- Chart of the Day

- November 20, 2025

- 3 Min. Lesezeit

NVIDIA: Strong Earnings, But Stock Action Hints at a Short-Term Pullback

NVIDIA just reported another blowout quarter, showing once again why it’s at the centre of the AI boom. Revenue hit an incredible $57 billion, up 62% from last year, with data center sales making up over $51 billion of that total. The company also gave upbeat guidance for next quarter, expecting around $65 billion in revenue—well above what analysts had predicted.

It’s clear that demand for NVIDIA’s AI chips and infrastructure remains red-hot, and analysts are already boosting their full-year earnings forecasts. Fundamentally, NVIDIA’s story looks stronger than ever.

But here’s the twist: the stock didn’t react the way you’d expect.

The Market’s Reaction: Strong Numbers, Weak Follow-Through

Right after the earnings report, NVIDIA’s stock jumped higher at the open, but it failed to break above its previous highs. Instead of continuing to climb, the stock faded quickly and ended up right back near where it started before the earnings announcement.

That kind of price action is important—it tells us something about investor psychology.

When a stock gaps up on strong earnings but can’t push past old highs, it usually means that the good news was already priced in. In other words, traders and investors were already expecting great results, so even a “beat and raise” wasn’t enough to push prices higher.

Why This Matters: Signs of Exhaustion in a Hot Stock

This pattern—a gap up, a failure to break highs, and then a quick pullback—isn’t new. Historically, it often happens when a stock has been running hot for a long time and investors are getting ahead of themselves.

NVIDIA has been a momentum leader for months. The AI infrastructure story has been one of the most talked-about investment themes in the market. But now that the story is well-known and expectations are sky-high, it’s harder for even fantastic results to surprise investors.

That’s why the current price behavior might signal that NVIDIA’s stock needs a “cooling off” period before it can move higher again.

What’s Next: A Healthy Correction Could Be Coming

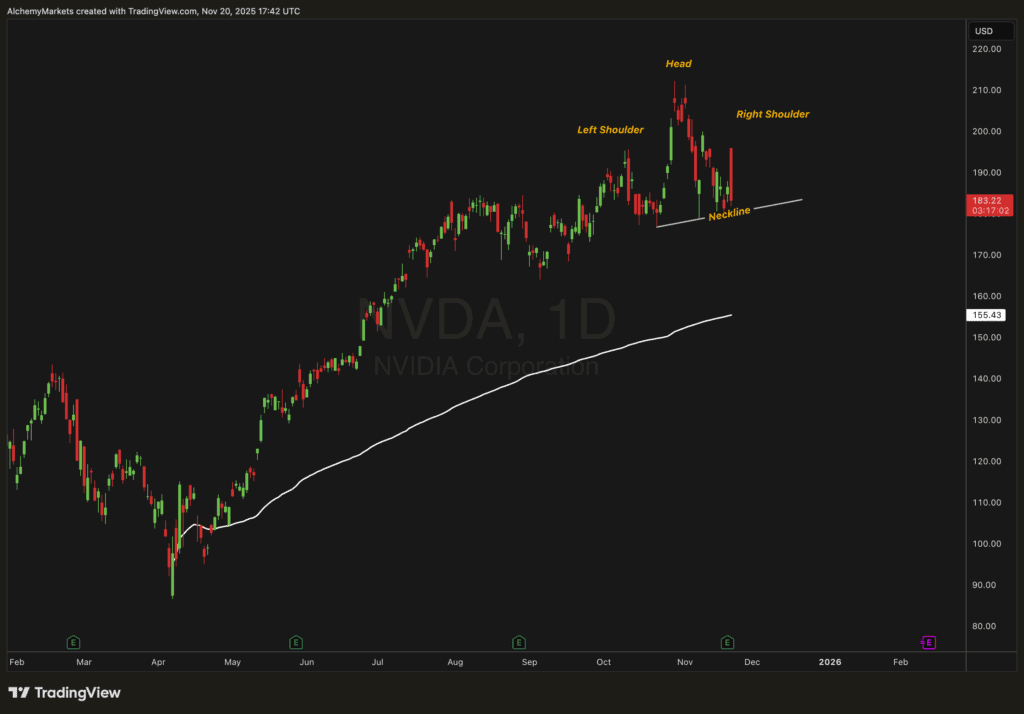

Technical traders are now watching the anchored VWAP (Volume Weighted Average Price) from NVIDIA’s last major swing once it break’s the head and shoulder pattern. This level, which sits below current prices, has acted as a key support zone all year.

A pullback toward that anchored VWAP would make sense. It would allow the market to:

- Rebalance positions after months of nonstop buying,

- Flush out short-term traders, and

- Reset sentiment to more realistic levels.

This kind of correction isn’t necessarily bearish. In fact, it’s often a healthy part of a larger uptrend. It gives strong stocks like NVIDIA a chance to build a fresh base before starting the next leg higher.

The Big Picture: Fundamentals Strong, Momentum Pausing

So, where does that leave investors?

- Earnings strength: Still impressive. NVIDIA continues to dominate in AI hardware and software.

- Market sentiment: Overheated in the short term.

- Technical picture: Pointing to a possible short-term correction.

Unless NVIDIA can reclaim the post-earnings gap and set new highs, the most likely near-term path is sideways or slightly down. A dip toward the anchored VWAP could give long-term investors a better entry point for the next rally.