- Weekly Outlook

- januari 16, 2026

- 4 min läsning

Growth Optimism Meets Fed Patience as SPX Tests Key Resistance

After a surprisingly resilient start to the year, markets seem to be settling into a new rhythm — one where optimism about growth and fading inflation are finally coexisting. Goldman Sachs’ latest outlook captures the mood: stronger-than-expected U.S. growth (2.8% full-year GDP forecast for 2026) and softer inflation (core PCE seen at 2.1% by year-end).

That combination — solid growth without an inflation rebound — is pretty much the dream scenario for investors. And for now, it’s being reflected in asset prices. Equities remain near record highs, credit spreads are calm, and volatility is muted.

But beneath the surface, the story isn’t completely smooth. The U.S. labor market looks softer, AI-driven efficiency talk is raising job security questions, and rate-cut expectations are slowly adjusting. The Fed has made it clear they’ll move carefully, and next week’s data — while not game-changing — will serve as another check on that cautious optimism.

Economic Calendar: What’s on Deck Next Week

Here’s what traders and investors will be watching most closely:

United States

- Thursday – PCE Inflation Data:

The core PCE deflator, the Fed’s preferred inflation gauge, is expected to confirm that inflation pressures remain muted despite the tariff-related distortions from last year. With inflation likely around 2.1% year-over-year, this should reinforce the narrative that the disinflation trend is intact.

Markets aren’t expecting any major surprises here, especially with the FOMC meeting just around the corner on January 28th. Fed speakers are in their pre-meeting quiet period, so the data will do the talking. - Personal Income & Spending:

A solid gain here would underscore the resilience of the U.S. consumer, which continues to benefit from strong real wages and tax relief under the new fiscal measures.Any weakness could reignite concerns about a “jobless growth” phase, something Goldman Sachs flagged as a risk for 2026.

United Kingdom

- Tuesday – Jobs Report:

The unemployment rate may temporarily dip, defying expectations of a softening labor market. However, wage growth continues to cool — a key trend that should encourage the Bank of England to maintain its easing bias.

Still, a surprisingly strong report could delay rate-cut expectations, prompting a short-lived hawkish reaction in sterling. - Wednesday – CPI Inflation:

The December/early-January inflation read is expected to reflect seasonal volatility from airfares and holiday pricing. While a temporary spike in services inflation is possible, underlying trends still point downward.

By April, inflation is expected to return to the BoE’s 2% target, supporting rate-cut prospects later in Q2.

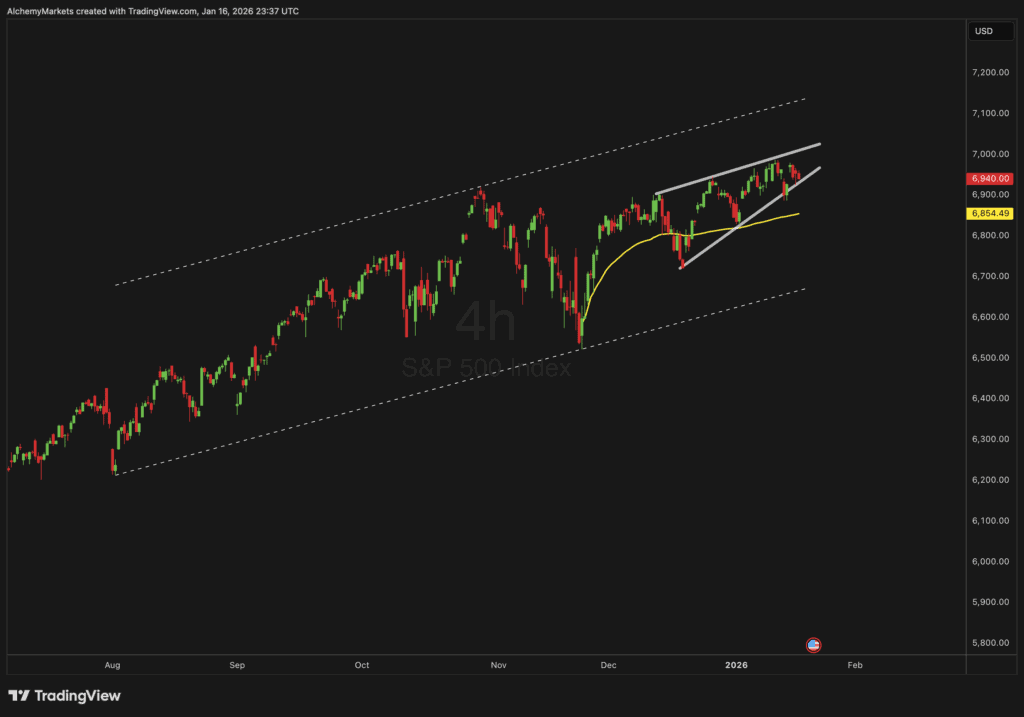

Market Technicals: S&P 500 (SPX) – Decision Point Ahead

Taking a look at the 4-hour SPX chart, the index remains within a well-defined ascending channel that’s been in place since mid-2024. Recently, price action has carved out a rising wedge pattern — typically a sign of potential exhaustion near the top of a trend.

Here’s the technical setup in plain terms:

- Support: Around 6,850, roughly aligned with the anchored VWAP (yellow line).

- Resistance: Near 7,000, marking the upper boundary of the wedge.

- Channel bounds: The broader channel extends from about 6,600 (lower bound) to 7,200 (upper bound).

Scenario 1: Bullish Breakout

If the wedge fails (meaning it breaks higher), momentum could drive price toward the upper boundary of the long-term channel, near 7,150–7,200. That would align with the bullish macro narrative — strong growth, easing inflation, and supportive fiscal policy.

Scenario 2: Bearish Breakdown

If the wedge breaks to the downside, a short-term correction could unfold, with initial support near 6,850 and a potential retest of 6,700 if selling accelerates. That would likely coincide with softer data or renewed Fed caution.

For now, the trend remains constructively bullish, but the wedge pattern signals a moment of decision — expect volatility to tick up as the market tests these boundaries.

Bottom Line

The market narrative is still one of optimism — growth surprising to the upside and inflation moving lower — but it’s bumping against technical resistance and economic crosscurrents.

Next week’s data should confirm that the disinflation trend is holding and that the Fed can stay patient. The SPX setup suggests traders should stay alert: whether this wedge breaks up or down will set the tone for the next leg of the move.