use the indicator to spot strategic trade entry and exit points by identifying crossover signals, where the price crosses the WMA. Based on their direction, these crossovers can act as solid trade entry and exit signals.

Customisable for Different Strategies

You can adjust the WMA’s timeframe to align with your trading style. A day trader or scalper might consider lower timeframes like the 15-minute or 1-hour charts. A swing or position trader may consider longer timeframes, such as the daily and weekly charts.

How to Calculate Weighted Moving Average

A Weighted Moving Average (WMA) gives more importance to recent data points, unlike a simple moving average that treats all data equally. Here’s how to calculate it step by step:

- List Your Data: Write down the prices or values for the selected period. For example, if you’re calculating a 5-day WMA, list out the closing prices for the last 5 days.

- Assign Weights: Weight each value, giving more weight to the most recent data. For a 5-day WMA, the weights might be 5, 4, 3, 2, and 1.

- Multiply and Sum: Multiply each data point by its weight, then add up all these products.

- Divide by Total Weights: Add up the weights (e.g., 5+4+3+2+1 = 15) and divide the sum of the weighted values by this total.

Weighted Moving Average Formula

The WMA formula looks like this:

WMA = Σ(Price x Weights)/ Σ(Weights)

Weighted Moving Average Example

For example, if the prices for the past 10 days were 20, 16, 13, 19, 23, 18, 15, 21, 25, 17.

The weights would be 10, 9, 8, 7, 6, 5, 4, 3, 2, and 1.

- Multiply the price by the weights:

| Closing Price (N) | Weight | N x Weight | |

| Day 1 | 20 | 10 | 200 |

| Day 2 | 16 | 9 | 144 |

| Day 3 | 13 | 8 | 104 |

| Day 4 | 19 | 7 | 133 |

| Day 5 | 23 | 6 | 138 |

| Day 6 | 18 | 5 | 90 |

| Day 7 | 15 | 4 | 60 |

| Day 8 | 21 | 3 | 63 |

| Day 9 | 25 | 2 | 50 |

| Day 10 | 17 | 1 | 17 |

| Total | 55 | 861 |

- Add the weighted values = 861

- Add weights = 55

- Calculate the WMA

WMA = 861/55 = 15.65

Therefore, the 10-period WMA is 15.65.

Weighted Moving Average Trading Strategies

The Weighted Moving Average (WMA) is a versatile technical analysis indicator that helps traders make smarter decisions by focusing on recent price trends. Let’s look at some actionable strategies you can apply when trading with the WMA.

