- Chart of the Day

- August 1, 2024

- 3 Min. Lesezeit

NVIDIA’s (NVDA) Bullish Flag

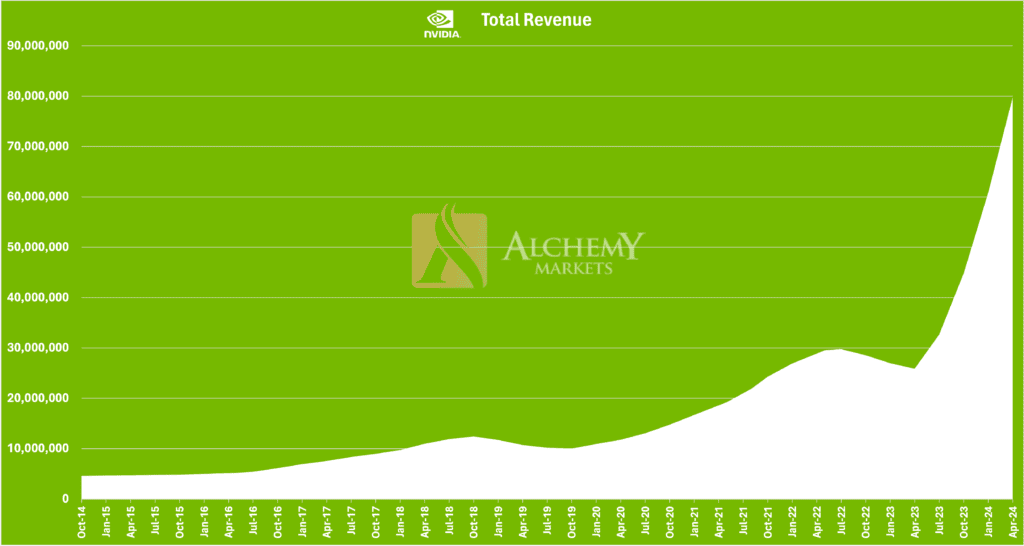

Source: Data from Stock Unlock. Image Created by Alchemy Markets

NVIDIA (NVDA) has been on a tear this year, seeing its stock price skyrocket thanks to a robust demand for its cutting-edge products. In Q2 FY2024, NVIDIA reported an impressive $13.51 billion in revenue, doubling year-over-year, with a significant boost coming from the data center segment. This growth has been fueled by the increasing need for high-performance GPUs, particularly in AI and other computationally intensive fields. The gaming segment also showed strong performance, buoyed by the release of the GeForce RTX 40 series, contributing $2.5 billion to the quarter’s revenue

Technical Analysis

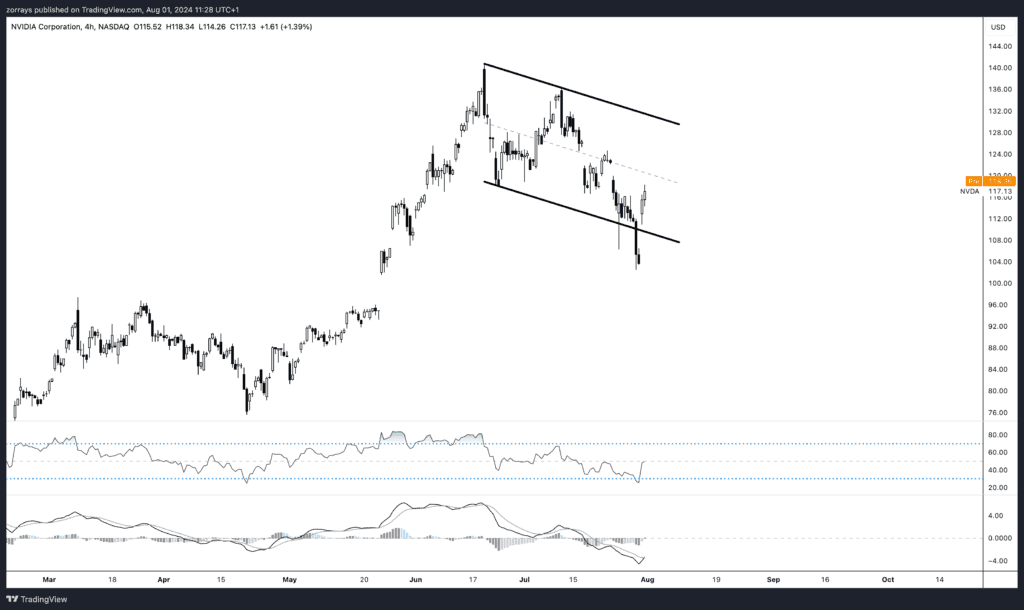

On the technical side, NVIDIA’s stock chart is showing a bullish flag pattern—a continuation pattern that often precedes a breakout in the same direction as the existing trend. The stock recently bounced off the lower boundary of this flag, a promising sign for potential upward movement. This bounce was accompanied by the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) indicators hitting oversold levels.

The RSI, a momentum oscillator, dropped below 30, indicating the stock was oversold—a condition often seen as a buying opportunity. Meanwhile, the MACD line was below the signal line, suggesting bearish momentum might be waning. These signals, combined with the potential for a breakout above the upper boundary of the flag, suggest that the stock could see further gains. Investors should watch closely for this breakout, as it could lead to continued upward momentum

Conclusion

With NVIDIA’s earnings report approaching, investors will be closely monitoring both fundamental and technical factors. Strong data center demand, continued innovation in gaming GPUs, and strategic buybacks all point to potential growth. Meanwhile, the technical setup offers a promising outlook, with the bullish flag pattern indicating that the stock may continue its upward trajectory. Investors should keep an eye on NVIDIA’s performance metrics and market conditions to gauge the likelihood of this trend continuing.

FAQ

Q: What is driving NVIDIA’s recent stock price surge? A: NVIDIA’s stock has surged due to record-breaking revenue growth in Q2 FY2024, driven by strong demand for data center GPUs and new gaming products.

Q: What technical pattern is NVIDIA’s stock currently showing? A: NVIDIA’s stock is forming a bullish flag pattern, indicating potential for continued upward momentum if it breaks above the upper boundary.

Q: When is NVIDIA’s next earnings report? A: NVIDIA is set to release its Q3 FY2024 earnings report on August 23, 2024.