Bullish

- September 18, 2025

- 24 min read

Short Squeeze: Causes and Consequences Explained

In theory, trading is simple: buy low, sell high. In reality? The financial markets are built on emotion. And nowhere is that more obvious than during a short squeeze.

When too many people bet on a lower price, even a small rally can become a stampede. The security’s price rips higher, and short sellers rush to buy back shares — not out of confidence, but survival. These aren’t gradual trends. They’re explosive reversals that flip the mood of the entire stock market, often within hours.

What is a Short Squeeze

A short squeeze occurs when prices suddenly surge, catching short sellers off guard and forcing them to buy back driving the price even higher. These traders bet on a stock’s price falling and must borrow shares to sell them first.

But when the market moves against them, they’re forced to buy back the stock to cut their losses. This wave of buying adds fuel to the rally, driving prices even higher.

Think of it like squeezing a tube of toothpaste — the more pressure builds, the more violently the price shoots out the other end. Short squeezes are often explosive and can unfold in the blink of an eye.

How Does a Short Squeeze Work?

A short squeeze starts when short sellers borrow shares and sell them, aiming to buy them back cheaper later.

But, if the stock price rises instead, these sellers begin to face mounting losses. At some point, they’re forced to close their positions, either by stop loss or liquidation. Closing a short position means buying back the stock, so these forced buys add upward pressure, pushing the price even higher.

It’s this pressure of growing unrealised losses that helps ‘squeeze’ short sellers, resulting in sellers panicking to cover positions — and the price skyrockets far beyond its fundamentals.

| Note: GME stock was a historic and unprecedented event and may never happen again. It is unusual for a short squeeze to cause the large rally witnessed in GME stock. |

The Implications of Short Squeezes

For short sellers, a squeeze can be devastating — losses aren’t just steep, they’re theoretically unlimited. That’s because while a stock can only fall to 0%, it can rise indefinitely… leaving short sellers exposed to runaway losses if they can’t exit in time.

These violent moves cause short sellers to lose money fast, and in extreme cases, wipe out an entire account. On the flip side, early buyers can catch explosive profits, but the rally is usually short-lived.

Prices often collapse just as quickly, leaving latecomers holding overvalued shares. It’s a high-risk, high-volatility play, and rarely forgiving.

What Causes a Short Squeeze?

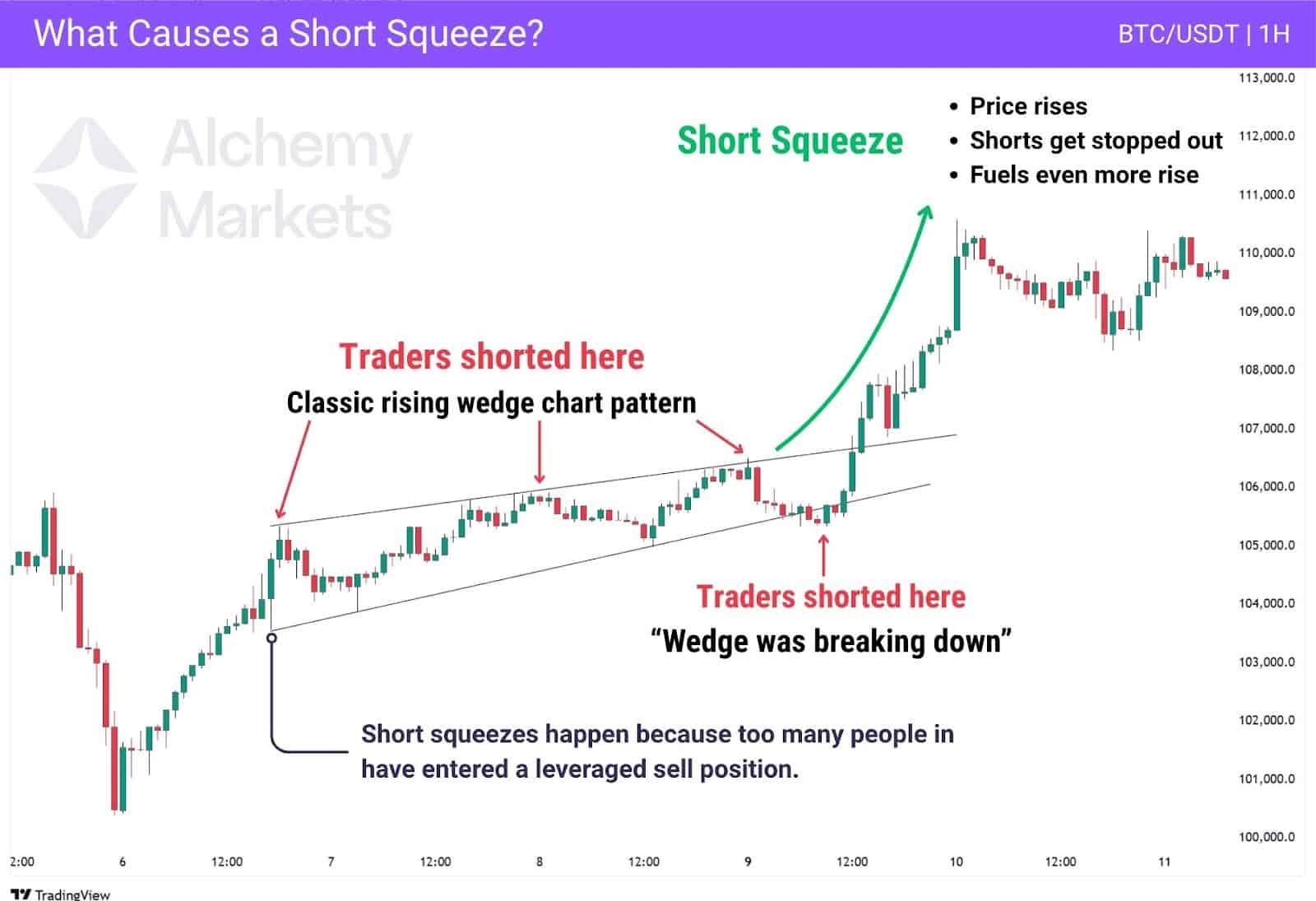

Short squeezes usually start when too many traders are shorting the same asset, creating a crowded bearish environment.