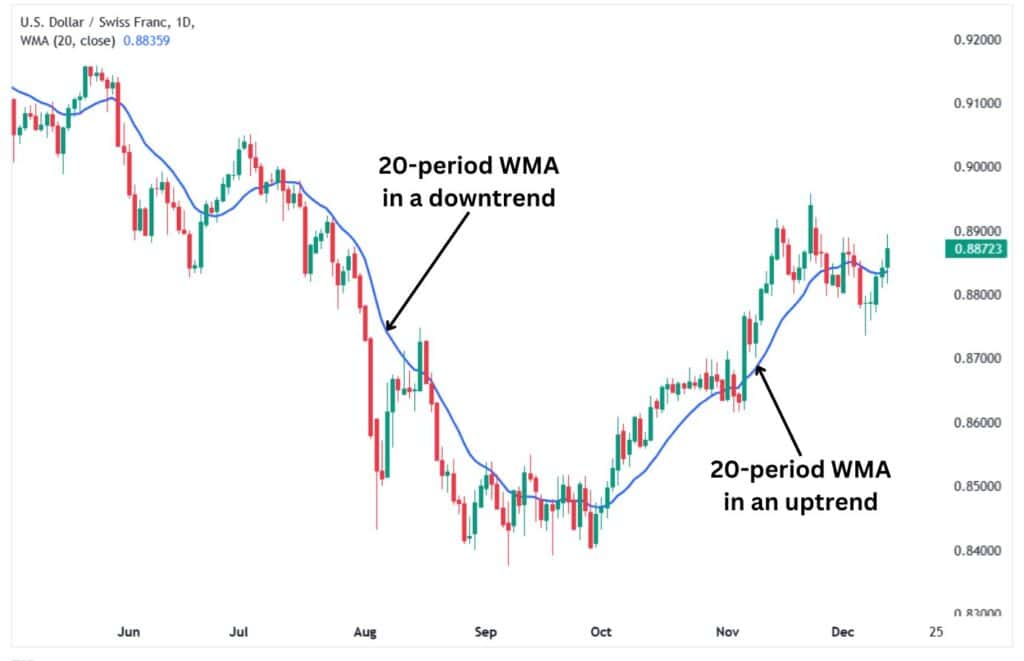

Determine Trend Direction

You can use the WMA to identify whether a market is moving up, down, or sideways. The WMA is an average price over the past x periods; therefore, if the current price is above the WMA, it is in an uptrend. The opposite is true of scenarios where the price is below the WMA, which usually indicates that the price is in a downtrend since it is performing worse than the average.

Therefore, in most cases, an uptrend will remain in place as buyers continue pushing prices higher, while a downtrend will likely persist as sellers continue pushing prices lower. This is why the WMA is considered a solid indicator of price trends, especially in trending markets.

Pro Tip: To confirm the trend direction, combine the medium WMA with a longer WMA, such as the 50 period.

Determine Trend Strength

You can determine the trend strength using the Weighted Moving Average (WMA) by analysing the crossovers of a short-term and long-term WMA. Price is considered in a robust trend if it trades above or below both the short-term and long-term WMAs. For example, the price is considered a strong uptrend if it trades above the 50-period and 200-period WMAs. A trend is considered weak if the price is trading sideways and frequently crisscrossing above and below the WMA as the price alternates between gains and losses.

Pro Tip: Pair the WMA with an oscillator like the RSI to validate whether the trend has enough strength to continue.

Determine Trend Reversals

WMAs can signal when a trend might be losing momentum and getting ready to reverse. This signal is usually generated whenever the price crosses above a long-term moving average. For example, if the price crosses above the 200-period WMA, it is considered to be in an uptrend, while if it crosses below the same WMA, it is regarded as being in a downward trend.

Find Support and Resistance Areas

The WMA can act as a dynamic level of support (in an uptrend) or resistance (in a downtrend). The WMA acts as resistance and support since it represents the average price in the recent past and acts as a value area.

Therefore, whenever the price touches the WMA in an uptrend, buyers think the asset is priced at a discount; hence, they buy more of it, leading to a bounce higher. The opposite is true when the price is in a downtrend; when it rises to touch the WMA, investors think the asset is overpriced and proceed to sell more, pushing prices lower.

WMAs can help you make informed, confident trading decisions by tracking trends, assessing their strength, and pinpointing reversals or support/resistance levels. It’s all about blending this tool into your trading style!

