- Opening Bell

- januari 14, 2026

- 4 min läsning

EPS Beats, Revenue Misses – Banks Turn Defensive in Q1

This trading week is firmly an American bank story, and the message from earnings has been consistent across the sector.

While several major banks managed to beat EPS expectations, most missed on revenue, reinforcing the idea that profits are being protected through efficiency rather than expansion.

Below is how that story is unfolding on the charts.

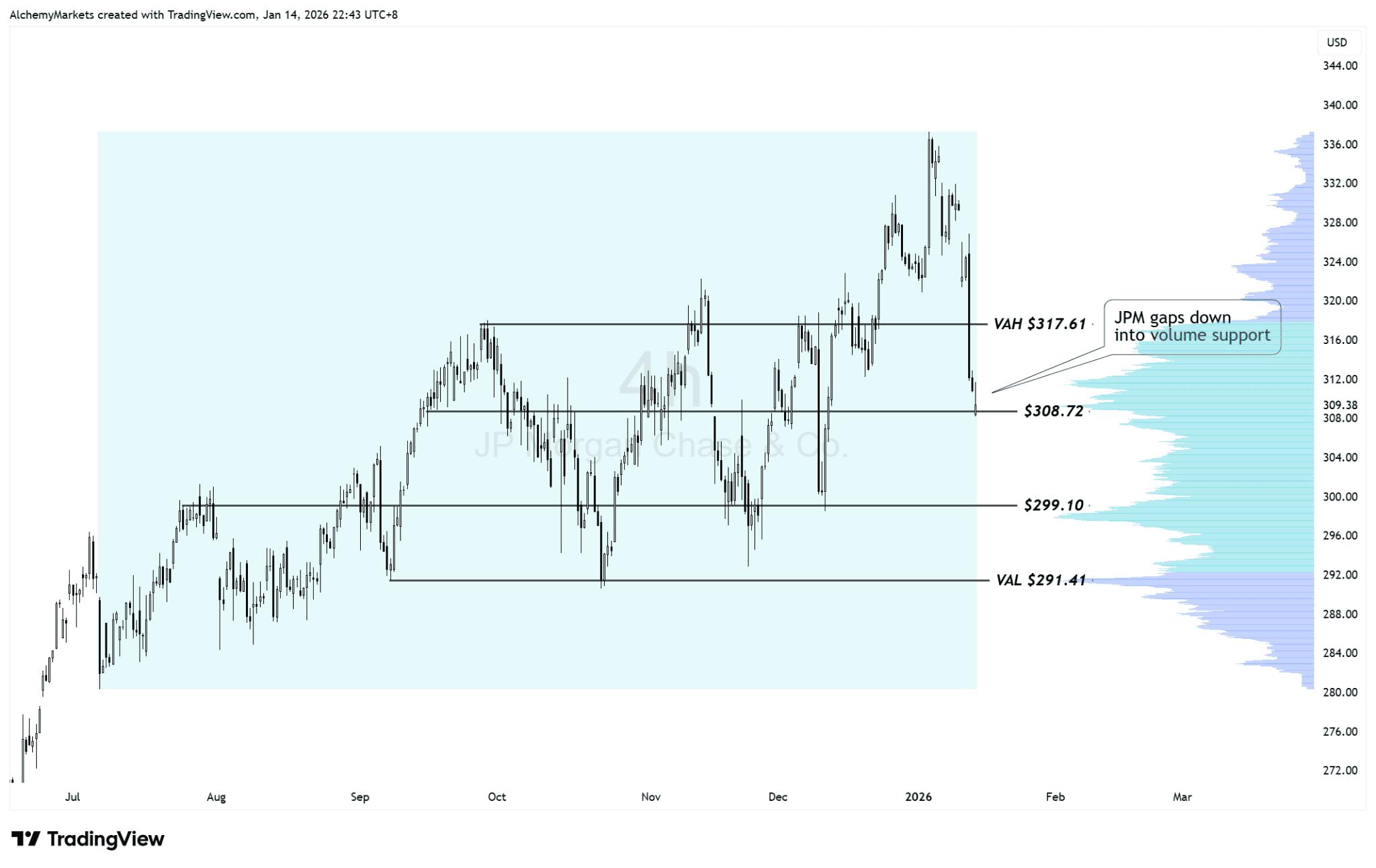

JPMorgan Chase

Earnings recap:

JPMorgan missed on both headline revenue and EPS, setting a cautious tone for the sector.