This builds the perfect conditions for a squeeze — all it takes is a spark: good news, a surprise announcement, or retail traders piling in to begin driving prices higher. When the price starts rising, the panic begins to set in and sellers are forced to buy stock to close out their positions.

Borrowing on Margin

Short sellers don’t use their own shares — they borrow them through a margin account, which is essentially a loan from a broker.

This setup lets traders open larger positions than their own capital would allow, amplifying both potential profits and losses. In simple terms, it means you are borrowing margin (funds) from the broker to open a trade. But, when too many traders are taking on leveraged trades, markets often collapse due to their inability to part pay back their losses.

But when the trade goes against them, the pressure builds fast. Losses begin to pile up. Traders then face two choices:

- Rush to cover: Traders panic close short positions by buying back the asset, which ironically drives the stock price higher.

- Hold and risk a margin call: If losses exceed the trader’s margin (collateral put up for the trade), the broker forcibly closes the position — often wiping out most or all of the margin.

| ⚠️ Margin Call: This happens when your trade can no longer be sustained because your account doesn’t have enough funds to cover the losses. The broker issues a quick demand to top up your margin (funds) — and if you don’t, the position is forcibly closed at a loss, often leaving your account close to zero. |

Because these short positions are highly leveraged, even a small move against them can have outsized impact. For example, if your CFD broker offers 100:1 leverage on commodities, a trader could open a $100,000 short with just $1,000 in capital. But if they’re forced to close that position, they trigger $100,000 worth of buying pressure — not $1,000.

That’s how short squeezes snowball: one trader covering triggers many others to do the same, creating a buying stampede in what was supposed to be a falling market.

High “short interest”

Short interest percentage measures how much of a stock’s available float is currently being sold short. The formula is:

| Short Interest (%) = (Total Shorted Shares / Float) × 100 |

The float refers to the total number of shares available for public trading (excluding insider holdings). So if 25 million shares are shorted out of a 100 million float, the short interest is 25%.

A high short interest percentage (typically above 20%) suggests a crowded bearish bet — too many people leaning to one side of speculation. If the stock unexpectedly rises, those traders may rush to cover their positions, triggering a short squeeze.

High “days to cover”

Days to Cover, also known as Short Interest Ratio, estimates how many days it would take all short sellers to exit their positions based on average daily trading volume. The formula is:

| Days to Cover = Total Shorted Shares / Average Daily Volume |

So if 20 million shares are short and the stock trades 2 million shares a day on average, it would take 10 trading days to fully unwind. The longer this number, the more difficult it is for shorts to escape once the price starts climbing — especially in low-volume environments, where exits become bottlenecks.

A “trigger” event

A short squeeze needs a trigger event— but that spark doesn’t have to be bullish. It just has to catch traders off guard. Often, it’s something positive like surprise earnings, a game-changing deal, or a wave of retail buying. These jolt the market higher, forcing short sellers to cover, which fuels even more upside.

But here’s the twist: even bearish news can set off a squeeze, especially when the market is overcrowded with shorts. If too many traders pile in at the lows after a negative headline, it only takes a minor bounce or failed follow-through to flip the script.