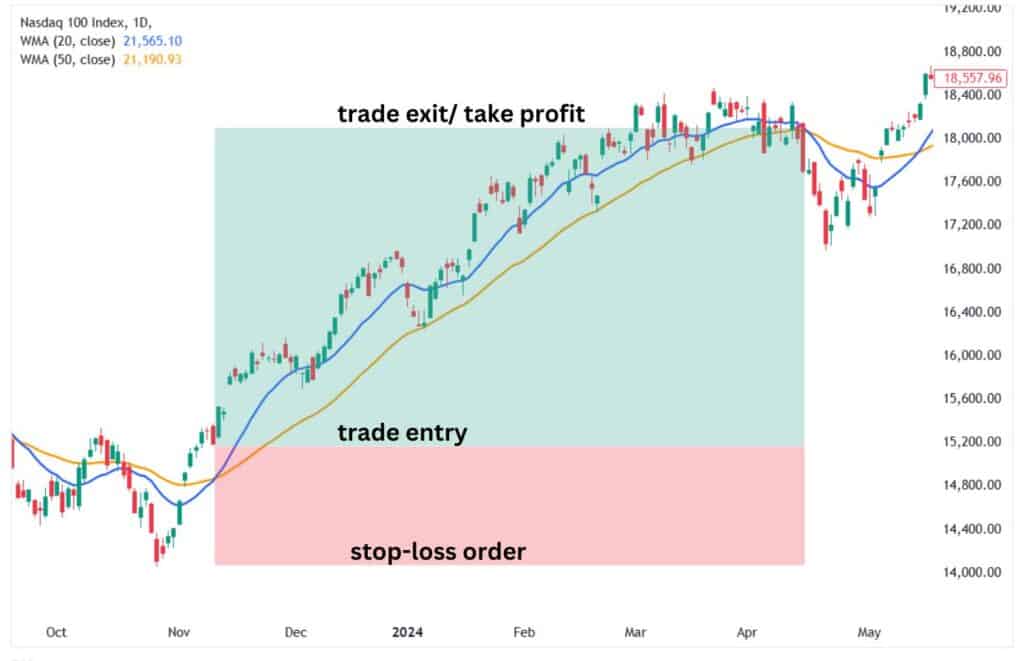

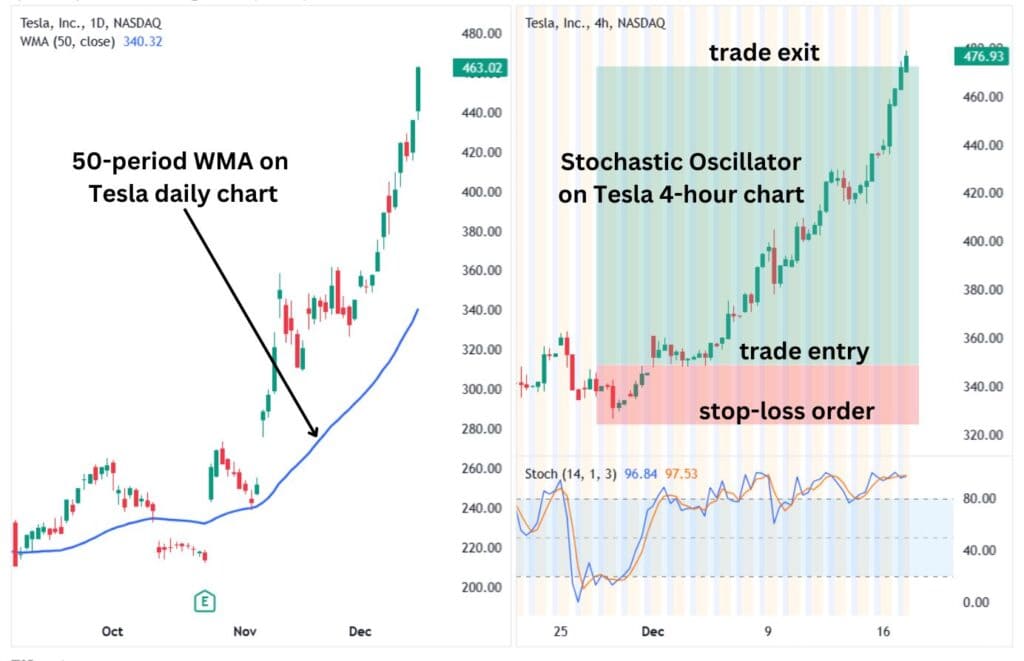

Trend Filter in Multiple Time Frame Analysis

A trend filter helps traders assess whether the market’s movement aligns consistently across various time frames. The multiple timeframe analysis can be split into three processes.

First, it involves analysing the longer timeframe, such as the daily chart, using the 50-period or 200-period Weighted Moving Average (WMA).

Step two is to move to a lower timeframe (the 4-hour chart in this example) while applying an indicator like Stochastic RSI. Wait for a StochRSI signal that aligns with the direction on the higher timeframe of step 1.