Technical view (4H, Anchored Volume Profile):

JPM has gapped down into a high-volume support zone, rotating back into its prior fair-value range. The key level to watch is the Value Area High near $317.61. As long as price remains below this level, the earnings gap acts as overhead supply, keeping rallies capped.

On the downside, $308.72 is the first important support. Holding this level would suggest the move is controlled profit-taking rather than panic selling. However, a loss of $299.10 would likely open the door to a deeper rotation toward the Value Area Low near $291.41.

Market takeaway:

JPM is the sector’s anchor. If it holds volume support, the broader market can remain stable. If it breaks lower and accepts below value, bank weakness tends to spill into wider risk sentiment.

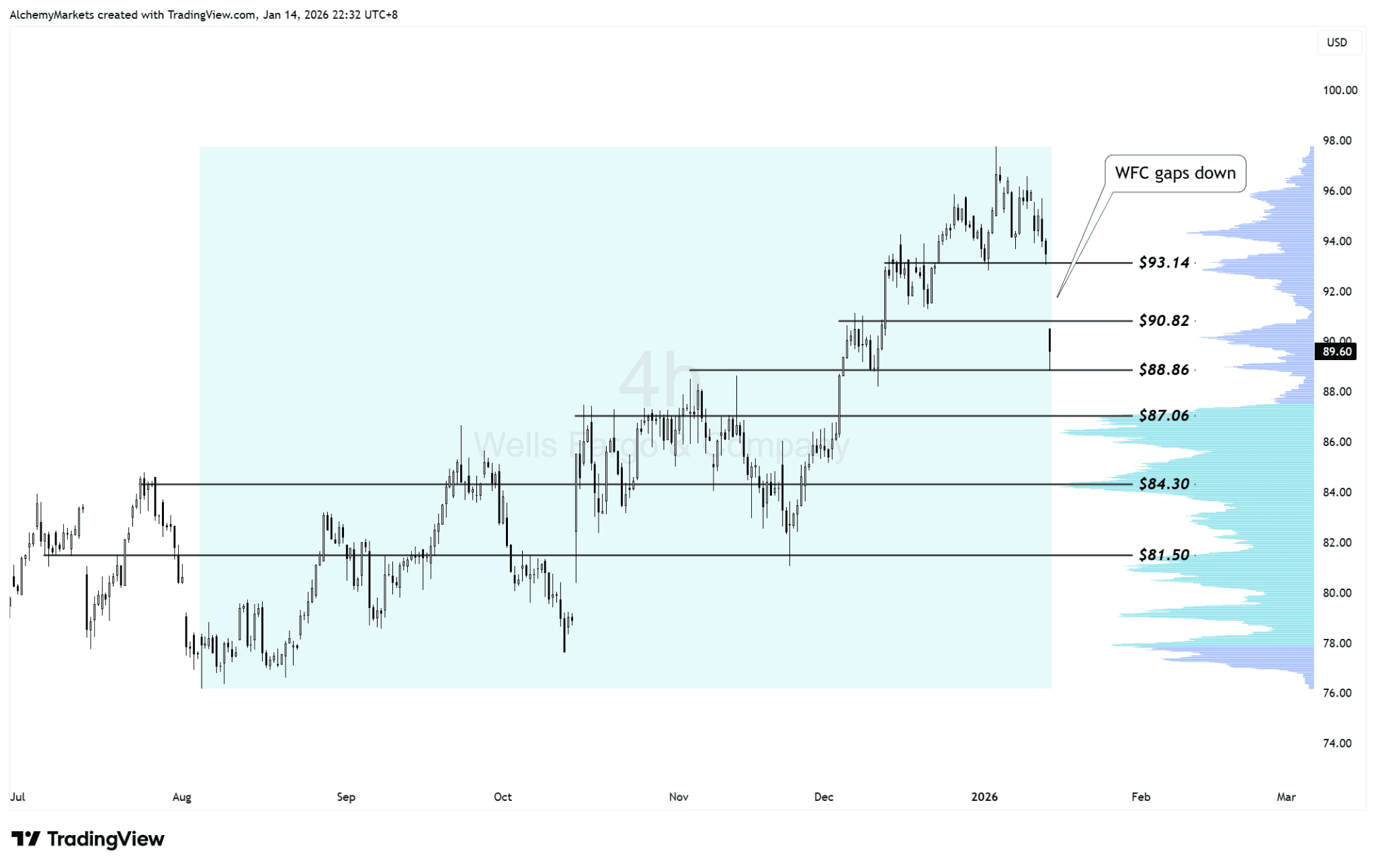

Wells Fargo

Earnings recap:

Wells Fargo beat EPS expectations but missed on revenue, highlighting slower consumer-driven activity despite solid cost control.

Technical view (4H, Anchored Volume Profile):

WFC has gapped below a key support level, which is short-term bearish. This move reflects the market repricing the bank after earnings, rather than chasing the EPS beat.

The immediate focus is whether price can reclaim the broken support. A close back above it would soften the bearish signal and suggest acceptance back into value. Failure to do so increases the probability of rotation toward the next high-volume node below.

Market takeaway:

As a consumer-facing bank, sustained weakness in WFC would reinforce concerns around household demand and make broader equity rallies harder to sustain.