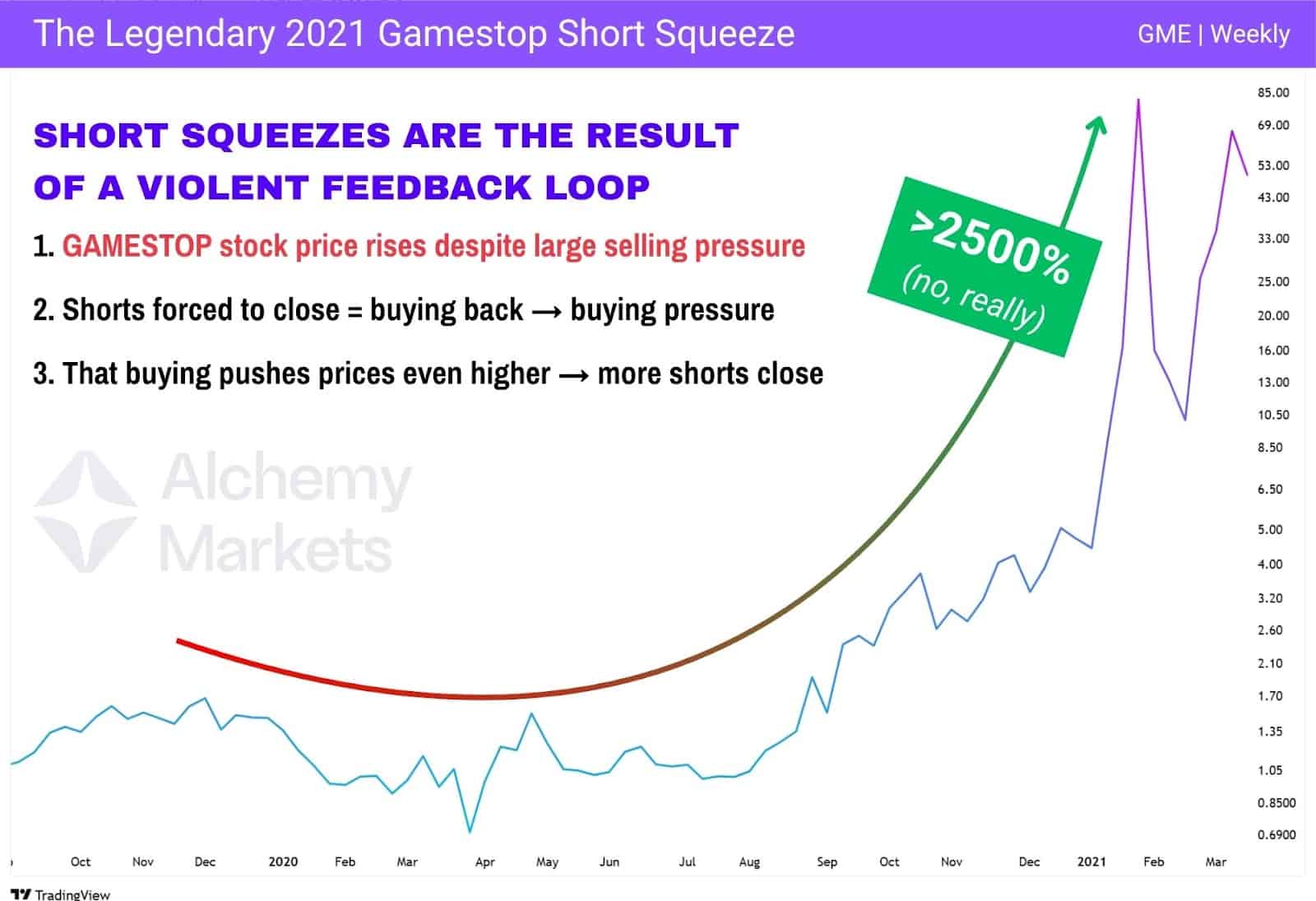

For example, GameStop’s infamous 2021 squeeze didn’t start with good news — it started with too many shorts from institutions. Hedge funds were betting against GME due to weak fundamentals: physical game sales were dying, and the company looked obsolete. To them, this was a classic repeat of Blockbusters (DVD rental company) dying out to the widely digitisation of media services, such as Netflix, Hulu, and Amazon Prime.

But then WallStreetBets stepped in, a chaotic group of Reddit retail traders, amassed with over 2.5m followers. This group called out the extreme short interest from hedge funds and began buying with the intention to squeeze them.

For once, retail was the one doing the market making. That unexpected retail surge flipped sentiment. As share prices rose, institutional investors were forced to cover their shorts, driving prices even higher.

A self-perpetuating cycle

A short squeeze unfolds like a domino effect. Each forced exit adds fuel to the buying fire, helping to squeeze short sellers out of their market positions.

Rallies such as these aren’t driven by fundamentals. Instead, they are powered by the panic from previous short sellers, scrambling to exit their losing positions.

As a squeeze plays out, it’s extremely difficult to tell when a squeeze has ended. Fighting it is risky, and you could easily become part of the fuel that feeds it before a blow-off top (price peak) is achieved.

How to Identify a Short Squeeze

Spotting a potential short squeeze starts with analysing positioning risk and the most important clue is short interest. If a large percentage of a stock’s available float is sold short, the setup is already there.

| 1. Look for high short interest (above 20%) but context matters. Compare it against the stock’s historical averages and sector norms. You can also use borrow rates, funding rates, or net short exposure on derivatives platforms to confirm how stretched sentiment is. 2. Next, check days to cover — which tells you how long it would take short sellers to unwind their positions based on average daily trading volume. A high number here means exits could be slow, especially if volume dries up. The longer it takes to cover, the more pressure builds if price starts moving quickly. 3. Now watch the price action. If a heavily shorted stock begins climbing on strong volume — especially without any major news — that’s your first red flag. Early buying can shake out weaker shorts, and once a few start covering, the move can snowball. This is often the first visual cue that a squeeze might be underway. 4. Finally, consider whether a trigger event is present — though one isn’t always required. A surprise earnings beat, a bullish analyst upgrade, or sudden retail hype (like WallStreetBets threads or social sentiment spikes) can flip the narrative. If momentum kicks in immediately after, short sellers may be forced to exit fast, adding fuel to the rally. |

By combining these signs — crowded short positioning, slow exits, unexpected price surges, and sentiment flips — you can spot when a market move is less about fundamentals, and more about traders scrambling to escape.

Biggest Short Squeezes in History

Let’s now look at how short squeezes have played out in the real world. The following examples—from GameStop to Tesla—show how high short interest, retail momentum, and trigger events can collide to create massive price surges.

GameStop (GME) – 2021

This is the most iconic short squeeze in recent times. GameStop, a struggling video game retailer, was a heavily shorted stock by hedge funds in 2021, expecting a further decline.

But retail traders on Reddit’s WallStreetBets noticed the extreme interest shorts—over 100% of float—and started piling in. As the share price jumped from under $20 to over $120, institutions were forced to buy back shares at massive losses, triggering a feedback loop that sent the stock vertical.