Step three involves placing your trade entries based on the alignment between the higher and lower timeframes.

When scaling down from the higher timeframe charts to the lower timeframe charts, the ratio you should use is 4:1 or 6:1. This means that if you are using a daily chart as your long-term chart, then your lower timeframe chart should be the 4-hour chart, which represents a 6:1 ratio.

Be careful about the ratio between the higher and lower chart time frame used. If you apply a 50-period WMA on the daily chart, you are tracking price changes over the past two months. On the other hand, if you use the 14-period stochastic on the 15-minute chart, you are tracking price changes over the past three and a half hours. The signals you receive from the past three and a half hours are not related to the price trends over the past two months.

In this instance, a massive gap exists between a two-month chart and a three-and-a-half-hour chart so the ratio needs to be brought back in line. Changing the trigger chart to a 14-period stochastic on a 4-hour chart OR changing the trend chart to a 60-minute or 90-minute chart time frame will resolve that gap.

WMA with RSI

Combining the Weighted Moving Average (WMA) with the Relative Strength Index (RSI) integrates a trend-following tool with a momentum-measuring indicator. The WMA focuses on recent price movements, offering insights into the market’s current trend. Whenever the price is above the WMA, it is in an uptrend; when it is below the WMA, it is in a downtrend.

Meanwhile, the RSI measures whether the trend is strong or showing signs of exhaustion. For example, when the RSI is in overbought conditions (above 70), it signals that the trend may have gone too far up and could be ready for a reversal lower. The same applies when the RSI is in oversold conditions (below 30); it usually signals that the trend has fallen too much and might be ready to reverse higher.

Therefore, if the price crosses below the WMA and the RSI crosses from overbought conditions, we could be in for a sustained downtrend. The opposite applies when the price crosses above the WMA and the RSI moves from oversold conditions, which could signal the beginning of a new uptrend.

WMA with MACD

The Weighted Moving Average (WMA) and Moving Average Convergence Divergence (MACD) are powerful tools for identifying trends and timing trades effectively. The WMA focuses on recent price changes and helps traders identify whether the price is in an uptrend, downtrend, or is trading sideways. On the other hand, the MACD evaluates the strength and momentum behind the price movement. The MACD has three components: the MACD line, the signal line, and the histogram.

For example, when the price is above the WMA (in an uptrend), and the MACD line is above the signal line, this typically means that the price is in a robust uptrend. The opposite is true when the price is below the WMA (in a downtrend), and the MACD line is below the signal line, which indicates a strong downtrend. The histogram bars are usually more prominent during a robust uptrend or downtrend than during weak trends.

WMA with Bollinger Bands

Pairing the Weighted Moving Average (WMA) with Bollinger Bands® offers a strategic blend of trend-following and volatility measurement. The WMA responds quickly to price movements and can easily identify whether an asset is in a downtrend, an uptrend, or is trading sideways. Meanwhile, Bollinger Bands are great at tracking the volatility in a market as they expand during periods of high market activity and contract when the market is quieter.

You can use the two indicators to identify potential trading opportunities, such as when the price breaks above the upper Bollinger Band and keeps trading above it while simultaneously being above the WMA. The price is in a robust uptrend. Alternatively, when the price is trading near or below the lower band and below the WMA, it indicates that it is in a robust downtrend.

WMA with ATR

The Weighted Moving Average (WMA) and Average True Range (ATR) are essential tools for tracking trends and assessing market activity. The WMA highlights the market’s directional movement, while the ATR measures the price volatility driving those trends. You can use the ATR in your trading strategy to determine the distance to base the stop-loss order. At the time of the WMA signal, a 1x or 2x ATR value can be the distance to set your stop loss from the entry.

