- Weekly Outlook

- December 13, 2025

- 3 min read

Week of Central Banks and GBP/USD: Key Decisions and Technical Outlook

As we move into this week’s trading session, market participants will be closely monitoring a slew of economic data and central bank decisions that will shape expectations for 2026. Let’s take a look at the key highlights across the United States and the United Kingdom, followed by a technical analysis of the GBP/USD currency pair.

United States

Federal Reserve’s Rate Decisions:

Following three consecutive interest rate cuts, the Federal Reserve signaled that the most likely path forward involves one more rate cut in 2026. The market, however, sees the risks skewed towards the Fed doing more, and many analysts, including us, forecast additional 25 basis point cuts in March and June. The Federal Reserve’s monetary policy stance will remain a central theme, as markets await further clues on its future moves.

Jobs Data & CPI (Thursday):

This week, the Bureau of Labor Statistics will release delayed October and November jobs numbers on Wednesday. The market consensus is for a subdued print, with payroll growth expected to be weak. Fed Chair Powell recently mentioned that payroll numbers could be overstating job creation by as much as 60,000 per month. If this proves true, it could further signal that the U.S. economy is losing jobs.

On Thursday, the November Consumer Price Index (CPI) will be released. While it will not include a month-on-month CPI due to a government shutdown, YoY inflation is expected to rise slightly to 3.2%, largely driven by tariff effects and higher insurance costs. Despite this, lower energy prices, easing housing rents, and weakening wage growth are likely to prevent a sharp rise in inflation, with the annual rate expected to moderate in the second half of 2026.

United Kingdom

Jobs Report (Tuesday):

The UK jobs market has been weakening throughout the year, particularly in the private sector, and we expect this trend to continue into 2026. The upcoming jobs report is likely to show further deterioration in wage growth, which could put downward pressure on the overall economy.

Inflation (Wednesday):

Inflation in the UK is expected to remain unchanged for November, although the Bank of England will be looking for signs that food inflation has peaked. Services inflation, which has been a critical driver of price levels, is also expected to show signs of improvement from early next year, especially after April.

Bank of England Meeting (Thursday):

The Bank of England is expected to deliver a rate cut this week, though the decision is likely to be a close one. The committee remains divided, and while Governor Andrew Bailey has expressed a more dovish stance, the vote will likely hinge on his decision. Given the recent easing of inflationary pressures, a rate cut is still on the table, although not guaranteed.

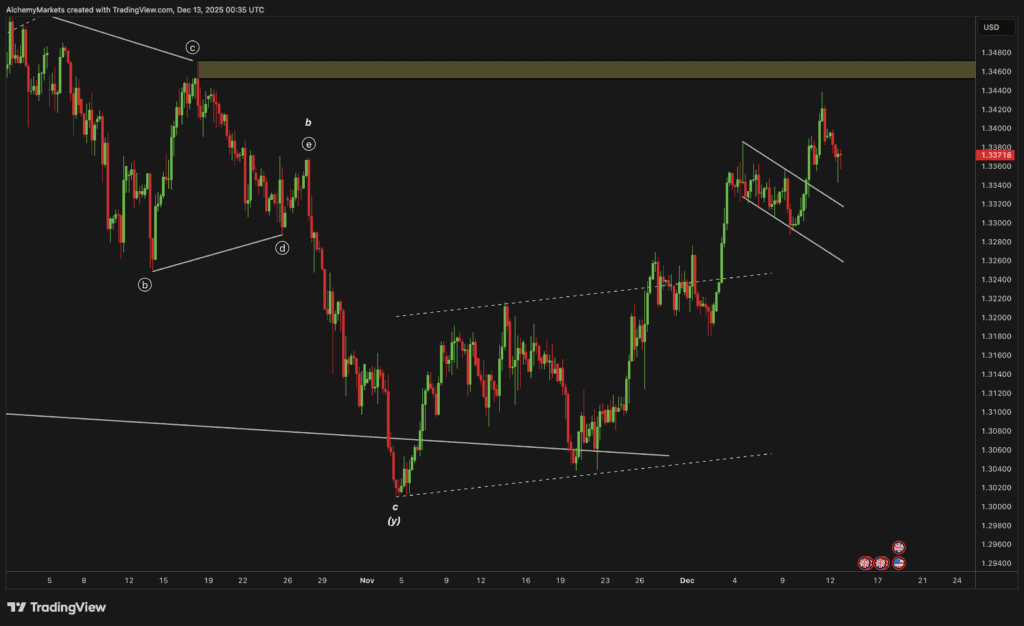

GBP/USD Technical Outlook

Turning to the technical side of things, GBP/USD has been moving closer to the key resistance level at 1.346, a level we have been eyeing for some time. Currently, the pair is trending higher, with an upward movement supported by a series of higher highs and higher lows.

The recent price action has shown a consolidation pattern within a rising wedge formation, indicating potential for a breakout toward the 1.346 level. If this level is breached, we could see further upside potential, with the next resistance likely to be around 1.355.

On the other hand, if the price fails to break through 1.346, we may see a pullback, potentially testing support levels around 1.330 or even 1.320. Traders will need to keep an eye on the Fed’s and BoE’s actions as these could significantly impact the GBP/USD pair’s direction over the coming weeks.