AMC Entertainment (AMC) – 2021

AMC was another battleground for short sellers during the pandemic, as cinema closures cast doubt on the company’s survival. Interest short soared, but retail traders — energised by the success of GameStop — stepped in. Coordinated spot buying and aggressive call option activity forced market makers to hedge by purchasing shares, while institutional shorts rushed to cover, resulting in a gamma and short squeeze.

| Call Options: Unlike spot buying, which directly moves the market, call options create indirect buying pressure. When enough options are bought, market makers hedge by purchasing shares of the stock, and this causes the actual stock price to increase. |

The end of it all? AMC rocketed from around $75 to $390, driven by short covering, retail momentum, and social media-fuelled speculation.

Volkswagen (VW) – 2008

At one point, Volkswagen briefly became the most valuable company in the world—because of a massive short squeeze. Hedge funds had shorted VW heavily, betting the stock would fall. But in a surprise move, Porsche revealed it had secretly accumulated a controlling stake in VW. With only a small portion of shares left in the market, short sellers panicked. The stock surged over 300% in just two days as funds rushed to cover. The squeeze was so severe it rattled global markets and caused billions in losses for short funds.

| Short funds: Hedge funds that bet on a stock’s decline by borrowing and selling shares, aiming to buy them back cheaper later. |

Tesla (TSLA) – Multiple Squeezes Between 2012–2020

Tesla has been a repeated short squeeze story. For years, many investors doubted its business model, profitability, and long-term survival—keeping short interest persistently high. But each time Tesla defied expectations with strong deliveries, new funding, or surprise profits, the stock would surge.

The rally became self-reinforcing, with each forced buy accelerating the move and continuing to squeeze short sellers until the uptrend finally broke.

One notable short squeeze occurred in early 2016. After a steep drop of about 40%, TSLA rebounded sharply from $9.40 to nearly $18 dollars — forcing short sellers to cover in a rapid squeeze higher. While not as dramatic as later rallies, it highlighted how quickly sentiment could flip when expectations were beaten.

Short Squeeze Trading Strategies

Short squeeze trading strategies focus on stocks where many traders are betting the price will drop. If buying pressure suddenly kicks in, those traders scramble to exit their losing positions, buying back shares quickly, which forces the price even higher. The idea is to spot this setup early and ride the wave before it fades. These moves can be fast and dramatic, so timing and exit discipline matter.

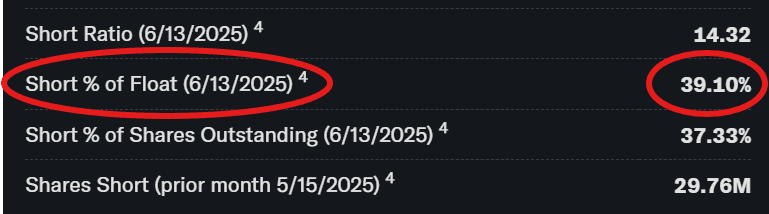

Spot High Short Interest

Short interest tells you how many traders are betting against a stock. A high percentage means a crowd is waiting for the stock to fall. But if the price starts rising, those traders can get trapped, adding fuel to a sharp upside move.

When the short interest is over 20% of the float, it’s a red flag that things could heat up fast. It becomes a pressure cooker, waiting for a spark.

You can find the short % of float on a stock or asset via its ‘Statistics’ tab on Yahoo Finance. For example, this BYND stock in particular, has a very high short interest percentage of 39.10% — that means nearly 4 out of every 10 freely available shares are being shorted.

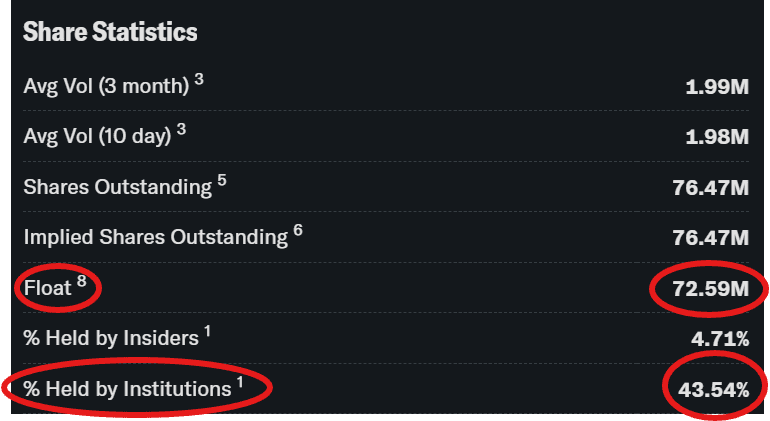

Check the Float

The float refers to the number of shares available for public trading — excluding those held by insiders or locked up in long-term institutional positions — and only the float trades freely in the open market.

On paper, a higher float suggests greater liquidity, but that can be misleading. What really matters is how many shares are actually accessible when the pressure kicks in. A low float means limited supply, so if demand suddenly spikes—especially in a heavily shorted stock—prices can rip higher fast.

There’s no strict definition of what makes a stock low float, but here’s a rough guide:

| Float Size | Category |

| Under 10M | Ultra Low Float ⚠️ |

| 10M – 50M | Low Float ⚠️ |

| 50M – 100M | Medium Float |

| Over 100M | High Float |

Let’s take Beyond Meat (BYND) as an example. As of June 2025:

- Float: 72.59 million (medium float)

- Short Interest Ratio: 39.10% of float

- % Held by Institutions: 43.54%

While BYND technically sits in the medium float range, the real story lies beneath the surface. With 43.54% of the float held by institutions—likely locked away for longer-term positioning—that’s about 31.6M shares potentially unavailable for active trading. Therefore, the current market conditions for BYND should be considered as low to mid float (30-50M).