For example, in the chart below, the price crossed above the 50-day WMA, signalling the beginning of an uptrend. At the time of the crossover, the ATR value was 66.4 pips. Hence, the trader can place their stop-loss at 2x ATR to give the trade enough breathing room and avoid prematurely being taken out of the trade. This means a stop loss distance of 132.8 pips from the entry price is where the stop loss order gets placed. The trader would then set their take-profit level at the next price intersection with the 50-day WMA.

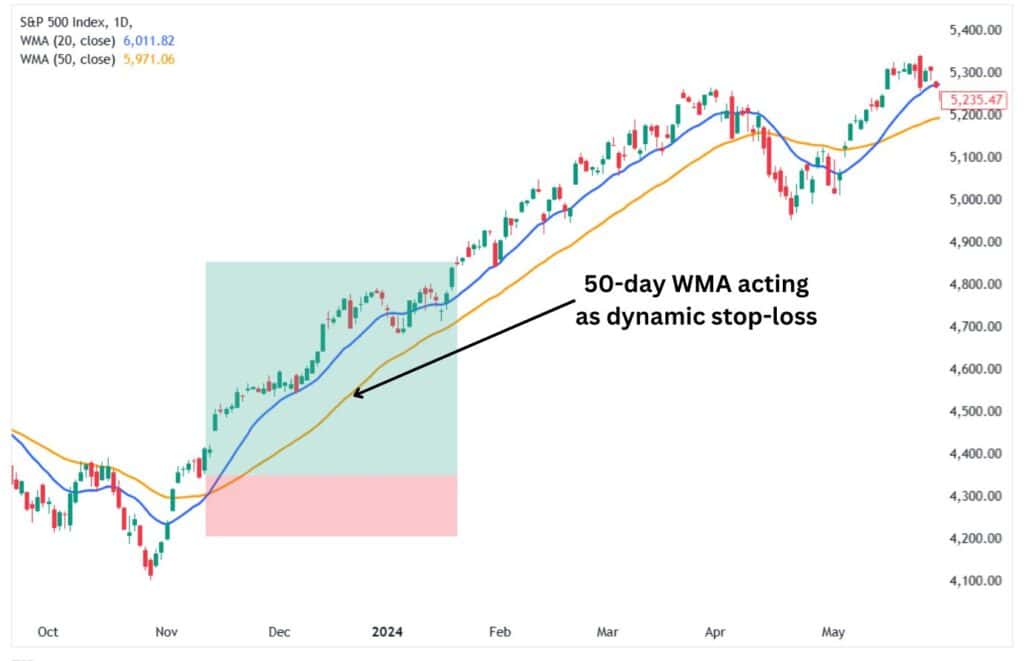

Use the Weighted Average as a Dynamic Stop Loss

Using the Weighted Moving Average (WMA) as a stop-loss guide provides a dynamic approach to managing risk. Instead of relying on a static level, the WMA adjusts with the market, allowing traders to respond to changing conditions.

For example, in an uptrend, positioning your stop-loss just below the WMA helps you stay in the trade while the trend holds, but it also protects your profits by triggering an exit if the price reverses direction. This method helps traders balance flexibility and discipline in their trading strategies.

Advantages of The Weighted Moving Average

Prioritises Recent Market Activity: Unlike some other moving averages, the WMA gives the freshest data more attention, making it quick to adjust when the market shifts. This is a great tool for traders who thrive on fast-paced action and need indicators that keep up.

Early Trend Spotter: Because it emphasises recent prices, the WMA can catch turning points in the market faster than slower averages. It’s like having a radar tuned to detect momentum changes before they fully develop.

Balances Noise Reduction and Speed: The WMA smooths out some of the random market noise while still reacting to meaningful price moves. It’s the middle ground between stability and sensitivity, giving traders a clearer view of what’s unfolding.

Disadvantages of The Weighted Moving Average

Overreacts to Market Volatility: The WMA’s focus on the latest prices can sometimes backfire. A sharp price jump or drop might throw off its accuracy, leading traders down the wrong path if they don’t confirm signals with other tools.

Complexity for Manual Use: While the math isn’t rocket science, the WMA’s formula is more complex than the simple averaging used in SMAs. For traders who prefer straightforward methods, this extra step might feel like a hassle.

