- Chart of the Day

- August 14, 2025

- 3min read

EUR/USD Outlook: Calm Before the Storm or Sustainable Momentum?

EUR/USD continues to push forward with renewed strength as we approach the US-Russia summit. Despite a potentially market-moving geopolitical event on the calendar, the option markets are surprisingly calm. One-week implied volatility for EUR/USD is sitting at the lower end of its recent range, suggesting traders aren’t bracing for sharp moves—at least not yet.

Eurozone Data Shows Fragile Progress

The eurozone economic picture remains mixed. Today’s release of the second estimate for Q2 GDP confirmed a soft 0.1% quarter-on-quarter growth. While that sounds weak, it’s not being overly scrutinised by the market due to distortions from earlier trade tariffs, which muddied the true strength of underlying demand.

Industrial production data for June adds to this hazy picture. Expectations were already low following Germany’s disappointing -3.6% YoY print, and the eurozone-wide numbers did little to brighten the mood. Still, markets seem more focused on future data rather than reacting harshly to backward-looking indicators.

For now, these data points are being taken in stride, and EUR/USD appears content hovering around the 1.1700 level. Short-term risks remain tilted to the upside, though conviction remains weak in the absence of a stronger eurozone recovery narrative.

UK Growth Surprises to the Upside

Across the Channel, the UK posted better-than-expected Q2 growth figures: 0.3% QoQ and 1.2% YoY. That’s a solid beat considering the backdrop of global economic headwinds and earlier tariff pressures. However, this hasn’t done much for the pound just yet.

Markets remain focused on inflation and jobs as the key drivers for the Bank of England’s next move. For now, stronger growth alone isn’t enough to shift rate expectations, and GBP/USD remains largely stable.

Technical Analysis: EUR/USD at a Crossroads

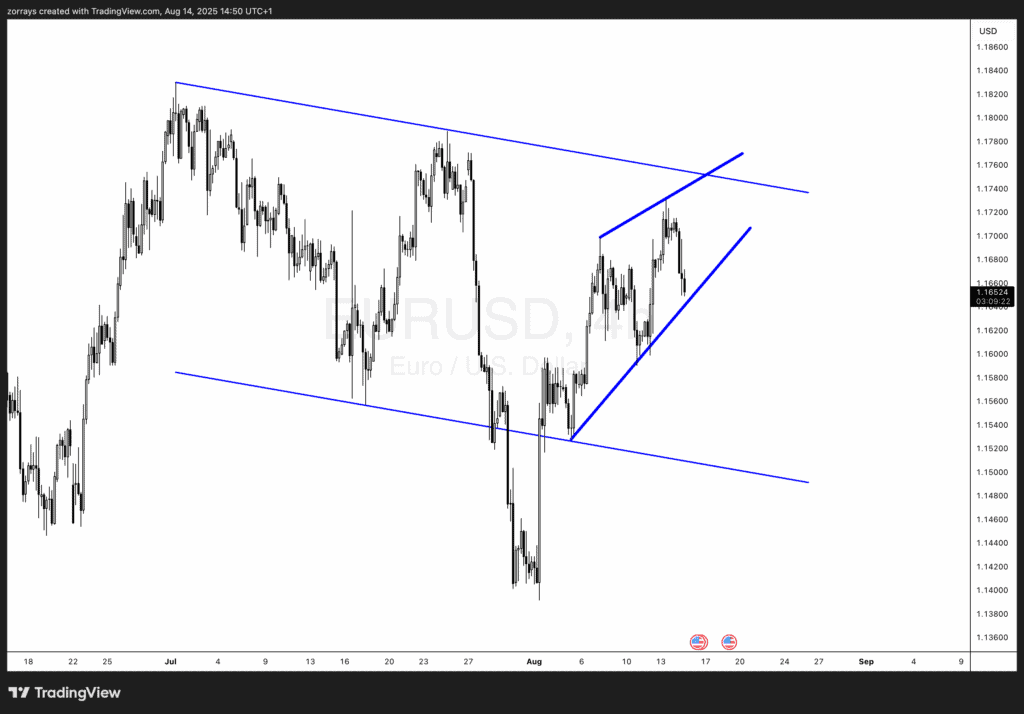

From a charting perspective, EUR/USD presents an interesting setup for both short-term traders and long-term position holders.

The pair is currently trading inside a rising wedge pattern—a formation often associated with temporary corrections. As we can see on the chart, price action has moved steadily higher within the wedge, but momentum appears to be slowing.

The rising wedge is now nearing its apex, suggesting a potential breakout is imminent. Given the pattern’s nature, there’s a good chance that EUR/USD could break lower in the short term. If this occurs, a pullback toward the 1.1600–1.1550 zone could be in play before buyers return.

However, the bigger picture tells a more bullish story. EUR/USD is still trading within a larger descending channel, stretching back to early July. If the current wedge resolves lower and finds support, this could simply be a healthy correction within a broader trend reversal setup.

Should the bulls regain control after the correction, a breakout above the descending channel’s upper boundary (around the 1.1750–1.1780 zone) could signal a much larger move higher—potentially opening the door to 1.1850 and beyond.

What Retail Traders Should Watch

For retail traders, this is a classic “watch and wait” moment:

- Short-term: A break below the wedge could mean a quick pullback opportunity for those looking to short near resistance.

- Medium to Long-term: Keep an eye on the top of the descending channel. A strong daily close above that level could confirm a bullish breakout and trend reversal.

Traders should also keep tabs on upcoming macroeconomic releases and the outcome of the US-Russia summit. While volatility is currently low, unexpected headlines could jolt the market out of its slumber.