- Weekly Outlook

- November 7, 2025

- 5 min read

SPX: Sentiment vs. Reality — Are We Worrying Too Much, or Not Enough?

For all the noise about recession fears and economic slowdown, the U.S. economy continues to hum along at a fairly steady pace. Growth hasn’t collapsed, inflation is easing (if stubbornly), and unemployment remains near historic lows. Yet sentiment has plunged to near three-year lows. Consumers feel worse, investors feel anxious, and markets are showing cracks in what’s been an impressive rally.

It’s one of those odd macro moments when the data says “we’re fine,” but everyone feels like something’s about to go wrong. The disconnect between sentiment and reality has rarely felt this wide — and it’s giving traders, businesses, and policymakers a strange sense of déjà vu.

The Mood: Pessimism in Search of a Problem

Reality check: the economy is still expanding. Job growth has cooled but not cratered, inflation is sticky but trending down, and most sectors remain resilient. Yet consumer and business confidence surveys are turning sour.

Part of this stems from policy uncertainty — the ongoing government shutdown, fiscal tensions, and political gridlock. Another part is psychological fatigue. After two years of high prices, volatile markets, and interest-rate shocks, optimism is running on fumes.

It’s like driving a car that’s still running smoothly but hearing a faint rattle under the hood — even if it’s nothing serious, you can’t help but worry. That’s where markets are now: cautious, twitchy, but still moving forward.

United States Outlook

In theory, next week should be a big one for U.S. data watchers. We were supposed to get CPI, retail sales, and a range of key macro indicators that would help gauge the economy’s pulse. In practice, though, the ongoing government shutdown has thrown that plan out the window. With government agencies closed, there’s simply no one around to collect, collate, or publish the official data.

That leaves investors reliant on third-party surveys, like the NFIB Small Business Optimism Index, which is expected to remain little changed. These alternative data points will become the market’s lifeline in the absence of traditional releases.

One piece of information that’s still expected is the federal budget statement — and this one might surprise. Typically, October is a heavy borrowing month for the U.S. Treasury:

- $257 billion borrowed in 2024

- $67 billion in 2023

- $88 billion in 2022

But with parts of the government shut down and wages temporarily unpaid, the short-term effect could be a budget surplus. Of course, that would be more illusion than improvement — once the shutdown ends and back pay is issued, the books will swing sharply back into deficit.

It’s a reminder that the U.S. economy isn’t short on noise, but that noise doesn’t always tell the real story.

United Kingdom Outlook

Across the Atlantic, the Bank of England remains on course to cut rates in December, assuming no major surprises from data or fiscal announcements. The central bank is deeply divided, but falling inflation and cooling wages are shifting the consensus toward easing.

Jobs Data (Tuesday): Private-sector wage growth is likely to continue edging down, staying below 4% by year-end. That’s a key signal for policymakers that inflation pressures are easing beneath the surface.

3Q GDP (Thursday): The UK economy is on track for around 0.2% growth in the third quarter, modest by any measure but steady considering recent headwinds. After a stronger first half of the year, helped by tariff frontloading and resilient spending, growth looks set to slow further into 2026 as government support fades.

The theme across both sides of the Atlantic is similar: growth holding up, inflation gradually easing, but sentiment slipping. People aren’t feeling the recovery — and that matters.

Market Technicals: The S&P 500’s Balancing Act

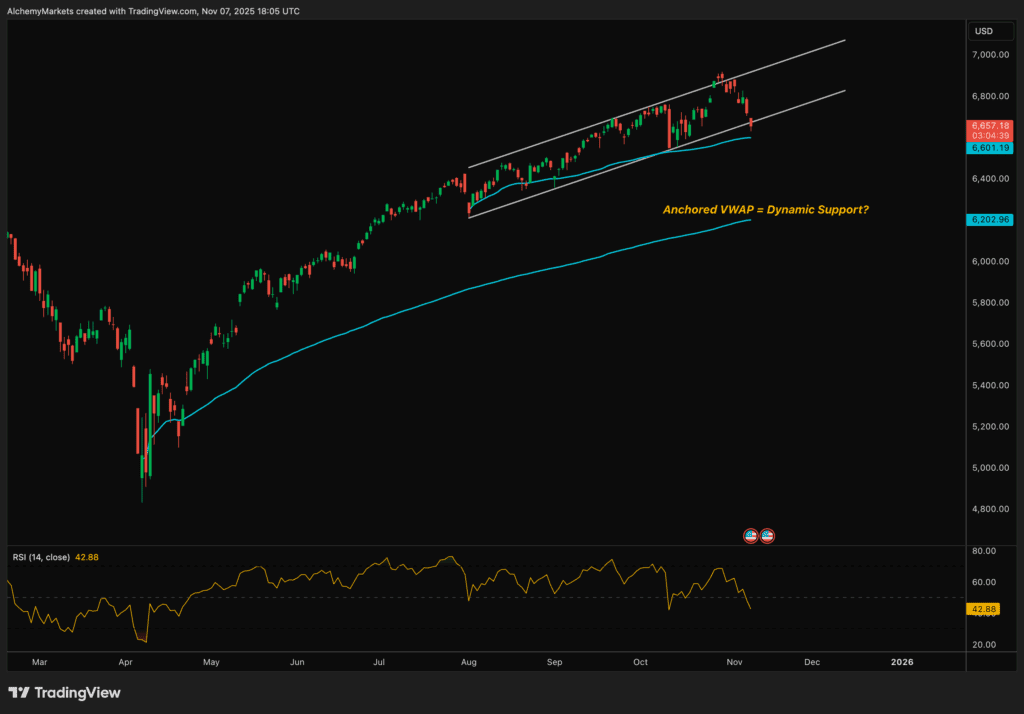

The chart above tells the story better than words can. The S&P 500 has broken below its ascending channel, a structure that’s defined the uptrend since early spring. That’s a warning shot — a sign that momentum is fading after a strong run.

Right now, the index is testing key dynamic support near 6200, which coincides with the Anchored VWAP from the March pivot. This level could prove to be a critical line in the sand for bulls. If it holds, a rebound could follow; if it breaks, the next leg lower might be underway.

Adding to the caution, the RSI has slipped into bearish territory, showing divergence between price action and momentum — lower highs in RSI even as prices hit new peaks earlier this quarter. That kind of divergence often signals exhaustion in an uptrend.

In short, the market still looks healthy from afar, but beneath the surface, it’s starting to sweat. Bulls have lost some control, and sentiment is turning defensive. The chart supports the macro story: fundamentals remain solid, but the collective mood has darkened.

The Bigger Picture

This “sentiment vs. reality” gap matters because it shapes how consumers spend, how businesses invest, and how markets trade. When people feel worse than the data suggests, they often act accordingly — pulling back on spending, hiring, and risk-taking. That can turn perception into reality faster than policymakers would like.

So, are we worrying too much, or not enough? The answer probably lies somewhere in between. The economy’s still resilient, but the psychological scars from years of volatility, inflation, and political noise haven’t healed. Until confidence catches up to the data, markets may stay choppy and reactive.

For traders, this means keeping an eye on both — the hard numbers (when they finally arrive) and the soft mood that often moves prices first.

Bottom Line:

The data still says “steady.” The charts say “watch out.” And sentiment says “brace yourself.” Next week’s numbers — if they come — won’t just measure inflation or spending. They’ll test whether confidence itself can find a floor.