Combine that with 39.10% of the float being shorted, and you get a significant supply-demand imbalance. Short sellers are effectively crowding into a shrinking pool of tradable shares, making the setup far more volatile than the float size alone suggests. This kind of structure can snap violently if momentum turns and shorts rush to cover.

Look for Volatility

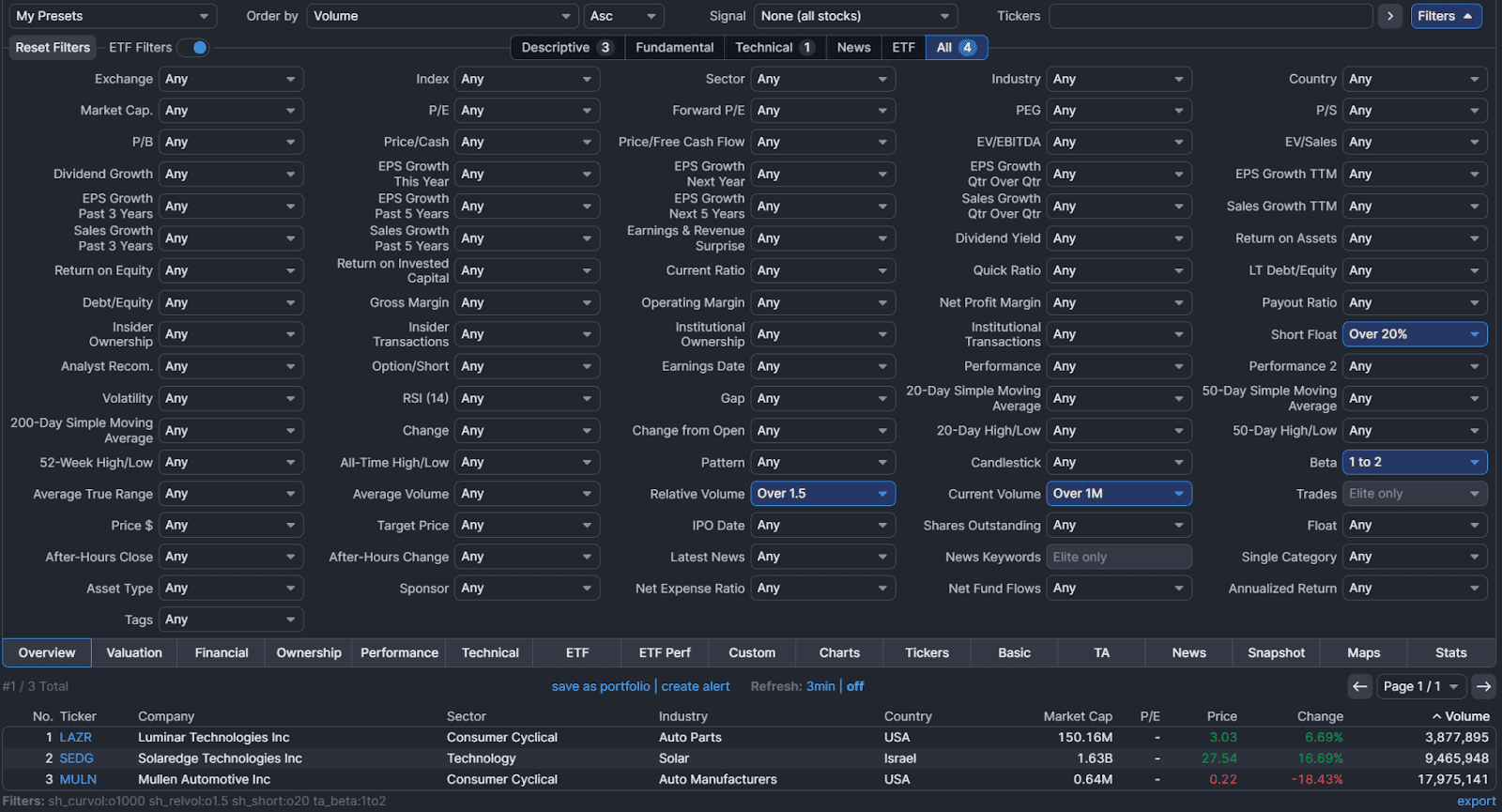

Volatility is key when hunting for short squeezes. You want stocks that move fast—not ones that drift sideways. The more a stock swings, the more likely it is to trigger panic among short sellers when momentum flips. But rather than guessing, you can use free screeners like Finviz to screen for volatility, and potentially capture the next short squeeze.

On Finviz.com, you can filter for stocks that meet specific volatility criteria:

- Go to the “Screener” tab.

- Set these filters:

- Beta > 1.5 (high beta stocks tend to be more volatile)

- Price > $5 (optional – removes penny stocks)

- Float Short > 20% (to spot potential squeeze setups)

- Relative Volume > 1.5 (to spot high volatility in recent times)

- (Optional) Add Current Volume > 1M to avoid thinly traded stocks.

These filters help you zero in on setups before they explode. High short interest means pressure is building; high volatility means the moves—when they come—will be fast, chaotic, and tradeable.

Look for Higher Relative Volume

Relative volume compares current daily trading volume to its recent average, highlighting when a stock is suddenly in play. If volume suddenly doubles or triples its average, something is brewing. This often means buyers are piling in, or shorts are scrambling to cover. It’s one of the strongest signals that a stock is heating up. Combine that with a breakout level, and it might be go-time.