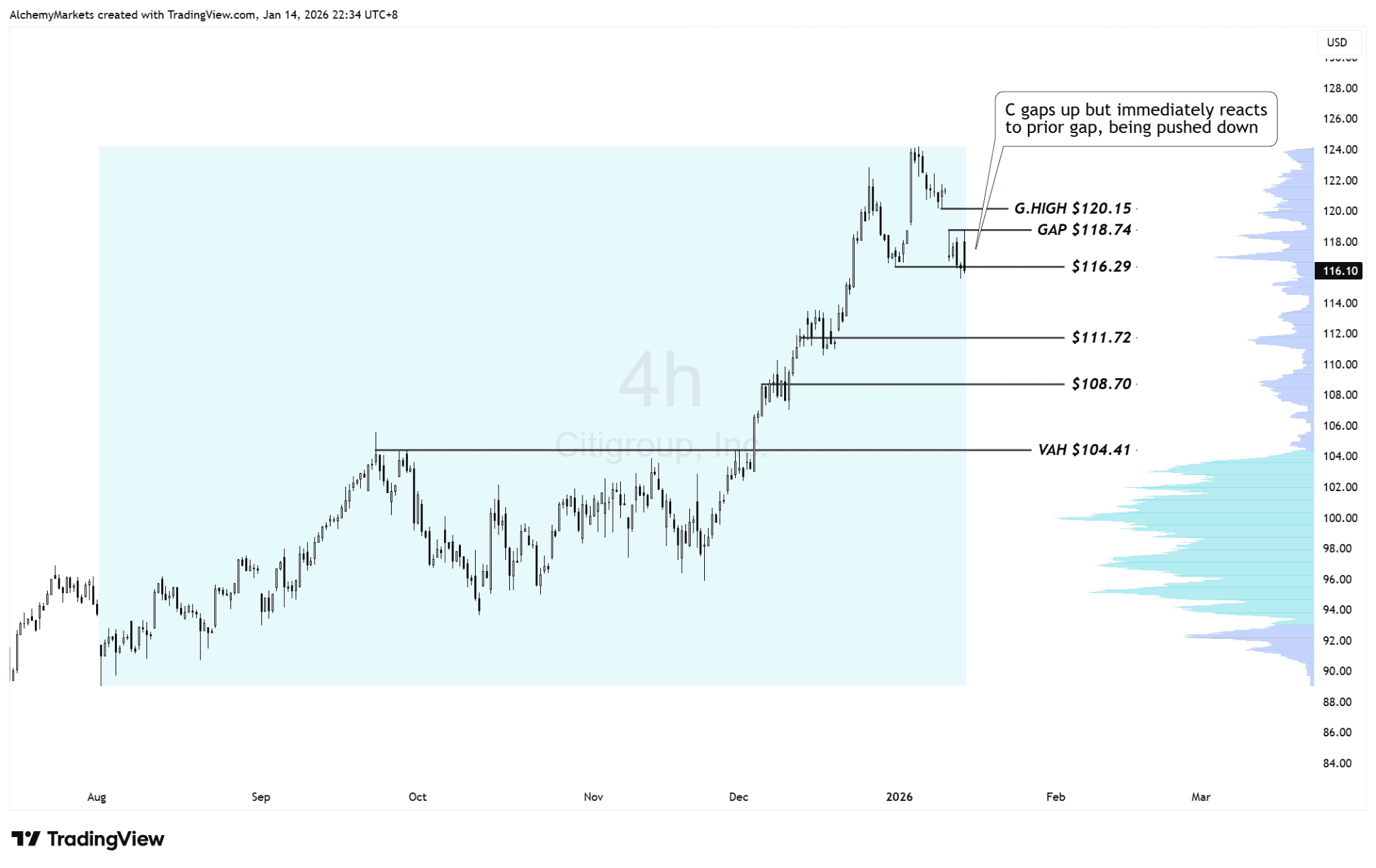

Citigroup

Earnings recap:

Citigroup beat EPS on an adjusted basis but missed revenue, reflecting ongoing restructuring success rather than stronger global demand.

Technical view (4H):

Citi is set to gap higher, but price is immediately reacting to a prior gap zone above, which often acts as resistance. This area represents trapped supply, where sellers from previous sessions look to exit.

If price fails at this upper gap, the move risks turning into a fade, consistent with a defensive earnings interpretation. Acceptance above the gap, however, would suggest stronger follow-through demand and improve the tone for global banks.

Market takeaway:

Citi’s reaction will help determine whether this earnings move is positioning-driven or the start of a more durable recovery in global financials.