Delayed Action in Fast Markets: Despite being faster than the SMA, the WMA can’t fully escape its dependence on historical data. It might lag just enough to make a difference in high-stakes trading, where every second counts.

Weighted Moving Average vs Simple Moving Average

Think of moving averages as tools to smooth out price movements and reveal trends. But how they treat past prices is where the story changes:

Simple Moving Average (SMA):

The Simple Moving Average (SMA) is like an equal opportunity calculator—it treats all past prices in the selected period the same. If you’re looking at a 10-day SMA, it adds up the last 10 days of prices and divides by 10. Simple, right? This makes it steady and less reactive to short-term price jumps, which is great for spotting long-term trends but slower to catch rapid changes.

- Good for: A broad view of the market.

- Limitation: Slow to react to sudden price shifts.

Weighted Moving Average (WMA):

The WMA doesn’t play fair—it gives the latest prices more importance. Recent data gets a heavier “weight” in the calculation, so the indicator reacts faster to what’s happening now. It’s like having a front-row seat to the market action. This makes it more useful for traders who need timely signals.

- Good for: Quick adjustments to market changes.

- Limitation: Overreacts to sudden price spikes or noise.

In Summary:

If the market is a conversation, the SMA listens to everyone equally, while the WMA leans in to hear what the most recent speakers have to say. SMA is your go-to for slow, steady trends, while WMA is for those who want to stay sharp and catch the latest moves.

Weighted Moving Average vs Exponential Moving Average

Both the WMA and EMA are like magnifying glasses for spotting market trends, but they focus on recent price movements in slightly different ways.

Weighted Moving Average (WMA):

The WMA gives each price in the selected period a specific weight. Recent prices are treated as VIPs, with older prices getting less say in the calculation. This means the WMA responds quickly to price changes, making it a good fit for short-term traders who want to stay on top of the latest price shifts.

- Strength: Reacts quickly to market changes.

- Weakness: It might overreact to sudden spikes, so confirm signals with other tools.

Exponential Moving Average (EMA):

The Exponential Moving Average (EMA) is a bit more sophisticated. Instead of assigning fixed weights like the WMA, it applies a mathematical formula that gives recent prices an exponential emphasis. While the EMA also prioritises the latest data, it does so in a smoother, more gradual way, making it less likely to overreact to one-off price jumps.

- Strength: Balances responsiveness with stability, making it useful for both short-term and long-term analysis.

- Weakness: Still lags slightly behind real-time price action.

The Key Difference:

The WMA is straightforward and laser-focused on the newest prices, giving sharper reactions. The EMA, on the other hand, is like a seasoned diplomat—it values the present but doesn’t completely ignore the past, resulting in smoother signals. Choose the WMA for fast-paced markets and the EMA for a steadier approach to trend following.

Weighted Moving Average vs Exponentially Weighted Moving Average

Both the WMA and EWMA prioritise recent prices, but they take different paths to get there. Let’s break it down in simple terms:

Weighted Moving Average (WMA):

The WMA applies a fixed set of weights to price data. The newest price gets the heaviest weight, and the further back you go, the smaller the weight. Think of it like a ranking system: today’s price is the star player, and yesterday’s prices are the backup crew. It’s straightforward and reacts quickly to market changes, but it can be overly sensitive to sharp price swings.

- Best For: Traders who need fast responses in short-term markets.

- Watch Out For: Overreacting to sudden price jumps or drops.

Exponentially Weighted Moving Average (EWMA):

The EWMA takes a more mathematical approach. It doesn’t just assign fixed weights—it uses an exponential formula to gradually decrease the influence of older prices. The newest prices still matter most, but the decline in importance is smoother and more balanced. This makes the EWMA less prone to whipsaws while still staying responsive to trends.

- Best For: Traders who want a balance between quick reaction and stability.

- Watch Out For: Slightly slower responses compared to the WMA.

