- Opening Bell

- February 2, 2026

- 3 min read

Metals Extend Rout, Oil Tests Key Support

Markets opened the week on a shaky footing as volatility swept through commodities, led by another sharp retreat in precious metals and a renewed pullback in oil prices.

Metals – Gold and Silver Slide Further

Precious metals extended Friday’s dramatic decline, with spot gold tumbling as much as 10% early Monday and silver plunging up to 16%. The selloff followed the announcement that U.S. President Donald Trump plans to nominate Kevin Warsh as the next Federal Reserve chair — a move that bolstered the dollar and reinforced expectations of a more hawkish policy path.

The magnitude of the drop far exceeded what most traders anticipated, marking the steepest two-day decline in years. ETF flows underscore the cautious tone, with silver holdings down for a seventh consecutive session to 823.8 million ounces — the lowest since late 2025.

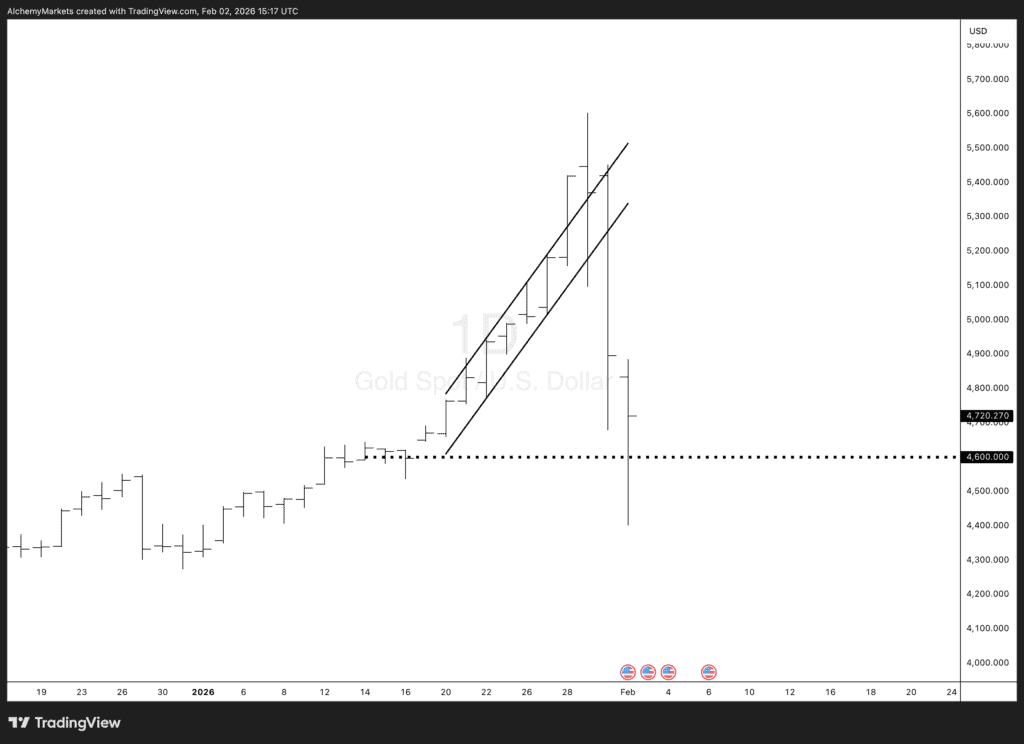

Technically, gold rejected the $4,600 support zone shown in the chart and has yet to convincingly break below it. For now, price action suggests that gold could consolidate sideways within this range, though a decisive close under $4,600 would open room for further downside. Upside momentum appears capped, at least in the near term.

Meanwhile, the CME’s decision to raise margin requirements on both COMEX gold and silver — up to 8.8% for gold and 16.5% for silver — signals expectations of continued turbulence. Managed money positioning from the CFTC also points to fading speculative interest, with gold net longs down nearly 18,000 lots and silver at its weakest positioning since early 2024.

