- Weekly Outlook

- Febbraio 6, 2026

- 3 min di lettura

Equal Weight Signals Underlying Strength

United States

Non-Farm Payrolls (Wednesday)

While headline labour market conditions have avoided outright deterioration, the underlying picture remains fragile. Firings remain contained, but hiring momentum continues to disappoint. Excluding government, leisure & hospitality, and private education and healthcare, the US economy has shed jobs in seven of the past eight months. We expect January’s delayed NFP report to reflect a similar pattern.

The January FOMC statement removed the reference to “downside risks to employment” while noting “some signs of stabilisation” in the unemployment rate. We expect unemployment to remain steady at 4.4%, though risks are skewed to the upside in coming months as hiring remains sluggish and labour supply continues to rise. Markets should also be alert to benchmark revisions, which could materially lower the reported pace of job creation over the past year and reinforce the view that the labour market has been weaker than previously assumed.

CPI Inflation (Friday)

January CPI, delayed from Wednesday to Friday, will be closely scrutinised. While several private-sector inflation indicators have cooled sharply, we still see scope for stickiness in the official data. Delayed tariff pass-through remains a key risk: import prices are rising, and tariff revenue is being absorbed by US importing firms.

Although some companies suggest “efficiency savings” are offsetting these cost pressures, we believe further consumer-level pass-through cannot be ruled out. That said, lower energy prices and continued moderation in housing rents should provide an important offset, limiting the upside risk to headline inflation.

United Kingdom

UK GDP (Thursday)

Fourth-quarter growth should appear relatively resilient, helped by the restart of car production at a major manufacturer. However, this strength is unlikely to alter the Bank of England’s policy outlook. Policymakers have repeatedly argued that recent GDP figures overstate the underlying health of the economy, with public sector output accounting for a disproportionate share of growth.

This week’s BoE meeting reinforced expectations for a March rate cut, as weak private-sector momentum and easing inflation pressures continue to dominate the policy debate.

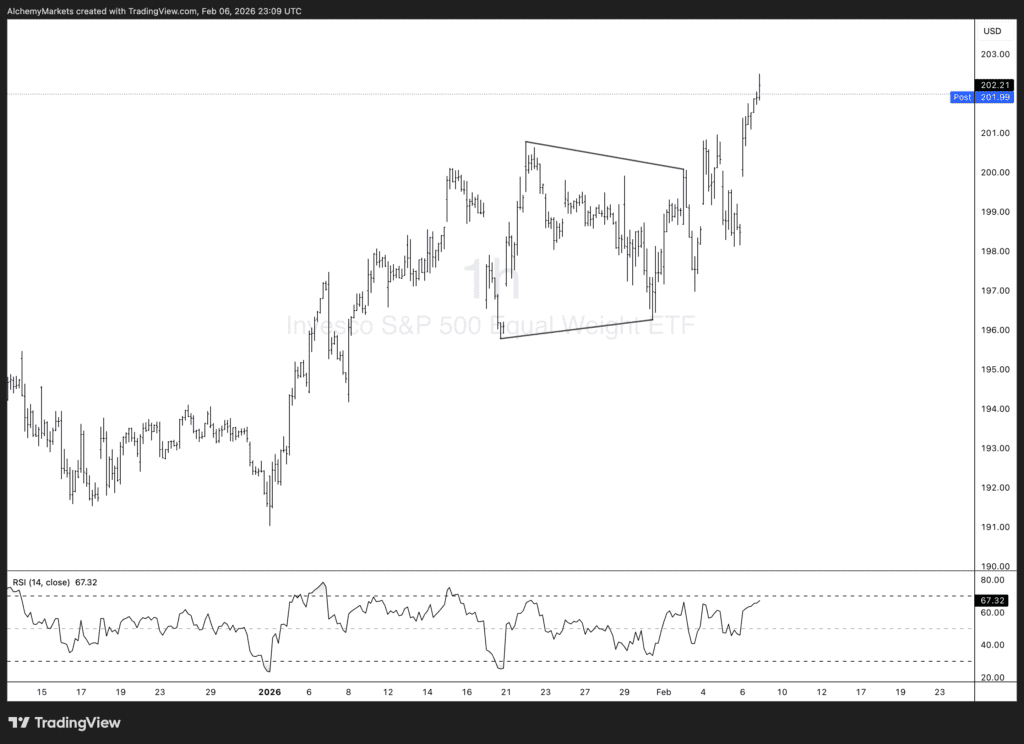

Technical Perspective: Breadth Sends a Different Signal

From a technical standpoint, caution around headline indices remains warranted. The traditional market-cap-weighted S&P 500 continues to look toppy, reflecting the heavy concentration in a small group of mega-cap stocks.

However, the S&P 500 Equal Weight index—which gives each constituent the same influence regardless of size—has delivered a more constructive signal. It has broken out to new highs, resolving a multi-week triangle pattern to the upside. Importantly, the breakout has been accompanied by RSI momentum that remains elevated but not yet overextended, suggesting there is still some energy left in the move.

This divergence highlights improving market breadth beneath the surface and suggests that, while index-level risks remain, participation across the broader market has quietly strengthened—an important dynamic to watch as macro data and central bank expectations evolve.