- Chart of the Day

- August 13, 2025

- 1min read

Gold Eyes Reversal as Softer CPI Boosts Rate-Cut Bets

An interesting development just occurred: inflation cooled more than expected.

- Core CPI m/m: 0.3% (Forecast 0.3%, Previous 0.2%)

- CPI m/m: 0.2% (Forecast 0.2%, Previous 0.3%)

- CPI y/y: 2.7% (Forecast 2.8%, Previous 2.7%)

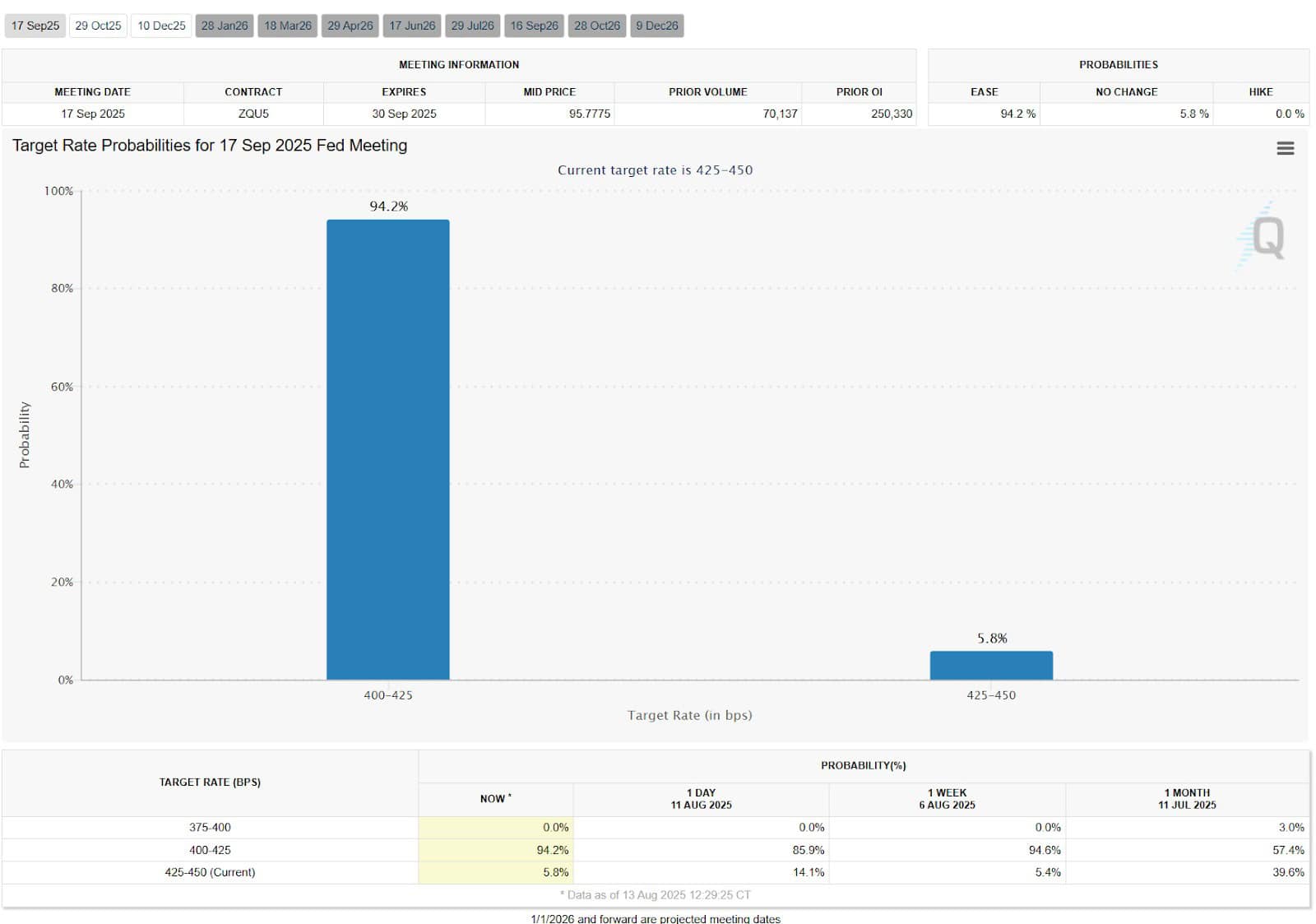

While markets have been preoccupied with the tariff and inflation acceleration narrative, the actual CPI print told a different story — one that strengthens the case for a September Fed rate cut, now priced at over 94% odds.

This shift has set the stage for risk-on sentiment across equities, with the S&P 500 and Nasdaq pushing into new all-time highs. Investors are rotating back into growth assets, but that doesn’t mean safe havens are left out.

The star of today’s story is actually Gold. Despite its defensive reputation, it stands to benefit from lower interest rates.

On the daily chart, price is holding above the Fair Value Gap (FVG) + POC support at $3,331, with strong anchored VWAPs reinforcing the bullish structure. A sustained bid here could open the door to retesting the $3,430–$3,500 resistance zone, especially if rate-cut momentum builds.

In other words, even in a risk-on environment, gold is quietly positioning for its own rally…one that could run in parallel with equities as the cost of holding non-yielding assets falls.