Look for Catalysts

Catalysts are events or headlines that shake things up—such as a surprise earnings report, a press release, or an analyst upgrade. These events give traders a reason to act and can completely flip the narrative for a stock. Without a catalyst, even the most shorted stocks may stay flat. But with one, price can explode in minutes.

To prepare for this, use the Economic Calendar by Trading Central, available via the Alchemy Markets dashboard. This tool helps you filter for high-impact events—such as central bank rate decisions or non-farm payrolls (NFP) — that could spark major market moves.

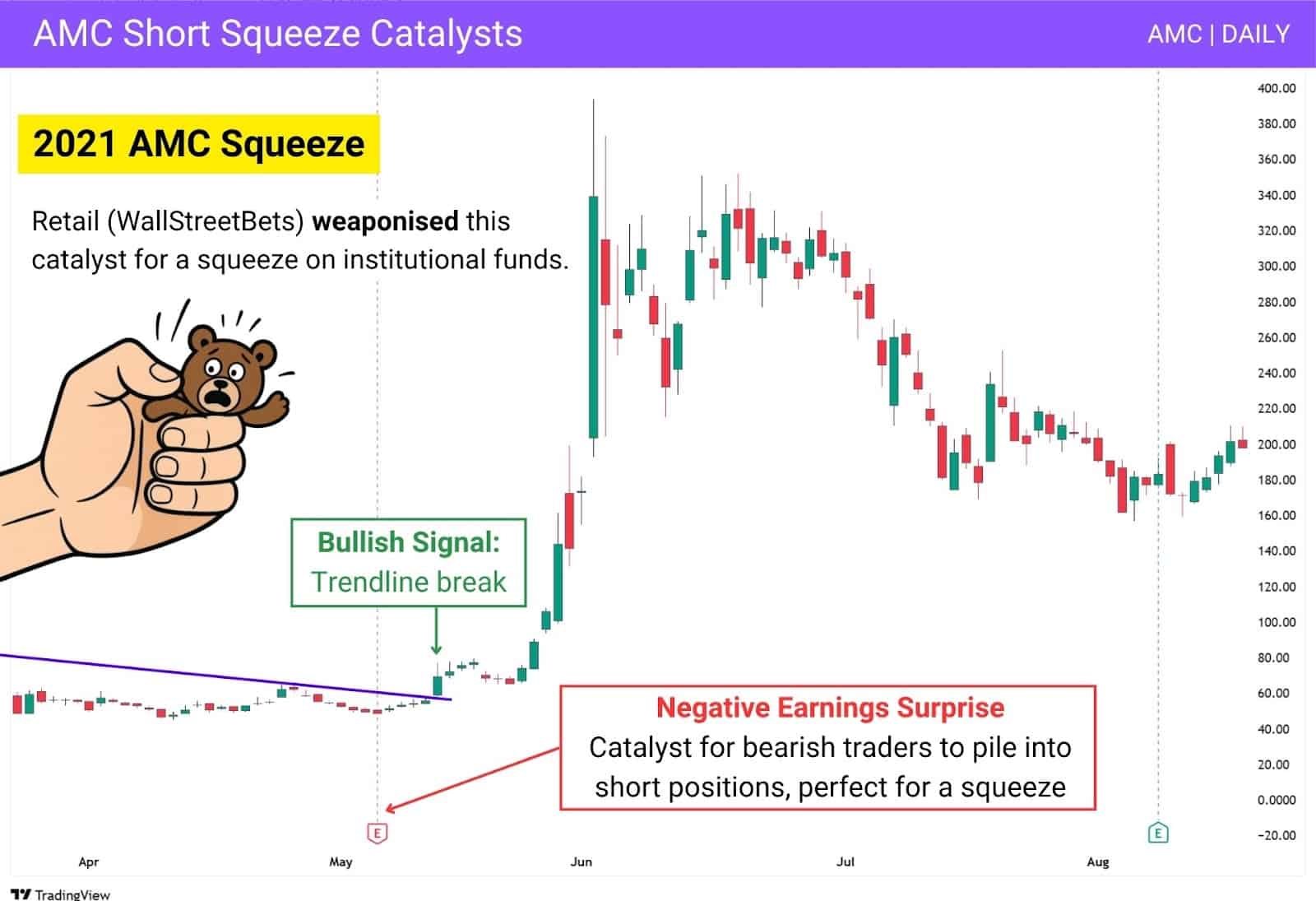

Additionally, understanding the behind the scenes of a stock and its community helps a lot. For instance, the 2021 AMC short squeeze was driven largely by retail investors coordinating through Reddit.

In May 2021, while AMC’s earnings report surprised to the downside (fundamentally bearish), WallStreetBets once again noticed the extreme short interest on the stock. They alerted their retail community, and effectively weaponised the bearish catalyst against institutional short sellers — driving the price higher not just for profit and entertainment.

AMC had already earned its reputation as a meme stock, and the price surge made little sense relative to the company’s fundamentals — making the entire move feel like an inside joke for those who joined in.

Check the Trend

The trend tells you the stock’s story before the action begins — and technical traders often study these patterns to anticipate short squeeze setups.

A slow climb or steady support could show quiet accumulation. If the price is breaking out of a base or holding higher lows, that’s a good sign. Choppy or fading trends, on the other hand, make squeezes less reliable. You want to trade with the momentum, not fight it.

Wait for a Catalyst

Even if a setup looks great, jumping too early can backfire. It’s smarter to wait for a clear reason, like breaking news, a sudden spike in volume, or a strong price breakout. That confirmation lowers the chance of getting stuck in a false move. The best short squeezes usually happen fast and loud, you want to be ready, not rushing in blind.