The Difference in a Nutshell:

The WMA is like a bold spotlight on recent prices—it’s sharp and reactive. The EWMA, on the other hand, is like a dimmer switch—it highlights the present while gently fading out the past. Use the WMA for speed and the EWMA for smoother, more consistent trend tracking.

Weighted Moving Average vs Triangular Moving Average

Both the WMA and TMA are tools to simplify price movements, but they approach the job with very different attitudes.

Weighted Moving Average (WMA):

The WMA is like a speedboat—it focuses heavily on the latest prices, giving them the most weight. As new prices roll in, it quickly adjusts to reflect recent activity. This makes it perfect for traders who want a fast-moving tool that keeps them updated. However, it’s so quick to react that it can get thrown off by sudden price spikes or random market noise.

- Best For: Short-term traders who need signals that move as fast as the market does.

- Caution: May overreact to sharp movements and create misleading signals.

Triangular Moving Average (TMA):

The TMA, on the other hand, is more like a slow train—it takes its time and focuses on the centre of the data set. Instead of prioritising the latest prices, it gives the most weight to the middle of the price series. This results in a super-smooth line that’s great for analysing long-term trends but far too slow for catching quick changes in the market.

- Best For: Traders who value clarity and prefer to focus on the big picture.

- Caution: Lags behind price movements, so it’s not ideal for fast decisions.

How They Compare:

The WMA zooms in on the here and now, making it ideal for quick pivots and short-term trading. The TMA, with its even-handed approach, is better suited for traders who want to strip out the noise and focus on steady, reliable trends. Think of the WMA as your go-to in a race, while the TMA works best when you’re cruising.

Weighted Moving Average vs Double Exponential Moving Average

Both the WMA and DEMA are used to analyse price trends, but they cater to different trading needs with their unique methods of calculation.

Weighted Moving Average (WMA):

The WMA gives more influence to recent prices. It assigns weights that decrease as you move further back in the data. This makes it responsive and quick to reflect new market developments, but its sensitivity can make it prone to reacting to short-lived price jumps or dips.

- Strengths: Reacts quickly to market changes; ideal for short-term strategies.

- Weaknesses: Overreacts to sudden price spikes or noise, which can result in misleading signals.

Double Exponential Moving Average (DEMA):

The DEMA takes responsiveness to the next level by layering two exponential moving averages (EMAs) together. It’s designed to reduce the lag that traditional EMAs have while still maintaining the smoothness. This makes the DEMA faster at catching trends without overreacting as much as the WMA might.

- Strengths: Combines speed with smoothness; great for catching trends earlier while avoiding unnecessary noise.

- Weaknesses: Slightly more complex to calculate and may still lag during extreme market volatility.

Key Difference:

The WMA is like a sprinter—it’s quick and sharp, focusing entirely on the latest prices. The DEMA, on the other hand, is like an athlete with stamina—it moves fast but with more balance and less susceptibility to short-term fluctuations. Use the WMA for rapid responses in choppy markets and the DEMA for a smoother yet timely view of trends.

Weighted Moving Average vs Smoothed Moving Average

The WMA and Smoothed Moving Average are both instruments for analysing trends, yet they each possess distinct characteristics in managing price information.

Weighted Moving Average (WMA):

The WMA emphasizes recent prices, assigning them greater significance in its computation. Picture yourself in a discussion where the viewpoint of the most recent speaker holds the greatest significance—that’s the essence of how the WMA functions. It’s a rapid tool that quickly responds to alterations, making it ideal for short-term trading. Nonetheless, this sensitivity implies that it can be disrupted by abrupt price surges or market fluctuations.

- Good for: Traders who want quick insights into recent market action.

- Watch out for: Overreacting to temporary price blips.

Smoothed Moving Average (SMMA):

The Smoothed Moving Average is more like a zen master—it looks at the entire dataset and spreads out the importance of prices evenly over a longer time frame. This means it reacts more slowly to new changes but provides a much steadier signal. It’s ideal for filtering out noise and focusing on the overall direction of the market.

