- Chart of the Day

- September 29, 2025

- 3min read

Ethereum: What’s Happening? Simple Analysis with vWAP & Volume Profile

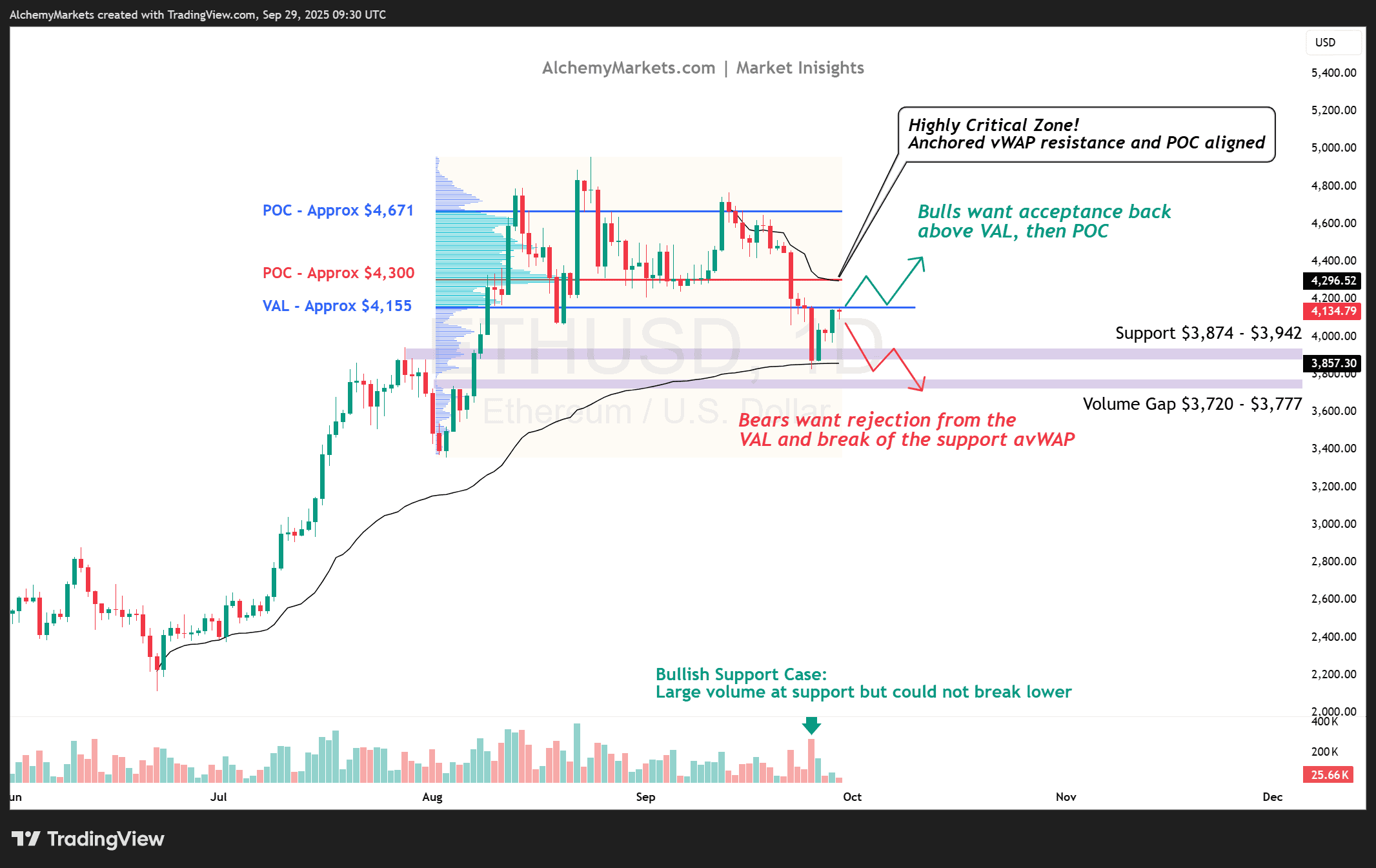

After a strong cascade from $4,700, Ethereum appears to be holding its critical support much better than Bitcoin. Now, it’s currently testing the VALUE AREA LOW (VAL) of its volume profile beginning from August, where its rally from ~$3,400 to ~$4,900 began.

Using Volume Profile and anchored vWAPs, we can gather a simple view of what’s happening on the cryptocurrency:

- Either we reject from here, confirming a reversal in the short term; or

- We reclaim the value area low at $4,155, and face a greater resistance zone at approx. $4,300

Technical Breakdown of ETHUSD Daily Chart

The Bigger Picture (Uptrend) is Still Intact

Zooming out, notice how Ethereum has bounced cleanly off the anchored vWAP from July’s rally, sitting around $3,857.

Why this matters: Anchored vWAP is basically the average price since that rally kicked off. If ETH stays above it, the market is still saying, “we’re backing this rally.” A clean break below, though, flips the script: it means the crowd has stopped believing in the July uptrend.

The Immediate Battleground is ~$4,155

Now zooming in, the immediate battleground is the $4,155 level — the Value Area Low (VAL) of the August run from $3,400 to $4,900. Since we slipped under it, the short-term read is weakness: traders are showing they’re not keen to trade in that higher value zone anymore.

A rejection here tells us buyers aren’t strong enough to drag ETH back into that range, which leaves us stuck under resistance and vulnerable to another leg down.

But if we get acceptance back above $4,155, momentum can flip — ETH can rotate higher within the old value area, with $4,300 being the real test. That zone is both the Point of Control (highest traded volume) and the anchored vWAP from the latest decline.

Watch $4,300 as Critical Resistance

$4,300 isn’t just a resistance level, it’s the line in the sand. If ETH clears it, bigger players are essentially signalling, “We’re still in this for the long haul,” – and the cryptocurrency could break into new highs.

Closing thought

If ETH can’t reclaim higher ground, then eyes shift back down to $3,720–$3,777. That volume gap is thin, meaning price could slide into it quickly, and while it might offer a pivot point, it would also cap upside momentum with layers of resistance overhead.

Combine that with a mixed macro backdrop — softening jobs data but also rate cuts coming through — and ETH’s next leg will likely be shaped by whether broader risk sentiment improves or cracks further.