Short Squeeze vs Short Covering

A short squeeze and short covering both involve traders buying back shares—but the difference lies in the speed and pressure behind the move. Short covering is routine. A trader bets against a stock, holds the position, and later buys back the shares to close out—no rush, no panic. A short squeeze, on the other hand, is fast and chaotic. It happens when a stock starts rising quickly, and short sellers are forced to buy back all at once to avoid bigger losses. That group panic fuels an even bigger price surge.

Short Squeeze vs Breakouts

A breakout happens when a stock moves past a key price level—like resistance or a trendline—and keeps going. It’s often powered by buyers stepping in, not necessarily from short sellers.

Alt text: Breakout on Nvidia stock leading to a rally.

A short squeeze, by contrast, isn’t just about breaking a level. It’s about pressure. As the price moves up, traders who bet against it are trapped, and their panic buying pushes the price even higher. Breakouts can be clean and controlled. Squeezes are sharp, unpredictable, and driven by fear.

Risks of Trading in a Short Squeeze

Short squeeze trades can look incredibly tempting — especially when a stock jumps 20%, 50%, or more in a single day. But these moves cut both ways.

Prices can spike fast—and collapse just as quickly. If you’re late, you could end up buying near the top, only to watch momentum vanish. Many of these rallies burn out within minutes. Liquidity dries up, slippage kicks in, and even a small news headline can kill the move.

Technically, the chart often becomes overbought very quickly. Indicators like RSI or stochastic momentum surge above normal levels, signalling that price has stretched too far from its base. That doesn’t mean the stock can’t go higher—but the risk-reward becomes skewed. At that point, you’re no longer trading a setup—you’re just chasing.

Short squeezes are a game of speed and timing. They’re not something to follow blindly after the move has already happened.

What is the top biggest short squeeze in history?

The most famous short squeeze in recent memory? GameStop, January 2021.

Hedge funds were heavily short selling the stock, betting it would keep falling. But a group of retail traders on WallStreetBets spotted the massive short interest and started buying aggressively—then spread the word across forums. As the price started to climb, short sellers scrambled to cover their positions, which only pushed it higher. GameStop shot up from under $20 to over $120 in just a few days. Billions were won and lost. The chaos shook Wall Street, rewrote how funds think about risk, and even led to congressional hearings.