- Good for: Traders who prefer a stable, long-term view of trends.

- Watch out for: Lagging behind real-time price movements.

How They Compare:

The WMA is your best choice for keeping pace with rapidly changing markets—it’s quick, responsive, and prepared to adjust. The Smoothed Moving Average, in comparison, adopts a relaxed method, easing the fluctuations for a clearer long-term perspective. Select the WMA for dynamic trading and the SMA for smoother conditions and broader perspective evaluation.

Which Moving Average Is Best?

There’s no “one-size-fits-all” answer to which moving average is best—it depends on your trading style, goals, and the market you’re analyzing. Here’s a breakdown to help you decide:

1. Simple Moving Average (SMA):

- Best for: Long-term analysis and spotting overarching trends.

- Why use it: It’s steady and less sensitive to short-term price fluctuations.

- Downside: Reacts slowly to sudden market changes, which might delay signals.

2. Weighted Moving Average (WMA):

- Best for: Short-term traders needing quick reactions.

- Why use it: Gives more emphasis to recent prices, making it faster to adapt to market shifts.

- Downside: Can overreact to temporary price spikes or noise.

3. Exponential Moving Average (EMA):

- Best for: Swing traders or day traders looking for a balance between speed and stability.

- Why use it: Puts more focus on recent prices while smoothing out older data for better trend detection.

- Downside: Still lags slightly and may give false signals in choppy markets.

4. Smoothed Moving Average (SMA):

- Best for: Long-term trend analysis with minimal noise.

- Why use it: Takes a broad view by averaging data over a long period.

- Downside: Reacts too slowly to be useful in fast-moving markets.

5. Double Exponential Moving Average (DEMA):

- Best for: Traders who need a fast-moving indicator with less lag.

- Why use it: Combines speed and smoothness, reducing the lag seen in standard EMAs.

- Downside: More complex to calculate and still not immune to volatility.

How to Choose:

- If you’re day trading or scalping, the WMA or EMA can help you react faster to price changes.

- For swing or position trading, the SMA or Smoothed Moving Average offers a clearer long-term picture.

- Want a middle ground? The EMA often strikes a balance for traders who need both speed and reliability.

Ultimately, the best moving average is the one that aligns with your strategy and fits the market conditions you’re trading in. Experiment with different types and periods to find what works best for you.

FAQ

What is the difference between a Moving Average and a Rolling Average?

A moving average adjusts its calculation as each new data point is added, focusing on a specific timeframe. A rolling average is the same except it is often associated with smoothing data in other industries of analytics beyond trading. The key difference lies in application, with “moving” being a trading staple and “rolling” more common in analytics.

How reliable is Weighted Moving Average?

The Weighted Moving Average is reliable for spotting recent price trends since it emphasises the latest data. However, its sensitivity to short-term fluctuations can sometimes lead to false signals in volatile markets. Combine it with other indicators or confirm trends over multiple timeframes to boost its reliability.

Is Weighted Moving Average a leading or lagging Indicator?

Weighted Moving Average sits firmly in the lagging category since it relies on past data. It’s more about confirming the market’s current rhythm than predicting the next dance move. While helpful for trend followers, it won’t shine as a crystal ball.

What is the origins of Weighted Moving Average?

Yule first used the term “Weighted Moving Average” in 1909. Yule was one of the people who created the Yule-Walker moving average model. However, the indicator has its roots in the early 20th century when R.H. Hooker published a paper on time series analysis and referred to weighted moving averages as “instantaneous averages.” Traders in the 20th century tailored the approach to price analysis, fine-tuning weights to emphasise what matters most.

What common mistakes should traders avoid when using the Weighted Moving Average?

Jumping into trades based solely on WMA signals often leads to regret; context is everything. Another misstep is picking inappropriate timeframes that either overreact or miss the plot entirely. And don’t forget: it’s a tool, not a crystal ball, so diversify your analysis arsenal.