Energy – Oil Finds Support at Channel Upper Bound

Oil prices came under renewed pressure in early trading, with both WTI and Brent down more than 5% as traders reacted to reports of fresh U.S.–Iran negotiations that could ease geopolitical tensions and unwind the recent risk premium. Broader market weakness added to the bearish tone after last week’s risk-off reversal.

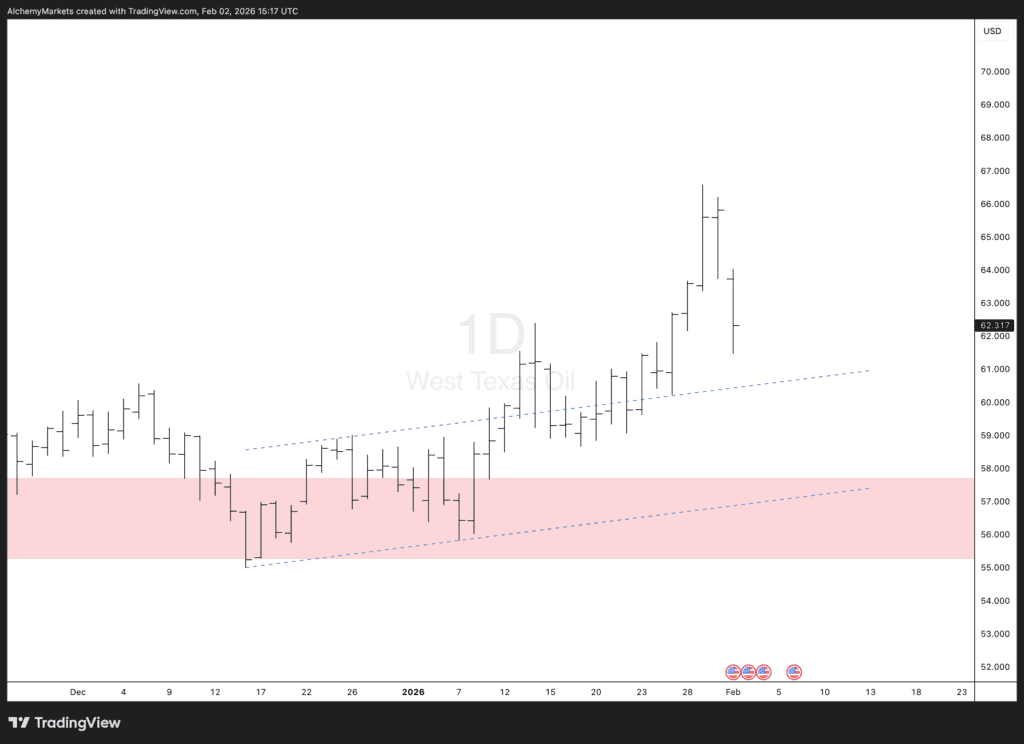

From a technical perspective, West Texas Intermediate (WTI) is now pulling back into the upper boundary of the ascending channel it recently broke out from — a zone that could provide near-term support around the $61–62 region. If buyers step in here, the channel retest could serve as a springboard for stabilization after the steep correction.

Fundamentally, OPEC+ confirmed its pause on supply increases through March, maintaining the production freeze initially agreed in November. However, the group gave little forward guidance ahead of its next meeting on March 1. U.S. drilling activity remains subdued, with the oil rig count unchanged at 411, reflecting continued caution despite prior price gains.

Speculative positioning had leaned heavily long before the latest pullback. Hedge funds boosted net longs in both Brent and WTI to their most bullish levels since mid-2025, suggesting that position unwinds could amplify short-term volatility as traders de-risk.

Natural gas also reversed sharply, with Henry Hub futures down 17% to $3.62/MMBtu as milder weather forecasts erased last week’s cold-driven rally. Storage data from the EIA showed a larger-than-expected draw of 242 Bcf, but inventories remain 5.3% above the five-year average.

Bottom Line

Volatility across commodities remains elevated, with macro factors — including U.S. monetary policy signals, currency strength, and geopolitical headlines — steering sentiment. For gold, the $4,600 area is the key line in the sand. For oil, the retest of its former breakout zone could determine whether the pullback stabilises or deepens.