- Opening Bell

- September 23, 2025

- 2min read

Dollar Softens Despite Hawkish Fed Voices as Powell’s Speech Looms

Dollar Retreats as Markets Focus Beyond Hawkish Fed Members

The dollar softened in line with expectations at the start of the week, partly reconnecting with underlying short-term drivers. This move unfolded despite hawkish commentary from Federal Reserve members Alberto Musalem, Raphael Bostic, and Beth Hammack, who all struck a cautious tone on rate cuts. Given their positioning on the hawkish side of the spectrum, their stance wasn’t unexpected, but it underlines that the hawkish front at the Fed remains relatively firm despite growing dovish pressure.

Adding to the policy debate, Stephen Miran outlined his hyper-dovish view yesterday, arguing for a far more accommodative stance. However, Miran’s view remains an outlier, consistent with the Fed’s own Dot Plot distribution, and is unlikely to have been the primary trigger behind the dollar’s weakening.

All Eyes on Powell, But Others May Matter More

Attention now shifts to Fed Chair Jerome Powell, who is scheduled to speak today. Markets do not expect him to deviate significantly from last week’s press conference, meaning investors may instead be more focused on remarks from other Fed members. In particular, Austan Goolsbee and Michelle Bowman—both leaning on the dovish side—could provide insights that influence short-term expectations.

Data Watch: PMIs Across Major Economies

On the data front, Purchasing Managers’ Index (PMI) releases across developed markets will provide a snapshot of global economic momentum. While U.S. PMIs typically hold less weight than ISM surveys, they are valuable for cross-comparison with the EU and UK. Risks remain skewed to the downside for the dollar this week, although some consolidation could take place around today’s events.

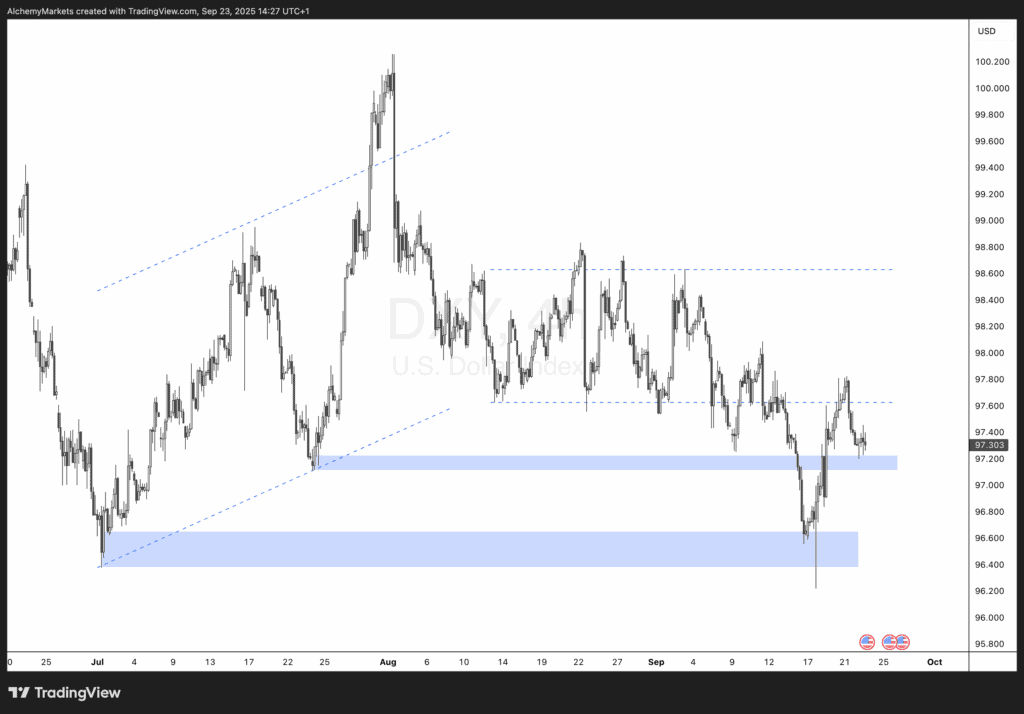

Technical Outlook: DXY at a Crossroads

From a technical perspective, the U.S. dollar index (DXY) is currently trading in a tight range, caught between support near 96.600 and resistance at 97.200. Price action shows that DXY briefly breached the 97.200 level but has since retreated, leaving the market in a holding pattern.

The next move may hinge on Powell’s tone:

- More dovish than expected: Another wave of selling could take DXY back toward the 96.600 support.

- No surprises / reaffirming last week’s stance: Markets may consolidate further, suggesting much of Powell’s message is already priced in.

This makes today’s speech pivotal in determining whether the dollar resumes its decline or stabilizes in the short term.