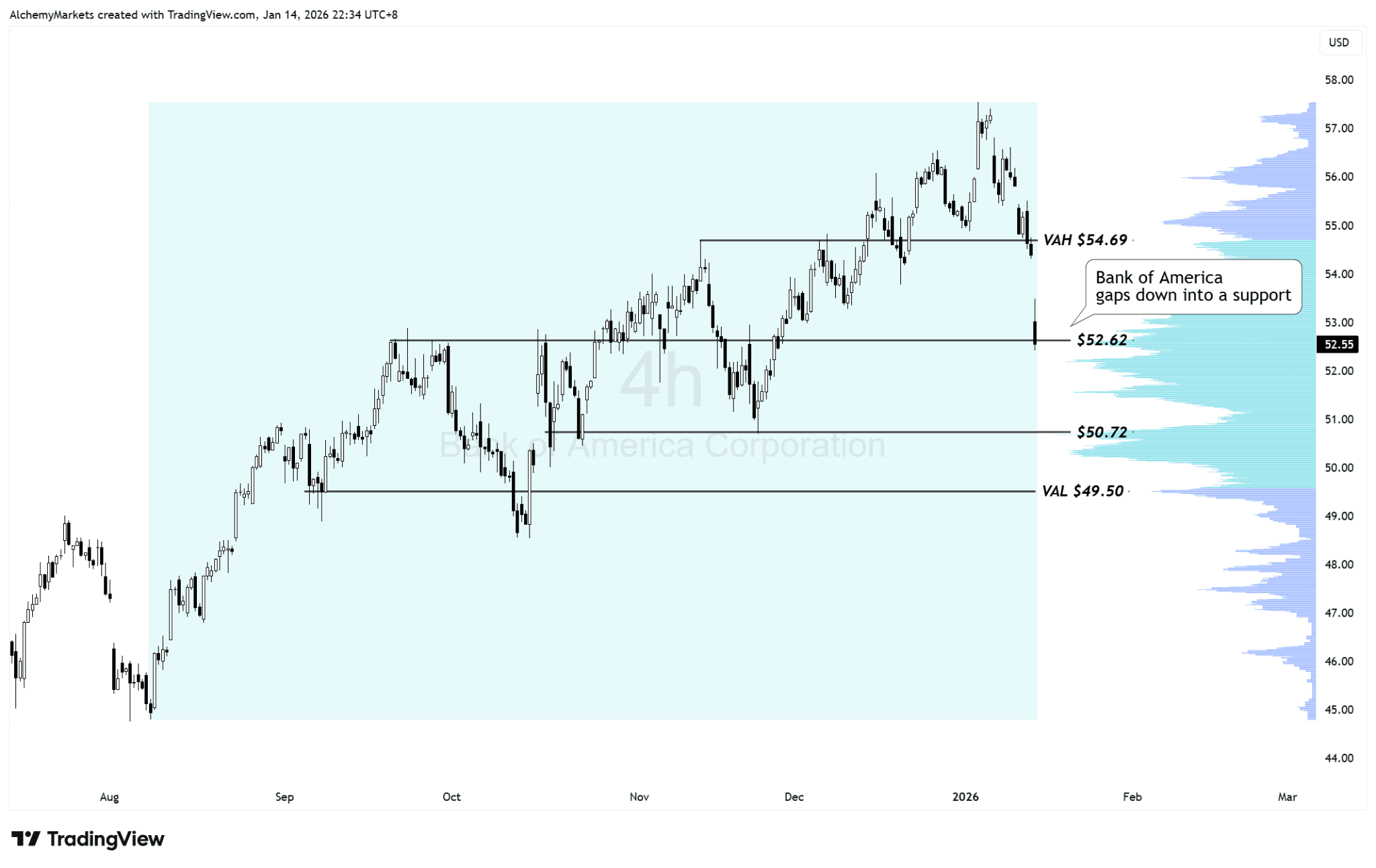

Bank of America

Earnings recap:

Bank of America beat both EPS and revenue expectations, but remains the most rate-sensitive of the major banks.

Technical view (4H, Anchored Volume Profile):

BAC has gapped down into support but importantly has rotated back into the Value Area High near $54.69. This places the stock back inside its fair trading range, where the market must now decide direction.

Holding above VAH keeps the broader uptrend intact. Losing acceptance would likely trigger a rotation toward $52.62, then $50.72, with the Value Area Low near $49.50 acting as a deeper support target.

Market takeaway:

BAC is the cleanest technical setup. Its ability to hold value will be a key tell for whether the market remains constructive or shifts more defensively.

What This Means for the Broader Market

Across JPMorgan, Wells Fargo, and Citigroup, the pattern is clear:

Earnings are being defended, not grown.

EPS beats driven by cost control — alongside revenue misses — signal late-cycle behaviour, where management teams prioritise margins and balance-sheet protection over expansion.

That doesn’t imply an immediate downturn, but it does mean markets are more sensitive to downside risk.

From here:

- Holding volume support keeps the market in rotation mode

- Losing value acceptance across banks would likely pressure risk sentiment more broadly

Bottom line: US banks are telling us this is a market about defence, not acceleration — and price action should be traded with that mindset.