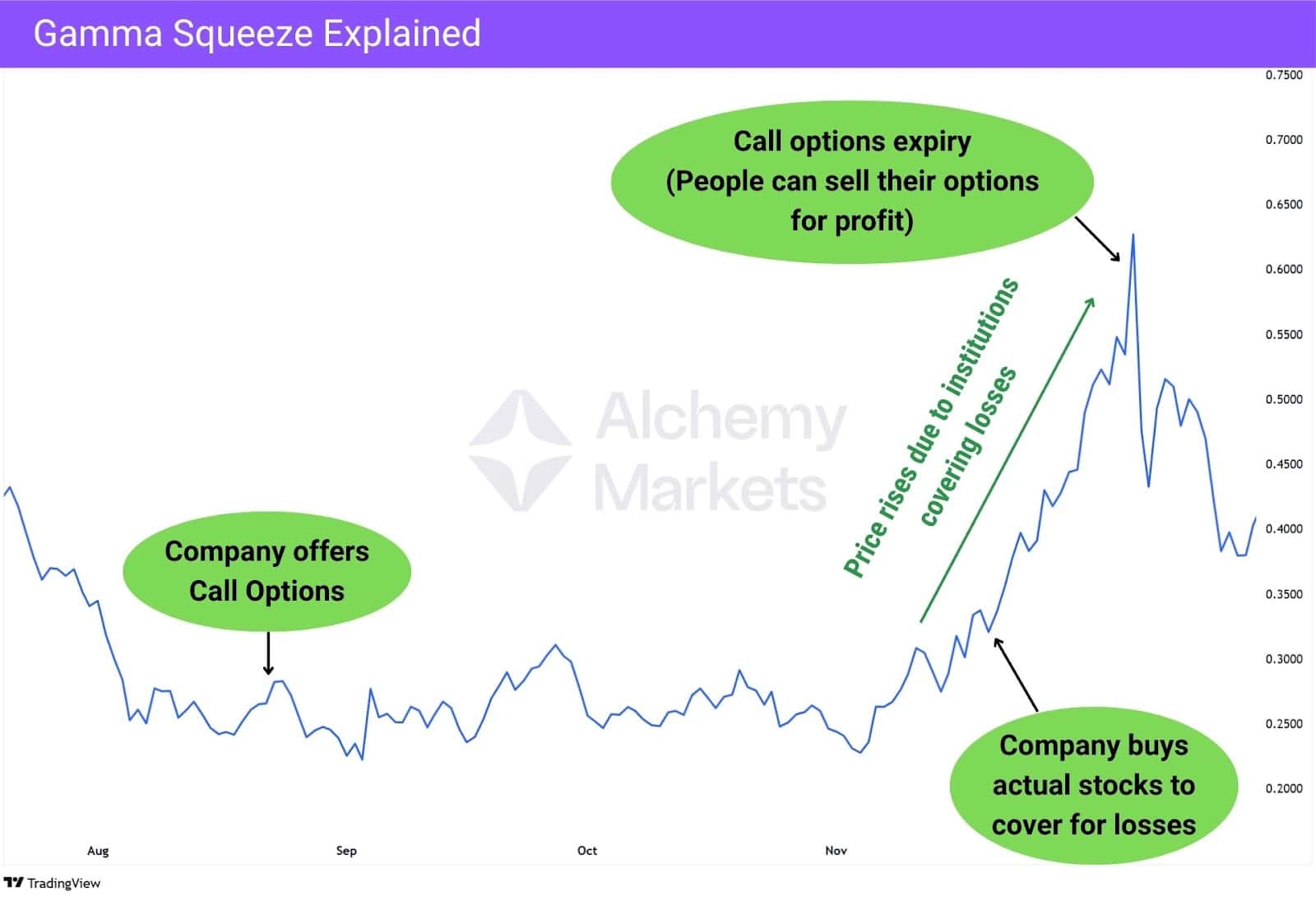

Gamma Squeeze vs Short Squeeze

A gamma squeeze starts when lots of traders buy call options, which are contracts that benefit if the stock goes up. The firms that sell these options don’t want to lose money if the stock rises, so they protect themselves by buying some of the stock ahead of time. This is called hedging. As the stock price climbs, the risk to those firms increases, so they keep buying more shares to stay covered. All that extra buying can drive the stock price up even faster, even though it didn’t start with people buying the stock directly.

A short squeeze works differently. It happens when traders who bet against the stock start losing money as the price rises. To stop the loss from getting worse, they buy back the stock to close their position. That buying adds more demand, which pushes the price up even further and forces more short sellers to do the same.

Both squeezes can create fast and powerful rallies, especially when paired together. One is caused by option sellers managing risk, the other by short sellers escaping losses — but both flood the market with buy orders.

FAQ:

What are the Common mistakes in Short Squeeze Trading?

One big mistake is chasing the move after it’s already gone too far. Traders see a stock flying and jump in without checking the setup—it’s usually too late by then.

Another mistake is ignoring volume and catalysts. Just because short interest is high doesn’t mean the stock will explode. It needs a reason to move. Some also skip risk control, thinking they’ll just “get out fast.” But squeezes can turn on a dime, and hesitation can be costly. Going all-in without a plan? That’s gambling, not trading.

How long does a short squeeze last?

There’s no set timer on a short squeeze. Some play out in an hour. Others can stretch across days, rarely weeks.

It all depends on how much pressure is behind the move. If the squeeze is based on breaking news or a huge shift in sentiment, it may run longer. But if it’s just hype with no real follow-through, it could fizzle out the same day. That’s why fast decision-making matters, these setups don’t wait around.

What are some tips for success with short squeezes?

Start by spotting stocks with high short interest and a small float. Watch for strong volume and clear signs of momentum, especially after a catalyst hits.

Don’t buy blindly, wait for confirmation like a breakout or price surge. Keep your risk tight and don’t hang on too long. These trades are about speed, not patience. Know your entry, exit, and backup plan before clicking “buy.” And most importantly, don’t get greedy. Get in, take profit, and move on.

Is a short squeeze bullish or bearish?

It’s short-term bullish—prices rise fast as shorts cover—but that momentum isn’t always backed by fundamentals. Once the squeeze ends, the stock often cools off or reverses.

Whether it stays bullish long-term depends on the catalyst behind the move and the broader market trend. Without real strength, it’s often just a spike—not a sustained breakout.

Why do Short Squeezes matter?

They’re a reminder that short squeezes aren’t just trading setups — they’re cautionary tales.

When too many traders are crowded into the same short position, and the trade turns against them, it’s not just about the chart anymore. Emotion takes over. Panic buying sets in. And the market can move in ways that defy logic or fundamentals.

For traders who understand the setup, squeezes can create fast, high-reward opportunities. But more importantly, they serve as a warning:

- Don’t blindly short crowded trades—especially when volume surges or a catalyst is in play.

- If the conditions are ripe for a squeeze, being on the wrong side of it can be brutal.

These moments show how fear can unwind a position faster than any valuation model can explain. Knowing how to spot them helps you either trade with the move—or stay out of the way before it runs you over.

What was the “MOASS”?

MOASS stands for “Mother of All Short Squeezes.” It’s a term traders used—mostly online—during the GameStop drama in 2021.

The idea was that if enough people bought and held heavily shorted stocks like GameStop or AMC, it would force short sellers to cover all at once, sending prices to extreme highs. While it sparked massive moves, the “MOASS” as imagined by many never fully materialized. Still, it lit a fire under retail trading and shook up Wall Street.

Are short squeezes legal?

Yes, short squeezes are legal—but manipulating one isn’t.

If a squeeze happens naturally, based on market forces like volume, news, and price movement, it’s fair game. What crosses the line is coordinated manipulation—like spreading false info or organizing mass buy-ins purely to trap short sellers. Regulators watch for that. So if the setup is real and traders are reacting, it’s legal. If it’s manufactured on purpose? That’s a different story.

What is the biggest short squeeze of all time?

The Volkswagen short squeeze in 2008 is still considered the biggest ever.

At one point, VW briefly became the most valuable company in the world—on paper. Porsche revealed it had control over most of Volkswagen’s shares, leaving short sellers scrambling to buy back in a panic. The price skyrocketed in just days. Billions were lost by hedge funds, and the whole episode became a textbook example of what a full-blown squeeze looks like.

How high can a short squeeze go?

There’s no real ceiling—it can keep rising as long as short sellers keep getting squeezed. New sellers don’t always stop the move; if price keeps climbing, they can get trapped too. But once momentum fades and shorts are mostly cleared, the squeeze can unwind fast—often dropping just as hard as it rose.

Is short squeeze bullish?

Yes, a short squeeze is short-term bullish — price rises fast as short sellers buy to cover. But unless supported by strong fundamentals, the rally may fade quickly once the squeeze ends.