- Chart of the Day

- November 19, 2024

- 3min read

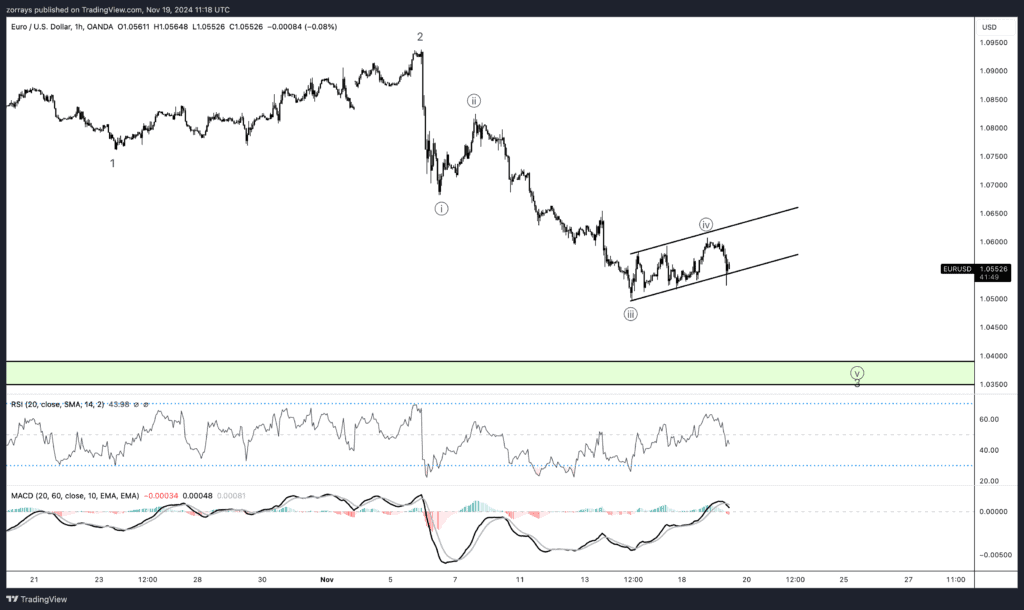

EUR/USD: Navigating the Bearish Tide Under ECB Hawks and Rate Differentials

EUR/USD is attempting a brief correction amidst mixed signals from both fundamental and technical perspectives. Recent comments from ECB officials, alongside shifting market expectations for interest rate adjustments, have created a nuanced outlook for the pair. Here’s a detailed analysis blending fundamental drivers and technical observations:

ECB Hawkish Speculation and Rate Differential Dynamics

A key catalyst behind the recent EUR/USD correction is the hawkish tone from some ECB policymakers. ECB’s Joachim Nagel suggested yesterday that global fragmentation—arising from supply chain reconfigurations and trade tensions—could drive persistent inflation, necessitating higher interest rates. These remarks contributed to narrowing the two-year EURO swap differential by approximately 10 basis points, temporarily lifting EUR/USD to the 1.06 handle.

The rate differential remains a key influence on EUR/USD. Currently, the market anticipates 10 basis points of Fed rate cuts in December (our base case calls for a more aggressive 25bp cut) compared to 31bp of ECB cuts (our forecast is for 50bp). If the Fed moves forward with a 25bp cut while the ECB delivers only 25bp, this relative narrowing could support a modest upside for EUR/USD. However, the broader macro backdrop suggests that the scope for meaningful upside remains limited.

For now, the bearish trend remains intact, and the current fundamentals do not strongly support a prolonged recovery in EUR/USD. Even a move toward the 1.0660-1.0665 level would align with the overall bearish outlook.

Bearish Flag and Key Levels

From a technical perspective, EUR/USD is trading within a well-defined bearish flag pattern—a zig-zag corrective structure that typically signals continuation of the prior downtrend. Price action remains confined within the sloping channel, with successive lower highs and higher lows indicative of consolidation. However, momentum is poised to break lower.

- Critical Zone: The green zone on the chart highlights a potential target area in the 1.0350–1.0400 range. This aligns with the bearish flag’s projected breakdown zone, indicating that further downside momentum is likely required to complete the pattern.

- Indicators:

If bearish momentum intensifies, EUR/USD could break below the lower trendline of the flag and target the 1.0350 region. A decisive break here could open the door to further downside toward 1.0300 or even 1.0250 in the medium term.

Outlook for Today

With no major data releases on the calendar, EUR/USD is likely to trade quietly, focusing on broader macro developments such as the US Treasury nominations. For intraday traders, the 1.0660-1.0665 resistance zone provides a cap, while support below the 1.0500 handle could lead to further tests of the 1.0350–1.0400 region.

Expect another subdued trading session unless significant headlines alter the market’s expectations on rate differentials or the broader risk sentiment.

Key Levels to Watch

- Resistance: 1.0660–1.0665

- Support: 1.0500, 1.0400, 1.0350

EUR/USD remains bearish both fundamentally and technically, with only limited room for upside corrections before resuming its downward trajectory.